Basel crypto capital rules for banks: US and UK pushback forces rethink

Global bank regulators are reconsidering the strictest aspects of their crypto framework after the United States and the United Kingdom opted not to adopt it in its original form, according to Basel Committee chair Erik Thedéen. The decision highlights the ongoing challenges in achieving a unified global approach to crypto regulation, especially as major economies chart their own paths in managing digital assets. Regulators are now evaluating which measures can be realistically implemented while maintaining financial stability.

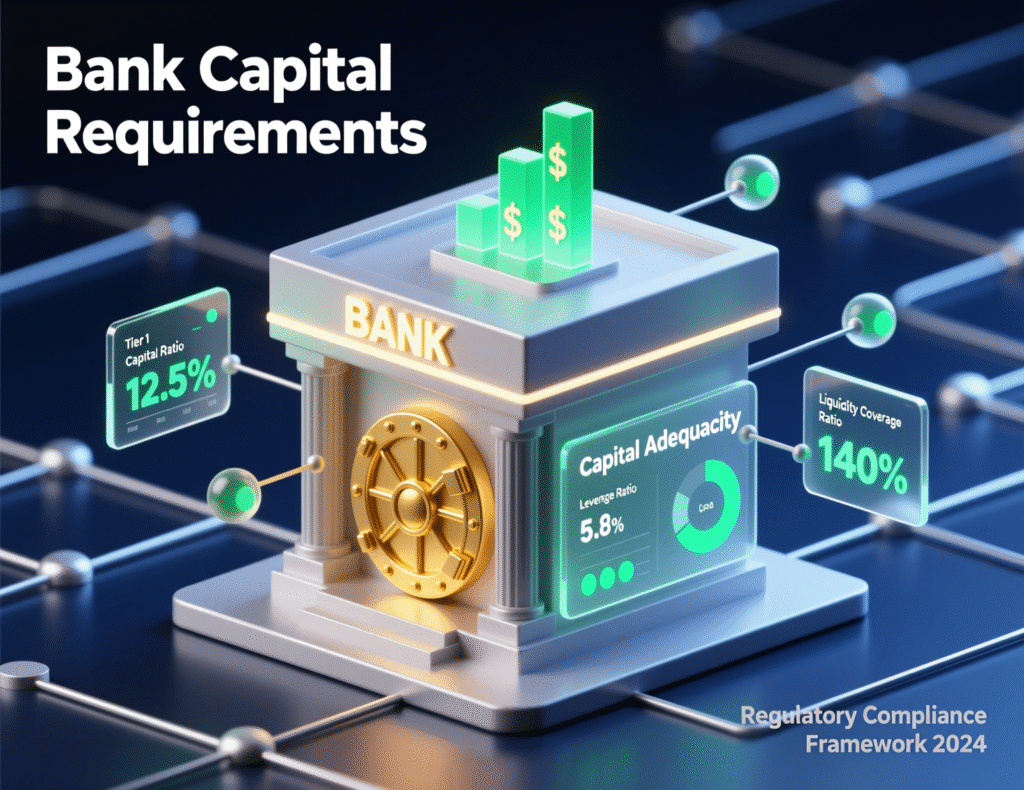

This reassessment particularly affects the Basel rules on capital requirements for banks’ crypto exposures. Notably, the framework’s 1,250% risk weight on permissionless blockchain holdings—including many stablecoins and other crypto assets—may be subject to revision. The outcome could reshape how banks handle crypto risks and influence the broader regulatory landscape for digital assets worldwide.

Why Basel crypto capital rules for banks are under review

Thedéen said the rapid rise of regulated stablecoins warrants “a different approach,” noting the policy environment has shifted materially since the standard was finalized. Under the Basel framework, crypto assets on permissionless chains default to a 1,250% risk weight unless stringent criteria are met effectively requiring banks to hold capital roughly equal to the full exposure, making participation uneconomic.

Market impact of Basel crypto capital rules for banks

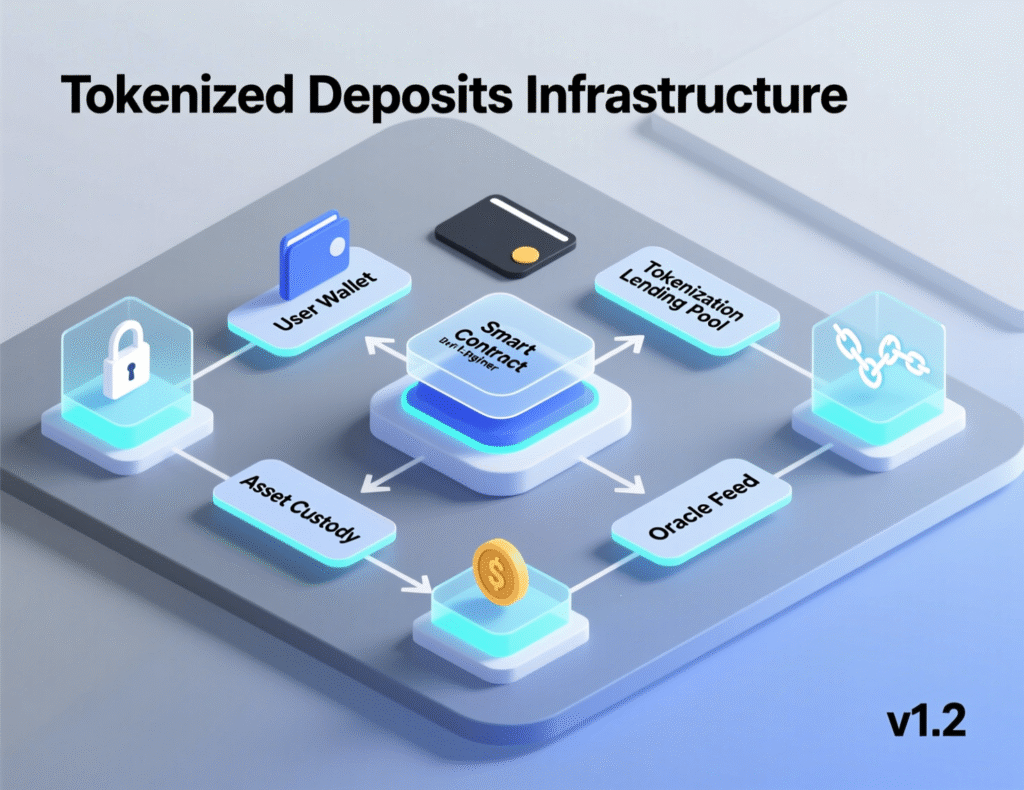

US and UK supervisors have indicated they won’t apply the permissionless-chain treatment as written, while the EU has adopted a CRR III transitional regime with its own parameters, including differentiated treatment for certain tokenized assets and asset-referenced tokens. The uneven rollout is shaping where banks can offer stablecoin services, tokenized deposits and crypto custody at scale. Financial Times+1

What the US, UK and EU are doing now

United States

Policymakers have criticized the Basel crypto treatment as unrealistic. Separately, Congress enacted the GENIUS Act (July 18, 2025), creating a federal framework for payment stablecoin issuers an impetus for bank engagement and product development.

United Kingdom

The Bank of England has signaled it will not apply the Basel standard in its current form.

European Union

The CRR III transitional regime applies now and deviates from Basel in places (e.g., treatment of certain tokenized and asset-referenced tokens), with further RTS being finalized by the EBA.

Stablecoins: the flashpoint

Stablecoins’ growth and new US law has intensified pressure to recalibrate capital charges. Analysts note that a blanket 1,250% weight for permissionless-chain exposures can deter banks from serving payments, market-making, or custody use cases even when reserves are high-quality and risks are ring-fenced. Basel is weighing whether more risk-sensitive approaches are feasible without undermining safety and soundness.

Context & Analysis

If the US and UK maintain a more permissive stance while the EU holds closer to current Basel language, global banks may concentrate crypto payment and custody build-outs in US/UK entities, leaving EU institutions at a relative disadvantage until harmonization improves. That could shift liquidity, revenues, and innovation clusters particularly in tokenized deposits and bank-issued stablecoins to jurisdictions with clearer, more risk-sensitive capital treatment.

Conclusion

Basel’s re-evaluation paves the way for a more refined crypto framework that differentiates between various use cases and blockchain designs. This approach aims to tailor capital requirements more accurately to the specific risks posed by different types of digital assets, moving away from a one-size-fits-all model.

In the meantime, financial institutions face a fragmented regulatory environment. The US and UK offer more flexible approaches, while the EU continues with transitional rules. Banks should prepare for multiple capital scenarios and stay alert to Basel’s upcoming consultations to adapt their strategies and ensure compliance with evolving international crypto regulations.

FAQs

Q : What are the Basel crypto capital rules for banks?

A : A Basel framework assigning high risk weights (up to 1,250%) to certain crypto exposures, especially on permissionless chains.

Q : Why are the US and UK pushing back?

A : Supervisors argue the charges are impractical and could stifle safe, regulated activity.

Q : How does the EU’s CRR III differ?

A : It installs a transitional regime and EBA RTS with differentiated treatment for tokenized and asset-referenced tokens.

Q : Did the GENIUS Act change the US outlook?

A : Yes. The July 18, 2025 law creates a federal regime for payment stablecoin issuers, catalyzing bank interest.

Q : Are all stablecoins treated the same under Basel?

A : No. Treatment depends on factors like backing, redemption, and whether exposure is on a permissionless chain; a 1,250% fallback applies in many cases.

Q : What’s the likely timeline for Basel revisions?

A : Basel has flagged a reassessment; details and dates will follow via consultation.

Q : What’s the main risk of global divergence?

A : Competitive imbalances in custody, market-making, and tokenized deposit initiatives across regions.

Facts

Event

Basel signals review of toughest crypto capital rules amid US/UK resistance and EU divergence.Date/Time

2025-11-19T15:00:00+05:00Entities

Basel Committee on Banking Supervision (BCBS); US Federal Reserve; Bank of England; European Banking Authority (EBA); European Union (CRR III); Erik Thedéen (Sveriges Riksbank).Figures

1,250% risk weight (fallback for many permissionless-chain exposures). Bank for International SettlementsQuotes

“a different approach” Erik Thedéen, BCBS chair (via FT). Financial TimesSources

FT (link), BIS Basel Framework SCO/60 (link)