Strategy targets plan to equitize convertible debt over 3–6 years, Saylor says

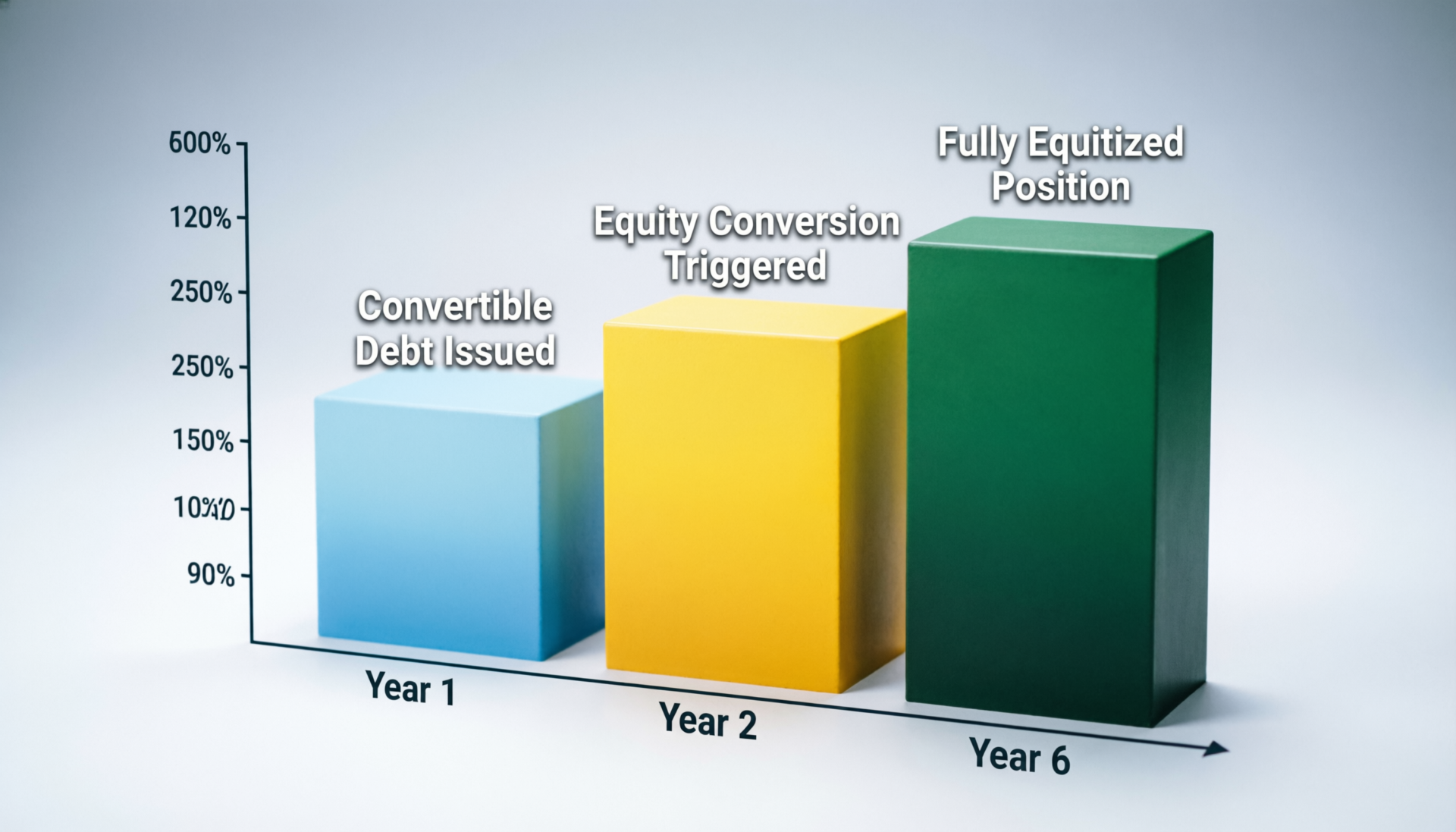

Strategy plans to equitize a large portion of its convertible debt over the next three to six years, according to comments from Michael Saylor. The company is targeting the conversion of roughly $6 billion in convertible bonds into equity, a move that would gradually replace debt with newly issued shares. This approach reflects a long-term capital strategy rather than an immediate balance-sheet adjustment.

If executed as outlined, the plan could materially reduce the amount of debt carried by Strategy, strengthening its financial flexibility and lowering leverage over time. However, the trade-off is potential dilution for existing shareholders, as converting debt into equity increases the total share count. Investors may benefit from a cleaner balance sheet, but they also face the risk that future earnings and ownership stakes are spread across more shares.

What Saylor and Strategy said

In an exchange on X, Strategy pointed to its asset coverage under an extreme downside case: “Strategy can withstand a drawdown in BTC price to $8,000 and still have sufficient assets to fully cover our debt,” prompting Saylor to reiterate that the company’s plan is to equitize convertible debt over the next three to six years.

Strategy has continued positioning itself as a Bitcoin treasury company, with multiple reports placing its holdings at 714,644 BTC.

Strategy equitize convertible debt over 3-6 years Saylor what “equitizing” means

Equitizing convertible debt generally refers to settling convertible notes by issuing equity—turning bondholders into shareholders rather than repaying principal in cash at maturity. That can reduce debt pressure and refinancing needs, but it can also dilute existing shareholders if conversions occur at scale.

Strategy equitize convertible debt over 3-6 years.

Potential benefit: lower debt outstanding and reduced cash outflows tied to repayment/refinancing.

Potential cost: shareholder dilution (more shares issued) and market sensitivity around conversion timing and pricing.

Market snapshot referenced in reports

Bitcoin was reported trading around the high-$60,000s on Feb. 16, 2026, depending on venue and timestamp.

Reporting also cited Strategy’s average BTC cost basis around $76,000–$76,056 per BTC.

Strategy shares were reported near $133 recently, with commentary noting a steep drawdown from a ~$456 high in the past year.

Context & Analysis

Strategy’s plan, as described, is aimed at reducing balance-sheet debt without needing to repay all convertibles in cash an approach that can look more feasible when the equity price and conversion mechanics support it. At the same time, the company’s strategy remains highly exposed to Bitcoin price swings, since the BTC position is central to the “asset coverage” argument it is making publicly.

Bottom Lines

If Strategy follows through on equitizing its convertible debt over a 3–6 year horizon, the near-term impact could be reduced headline debt, with the medium-term question shifting to how much dilution occurs and under what conversion prices alongside continued sensitivity to Bitcoin’s market cycles.

FAQs

Facts

Event

Strategy says it plans to convert (equitize) convertible bond debt into equity over 3–6 years.Date/Time

2026-02-16T11:13:44+05:00Entities

Strategy Inc (Nasdaq: MSTR); Michael Saylor; Bitcoin (BTC)Figures

~$6B convertible debt; 714,644 BTC holdings; average BTC cost ~$76k (reported)Quote

“Strategy can withstand a drawdown in BTC price to $8,000 and still have sufficient assets to fully cover our debt.” Strategy (X), as reportedSources

Cointelegraph / TradingView item; Yahoo Finance report; Barron’s reporting; CoinGecko pricing page