Top 5 Crypto Friendly Countries in the Middle East 2025

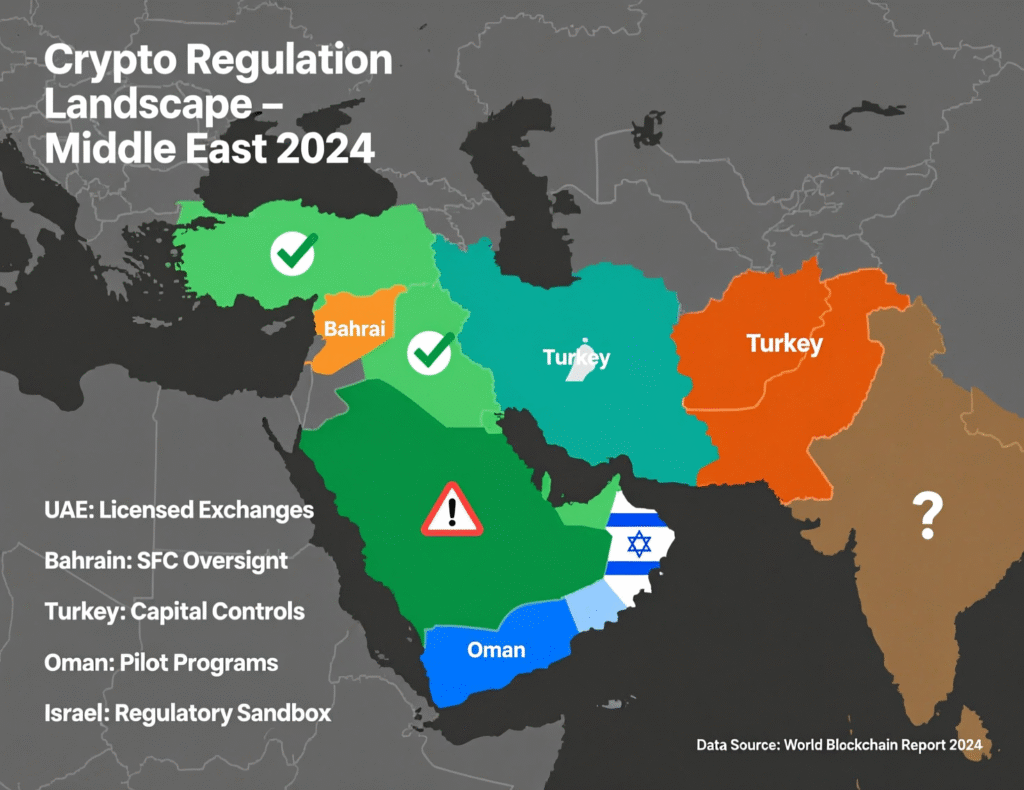

The most crypto friendly countries in the Middle East in 2025 are the United Arab Emirates, Bahrain, Oman, Turkey and Israel, with the UAE (Dubai/Abu Dhabi) and Bahrain usually ranking first thanks to clear virtual asset licensing, strong banking access and 0% personal income tax on most crypto gains. For US, UK and EU/German investors, choosing between them comes down to how much you value tax neutrality (UAE/Bahrain) versus staying in a more “traditional” taxable but regulated environment (Turkey, Israel, Oman), plus your home-country rules on reporting and controlled foreign corporations.

Introduction

Not every “Middle East” headline means Dubai-level crypto friendliness. Some Gulf and wider MENA states are racing to attract Web3 founders, while others quietly ban trading, restrict banks from touching exchanges, or keep rules deliberately vague.

This guide focuses on genuinely crypto friendly countries in the Middle East: United Arab Emirates, Bahrain, Oman, Turkey and Israel and contrasts them with more cautious markets like Saudi Arabia, Qatar and Kuwait. You’ll get a fast comparison of tax and residency, a GCC virtual asset regulations overview, a banking and licensing snapshot, and a practical framework for US, UK, German and wider EU investors deciding where to base trading, Web3 SaaS or an exchange/fund.

Global cryptocurrency ownership is estimated at roughly 6.8% of the world’s population (560M+ people) in 2024, with the UAE among the highest-ownership countries globally. The Middle East & North Africa region now accounts for an estimated $300B+ in on-chain value annually, making it the seventh-largest crypto market worldwide.

Snapshot Top 5 Crypto Friendly Countries in the Middle East

UAE, Bahrain, Oman, Turkey, Israel

In 2025, the most crypto friendly countries in the Middle East are.

United Arab Emirates (UAE)

Dubai’s VARA and Abu Dhabi’s ADGM anchor a deep, global-facing crypto hub with clear licensing for exchanges, brokers, custodians and Web3 platforms.

Bahrain

A “regulated but friendly” hub under the Central Bank of Bahrain (CBB) Crypto-Asset Module, with strong conventional banking and Bahrain FinTech Bay.

Oman

Building a formal virtual asset and VASP framework under the CMA/FSA, with AML/CTF-focused registration and travel-rule compliance.

Turkey (Türkiye)

Now has a full crypto asset law (Law 7518) under the Capital Markets Board, plus planned transaction taxes and tighter AML rules.

Israel

Digital assets are legal, treated as taxable capital assets, and subject to emerging Israel Securities Authority / Israel Tax Authority frameworks.

These are the realistic “shortlist” jurisdictions for middle east blockchain adoption and investment, especially for investors in New York, London, Berlin or wider EU considering a regional base.

Tax, Regulation, Banking & Residency Scorecard

Below is a high-level scorecard. It’s not tax or legal advice just a fast way to narrow where you should get professional counsel.

| Country | Capital gains on individuals (local rules) | Business licensing for VASPs / Web3 | Banking access for crypto | Residency options for investors |

|---|---|---|---|---|

| UAE (Dubai / Abu Dhabi) | No federal personal income tax; corporate tax at 9% above certain thresholds; many individuals pay 0% on capital gains if properly structured. [VERIFY LIVE] | Clear virtual asset rulebooks via VARA (Dubai mainland & most free zones) and ADGM FSRA (Abu Dhabi); multiple free zones (DIFC, DMCC, DWTC) for Web3/SaaS. rulebooks.vara.ae+2ADGM+2 | Good but KYC-heavy; local and international banks serve regulated exchanges and funds, often with enhanced onboarding. | Golden visas, employment and investor visas; tax residency certificates possible with sufficient days + substance. |

| Bahrain | 0% personal income tax; no capital gains tax for individuals on most investments. [VERIFY LIVE] | CBB Crypto-Asset Module with defined categories of crypto-asset services; single-country regulator. cbb.gov.bh+2CBBen+2 | Strong conventional banking; licensed exchanges like Binance/Crypto.com already onboarded. | Investor and entrepreneur residence options; smaller ecosystem but relatively straightforward. |

| Oman | Standard income taxes apply; detailed crypto tax practice still evolving. [VERIFY LIVE] | CMA/FSA VASP registration + AML/CTF Instructions; must register before offering virtual asset services. FATF+3fsa.gov.om+3fsa.gov.om+3 | Banking is cautious but improving for registered VASPs. | Investor residency pathways; lifestyle quieter than Dubai/Manama but attractive for certain families. |

| Turkey | Crypto treated as taxable asset; new transaction tax on crypto trades; general capital gains/tax rules apply. [VERIFY LIVE] Reuters+1 | Law 7518 makes crypto service providers licensable under the Capital Markets Board; strong AML/travel-rule push. Reuters+3tr.schindhelm.com+3legal500.com+3 | FX controls and banking risk still exist, but regulated platforms can access local rails. | Residence permits and citizenship-by-investment routes exist but are changing; always check current rules. |

| Israel | Digital assets taxed as capital assets; CGT applies and may be high depending on activity. [VERIFY LIVE] Lexology+2library.mevaker.gov.il+2 | Multi-agency oversight (ISA, Ministry of Finance, Tax Authority); still evolving but moving toward full licensing. | Banks historically cautious but opening more to compliant, well-documented flows. | Residency often driven by aliyah / immigration law; tax holidays may apply to new residents in specific cases. |

US, UK & EU/German Investors and Founders

This guide is written for

US LLC owners in places like Delaware or Wyoming who are trading crypto, running DeFi protocols or building Web3 SaaS.

UK fintech and Web3 founders regulated or supervised by the FCA or falling under upcoming UK cryptoasset regimes.

BaFin-regulated German startups and EU funds that must navigate MiCA, GDPR/DSGVO and BaFin crypto custody rules while using Dubai, Abu Dhabi or Manama as operational hubs.

If you’re one of these, your real question isn’t “Is crypto legal in the Middle East?” but “Where do I set up so my US/UK/EU compliance and tax story still works?”

Why UAE & Bahrain Dominate as Regional Crypto Hubs

VARA, ADGM, DIFC, DMCC & the UAE Crypto Stack

Many crypto investors choose UAE over Turkey or Israel for exchanges and funds because Dubai and Abu Dhabi have multi-layered but understandable frameworks, plus huge international connectivity.

Key pieces of the UAE crypto stack.

VARA (Dubai)

Regulates most virtual asset activities in Dubai (outside DIFC), with rulebooks for exchanges, brokers, custodians, lending/borrowing, and marketing.

ADGM / FSRA (Abu Dhabi)

A common-law financial centre with a mature digital asset framework, dedicated guidance for VASPs, and recent updates for staking and capital rules.

SCA & DFSA

The UAE Securities and Commodities Authority oversees securities and some crypto at the federal level, while the DFSA in DIFC has its own digital asset regime for security tokens and certain services.

Free zones like DMCC Crypto Centre, DWTC, DIFC and ADGM provide specialised licensing for Web3, prop trading, tokenisation platforms, and middle east blockchain adoption and investment hubs.

For a New York-based fund or London-based market maker, this looks familiar: clear rulebooks, recognised regulators, FATF-aligned travel-rule standards, and access to AWS, Azure and GCP Middle East regions for compliant hosting topics Mak It Solutions often addresses in its future of cloud hosting and cloud cost optimization guides.

CBB Crypto Assets Module & Sandbox

Bahrain is smaller, but punches above its weight as a “regulated but friendly” jurisdiction.

The Central Bank of Bahrain (CBB) has a full Crypto-Asset Module, defining crypto-

Bahrain FinTech Bay and a long-running Regulatory Sandbox let startups test digital asset products in a controlled environment. Global players like Binance and Crypto.com already hold Bahraini licenses, signalling CBB’s openness to high-profile VASPs.

For many institutional teams, Manama offers a more compact ecosystem than Dubai, but excellent banking connectivity and a strong reputation with regional regulators.

Bahrain vs Dubai for Crypto Exchange & Web3 Setup

For US, UK and EU compliance teams, Dubai vs Bahrain usually comes down to:

Dubai / UAE

Multiple free zones (ADGM, DIFC, DMCC, DWTC) and regulators give you choice on legal system (e.g., English-law courts), product scope and investor targeting.

Global branding power“Dubai” on a pitch deck lands well with LPs in New York, London or Singapore.

Larger ecosystem of exchanges, funds, Web3 SaaS and service providers (compliance, cloud, legal).

Bahrain

Single main regulator (CBB) and one primary licensing path—simpler map for your GCC virtual asset regulations overview.

Deep, well-established banking sector with strong links into Saudi Arabia and the wider GCC.

Often perceived as a good base for conservatively-run VASPs that want GCC access without Dubai’s hype.

If you’re a German VASP under BaFin rules or an EU fund subject to MiCA, your board will often prefer jurisdictions where supervisors understand foreign regulation and are FATF-aligned which is why UAE and Bahrain tend to beat Turkey or Israel for exchange headquarters, even though the latter are perfectly usable for trading and investment.

Crypto Tax & Residency Comparing the Top 5 for US/UK/EU Investors

0% Personal Income Tax and Substance Requirements

For many readers in New York, London, Berlin or Manchester, the headline is simple: UAE and Bahrain have 0% personal income tax, so properly structured residents can often enjoy 0% local tax on crypto capital gains.

In practice.

You typically need residency (visa) plus real substance time on the ground, local housing, possibly a local employer or company.

UK readers must consider UK statutory residence tests and “split year” rules; Germany and many EU states look at centre of vital interests and days/years away.

US citizens remain taxed on worldwide income regardless of where they live; moving to Dubai or Manama does not turn off the IRS.

Both UAE and Bahrain offer

Investor / entrepreneur visas tied to free-zone or mainland companies.

Potential for tax residency certificates, which your home-country advisor can use in double-tax treaty planning where applicable.

Oman, Turkey & Israel: Regulated but Taxable Crypto Regimes

Oman, Turkey and Israel are more “normal” from a Western tax perspective: crypto is legal but taxed.

Oman

Virtual asset service providers must register and apply robust AML/CTF measures; crypto gains are typically taxed under standard income or corporate tax rules once clarified in local practice.

Turkey

Crypto assets are now specifically regulated; a transaction tax on stock and crypto trading has been announced, on top of existing corporate/income tax.

Israel

Digital assets are recognised as capital assets, taxed under income/capital gains principles, with the Israel Tax Authority publishing detailed brochures and memorandums.

For some investors (especially institutional money in Berlin or Frankfurt under BaFin supervision), a taxable but tightly regulated regime can be more acceptable than a zero-tax hub particularly if they must demonstrate substance and robust oversight to EU regulators.

Double Tax, Reporting & CFC Rules

Even if you move your exchange or investment vehicle to Dubai, Manama or Muscat, home-country rules still follow you:

United States

The IRS treats digital assets as property, and you must report trades, income and certain foreign accounts (FBAR/FATCA).

United Kingdom

HM Treasury and the FCA are building a full regulatory regime for cryptoasset activities; HMRC already taxes crypto as property/capital.

Germany / EU

MiCA is now in force, with full application by late 2024; BaFin supervises crypto custody and certain trading activities; GDPR/DSGVO governs personal data.

AEO Micro-Answer

A US or UK investor comparing crypto tax rules across UAE, Bahrain, Turkey, Israel and Oman should first map local headline tax (0% vs taxable), then check treaties, CFC rules and reporting (IRS, HMRC, BaFin/MiCA) with a qualified advisor in both the target jurisdiction and their home country. The decision is rarely just about the lowest local tax rate.

Regulation & Compliance by Country

Clear Virtual Asset Rulebooks (VARA, ADGM, CBB)

The UAE and Bahrain are the clearest in the region for digital asset licensing for exchanges in Dubai and Abu Dhabi and Manama.

VARA has a multi-part Virtual Assets and Related Activities Regulations 2023 and accompanying rulebooks that define activities, licensing, disclosure and marketing.

ADGM FSRA runs a comprehensive digital asset regime with detailed guidance on custody, market integrity, substance and data protection obligations.

CBB (Bahrain) has a Crypto-Asset Module integrated into its main rulebook, clearly listed on official sites and government portals.

All three align with FATF’s travel rule, meaning VASPs must share sender/recipient data for qualifying transfers something your SEC, FinCEN, FCA or BaFin contacts will expect to see.

Oman, Turkey, Israel: From “Is Crypto Legal?” to Licensed VASPs

These jurisdictions have moved from “is crypto legal?” to “here’s the regime”.

Oman

The former CMA (now FSA) is rolling out a Virtual Assets Regulatory Framework plus detailed VASP registration + AML/CTF instructions, making Muscat a potential niche hub for compliant trading platforms.

Turkey

Law 7518 amends the Capital Markets Law to regulate crypto-asset service providers, with CMB licensing, custody rules, and new AML/travel-rule enforcement.

Israel

Digital assets are recognised as taxable assets; memorandums and economic-plan laws formalise tax and regulatory treatment, with the ISA and Tax Authority both involved.

From a London FCA or Berlin BaFin perspective, these look like serious, evolving markets good for trading desks, Web3 dev teams or local partnerships, even if you still put your primary VASP license in Dubai, ADGM or Bahrain.

Saudi Arabia, Qatar, Kuwait & Others

AEO Micro-Answer

Not all Middle Eastern countries are crypto friendly. Saudi Arabia, Qatar and Kuwait experiment with sandboxes and CBDC pilots but often restrict retail crypto trading or banking access, so you should not assume “Middle East = Dubai rules everywhere.”

Saudi Arabia

SAMA and the Capital Market Authority warn that virtual currencies are not approved as official currencies; trading by financial institutions is essentially prohibited, even as the country pilots CBDCs and pursues Sharia-compliant digital finance.

Qatar

The Qatar Central Bank and QFCRA have banned crypto trading in the Qatar Financial Centre, with narrow exceptions for tokenised securities.

Kuwait

Enforces an “absolute prohibition” on most crypto activities (payments, investments, mining), with recent crackdowns on Bitcoin mining due to power concerns.

If you’re a US, UK or EU-regulated entity, regulators like the SEC, FinCEN, FCA, BaFin and ESMA increasingly expect you to understand this risk map when interacting with counterparties in the region especially under MiCA, which pushes for consistent oversight across the EU.

Banking, Exchanges & Practical Setup in the GCC

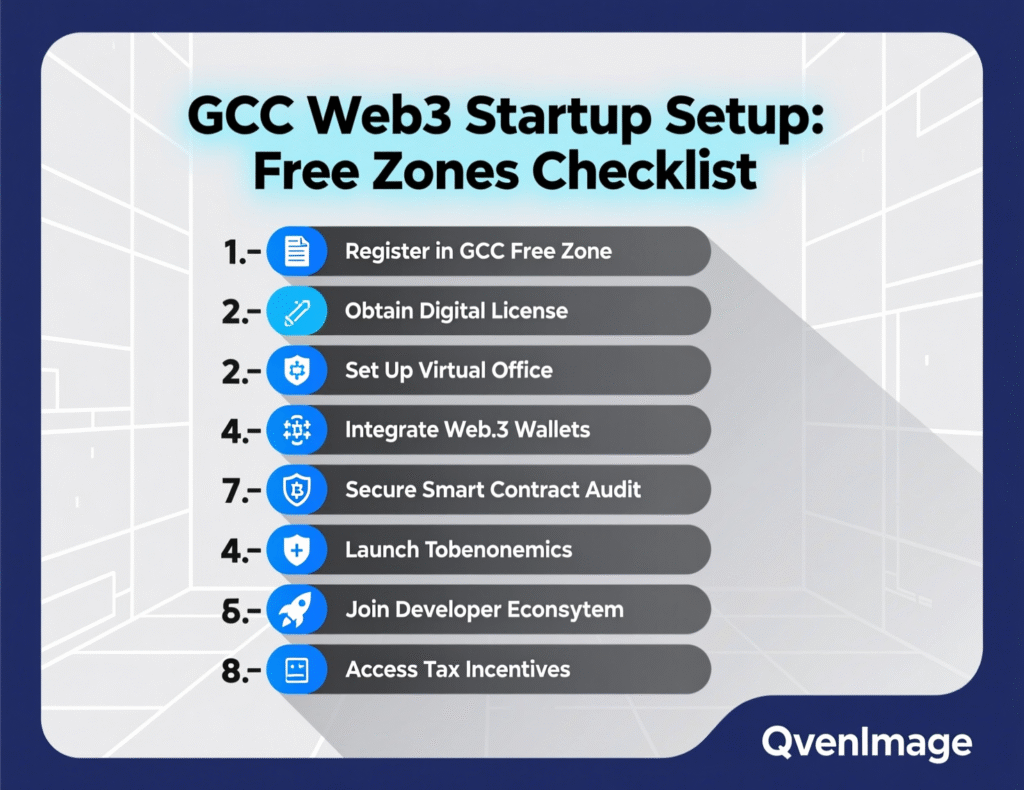

Setting Up a Web3 Startup in GCC Free Zones

Think of this as a practical How-To rather than a marketing brochure:

Choose your free zone & regulator

For capital-markets style activity, many pick ADGM or DIFC.

For ecosystem and community, DMCC Crypto Centre and DWTC in Dubai are popular.

Pick the right license category

Trading/exchange, brokerage, custody, prop trading, Web3 SaaS, or tokenisation.

Map each against your SEC/FinCEN, FCA or BaFin regulatory perimeter so there are no surprises later.

Design your compliance stack

AML/KYC/KYB, travel-rule implementation, sanctions screening, transaction monitoring, custody controls.

This is where using a cloud-native architecture with proper data residency controls something Mak It Solutions covers in its zero-downtime deployments and Django development content really pays off.

Embed governance and reporting

Board-approved policies, risk appetite, incident response, and regular reporting to VARA/ADGM/CBB where applicable.

Align tech, security & audits

Pen tests, SOC/ISO where needed, PCI DSS if you handle fiat card payments, and thorough logging for regulators and auditors.

Best Crypto Friendly Banks & Payment Partners in Dubai, Abu Dhabi & Manama

There isn’t a single “best bank”, but strong pattern recognition:

Look for locally licensed banks and EMI/PSP providers that:

Understand VASP risk and FATF travel-rule obligations.

Support multi-currency accounts (USD, EUR, GBP, AED) and good connectivity back to New York, London, Berlin.

Many exchanges and Web3 firms also use specialised payment partners for card ramps, instant payouts and FX especially those already compliant with PCI DSS and regional AML rules.

Rather than chasing a secret list, focus on presenting a clean compliance narrative: clear ownership, audited source-of-funds, robust transaction monitoring and a sane business model. That’s exactly the kind of story a technical partner like Mak It Solutions can support when building your SaaS, analytics and reporting stack. makitsol.com+1

Opening a Crypto Company as a US, UK or German Founder

Plan for more paperwork than a typical SaaS startup

KYC/KYB

Passport, proof of address, CV, corporate structure charts, ultimate beneficial owner declarations.

Proof of source-of-funds

Historical trading records, tax returns, audited statements, and explanations for any large inflows.

Regulatory story

How your UAE/Bahrain/Turkey/Israel structure respects SEC/FinCEN, FCA, BaFin/MiCA and home-state rules.

Tech & data

Where you host user data (EU data boundary, Middle East regions, etc.), and how you comply with GDPR/DSGVO, UK-GDPR when EU/UK users use your Dubai or Manama platforms.

Risk Map & Future Trends in Middle East Crypto Regulation

AML/CTF, Travel Rule & Sanctions: What Tightening Rules Mean for Traders

Middle Eastern regulators are tightening AML/CTF and travel-rule enforcement, but generally keeping regulated trading open:

Turkey is introducing waiting periods and limits around stablecoin transfers when the travel rule is not applied, explicitly targeting laundering risks.

Oman has implemented detailed AML/CTF instructions for VASPs and was recently assessed by FATF on its AML regime.

Banks across the region are de-risking unlicensed platforms, which can mean account closures for individuals dealing with offshore or unregulated exchanges.

If you’re a high-volume trader from Germany, the US or the UK, expect more KYC, transaction monitoring questions, and proof of tax compliance whether you are in Dubai, Manama or Istanbul.

Sharia, CBDCs & Regional Political Risk

You also need to factor in

Sharia-compliant finance

Some scholars question the permissibility of speculative crypto trading; others accept carefully structured digital assets. Saudi Arabia and others lean into this debate when restricting certain products.

CBDCs

Projects like those of SAMA (Saudi Arabia) and QFCRA/QCB (Qatar) aim to build government-controlled digital currencies even as they limit decentralised crypto.

Geopolitics

Sanctions exposure (e.g., flows from Iran), conflicts, and US/EU policy shifts can quickly change the risk posture of Middle Eastern banks and regulators.

How GDPR/DSGVO, UK-GDPR & MiCA Interact with UAE/Bahrain Platforms

AEO Micro-Answer: When EU or UK citizens use non-EU exchanges in Dubai or Manama, firms typically rely on standard contractual clauses (SCCs), data-processing agreements and robust security controls to bridge GDPR/DSGVO and UK-GDPR requirements while also meeting MiCA and local rules.

In practice

If you’re serving EU users from Dubai, you’re still subject to GDPR/DSGVO and MiCA, regardless of local UAE law.

You’ll need SCCs or equivalent safeguards for cross-border transfers, plus transparent privacy notices and data-subject rights handling.

Good architecture using sovereign/EU regions for certain data, plus regional Middle East zones for latency-sensitive workloads can make this manageable, as discussed in Mak It Solutions’ work on cloud hosting trends and business intelligence services. makitsol.com+1

How to Choose the Right Middle East Jurisdiction

Tax, Regulation, Banking, Lifestyle & Exit Options

Here’s a five-point checklist to narrow your options fast.

Tax & residency

Are you aiming for 0% local tax (UAE/Bahrain) or a more conventional but familiar regime (Turkey/Israel/Oman)? What do your US/UK/EU home rules say about tax residency and CFCs?

Regulatory match

Which jurisdiction’s rulebooks best match your SEC/FCA/BaFin/MiCA obligations and risk appetite?

Banking & fiat rails

Can you realistically get stable, long-term banking for your volume and risk profile?

Lifestyle & hiring

Will key staff actually move to Dubai, Abu Dhabi, Manama, Muscat, Istanbul or Tel Aviv? Can you hire locally at the skills and cost level you need?

Exit & re-domiciliation

If regulations change, how easy is it to re-domicile a fund, migrate a token issuer, or shift your Web3 SaaS stack elsewhere?

Trader, Long-Term Investor, Exchange/Fund, Web3 SaaS

A few simplified scenarios

High-volume German trader

Might favour UAE residency for 0% local tax, while working closely with German advisors on exit from German tax residency and MiCA reporting obligations.

US founder with a Delaware LLC moving into Web3

Could keep IP and US entity for certain activities while using ADGM or DMCC for a regional operating company; IRS obligations remain.

UK-regulated fintech launching a regional exchange

May prefer Bahrain or ADGM for closer alignment with traditional finance, then passport products into KSA or other GCC markets via partnerships.

Web3 SaaS / analytics platform

Might prioritise cloud infrastructure, DevOps and data analytics capabilities, making Dubai or Abu Dhabi attractive in combination with a partner like Mak It Solutions and its experience in SaaS, Adobe Commerce and Golang/Node backends.

Due Diligence, Local Counsel & Banking/Relocation Partners

Whatever your profile, the sequence is broadly

Shortlist 2–3 jurisdictions using the checklist above.

Engage local counsel (plus US/UK/EU tax lawyers) to confirm how your structure, token model and activities will be treated.

Run a technical discovery with a build partner like Mak It Solutions to map cloud regions, data residency, analytics and DevOps to your chosen jurisdictions.

Work with licensed corporate service providers, relocation firms and banks to set up your entity, visas and banking.

Disclaimer

This article is general information, not tax, legal or investment advice. Always consult qualified advisors in both your home country and the target jurisdiction before making relocation or structuring decisions.

Key Takeaways

UAE and Bahrain are the primary crypto hubs for exchanges, funds and serious Web3 businesses, thanks to 0% personal tax, clear rulebooks and good banking.

Oman, Turkey and Israel offer regulated but taxable regimes that may suit more conservative or locally focused investors.

Home-country rules (IRS, HMRC, BaFin/MiCA, GDPR/DSGVO, UK-GDPR) still apply even if you relocate to Dubai, Manama, Muscat, Istanbul or Tel Aviv.

Banking, AML/CTF and travel-rule compliance are as important as headline tax rates when choosing a jurisdiction.

A robust cloud, data and compliance architecture including regional hosting, analytics and DevOps makes regulatory and audit conversations easier across US, UK and EU regulators.

If you’re weighing Dubai vs Bahrain vs Turkey or Israel for your next crypto move, you don’t just need a lawyer you need a technical team that understands regulation, data residency and cloud architecture end-to-end. Mak It Solutions can help you map your exchange, Web3 SaaS or analytics platform onto compliant, high-performance infrastructure in the Middle East and Europe.

Reach out via the Mak It Solutions website to book a consultation and get a scoped roadmap covering cloud regions, data flows, DevOps, and the integrations you’ll need to satisfy both regional regulators and US/UK/EU oversight. ( Click Here’s )

FAQs

Q : Is crypto legal in all Middle Eastern countries, or only in places like Dubai and Bahrain?

A : No crypto is not uniformly legal or bank-friendly across the Middle East. The UAE, Bahrain, Oman, Turkey and Israel have developed clear or emerging frameworks for trading, exchanges and Web3 businesses. In contrast, countries like Kuwait and Qatar restrict or ban many crypto activities, and Saudi Arabia takes a cautious, Sharia-aware stance with warnings from SAMA and limited institutional engagement.Always check the specific country’s central bank and securities regulator before operating.

Q : Do I need to become a tax resident in the UAE or Bahrain to benefit from 0% tax on crypto gains?

A : In general, yes you usually need to be treated as a tax resident under local rules (visa, days in-country, substance) to rely on UAE or Bahrain’s 0% personal income tax for crypto gains. If you remain tax-resident in the US, UK, Germany or another EU state, your home-country may still tax your worldwide gains regardless of where the exchange or wallet is located. Talk to a cross-border tax advisor before moving or changing your trading structure.

Q : Can a UK or EU-regulated crypto company open a licensed exchange in the Middle East without moving its entire team?

A : Yes many UK and EU firms open regional entities in Dubai, Abu Dhabi or Manama while keeping much of their engineering and compliance staff in London, Manchester, Berlin or other EU hubs. Regulators will still expect real local substance for the licensed entity (e.g., responsible officers, risk, compliance, and some tech/customer-support presence). Remote-heavy models can work, but expect questions from VARA, ADGM or CBB about governance, outsourcing and operational resilience.

Q : How hard is it to get a bank account for a crypto company in Dubai, Abu Dhabi or Manama?

A : It’s doable but not trivial. Banks in Dubai, Abu Dhabi and Manama are open to regulated VASPs and Web3 firms with solid compliance, but they will demand detailed KYC/KYB, proof of source-of-funds, AML policies, and often prior licensing or in-principle approvals from VARA, ADGM or CBB. Unlicensed or offshore-only structures face much tougher scrutiny, and some will simply be declined. Using a well-architected, auditable tech stack for transaction monitoring and reporting can significantly improve your chances.

Q : What are the biggest risks of setting up a crypto business in Turkey or Oman compared with the UAE or Bahrain?

A : The main risks are regulatory change, tax uncertainty and banking friction. Turkey is formalising crypto rules and adding transaction taxes and AML measures, which is positive but may increase operational complexity and cost. Oman is building its framework but banks are still cautious and FATF assessments will shape future rules. Compared to the more established ecosystems in UAE and Bahrain, you may have fewer specialised service providers, less predictable licensing timelines, and more work to explain your risk controls to foreign investors and home regulators.