SWIFT and top global banks working on blockchain-based overhaul

SWIFT, together with over 30 leading banks, has announced that it is accelerating efforts to build a shared digital ledger aimed at transforming cross-border payments. The initiative is designed to provide instantaneous, round-the-clock transactions, removing delays caused by time zones or banking hours. This move highlights SWIFT’s commitment to adapting its global payment infrastructure to meet the demands of an increasingly digital economy and new forms of money.

By extending its existing network which already connects more than 11,000 institutions across 200+ countriesinto a blockchain-enabled environment, SWIFT aims to blend innovation with established standards of security, compliance, and resilience. The project underscores the push to modernize international settlements while maintaining the trust and regulatory safeguards that underpin today’s global banking system. Reuters

What the SWIFT shared digital ledger aims to deliver

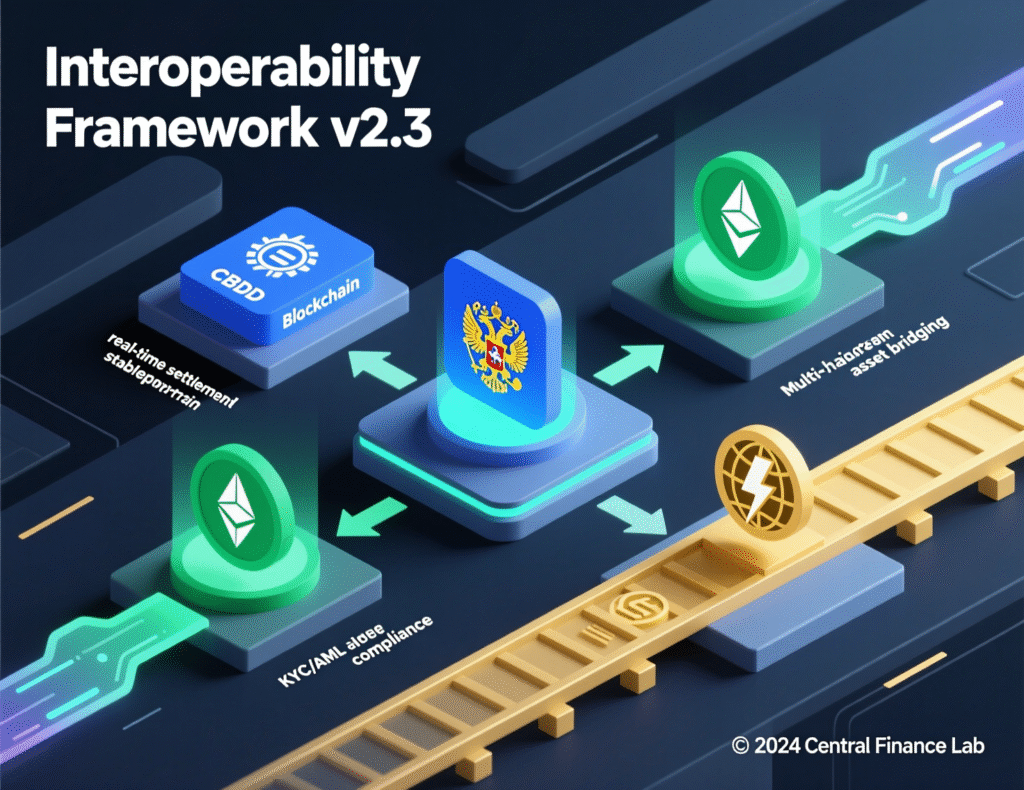

SWIFT describes the ledger as a secure, shared record between banks that can record, sequence and validate transactions and enforce rules via smart contracts features intended to reduce friction, errors and costs in international transfers. The initiative builds on pilots to make SWIFT interoperable with systems for CBDCs, tokenised deposits and stablecoins.

Participating institutions helping to design and test the platform include JPMorgan, HSBC, Deutsche Bank, MUFG, BNP Paribas, Santander and OCBC, alongside banks from the Middle East and Africa. While no go-live date is set, the coalition’s near-term priority is enabling real-time, always-on payment flows.

Timeline and scope for the SWIFT shared digital ledger

SWIFT has not published a definitive rollout schedule. The programme will initially concentrate on payments use-cases, then expand to interoperability with CBDC networks and tokenised assets as standards mature and regulatory clarity improves.

Why now: market momentum for on-chain money

Regulated digital money is moving into the mainstream. Citi’s latest analysis projects stablecoin circulation could hit up to $4tn by 2030, with on-chain settlement volumes rising accordingly—context that strengthens the case for bank-grade interoperability.

Industry voices have also criticised legacy cross-border rails as slow and dated; SWIFT’s upgrade seeks to combine blockchain programmability with existing compliance frameworks used by banks worldwide.

<section id=”howto”> <h3>How to prepare your treasury for instant cross-border payments</h3> <ol> <li id=”step1″><strong>Assess corridors:</strong> Map your top payment routes, cut-off times and pain points (fees, FX spreads, rejects).</li> <li id=”step2″><strong>Upgrade messaging:</strong> Ensure ISO 20022 readiness and align beneficiary data standards to reduce repairs.</li> <li id=”step3″><strong>Review wallets & accounts:</strong> Decide where to hold liquidity (nostros, multi-currency accounts, tokenised deposits).</li> <li id=”step4″><strong>Automate reconciliation:</strong> Integrate end-to-end references and APIs for real-time status/settlement updates.</li> <li id=”step5″><strong>Strengthen controls:</strong> Update sanctions/KYC/AML screening and set smart-contract rule guardrails.</li> <li id=”step6″><strong>Pilot & measure:</strong> Join bank pilots, track STP rates, costs, and delivery times vs. baseline.</li> </ol> <p><em>Note: Process may vary by bank and jurisdiction. Confirm requirements before acting.</em></p> </section>

CBDCs, tokenised deposits and stablecoins

Beyond payments speed, the design targets interoperability across new digital-money systems. SWIFT says the ledger will connect to CBDC platforms (e.g., projects in Europe and China) and tokenised bank deposits, with rule enforcement via smart contracts to preserve compliance and auditability.

Context & Analysis

SWIFT’s move could accelerate “network-of-networks” models where banks settle value on permissioned chains while retaining existing governance and oversight. Success will depend on common standards, clear liability frameworks and regulator buy-in. Competing private-sector ledgers and domestic instant-payment schemes may coexist, with bridges and FX smart-routing determining end-user experience. (Author analysis, informed by sources above.)

Conclusion

If ongoing pilots validate improvements in resilience, cost efficiency, and transaction speed, participating banks may begin routing specific payment corridors through the shared ledger. This phased approach would allow institutions to test real-world benefits while managing risks, before scaling into broader adoption.

Over time, the platform could support advanced use cases, including central bank digital currencies (CBDCs) and tokenised assets, aligning with global shifts in digital finance. While no fixed launch timeline has been announced, the groundwork for programmable, always-on cross-border payments is steadily moving forward, marking a significant step in the future of global settlements.

FAQs

Q : What is SWIFT building?

A : A blockchain-based shared digital ledger to enable instant, 24/7 cross-border payments and interoperate with CBDCs, tokenised deposits and stablecoins.

Q : Which banks are involved?

A : Participants include JPMorgan, HSBC, Deutsche Bank, MUFG, BNP Paribas, Santander and OCBC, plus banks from the Middle East and Africa.

Q : When will the system launch?

A : No firm date yet; early work targets always-on cross-border payments before expanding to broader interoperability.

Q : How does the ledger ensure compliance?

A : By recording and validating transactions on a permissioned ledger and enforcing rules via smart contracts, aligned with banks’ compliance controls.

Q : Will this replace current SWIFT rails?

A : It’s positioned as an evolution and interoperability layer rather than an immediate replacement. Existing messaging continues while ledger capabilities scale.

Q : What’s the market outlook for stablecoins?

A : Citi estimates stablecoins could reach up to $4tn in circulation by 2030, supporting on-chain settlement growth.

Q : Does this mean lower fees?

A : That’s a key goal; programmatic settlement and fewer repairs could reduce costs, though pricing depends on banks and corridors.