UK trading platform IG Group buys Australian crypto exchange

UK-based online broker IG Group has agreed to acquire Independent Reserve, a leading Australian cryptocurrency exchange, in a deal worth A$178 million (approximately $117.4 million, based on $1 = 1.5161 AUD). The purchase marks a strategic move to strengthen IG’s presence in the fast-growing digital asset sector and expand its reach across the Asia-Pacific region. Independent Reserve is among the region’s most established platforms, giving IG access to a broader crypto customer base.

According to IG, the transaction is expected to be accretive to cash earnings per share starting from the first full fiscal year after completion. This acquisition highlights the company’s push to diversify its product offering beyond traditional brokerage services, reinforcing its long-term commitment to tapping opportunities in the global cryptocurrency market.

IG Group buys Independent Reserve

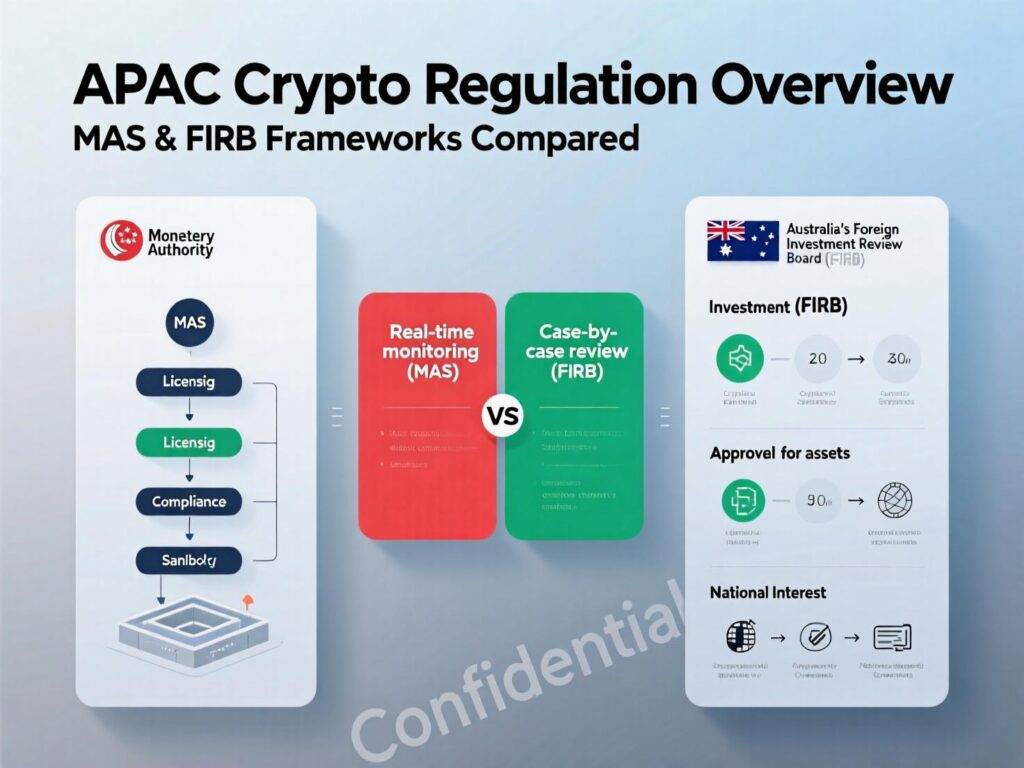

IG Group will acquire 70% of Independent Reserve for A$109.6m at closing, excluding an expected share of A$8.4m in surplus cash. A further A$15m is contingent on FY26 performance, taking the consideration for the 70% interest to A$124.6m. IG has a call option to buy the remaining 30% based on FY27–FY28 performance. Completion is subject to approvals from Singapore’s MAS and Australia’s FIRB, which IG currently expects in early 2026. Investegate

Why IG Group buys Independent Reserve matters for APAC crypto

The acquisition gives IG immediate access to Australia and Singapore, markets where Independent Reserve already operates with established permissions. IG plans to retain the Independent Reserve brand and integrate its products into IG’s trading platforms. Management framed the deal as a bolt-on that accelerates IG’s crypto roadmap in priority regions.

Performance snapshot of Independent Reserve

For the 12 months to 30 June 2025, Independent Reserve reported A$35.3m revenue and A$9.9m EBITDA, with about 11,600 average monthly active customers and a strong growth profile versus the prior year.

<section id=”howto”> <h3>How to track completion of the IG–Independent Reserve deal</h3> <ol> <li id=”step1″><strong>Step 1:</strong> Check IG Group’s RNS/press releases for closing updates and conditions. </li> <li id=”step2″><strong>Step 2:</strong> Review LSE announcements (ticker: IGG) and any subsequent transaction notices.</li> <li id=”step3″><strong>Step 3:</strong> Monitor regulatory approvals from <abbr title=”Monetary Authority of Singapore”>MAS</abbr> and Australia’s <abbr title=”Foreign Investment Review Board”>FIRB</abbr>.</li> <li id=”step4″><strong>Step 4:</strong> Watch Independent Reserve’s site and status pages for customer-facing changes.</li> <li id=”step5″><strong>Step 5:</strong> Verify any changes to product availability, fees or onboarding in Australia/Singapore.</li> </ol> <p><em>Note: Process may vary by regulator/provider. Confirm requirements before acting.</em></p> </section>

Executive commentary

“This acquisition marks an important step in IG’s crypto strategy in a key region,” said Matt Macklin, Managing Director, Asia Pacific & Middle East, IG Group. Adrian Przelozny, CEO and co-founder of Independent Reserve, said joining IG aligns with its mission to provide “secure, regulated crypto trading.

Context & Analysis

Structurally, IG’s staged approach (70% now, call option on 30% later) limits upfront risk while preserving upside linked to performance. The move follows IG’s recent spot-crypto rollout in the UK and expanded coin support in the US via tastytrade/Zero Hash partnerships, suggesting a broader cross-market crypto strategy. Post-approval integration while retaining the Independent Reserve brand may help preserve local trust and institutional relationships in Australia and Singapore.

Conclusion

IG Group expects its planned acquisition of Independent Reserve to close in early 2026, subject to approvals from the Monetary Authority of Singapore (MAS) and Australia’s Foreign Investment Review Board (FIRB). The deal reflects IG’s continued expansion into the cryptocurrency market, adding scale and regional strength to its digital asset strategy.

The company has guided that the transaction will be cash EPS accretive in FY27, the first full fiscal year post-closing. Investors will be watching closely for progress updates, which IG is likely to share through its upcoming trading statements and regulatory filings.

FAQs

Q : What did IG Group buy and for how much?

A : IG Group agreed to buy Australian crypto exchange Independent Reserve at an A$178m enterprise value, acquiring 70% initially.

Q : When will the acquisition close?

A : After MAS and FIRB approvals, currently expected early 2026.

Q : Will the brand change for customers?

A : IG plans to retain the Independent Reserve brand and integrate products into IG’s platforms.

Q : Is the deal expected to boost earnings?

A : IG expects the deal to be cash EPS accretive in FY27, the first full year after completion.

Q : What are Independent Reserve’s recent financials?

A : FY25 revenue A$35.3m, EBITDA A$9.9m; about 11.6k average monthly active customers.

Q : How much is that in US dollars?

A : Reuters references $1 = 1.5161 AUD, putting A$178m at about $117.4m.

Q : Does this affect regulation of my account?

A : Independent Reserve is a registered Digital Currency Exchange with AUSTRAC; regulatory oversight remains in place.

Q : Does the article’s exact keyword appear in FAQs?

A : Yes, this FAQ set references IG Group buys Independent Reserve directly.