XRP Near Exhaustion Zone After 34% Holder Drawdown. Could Macro Easing Pump Demand?

XRP traded in a narrow range between $2.31 and $2.47 in the past session, slipping about 2% as liquidity concentrated around the $2.31–$2.35 zone. Spot buyers appeared to step in and absorb selling pressure, stabilizing the price near that key shelf.

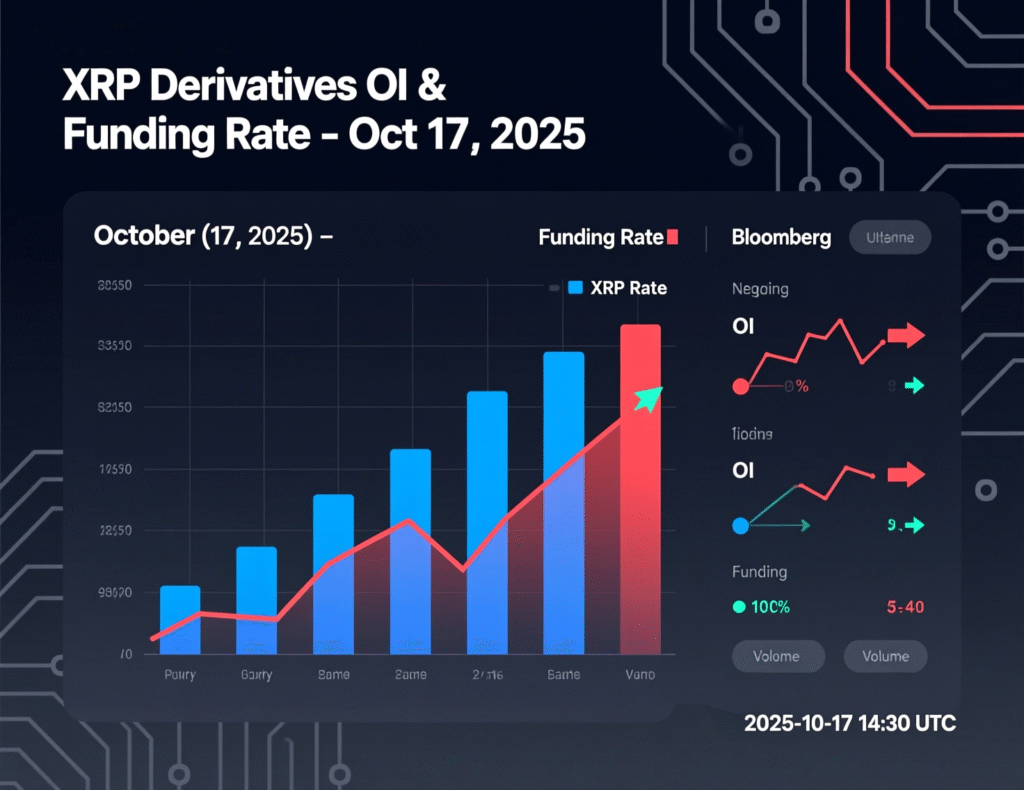

The move comes after data showed long-term holders reduced their positions by roughly 34%, while open interest rebounded to around $1.36 billion. Many trading desks interpret this setup as an exhaustion zone, suggesting the $2.31–$2.35 range could act as short-term support rather than signal the start of a deeper correction.

Market snapshot: range holds as positioning resets

XRP traded a $0.16 band (about 7% intraday), briefly undercutting $2.31 before clawing back into the range. Repeated rejection near $2.47 continues to cap rallies. The latest leg lower tracked broader crypto weakness amid macro headlines and positioning squeezes.

Positioning & flows

Derivatives open interest rebounded to ~$1.36B after a weekend flush, while funding normalized slightly positive consistent with short-covering ebbing and selective long rebuilding. Desks say activity reflects tactical risk-taking into quarter-end ETF chatter and potential policy easing. CoinDesk

Levels that matter (and why)

$2.31–$2.35

Demand zone where high-volume reversals emerged; bulls want holds here on dips.$2.47

First topside trigger; a clean reclaim/close above would invalidate the near-term bearish bias and open $2.55.Broader context

XRP remains well off mid-July highs on major venues.

Macro & catalysts to watch

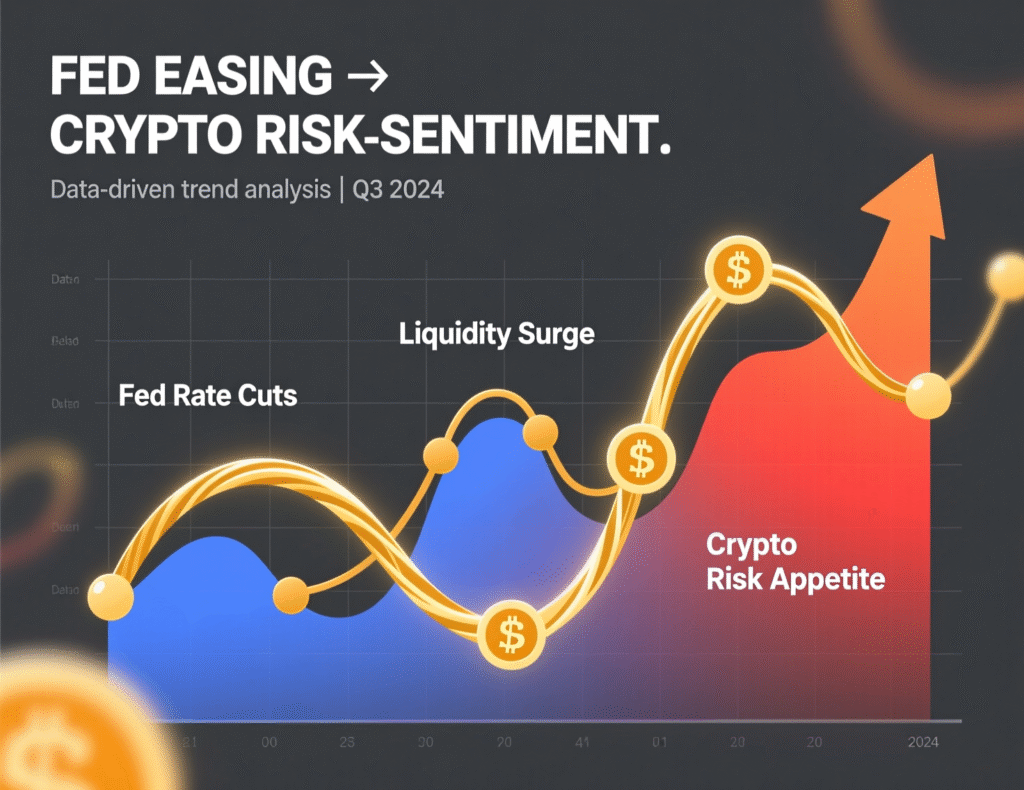

Fed officials have signaled openness to measured rate cuts, with debate over pace and size. Softer financial conditions could lift risk appetite across crypto, while ETF timelines remain a swing factor for flows.

XRP exhaustion zone support 2.31-2.35: what confirms/invalidates

Confirm

Sustained bid defense at $2.31–$2.35, rising spot volumes on up-swings, and a decisive reclaim of $2.47.Invalidate

Acceptance below $2.31 with accelerating volumes and funding flipping deeply negative. (Context from price/derivatives dashboards.)

Context & Analysis

Holder distribution spikes and subsequent OI rebounds often precede choppy re-accumulation rather than immediate trend reversals. Given macro uncertainty, baseline expectation is continued range-bound trade until a catalyst forces resolution most likely a dovish policy surprise or concrete ETF progress.

Conclusion

Bulls are focused on holding the $2.31–$2.35 support zone and pushing prices back above $2.47 to regain short-term momentum toward the $2.55 resistance level. Sustained buying near the lower range could signal renewed strength and attract fresh inflows from sidelined traders.

However, in the absence of a strong macro or ETF-driven catalyst, XRP may remain in a consolidation phase. Market participants are likely to find tactical trading opportunities near the range boundaries, with quick reactions to volume shifts and liquidity tests defining the next directional move.

FAQs

Facts

Event

XRP stabilizes near support after holder drawdown; OI reboundsDate/Time

2025-10-17T11:13:00+05:00Entities

Ripple (XRP), CoinDesk (market data), U.S. Federal Reserve (policy signals)Figures

Support $2.31–$2.35; resistance $2.47; OI ~$1.36B; holder drawdown ~34% (tokens from 163.7M → 107.8M on “Hodler Net Position Change”). CoinDeskQuotes

“Renewed activity could mark the start of tactical long positioning into quarter-end ETF speculation and macro easing signals.” Market desks cited by CoinDesk. CoinDeskSources

CoinDesk report; TradingView price chart; Reuters/FT Fed coverage. Financial Times+3CoinDesk+3TradingView+3