What Next for Crypto Bulls as ETH, XRP, SOL, ADA Drop 8–16% in a Week

A sharp, market-wide pullback has left crypto traders questioning the next move for bulls. Bitcoin dropped below the key psychological barrier of $100,000, briefly touching around $96,600. Analysts now highlight a crucial support zone between $93,000 and $95,000, which could determine whether downside pressure continues. On the upside, immediate resistance is forming near $100,200, with a stronger ceiling expected around $107,300.

Altcoin sentiment also weakened as liquidity thinned across major assets. ETH, XRP, SOL, and ADA posted weekly declines ranging from 8% to 16%, reflecting broader risk-off behavior. Traders are watching whether stabilization in Bitcoin can help restore confidence or if continued volatility will drag the market into deeper correction territory. For now, momentum remains fragile as participants await clearer direction.

Market Snapshot: BTC Leads Risk-Off

Bitcoin’s breach of the monthly mid-range at $100,266 “cleared a key liquidity shelf,” accelerating a slide into a thinner order book. ETH hovered near $3.18K; SOL near $140; broader majors mirrored the pullback. Sentiment metrics and on-chain positioning point to a defensively postured market.CoinDesk

Price Levels to Watch (Exact)

Support

$93,000–$95,000; below that, risk extends toward the ~$89,600 gap.

Resistance

$100,200; then $107,300 (recently rejected repeatedly).

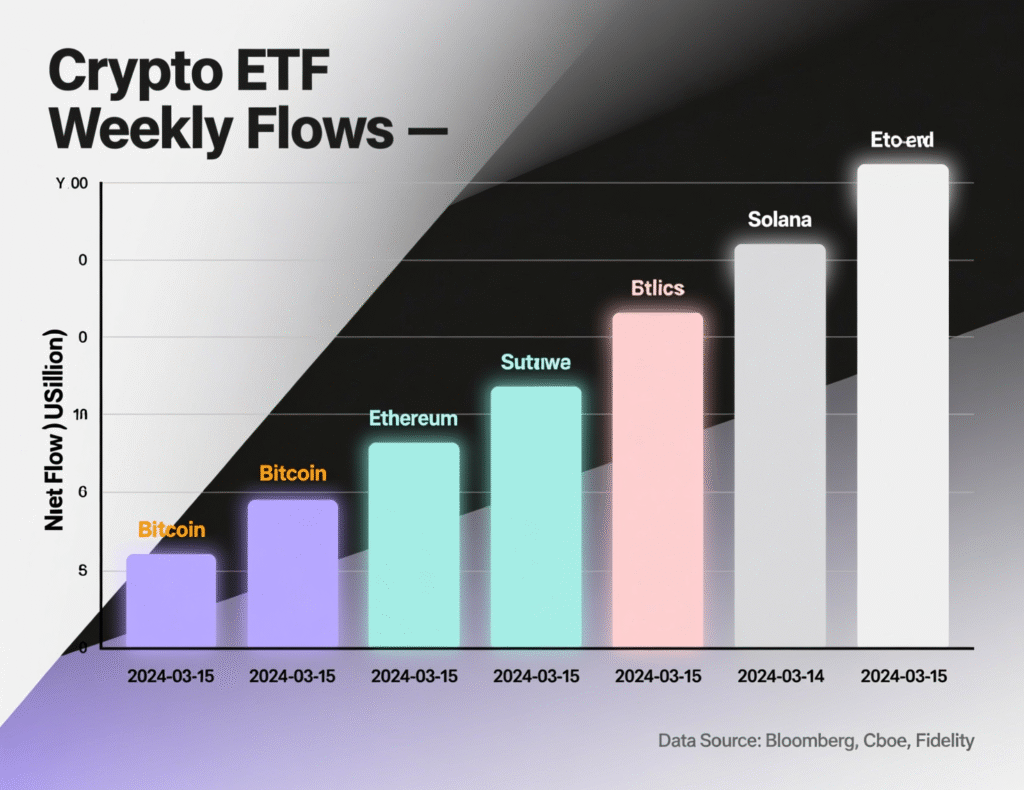

Flows & Positioning: Fuel for Bears

Multiple desks highlight a second straight week of softer spot-ETF flows alongside increased distribution by long-term holders. 10x Research characterizes conditions as a confirmed bear regime as structural support from funds and corporates wanes. Parallel reporting points to heavy outflows from U.S. spot bitcoin ETFs and elevated LTH selling.

Macro Overhang: Waiting on the Fed

Traders eye upcoming FOMC minutes for a possible dovish lean. With U.S. data releases unsettled post-shutdown and tech-stock volatility rising, crypto remains tightly linked to broader risk sentiment. Desk commentary suggests subdued activity unless a major macro catalyst emerges.

Strategy Map for Bulls and Bears

What Next for Crypto Bulls: Scenarios

Base-building near $93K–$95K

Acceptable if flows stabilize and risk assets calm. Failure opens room toward the upper-$80Ks.

Range reclaim

A swift reclaim of $100.2K would neutralize near-term momentum; above $107.3K reopens trend continuation.

Deeper drawdown

Persistent ETF outflows plus LTH selling keeps rallies capped, extending distribution.

Altcoin Check

ETH (-~12% w/w), SOL (~-16%), XRP (~-9%), ADA (~-8%) tracked BTC beta; dispersion likely continues with liquidity thin and risk premia elevated.

Context & Analysis

BTC’s path of least resistance remains lower while liquidity is thin and systematic buyers (ETFs/corporates) slow. Near-term, “value zones” for mean-reversion exist, but without a macro impulse or renewed ETF demand, bounces may stall below $107.3K. A decisive close back above that level would force bears to cover.

Conclusion

Without a strong catalyst, the market is likely to stay in a choppy range with a slight bearish lean. Key support sits between $93,000 and $95,000, while resistance remains clustered around $100,200 to $107,300. Price action within this band will guide short-term sentiment.

Traders should closely monitor upcoming FOMC communication, as policy signals could influence market direction. ETF inflow and outflow trends will also help reveal investor confidence, while any signs of long-term holder supply tightening may indicate when selling pressure could ease and the broader trend begins to stabilize.

FAQs

Q : Why did Bitcoin drop below $100,000?

A : Breached technical support, softer ETF inflows, and broad risk-off sentiment weighed on price.

Q : What are the key BTC levels now?

A : Support: $93K–$95K; resistance: $100.2K and $107.3K.

Q : How did altcoins perform this week?

A : ETH, XRP, SOL, ADA fell ~8–16% alongside BTC’s breakdown.

Q : Are ETF flows turning negative?

A : Reports note slowing inflows and notable outflows last week, a bearish signal if persistent.

Q : What next for crypto bulls if $93K fails?

A : Loss of that band raises risk of a move toward the upper-$80Ks; bulls would likely wait for a $100.2K reclaim.

Q : Did BTC fall below ~$93.7K?

A : Yes, over the weekend before rebounding early Monday.

Q : What could flip sentiment near term?

A : A dovish FOMC tone or a clear inflection in ETF creations could revive risk appetite.

Facts

Event

BTC breaks below $100K; majors drop 8–16% over the weekDate/Time

2025-11-17T11:15:00+05:00Entities

Bitcoin (BTC); Ethereum (ETH); Ripple’s XRP (XRP); Solana (SOL); Cardano (ADA); 10x Research; U.S. spot bitcoin ETFsFigures

BTC ~$96.6K intraday; support $93K–$95K; resistance $100.2K/$107.3K; weekly falls 8–16% across majorsQuotes

“Bitcoin’s break below the monthly mid-range at $100,266 cleared a key liquidity shelf… Near-term support sits at $93,000 to $95,000.” CoinDesk markets reportSources

CoinDesk markets analysis; Bloomberg via Moneyweb roundup (see links below). CoinDesk+1