U.S. Government Shutdown, UK ETNs, Hedera Upgrade: Crypto Week Ahead

The week of October 6 in crypto opens amid macro uncertainty as the U.S. government shutdown looms, keeping risk sentiment fragile. Market participants are watching Washington closely for signs of compromise while gauging how prolonged gridlock might affect liquidity and safe-haven flows. Meanwhile, expectations around the Federal Reserve’s upcoming communications are likely to steer short-term momentum in both crypto and broader markets.

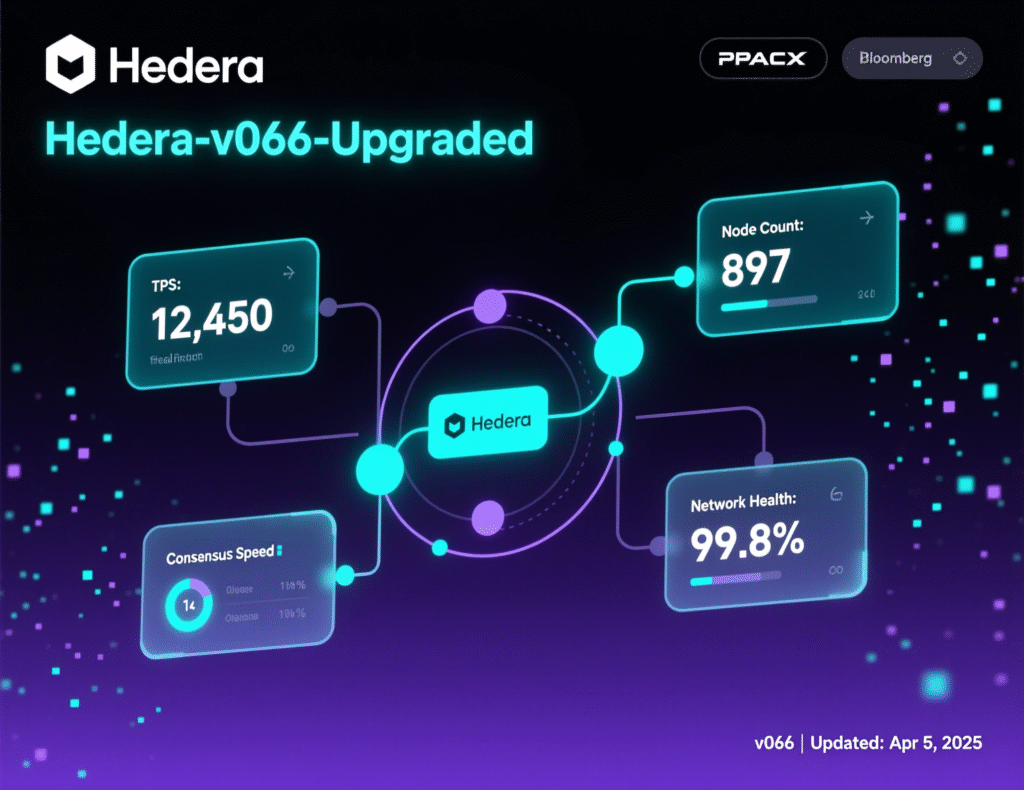

In regulatory developments, the UK marks a notable step forward as retail investors regain access to crypto exchange-traded notes (ETNs), signaling renewed institutional confidence. On the innovation front, Hedera’s latest network upgrade introduces batch transactions, improving efficiency and scalability for enterprise use cases. With fewer major data releases this week, traders are expected to focus more on macro guidance and technical market cues. Reuters+2FCA+2

What’s on the calendar crypto week ahead Oct 6

Crypto & industry

Oct. 6

Cronos sunsets CronoScan; Cronos Explorer becomes the canonical explorer/API.Oct. 6, 08:00 UTC

Floki monthly AMA on Telegram.Oct. 8

UK restores retail access to crypto ETNs via FCA-recognized exchanges (ban lifted Aug. 1; go-live Oct. 8).Oct. 8, 17:00 UTC

Hedera (HBAR) mainnet upgrade to v0.66; ~40 minutes maintenance window.DAO votes

Jito DAO’s JIP-25 proposes expanding validators to 400 and updating StakeNet eligibility/ranking.

Token unlocks (headline items):

Oct. 10: LINEA unlock (~6.57% of circulating; ≈$28–29M).

Oct. 11: Aptos (APT) unlock (~2.15%; ≈$57–62M).

Oct. 12: Aethir (ATH) unlock (~16.08%; ≈$65–68M).

Macro & central banks

Oct. 7–8 (St. Louis)

Community Banking Research Conference; Fed Gov. Michael S. Barr on Oct. 8.Oct. 7 (NYC)

Conversation with Federal Reserve Gov. Stephen I. Miran at MFA Policy Outlook 2025.Oct. 8, 2 p.m. ET

FOMC minutes from Sept. 16–17 meeting.Shutdown backdrop

Federal data publication curtailed across agencies; investors face reduced visibility.

Conferences

Oct. 6–7: London Fintech Summit • Oct. 7–8: FinTech LIVE London • Oct. 8–9: Digital Assets Week London • Oct. 8–9: Fintech Forward (Bahrain) • Oct. 9: Hedgeweek Digital Assets Summit US (NY) • Oct. 9–10: North American Blockchain Summit (Dallas). (Check individual sites for agendas and streaming.)

Market setup crypto week ahead Oct 6

With major U.S. releases delayed, near-term beta may hinge on the tone of Fed minutes and speakers; cross-asset correlations could drift as traders lean on private surveys and non-U.S. data. Hedera’s upgrade is time-boxed but may cause brief service interruptions; validator governance on Solana via Jito may influence infra-level flows rather than price beta.

<section id=”howto”> <h3>How to navigate a data-light, shutdown week</h3> <ol> <li id=”step1″><strong>Step 1:</strong> Reweight catalysts toward Fed minutes/speeches and non-U.S. data prints.</li> <li id=”step2″><strong>Step 2:</strong> Trim event-risk exposure around Hedera’s 17:00 UTC upgrade window if you hold HBAR-linked strategies.</li> <li id=”step3″><strong>Step 3:</strong> For UK accounts, confirm ETN venue eligibility and KIDs before trading on Oct. 8.</li> <li id=”step4″><strong>Step 4:</strong> If participating in Jito governance, review JIP-25 details and voting deadlines.</li> <li id=”step5″><strong>Step 5:</strong> Map token unlock times (UTC) to liquidity windows; adjust sizing and slippage controls.</li> </ol> <p><em>Note: Process may vary by jurisdiction/provider. Confirm requirements before acting.</em></p> </section>

Context & Analysis

The UK’s retail-ETN reopening broadens Europe’s regulated product set, potentially redirecting some flow from offshore venues toward recognized UK exchanges. However, ETFs remain off-limits to UK retail, limiting demand relative to U.S. spot ETFs. Hedera’s batch transactions aim to improve atomic multi-step operations useful for complex app flows while Jito’s validator expansion targets decentralization and stake distribution. Macro wise, a prolonged shutdown keeps uncertainty elevated until data resumes.

Conclusion

This week in crypto is set to bring lighter macro signals but several sector-specific catalysts. The UK’s FCA will allow retail access to crypto ETNs starting October 8, marking a key regulatory milestone that could lift institutional sentiment. At the same time, Hedera’s v0.66 network upgrade aims to enhance efficiency through batch transactions, reflecting steady technical progress.

On the U.S. front, markets may take cues from the upcoming Federal Reserve minutes and any signs of movement in government shutdown talks. With limited economic data ahead, traders are expected to focus more on governance votes and blockchain-specific developments.

FAQs

Q : What’s the biggest macro risk this week?

A : A prolonged U.S. government shutdown reducing visibility into key data releases.

Q : When do UK crypto ETNs become available to retail?

A : On Oct. 8, under FCA rules for listed cETNs on recognized exchanges.

Q : What does Hedera’s v0.66 add?

A : Batch transactions for atomic multi-step operations; upgrade scheduled at 17:00 UTC on Oct. 8.

Q : What is Jito’s StakeNet vote about?

A : JIP-25 proposes expanding validators to 400 and revising ranking/eligibility to improve pool dynamics.

Q : Any notable token unlocks?

A : Yes LINEA (Oct. 10), APT (Oct. 11), ATH (Oct. 12); values per project trackers.

Q : How does the shutdown affect jobless claims?

A : Several statistical releases face delays/suspensions; check agency notices for updates.

Q : Is this the same as ETFs launching in the UK?

A : No. FCA retail greenlight is for ETNs, not ETFs.

Q : Does this article cover the exact times for every conference?

A : Times can vary; verify agendas on each event’s official site.