VARA vs ADGM vs SCA UAE: Guide for US & EU Firms

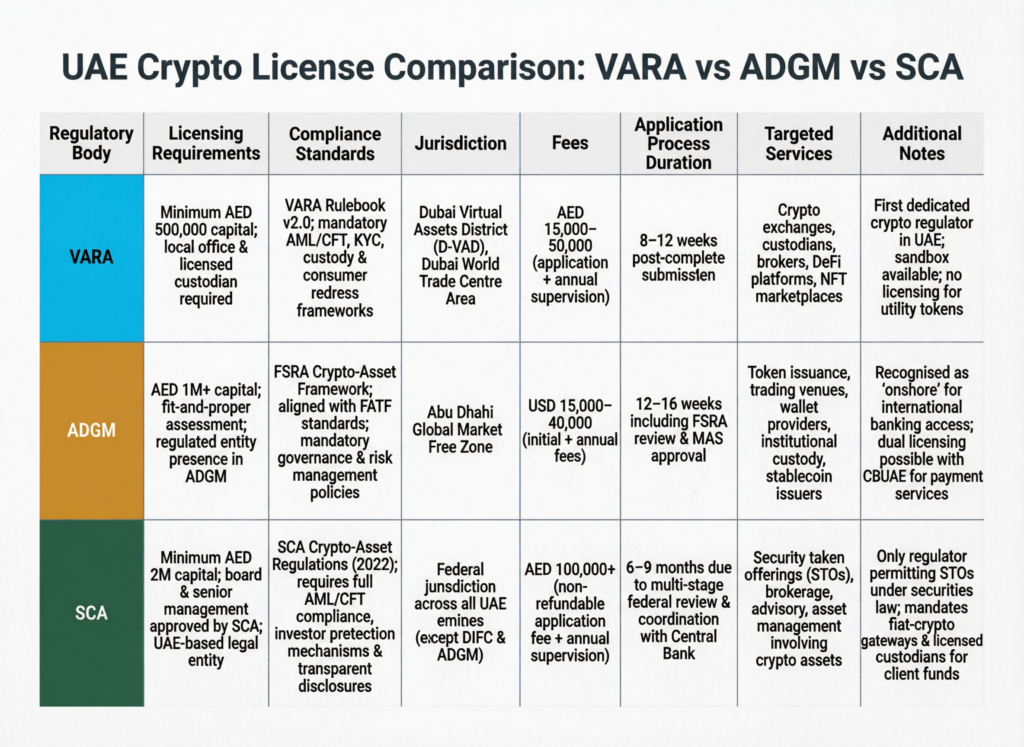

When you compare VARA vs ADGM vs SCA UAE for a 2026 crypto licence, there is no single “best” regulator. VARA usually suits retail-focused exchanges and consumer apps anchored in Dubai, ADGM tends to fit institutional desks and complex tokenization structures, while the federal SCA becomes critical wherever virtual assets start to behave like securities or you actively target UAE mainland investors.

If you’re weighing VARA vs ADGM vs SCA UAE for a crypto or virtual asset licence in 2026, you’re really choosing a long-term hub, not just ticking a regulatory box. The United Arab Emirates (UAE) has positioned itself as a global virtual asset centre alongside Switzerland, Singapore and the main EU MiCA hubs, with Dubai and Abu Dhabi competing to host serious exchanges, brokers and tokenization platforms.

MENA is already cited as the seventh-largest crypto market worldwide, with roughly $330B in on-chain value between mid-2023 and mid-2024 and around 7–8% of global transaction volume.The UAE alone is estimated to have seen about $56B in value in the latest reporting window, growing more than 30% year-on-year as clearer rules attracted capital and platforms.

Against that backdrop, founders, funds and exchanges now have three main UAE paths: a virtual asset service provider (VASP) licence from Dubai’s Virtual Assets Regulatory Authority (VARA), an institutional-style permission in Abu Dhabi Global Market (ADGM) under the FSRA, or alignment with the federal Securities and Commodities Authority (SCA) where virtual assets behave like securities. This guide focuses on when each tends to win especially for teams coming from the United States, United Kingdom and Germany / wider EU.

In practical terms, VARA is usually chosen for Dubai-focused retail exchanges and consumer apps, ADGM for institutional trading desks, funds and complex tokenization structures, while the federal SCA sits over everything that looks like a security, involves UAE mainland investors or onshore fundraising.

When VARA Is Usually the Best Fit (Retail & Brand-Led Plays)

VARA often works best if your play is brand-led, retail-facing and Dubai-centric: think spot exchanges, retail brokers, crypto payment apps, Web3 consumer platforms and gaming/NFT experiences. VARA’s 2023 Virtual Assets and Related Activities Regulations create an activity-based framework for advisory, broker-dealer, custody, exchange, lending/borrowing, payments and investment services.

For a US-style consumer exchange targeting tourists and residents in Dubai for example New York- or London-style retail trading apps the upside is clear: Dubai brand halo, strong marketing story, and proximity to a tech and tourism ecosystem that already hosts more than 40 licensed VASPs and hundreds of registered providers.

If your roadmap includes on-the-ground activations (events, sponsorships, signage) and B2C partnerships with local merchants or hospitality players, a VARA licence typically sends an immediately recognisable signal to counterparties in Dubai and the wider GCC.

When ADGM Tends to Win (Institutional & Complex Structures)

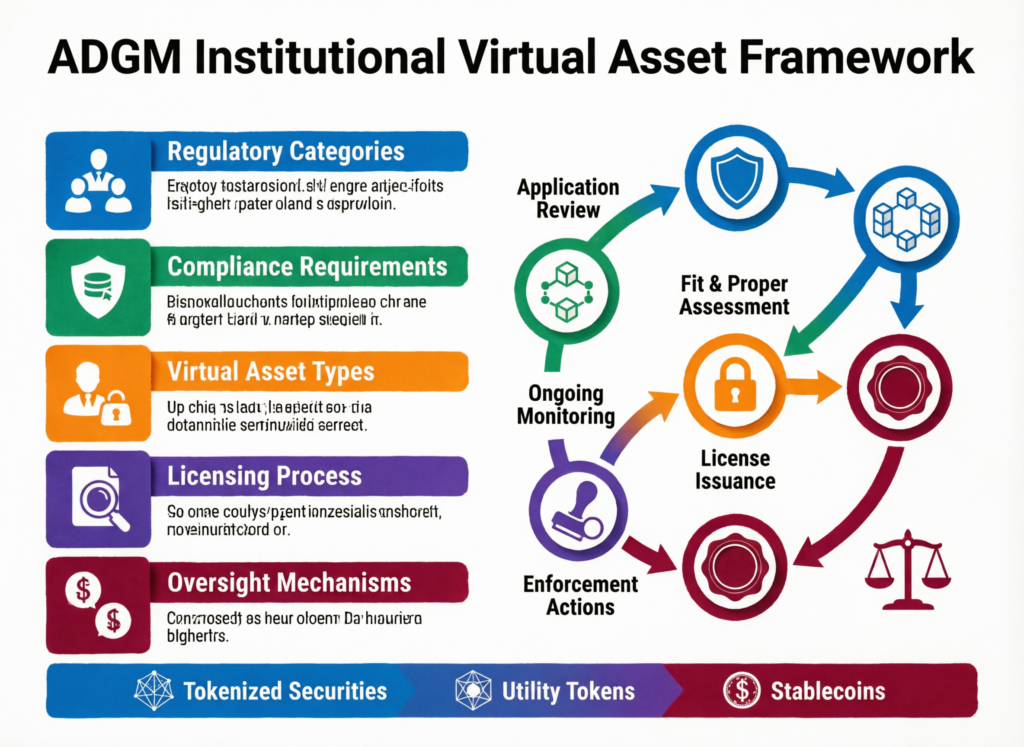

ADGM’s FSRA regime feels more like a traditional financial centre with a digital asset twist. The Virtual Asset Framework sits inside the broader Financial Services and Markets Regulations (FSMR), with permissions such as Multilateral Trading Facility (MTF), custody, brokerage and asset management that feel familiar to hedge funds, prop desks and prime brokers.

Institutional players for example a Chicago proprietary trading firm, a London FCA-regulated broker or a Frankfurt fund manager often prefer ADGM when they need.

Common-law courts and an English-language legal environment

Sophisticated fund and SPV structures for tokenized real estate or securities

Comfort that capital-markets-like virtual asset products can be mapped onto recognised “regulated activities”

ADGM has also been sharpening its framework around staking and “accepted virtual assets”, reinforcing its pitch as an institutional-grade hub for tokenization, structured products and derivatives.

Where the Federal SCA Still Controls the Perimeter

The SCA remains crucial whenever your tokens overlap with securities or collective investment schemes, or when you target UAE mainland investors directly. Its Crypto Assets Activities Regulation (originally Decision 23/2020, now evolved via later decisions) and Cabinet Resolution 111/2022 set a federal baseline for crypto asset offerings, trading and VASPs, alongside the UAE Central Bank for certain payment tokens.

If you’re planning IPO-style token offerings, STOs, structured notes or funds marketed into the mainland especially to family offices in Abu Dhabi or high-net-worth investors across the UAE you ignore SCA at your peril. A purely VARA or ADGM licence may not shield you if the product is really a security in SCA’s eyes.

UAE Virtual Asset Regulators Explained

Dubai’s VARA regulates virtual asset activities across the Emirate of Dubai (excluding the DIFC), ADGM’s FSRA oversees virtual asset activities within the ADGM free zone, and the federal SCA sets country-wide securities and virtual asset rules that still apply on the mainland and in some cross-border cases.

Dubai VARA and the Emirate-Level Virtual Asset Regime

Dubai Law No. 4 of 2022 established VARA as the specialist virtual asset regulator for the Emirate, with a mandate to regulate platforms and VASPs, protect investors and support Dubai’s digital-economy ambitions.

VARA’s regime is explicitly activity-based, with categories such as.

Advisory and broker-dealer services

Exchange / order-book trading

Custody and safekeeping

Lending, borrowing and staking-like services

Payments and remittances in virtual assets

Typical VARA VASPs range from regional retail exchanges and OTC brokers to payment apps integrated with point-of-sale systems in Dubai malls and hospitality venues.

ADGM FSRA Virtual Asset Framework in Abu Dhabi

Inside ADGM, the FSRA treats virtual assets within a single, comprehensive framework that plugs into existing financial services rules.

Permissions often used by crypto firms include.

Operating an MTF for spot or derivatives on virtual assets

Providing custody / safeguarding of client assets

Dealing as principal/agent (brokerage, OTC)

Managing assets and tokenized funds

This makes ADGM attractive for tokenization SPVs, structured products, derivatives venues and institutional-only exchanges particularly for German and EU managers who want something that feels aligned with MiCA and ESMA expectations on governance, disclosures and market abuse controls.

Federal SCA Decisions and Virtual Asset Laws

At federal level, SCA’s crypto assets regulations plus Cabinet Resolution 111/2022 form the backbone of UAE-wide virtual asset law, especially off-free-zone.

Key concepts include.

“Crypto asset” as an electronic record used for investment or payment

Licensing obligations for anyone offering, issuing, listing or trading crypto assets to UAE investors

Coordination with the Central Bank for payment-like tokens

SCA is also the lens through which global standards such as the FATF Travel Rule, AML/CFT expectations and federal sanctions / OFAC-style controls are applied to UAE VASPs.

License Scope, Costs and Timelines

Founders usually compare three things when choosing between VARA, ADGM and SCA.

Which activities are in scope (trading, custody, staking, tokenization)

All-in cost and substance (capital, people, office, systems)

Realistic timelines from pre-approval to go-live

ADGM often appeals on institutional clarity, VARA on market access and Dubai brand, with SCA as the baseline overlay for securities-like products.

Regulated Activities & Token Types.

Trading venues

Spot/derivatives exchanges and MTFs can be authorised under both VARA and ADGM; for pure securities tokens you may also look to Dubai Financial Services Authority (DFSA) inside the Dubai International Financial Centre (DIFC).

Brokerage / OTC

Both VARA and ADGM support broker-dealer style permissions. SCA oversight kicks in where underlying instruments are securities or where marketing targets mainland investors.

Custody

Strongly regulated in both VARA and ADGM; custody for security tokens in DIFC/DFSA or SCA space may follow slightly different capital and segregation rules.

Staking, DeFi, yield

VARA and ADGM increasingly capture staking-like services and interest-bearing products; ADGM has specifically consulted on staking frameworks to refine treatment.

Token issuance / STOs

Utility or payment tokens may sit under VARA/ADGM, but securities tokens and STOs must be analysed carefully for SCA or DFSA implications.

Capital, Fees, Substance and Timelines Compared

Exact numbers move, but a few patterns are emerging for 2025–2026 (always check live with local advisors)

Capital & fees

Both VARA and ADGM apply risk-sensitive capital and supervision fees; ADGM has recently refined capital rules for digital assets firms and the process for approving “accepted virtual assets”.

Substance

Expect at least a small local team (including MLRO/Compliance Officer), real office, board governance and on-the-ground decision-makers especially important for US, UK and EU banks conducting due diligence.

Timelines

Real-world experience suggests 9–18+ months from initial scoping to go-live is common for serious players under VARA or ADGM, depending on complexity and preparedness.(Regulators rarely promise timelines; this is market experience, not a guarantee.)

“Hidden” costs that US/European founders often underestimate include: local compliance and MLRO roles, external legal and regulatory consultants, ongoing audit, Travel Rule and on-chain analytics solutions, and the engineering work needed to embed those controls in your stack.

Ongoing Compliance.

Whichever route you choose, UAE regimes expect FATF-aligned AML/CFT controls and Travel Rule compliance for virtual asset transfers.

Common themes across VARA, ADGM, SCA and DFSA include.

Robust KYC for retail and institutional clients (with enhanced due diligence for higher-risk geos)

Travel Rule message routing and data sharing between VASPs

Transaction monitoring and on-chain analytics to identify sanctions and illicit-finance risks

STR/SAR filings and regular supervisory reporting

Periodic independent audits and, for some firms, thematic or on-site inspections

Good compliance isn’t just about keeping the regulator happy. It heavily influences whether banks in Dubai, London, New York City or Berlin will actually open and maintain accounts for your VASP.

Dubai vs Abu Dhabi vs DIFC/Mainland.

For many serious projects, the question isn’t “VARA or ADGM?” but “what combination, in what order?”. VARA, ADGM and DIFC/DFSA each play different roles for exchanges, brokers, tokenization SPVs and capital-markets products, with SCA as the federal backstop.

Dubai VARA vs Abu Dhabi ADGM for Exchanges and Brokers

A VARA-licensed exchange in Dubai typically leans into brand, B2C acquisition channels and local ecosystem co-location with Web3 events, tourism-driven retail flows and a wider consumer fintech scene. By late 2025, Dubai was reported as being home to dozens of licensed VASPs and hundreds of registered providers, servicing millions of investors and traders.

An ADGM-licensed venue in Abu Dhabi often emphasises institutional depth: access to local sovereign wealth capital, proximity to global banks and a narrative of “regulated like a financial market infrastructure” that resonates with desks in New York, London and Frankfurt.

Cost of living, talent and office space differ slightly between the cities, but for most well-funded startups, regulatory fit and bankability matter far more than rent.

Role of DIFC/DFSA and Mainland SCA for Tokenization & Securities

The DIFC, regulated by DFSA, has its own Crypto Token regime that focuses on investment tokens, securities-like instruments, funds and capital-markets activity.

If you’re running.

Tokenized private credit, real estate or fund units

Structured products with embedded crypto exposure

An STO platform aimed at professional investors

Then DFSA or SCA alignment may be more relevant than a pure VARA or ADGM VASP licence. In some cases, firms layer these: for example, a VARA-licensed retail interface, with an underlying DFSA-regulated fund or SCA-regulated STO.

Dual-Hub and Phased Strategies (VARA, ADGM and SCA Together)

Many sophisticated groups now run dual-hub or phased strategies, such as.

Starting institutional execution and custody in ADGM, then adding a VARA-licensed retail front-end

Keeping tokenization SPVs and funds in ADGM or DIFC while operating a consumer app under VARA

Obtaining SCA-aligned approvals for any mainland distribution or STOs, even if primary operations sit in a free zone

This can align well with BaFin, FCA or SEC expectations, where regulators like to see functional separation between trading, custody, issuance and advisory lines.

Guidance for US, UK and EU/German Firms

US, UK and EU/German firms face different home-country constraints (SEC, FCA, BaFin, MiCA, GDPR/UK-GDPR) and bankability issues. The “right” UAE regulator often depends on where your investors sit, how you market, and how tightly you must align with Western regulatory expectations.

US Founders and Funds.

For US Delaware C-corps, hedge funds and family offices, ADGM often feels like the closest analogue to a US-style financial centre: common-law courts, clear mapping to securities and derivatives concepts, and comfort for US counsel who already understand offshore funds and prime brokerage.

The U.S. Securities and Exchange Commission (SEC) hasn’t given firms a MiCA-style “passport”, so you’ll still manage SEC, CFTC, OFAC and US tax issues separately. But being regulated in a jurisdiction seen as serious on AML/CFT and FATF alignment often helps with correspondent banking and KYC at US institutions.

UK Fintech’s and Exchanges.

United Kingdom-based firms supervised by the Financial Conduct Authority (FCA) typically look for.

Clear conduct rules, conflicts-of-interest controls and disclosure frameworks

The ability to map their UK-GDPR and Data Protection Act 2018 obligations onto UAE data hosting and processing.

Both VARA and ADGM can work, but you’ll need to think carefully about where personal data is stored (for example, in EU or UK cloud regions) and how you structure cross-border outsourcing and incident-response obligations. For anything resembling open-banking-style or health-linked data, this becomes even more sensitive.

German/EU Players.

For German and wider EU firms regulated under Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) or other national competent authorities working with ESMA and MiCA, the priority is usually not “regulatory arbitrage” but complementarity.

MiCA is setting a harmonized baseline for EU crypto-asset issuance and services from 2024/2025, while GDPR/DSGVO drives strict data-protection requirements. A UAE license whether ADGM, VARA or a hybrid structure is typically used to serve MENA investors (Riyadh, Dubai, Doha) while keeping EU investor relationships and data within MiCA and GDPR guardrails.

How to Decide: Practical Checklist & Next Steps

To choose between VARA vs ADGM vs SCA UAE, start by mapping your products (exchange, brokerage, custody, staking, tokenization), target clients (retail vs institutional, UAE vs global), fundraising plans and risk appetite, then back-solve into the regulator or combination that best fits those parameters.

Map Your Business Model to the Right Regulator

A simple working sequence for founders.

List activities spot, margin, derivatives, staking, lending, custody, token issuance, STOs.

Classify clients retail vs professional, UAE vs global, B2C vs B2B.

Map tokens pure crypto, utility, payment, security-like, real-world-asset (RWA) tokenization.

Banking & fiat how fiat enters and leaves (cards, wires, local payment rails) and which banks you realistically want to work with.

Regulator fit retail-heavy, Dubai-centric models often lean VARA; institutional, derivatives, structured products and tokenization SPVs often lean ADGM/DIFC; securities-heavy or mainland distribution will trigger SCA/DFSA overlays.

Even a basic decision grid in Excel or a whiteboard workshop something Mak It Solutions regularly runs for SaaS and fintech founders expanding to GCC markets can clarify the short list of viable paths.

Key Questions to Ask Advisors Before Choosing VARA, ADGM or SCA

When you speak to UAE counsel, regulatory consultants or implementation partners, ask:

How many VARA/ADGM/SCA projects have you taken from scoping to license and go-live?

What are typical timeline bands for a business like ours, and what slows things down?

How do you approach banking which UAE and international banks have actually opened accounts for your clients?

How do you coordinate with EU/UK/US counsel on MiCA, SEC, FCA and BaFin interactions?

Can you share anonymised examples where you advised against “fastest/cheapest” options, and why?

If answers are vague or purely marketing-driven, that’s a red flag. A good advisor will talk frankly about regulator questions, remediation rounds and documentation pain as well as the upside.

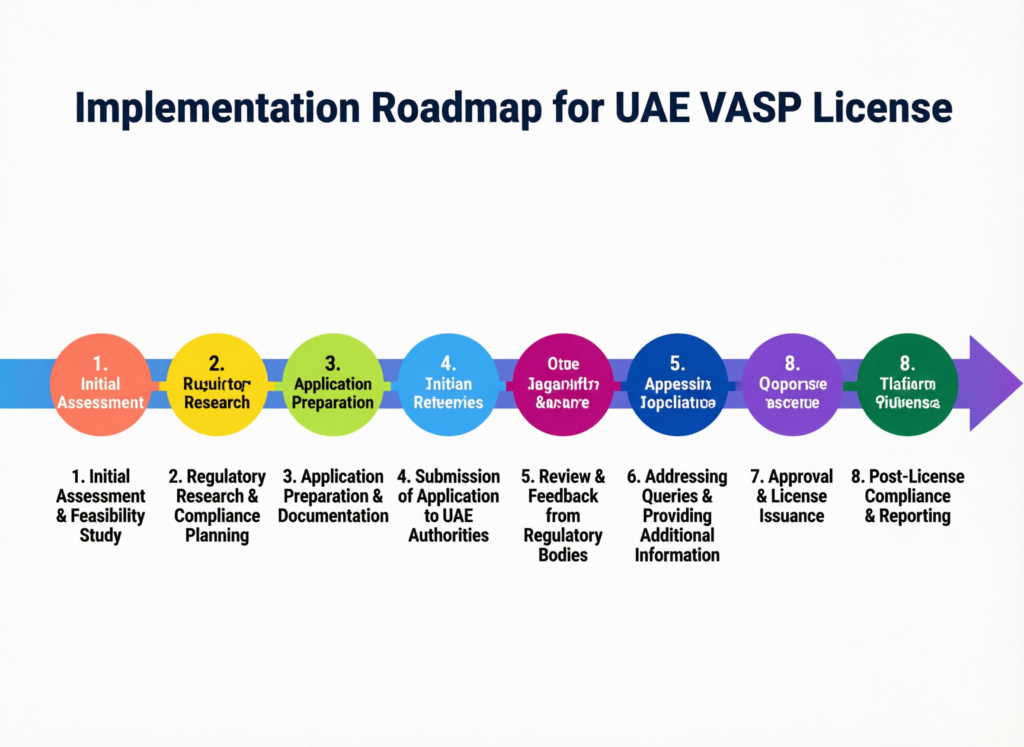

Implementation Roadmap.

A realistic implementation roadmap usually looks like this

Structuring workshop

Map activities, entities and geos; pick a target regulator mix (VARA, ADGM, DIFC/DFSA, SCA overlay).

Detailed activity mapping

Translate your product roadmap into regulated activities and permissions; identify any MiCA/GDPR, UK-GDPR or US SEC constraints.

Documentation & policies

Draft business plan, financials, AML/CTF framework, Travel Rule strategy, tech and security documentation (PCI DSS, SOC 2, cloud controls if relevant).

Regulator engagement

Submit initial filings, respond to information requests, refine scope and conditions.

Pre-go-live build

Finish core platform, integrate KYC/AML, Travel Rule and monitoring; dry-run reporting packs. Mak It Solutions often pairs this with broader cloud, FinOps and data-governance work.

Launch & iterate

Go live with phased client onboarding, then refine based on regulator feedback, incident reports and evolving FATF and MiCA guidance.

For US, UK and EU teams, a structured onboarding pack for UAE advisors architecture diagrams, regulatory history, current policies can compress the early stages significantly.

Concluding Remarks

VARA, ADGM and SCA are complementary rather than competing in a zero-sum game. Many serious players now run phased or dual-hub strategies that combine retail access in Dubai, institutional depth in Abu Dhabi, and securities-grade oversight under SCA or DFSA. With careful structuring, a UAE hub can sit alongside SEC, FCA, BaFin and MiCA supervision instead of clashing with it especially when your cloud, data, AML and governance foundations are engineered correctly from day one.

Key Takeaways

Use VARA when your edge is retail distribution, Dubai brand and consumer-facing apps.

Use ADGM (and sometimes DIFC/DFSA) when you’re institutional-first, derivatives-heavy or focused on tokenization SPVs and funds.

Treat SCA as the federal perimeter for securities-like tokens, mainland distribution and STOs not optional paperwork.

For US/UK/EU firms, choose the mix that best fits SEC/FCA/BaFin/MiCA expectations on governance, disclosures, AML and data protection.

Build compliance, cloud and data-governance architecture in parallel with licensing; that’s where Mak It Solutions can do much of the heavy lifting for you.

This article is general information, not legal, tax or investment advice. Always obtain advice from qualified UAE and home-jurisdiction counsel before acting.

If you’re mapping VARA vs ADGM vs SCA for a 2026 launch, you don’t have to solve the puzzle alone. The team at Mak It Solutions works with US, UK, German and wider EU founders on regulated-ready architectures, from data residency and cloud layouts to AML reporting and dashboarding for boards and regulators.

Share your business model, target regulators and launch timeline, and we’ll help you turn them into a concrete roadmap including the technical, data and analytics foundations you’ll need to make your UAE licence actually bankable and scalable.( Click Here’s )

FAQs

Q : Is a VARA licence enough to serve UAE mainland clients, or do we still need SCA approval?

A : Not always. A VARA licence covers virtual asset activities in the Emirate of Dubai (outside DIFC), but it doesn’t override federal SCA rules on securities-like instruments or mainland distribution. If you actively target mainland investors, run STOs or structure products that look like securities or funds, you may need SCA authorisation, SCA-aligned intermediaries or a DIFC/DFSA structure on top of your VARA licence. Always have your specific products mapped against SCA and Cabinet Resolution 111/2022 with local counsel.

Q : Can a crypto firm hold both VARA and ADGM licences at the same time, and is this common in practice?

A : Yes, it’s possible and increasingly common. Groups often use ADGM for institutional trading, custody or tokenization SPVs while holding a VARA licence for retail interfaces, marketing and Dubai-centric operations. The governance challenge is to prevent conflicts of interest and ensure group-wide AML, risk and data-protection frameworks are consistent across both regulators and any SCA/DFSA overlays. Well-structured multi-hub models tend to impress, rather than worry, sophisticated investors and banking partners.

Q : Does a DeFi protocol without fiat on-ramps need a UAE virtual asset licence under VARA or ADGM?

A : A purely decentralised protocol, with no identifiable entity operating an exchange, providing custody or soliciting users in the UAE, is less likely to fall neatly into current VARA or ADGM licensing buckets but that doesn’t mean it’s outside regulatory risk. As soon as you operate a front-end, run a treasury, take fees, market to UAE users or integrate fiat on-ramps, regulators may view you as a VASP or equivalent. Founders with meaningful admin keys, multisig control or fee flows should assume that UAE (and FATF) rules on VASPs may apply and seek advice before onboarding UAE users at scale.

Q : How does a VARA or ADGM licence affect our ability to open bank accounts in the UAE and abroad?

A : A recognised VARA, ADGM or DFSA licence usually improves your bankability versus being unregulated, but it isn’t a magic key. Banks still look at your shareholder structure, jurisdictions, AML controls, Travel Rule implementation, audited financials and how well your activities fit their risk appetite. The biggest advantage of licensing is that it gives relationship managers and risk committees a concrete regulatory framework to lean on, especially when combined with strong cloud, data-security and compliance documentation

Q : Do EU MiCA-authorised firms still benefit from getting a UAE crypto licence, or is MiCA alone sufficient?

A : MiCA authorisation is powerful in the EU/EEA, but it doesn’t give you automatic rights in the UAE. If you want a serious presence in Dubai or Abu Dhabi, or to serve GCC investors directly, you’ll still need to work within VARA, ADGM, DFSA and/or SCA frameworks. The good news is that MiCA-grade governance, disclosure and safeguarding standards generally align well with what UAE regulators want to see, so a MiCA-ready platform often adapts more easily to UAE requirements than a lightly regulated offshore structure.