Western Union’s ‘WUUSD’ trademark hints at crypto offerings

Western Union’s newly filed WUUSD trademark suggests plans that go beyond its announced Solana-based stablecoin, USDPT. The filing indicates the company’s growing interest in the cryptocurrency space and signals that it may be preparing to expand its digital asset operations.

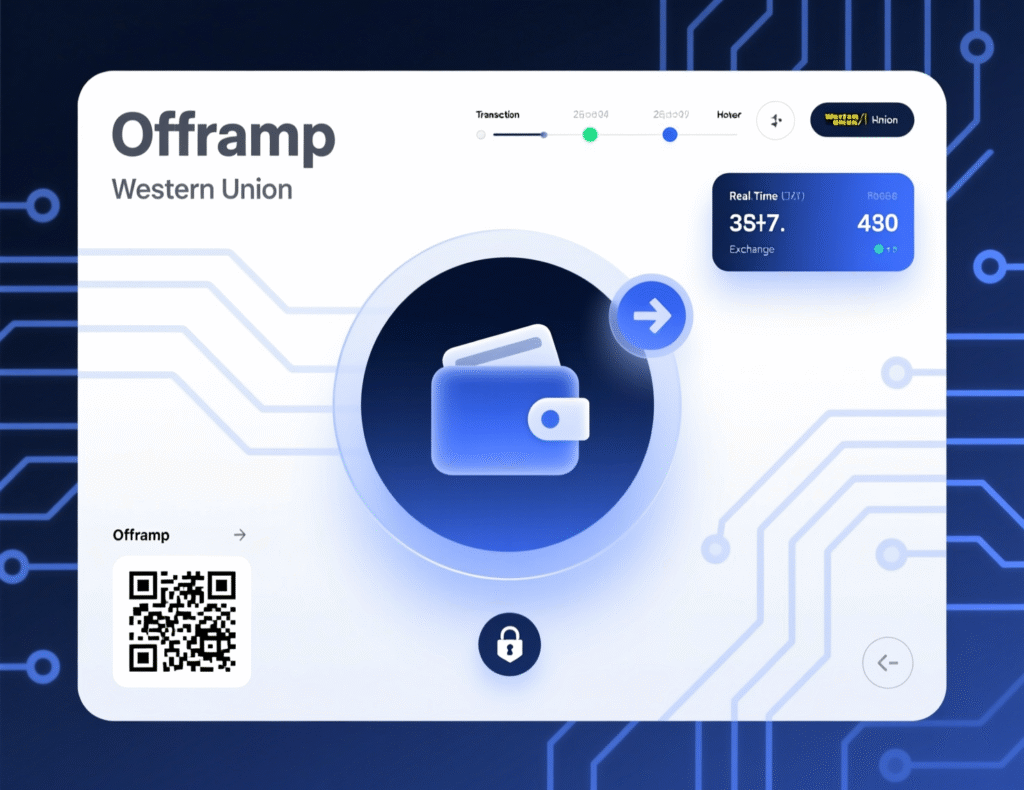

According to the U.S. trademark application, Western Union could introduce a range of crypto-related services, including digital wallets, trading and exchange platforms, and payment processing tools. It also mentions lending and brokerage offerings, hinting that the firm aims to play a larger role in the evolving blockchain and financial technology ecosystem. This move highlights Western Union’s intent to modernize its global money transfer business through deeper integration with digital finance solutions.

What the Western Union WUUSD trademark covers

Public details of the “WUUSD” application indicate a broad scope: software for managing and verifying crypto transactions, tools for spending and trading cryptocurrency, exchange and brokerage services, payment processing, and mentions tied to lending services. While the filing has been accepted for processing by the USPTO, it has not yet been assigned to an examiner leaving timelines and specific products subject to change. TradingView

Why the Western Union WUUSD trademark matters

A day after Western Union said it would bring a USDPT stablecoin to Solana with issuance via Anchorage Digital Bank the trademark suggests the company may support stablecoin utility with in-house wallet and trading capabilities and an off-ramp Digital Asset Network. This could extend Western Union’s brand from fiat remittances into regulated digital asset rails, potentially lowering costs and settlement times for cross-border payments once products launch.

USDPT on Solana: launch window and partners

Western Union announced on Oct. 28 that USDPT will be built on Solana and issued by Anchorage Digital Bank, with anticipated availability in the first half of 2026. The company says users will be able to send, receive, spend and hold USDPT, and expects access through partner exchanges for broad reach. A separate Digital Asset Network aims to provide cash off-ramps, leveraging Western Union’s global footprint.

Policy context: the GENIUS Act and stablecoins

Western Union’s timing follows the GENIUS Act being signed into U.S. law on July 18, 2025, establishing a federal framework for payment stablecoins, including reserve, disclosure and issuer requirements. Analysts view the law as a catalyst for mainstream adoption by financial firms considering dollar-backed tokens.

Market uncertainty: WUUSD vs. USDPT

It remains unclear whether “WUUSD” will be a product brand distinct from USDPT, an internal label, or a broader services mark around the USDPT ecosystem. Western Union has also filed a trademark for USDPT, adding to the ambiguity. The company has not yet publicly clarified differences between the two.

If Western Union executes both the stablecoin (USDPT) and supporting services implied by the Western Union WUUSD trademark, it could fuse regulated issuance (via Anchorage) with retail access through Western Union’s distribution. Key variables include regulatory approvals, product scope (especially any lending or brokerage elements) and interoperability with existing crypto wallets and exchanges.

Outlook

Western Union’s WUUSD trademark filing, paired with its USDPT stablecoin on Solana and partnership with Anchorage for cash off-ramps, signals a broad and coordinated push into digital assets. The company appears to be building a multi-layered framework connecting blockchain payments, stablecoin transfers, and real-world cash accessibility.

However, key details remain unclear particularly how WUUSD will complement or differ from USDPT, and which services will debut first. These answers will shape market expectations as Western Union moves toward its planned H1 2026 launch, marking a major step in its digital transformation strategy.

FAQs

Q : What is WUUSD?

A : “WUUSD” is a Western Union trademark filing that covers potential crypto services including wallets, trading, payment processing, and mentions of lending/brokerage.

Q : How does USDPT differ from WUUSD?

A : USDPT is the planned U.S. dollar stablecoin on Solana; WUUSD appears to be a services mark. Western Union hasn’t publicly clarified the distinction yet.

Q : When will USDPT launch?

A : Western Union anticipates availability in the first half of 2026.

Q : Who is issuing the stablecoin?

A : Anchorage Digital Bank will issue USDPT; Western Union provides distribution and compliance infrastructure.

Q : Why is the GENIUS Act relevant?

A : It established a U.S. federal framework for payment stablecoins in July 2025, encouraging regulated participation by firms like Western Union.

Q : Will Western Union offer crypto lending?

A : The filing references lending/brokerage concepts, but no product is confirmed. Details depend on regulatory approvals and Western Union’s final offerings.

Q : Does the Western Union WUUSD trademark mean a token named WUUSD is coming?

A : Not necessarily. A trademark can cover branding for services or software; Western Union’s stablecoin token is named USDPT for now.

Facts

Event

Western Union files U.S. trademark for “WUUSD,” signaling expanded crypto servicesDate/Time

2025-10-31T00:00:00+05:00Entities

The Western Union Company (NYSE: WU); Anchorage Digital Bank; SolanaFigures

USDPT anticipated launch: H1 2026; network: Solana; issuer: Anchorage Digital BankQuotes

“We are committed to leveraging emerging technologies to empower our customers… Western Union’s USDPT will allow us to own the economics linked to stablecoins.” Devin McGranahan, CEO, Western Union (press release) ir.westernunion.comSources

Western Union press release; Cointelegraph report (via TradingView)