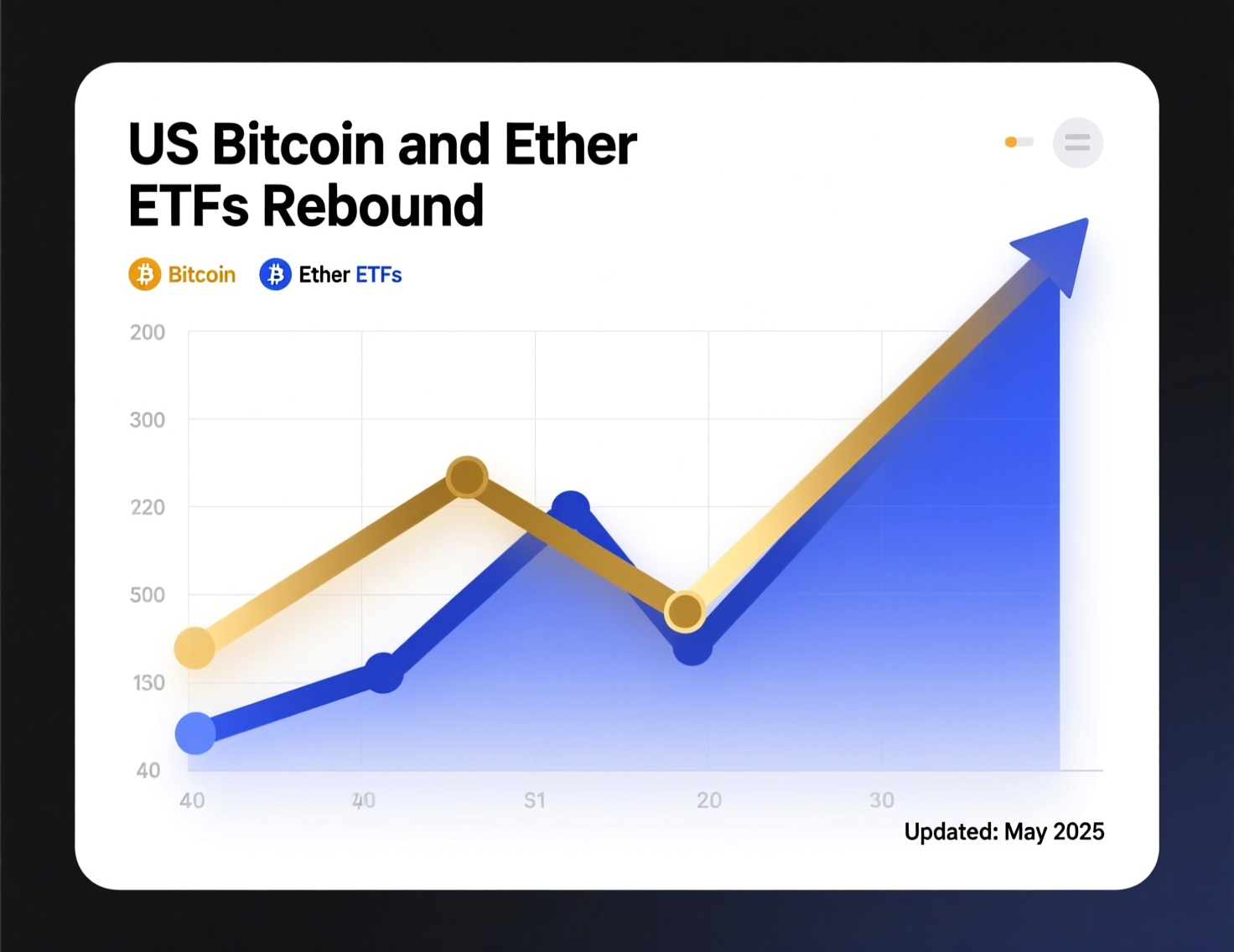

US Bitcoin and Ether ETFs rebound as Powell signals rate cuts

After a sharp selloff and significant redemptions, US Bitcoin and Ether ETFs have staged a rebound, attracting fresh inflows from investors. The bounce comes as the market digests recent signals from the Federal Reserve, which hint that the current cycle of quantitative tightening (QT) could be nearing its end. Investor sentiment appears to have been buoyed by the prospect of looser monetary conditions, encouraging renewed interest in crypto-backed ETFs.

Market participants are now closely watching for potential interest rate cuts before year-end, as suggested by the Fed’s commentary. This shift in policy expectations has helped restore confidence, prompting capital to flow back into digital asset ETFs. The renewed inflows underscore how sensitive crypto markets remain to macroeconomic cues and central bank guidance.

ETF flows snap back as policy tone softens

US spot Bitcoin ETFs posted $102.6m in net inflows on Oct. 14, reversing the prior day’s $326.4m outflow. Fidelity’s Wise Origin Bitcoin Fund (FBTC) led with $132.7m in inflows, while BlackRock’s iShares Bitcoin Trust (IBIT) recorded a $30.8m outflow. Ether ETFs mirrored the bounce with $236.2m in net inflows, driven by Fidelity’s FETH ($154.6m) and supported by gains at Grayscale and Bitwise. Farside+1

Policy backdrop: Powell hints at more easing

Speaking at a National Association for Business Economics event, Fed Chair Jerome Powell said the end of QT may be approaching, noting reserves are “somewhat above the level” needed for ample liquidity, and indicated the Fed is prepared to cut rates further if the labor market weakens. These remarks eased liquidity concerns and supported risk assets, including crypto ETPs.

Market context: resilience despite volatility

Even amid recent turbulence linked to US–China tariff headlines and a flash crash, digital-asset investment products drew $3.17bn last week, pushing YTD inflows to $48.7bn, underscoring robust institutional demand.

US Bitcoin and Ether ETFs rebound: fund-by-fund highlights

FBTC (Fidelity): +$132.7m (BTC)

IBIT (BlackRock): −$30.8m (BTC)

FETH (Fidelity): +$154.6m (ETH)

ETHE/ETH (Grayscale): +$34.8m (ETH)

ETHW (Bitwise): +$13.3m (ETH)

Figures are for Oct. 14 US trading.

What this means for investors

The return to positive flows suggests dip-buying and re-risking as policy uncertainty eases. ETF activity remains a leading gauge for institutional sentiment toward Bitcoin and Ether.

US Bitcoin and Ether ETFs rebound: what to watch next

Upcoming Fed meetings (late October, December) and any QT-related decisions.

Sustainability of inflows if volatility persists.

Spread of flows across issuers (Fidelity vs. BlackRock) and between BTC vs. ETH funds.

Context & Analysis

Historically, policy easing and liquidity stabilization have coincided with stronger ETF demand for risk assets. If QT slows and rates decline further, US crypto ETPs may continue to absorb capital, though idiosyncratic crypto factors (leverage, exchange liquidations) can still interrupt flow momentum.

Conclusion

With Fed Chair Powell hinting at a potential end to quantitative tightening (QT) and showing openness to additional rate cuts, the near-term environment appears supportive for continued participation in crypto ETPs. Investors are watching closely, as favorable macroeconomic data could further encourage engagement in these digital asset products.

Daily flow dashboards continue to provide the clearest insight into institutional sentiment, highlighting patterns in capital movement and investor confidence. Tracking these flows remains essential for understanding how market participants are positioning themselves amid evolving Fed policy signals and the broader macro landscape.

FAQs

Facts

Event

US spot Bitcoin and Ether ETFs rebound with fresh inflowsDate/Time

2025-10-14T16:00:00+05:00 (flows reference date); 2025-10-15T10:00:00+05:00 (publication)Entities

Federal Reserve; Jerome Powell; Fidelity (FBTC, FETH); BlackRock (IBIT); Grayscale (ETHE/ETH); Bitwise (ETHW)Figures

BTC ETFs +$102.6m; ETH ETFs +$236.2m; prior day outflows BTC −$326.4m, ETH −$428.5m; weekly inflows $3.17bn, YTD $48.7bnQuotes

“We may be approaching this level in the coming months.” — Jerome Powell, on ending QTSources

Reuters (Powell) https://www.reuters.com/, AP News (Powell) https://apnews.com/, Farside (ETF flows) https://farside.co.uk/, CoinShares (weekly flows) https://coinshares.com/ coinshares.com+4Reuters+4AP News+4