U.S. Posts $345B August Deficit, Net Interest at 3rd Largest Outlay, Gold and BTC Rise

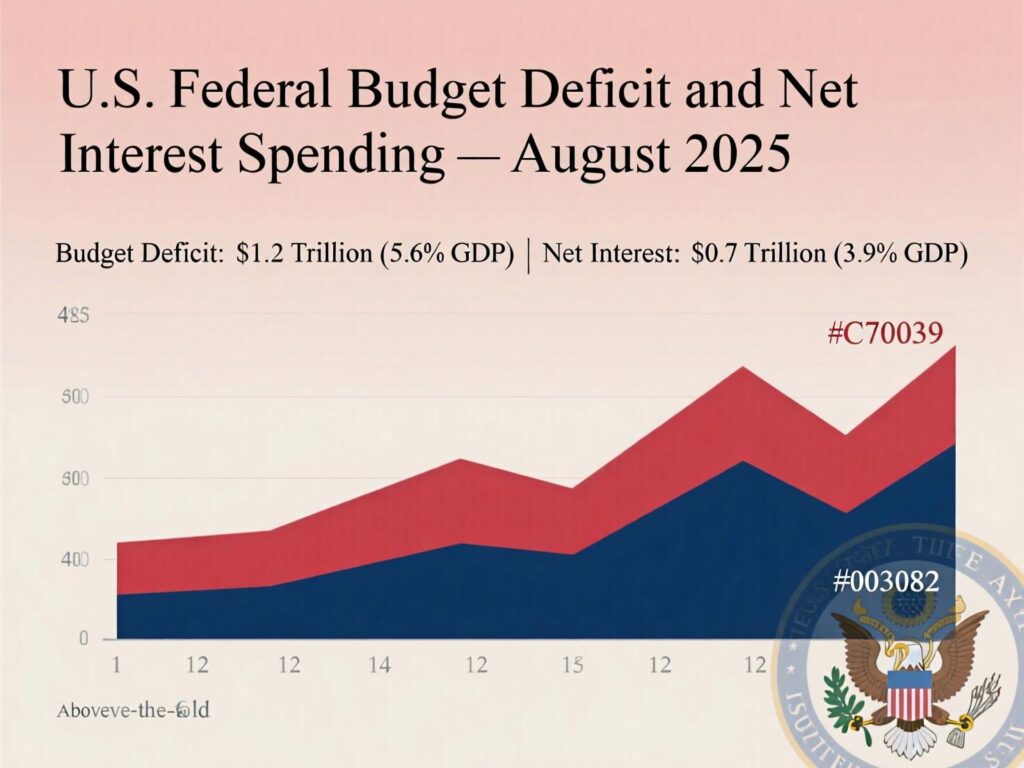

The U.S. budget deficit for August 2025 expanded significantly as federal spending surged well beyond revenue, reflecting how rising borrowing costs are reshaping the nation’s fiscal outlook. This widening gap highlights the strain higher interest payments and ongoing expenditures are placing on government finances, raising fresh concerns about long-term debt sustainability.

Markets were quick to react to the news. Gold prices climbed to record highs as investors sought safe-haven assets, while Bitcoin reached another milestone, signaling growing demand for alternative stores of value. The sharp moves in both traditional and digital assets underscore the broader financial market sensitivity to fiscal pressures and monetary dynamics, suggesting investors are bracing for more volatility as the U.S. navigates its shifting economic landscape.

By the numbers: August snapshot

Receipts: $344B

Outlays: $689B

Deficit: $345B

The US August 2025 budget deficit reflects the growing weight of interest costs.Largest line items: Medicare $141B, Social Security $134B

Net interest: $93B, now the third-largest expense

Why it matters: debt servicing is the new heavyweight

Interest is no longer a footnote it’s a headline. With $93B in August net interest, the government is spending more to service existing debt, crowding out policy flexibility. This dynamic helps explain why the US August 2025 budget deficit ballooned even without an extraordinary spike in other categories.

Rates, inflation and the Fed’s September call

The Fed is widely expected to trim rates by 25 bps this month. But a cut doesn’t guarantee lower long-term yields. We saw in late 2024 how easing coincided with a sharp rise on the long end, complicating financing costs. If inflation re-accelerates, term premiums can widen and push yields higher, further pressuring debt service—and by extension the US August 2025 budget deficit.

Market reaction: flight to alternatives

Investors are hedging fiscal and inflation risk. Gold ripped to fresh records just shy of $3,670/oz, while bitcoin jumped above $115,000. Momentum in both assets hints at renewed retail participation and a search for stores of value as the US August 2025 budget deficit puts debt sustainability back in focus.

What to watch

Fed meeting:

Forward guidance on inflation risks and balance-sheet plansTreasury borrowing estimates:

Any tweaks that alter supply at the long endInflation prints:

Upside surprises could reprice the entire curveRisk sentiment:

Sustained demand for gold/bitcoin if fiscal concerns persist

Conclusion

The August 2025 U.S. budget deficit signals that elevated debt servicing is becoming a lasting challenge. If inflation holds firm while the Fed moves cautiously on rate cuts, long-term yields could rise again, pushing borrowing costs higher and widening fiscal gaps. This dynamic keeps pressure on policymakers as they try to sustain growth without worsening the fiscal burden.

For markets, the outcome points to more volatility ahead. Investors are likely to continue favoring alternative assets, with gold and crypto positioned for further upside. Until fiscal numbers show real improvement, the safe-haven and digital asset bid may remain strong.

FAQs

Q1 . What is the US August 2025 budget deficit and why is it significant?

A : The US August 2025 budget deficit was $345B as outlays outpaced receipts. It matters because rising net interest ($93B) is now a top-three expense, reshaping fiscal priorities.

Q2 . How did markets react to the US August 2025 budget deficit?

A : Gold hit new highs near $3,670, and bitcoin climbed above $115K, signaling demand for alternatives as the US August 2025 budget deficit spotlights debt sustainability.

Q3 . Will a Fed rate cut reduce the US August 2025 budget deficit?

A : Not directly. A 25 bps cut could lower short-term rates, but long-term yields may rise if inflation risks firm, potentially worsening the US August 2025 budget deficit via higher interest costs.

Q4 . What drove net interest to the third-largest line item in August 2025?

A : Larger debt outstanding and higher average borrowing costs combined to push net interest to $93B, adding structural pressure to the US August 2025 budget deficit.

Q5 . What should investors watch next after the US August 2025 budget deficit report?

A : The Fed’s guidance, Treasury borrowing plans, upcoming inflation data, and risk appetite are all key to how the US August 2025 budget deficit reverberates across yields, gold, and crypto.