XRP, DOGE Zoom Higher as U.S. Shutdowns, Japan Bond Slowdown Charge Bitcoin Appetite

Bitcoin and other leading cryptocurrencies advanced as investors shrugged off concerns about a potential U.S. government shutdown and renewed turbulence in Japan’s bond market. The rebound signaled growing resilience across digital assets, with traders focusing more on market momentum than macro headwinds.

Bitcoin hovered close to $118,700, marking a gain of over 3% in a single day. Ether, solana, and dogecoin also delivered stronger moves, highlighting the upbeat sentiment. Among the notable standouts, XRP held steady just below the $3.00 mark, while DOGE attracted attention with sharp upside momentum, underscoring the appetite for high-beta tokens during the rally.

Market movers: XRP and DOGE zoom higher

Bitcoin changed hands around $118.7K; ether rose ~5.6% to $4,374, solana neared $223, and dogecoin advanced to $0.25. XRP held near $2.97 after tests of $3.00. The broad rally lifted sentiment across majors. CoinDesk

Macro overhangs, risk appetite

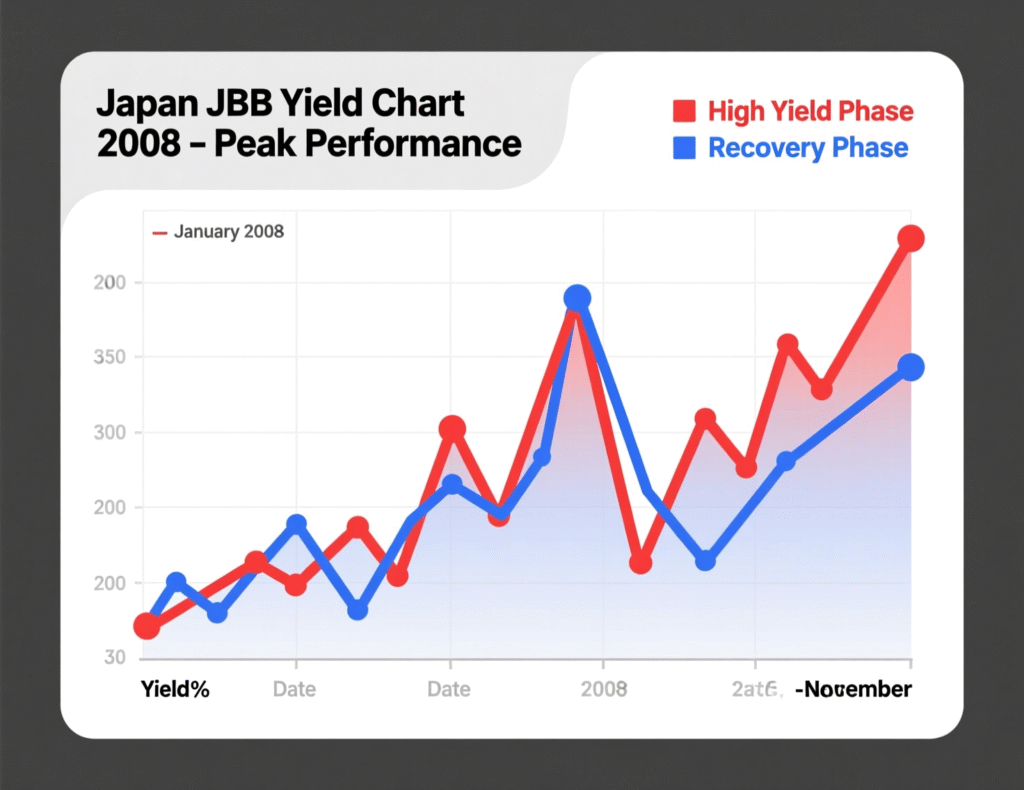

The U.S. government entered a shutdown, threatening to delay economic releases and weaken fiscal visibility conditions that often nudge central banks toward caution. In parallel, Japan’s 10-year government bond yield hovered around 1.66%, close to cycle highs last seen in 2008, pointing to BOJ policy evolution with global funding implications.

Jobs signal: ADP shows private-sector decline

ADP reported –32,000 private jobs in September, underscoring cooling labor momentum. Markets read the combination of softer jobs and a data blackout risk from the shutdown as supportive of easier financial conditions.

Price snapshot: XRP and DOGE zoom higher across majors

BTC: ~$118.7K, +3% (24h)

ETH: ~$4,374, +5.6% (24h)

SOL: ~$223, +7% (24h)

DOGE: ~$0.25, +9% (24h)

XRP: ~$2.97 (steady; week high near $3.00)

Aggregate crypto market capitalization was cited above $2.37T at press time. Figures reflect CoinDesk/CMC reporting.

<section id=”howto”> <h3>How to track crypto during macro shocks</h3> <ol> <li id=”step1″><strong>Step 1:</strong> Set real-time alerts for BTC, ETH, XRP, DOGE, SOL on a reputable price tracker.</li> <li id=”step2″><strong>Step 2:</strong> Monitor U.S. data calendars; during shutdowns, note potential release delays.</li> <li id=”step3″><strong>Step 3:</strong> Watch Japan’s 10Y JGB yield and BOJ communications for funding-market signals.</li> <li id=”step4″><strong>Step 4:</strong> Compare implied vs. realized volatility to gauge options pricing and risk.</li> <li id=”step5″><strong>Step 5:</strong> Reassess exposure and liquidity plans around high-impact events (e.g., payrolls).</li> </ol> <p><em>Note: Process may vary by jurisdiction/provider. Confirm requirements before acting.</em></p> </section>

Context & Analysis

Crypto’s resilience amid fiscal and rates uncertainty suggests positioning for a looser global liquidity path. If the shutdown delays data (e.g., nonfarm payrolls) and ADP’s weakness persists, rate-cut odds may firm. Meanwhile, higher JGB yields can tighten global financial conditions by reducing yen-funded carry, but the near-term read-through has not derailed crypto flows. Sustainability now hinges on whether on-chain inflows and derivatives positioning can absorb policy or funding surprises.

Conclusion

Bitcoin is consolidating around the $119,000 level, while memecoins continue to lead with strong performance. The focus now shifts to whether optimism around liquidity can keep driving momentum, even as policy and funding challenges from Washington and Tokyo linger in the background.

For a meaningful breakout higher, markets may need sustained inflows and greater stability in interest rates. Traders are watching closely to see if capital continues flowing into digital assets, as steady demand combined with calmer macro conditions could provide the fuel for the next leg upward in the crypto market.

FAQs

Q : Why did crypto rise during a U.S. shutdown?

A : Markets priced delayed data and a cautious Fed, which can support risk assets.

Q : Did macro stress in Japan matter?

A : Rising JGB yields near cycle highs signal policy shifts but didn’t derail crypto gains today.

Q : Where did Bitcoin trade intraday?

A : Around $118.7K alongside broad altcoin gains.

Q : Are implied volatilities falling across assets?

A : Yes, commentary pointed to lower implied vols across equities, rates, FX and BTC.

Q : Did ADP show weakness ahead of payrolls?

A : ADP reported –32K private jobs in September, adding to easing expectations.

Q : Is momentum sustainable?

A : It depends on flows, volatility, and any surprises from Washington or Tokyo.

Q : Does this mean XRP and DOGE zoom higher again soon?

A : Not guaranteed; today’s move reflects near-term liquidity and positioning.