Strategic MENA Crypto Market Forecast for Global Investors

The MENA crypto market currently accounts for roughly 7–8% of global on-chain transaction volume, in the mid-$300B range annually, with Turkey, the UAE and Saudi Arabia driving most activity and adoption.

Most scenarios for the MENA crypto market forecast to 2030 point to high-teens annual growth, with the region’s share of global flows potentially rising toward 10–12% if regulatory momentum and institutional participation continue. That would make MENA a meaningful diversification lane for US, UK, German and wider EU capital.

Introduction

The MENA crypto market forecast matters because the region has quietly shifted from “emerging niche” to one of the fastest-growing digital-asset hubs on the planet. In the most recent Chainalysis geography report, Middle East & North Africa received an estimated ~$340 billion in on-chain value between mid-2023 and mid-2024, accounting for about 7.5% of global transaction volume.Turkey, the United Arab Emirates, Saudi Arabia and Morocco anchor this growth, with the UAE emerging as a regional regulatory showcase and Turkey dominating by sheer volume.

For US, UK and EU investors, the question is no longer if MENA will matter, but how to size, access and govern exposure. This article offers a neutral, data-led MENA crypto market forecast for 2026–2030: three growth scenarios, country-level views, adoption trends, regulatory impacts and practical access routes via regulated exchanges, funds and tokenised structures. Our framework blends on-chain analytics from Chainalysis, public filings, central-bank and regulator rulebooks, plus research from London and Frankfurt-based houses and regional press.

This is not a price call on Bitcoin or any specific token. Treat the numbers as scenario ranges, not investment advice, and always benchmark them against live datasets and your own risk framework.

What Is the MENA Crypto Market in 2026–2030?

Defining MENA and Key Crypto Hubs

For this forecast, “MENA” covers core markets including the UAE, Saudi Arabia, Qatar, Bahrain, Egypt, Turkey and Morocco, with spill-over from the wider Middle East and North Africa. Together they combine hard-currency energy exporters, import-dependent economies, and North African markets with large diasporas in the United Kingdom, Germany and wider EU.

City hubs such as Dubai, Abu Dhabi, Riyadh, Istanbul and Cairo concentrate licensing, liquidity, talent and banking relationships. Dubai and Abu Dhabi host free-zone regimes optimised for digital assets; Riyadh and Doha are building capital-market infrastructure under national transformation plans; Istanbul and Cairo bring large, retail-heavy domestic markets.

Current size AEO answer. Across MENA, on-chain inflows have hovered in the mid-hundreds of billions of dollars per year since 2022, representing roughly 7–9% of global crypto transaction value depending on the period analysed.Turkey leads by raw volume, while the UAE and Saudi Arabia show some of the fastest institutional and high-value transaction growth worldwide.

Segments Within the MENA Digital Asset Ecosystem

The digital asset ecosystem in the Middle East spans far more than speculative spot trading. Key segments include:

Centralised exchanges spot and derivatives.

Local platforms like BitOasis and CoinMENA serve retail and high-net-worth users, while global exchanges run regional entities under Emirati, Bahraini and Turkish rules.

DeFi and Web3 protocols.

Chainalysis data shows the UAE has one of the highest DeFi shares of activity in MENA, reflecting a more sophisticated user base and institutional experimentation.

Stablecoins and remittances.

US-dollar stablecoins dominate retail flows, acting as substitutes for volatile local currencies and as rails for remittances and cross-border B2B payments.

Tokenisation of real-world assets (RWAs).

Early pilots in GCC markets tokenise funds, treasuries and real estate as part of broader programmes like Saudi Vision 2030 and UAE digital-economy strategies.

Wallets and custody.

Non-custodial wallets serve self-directed users, while institutional investors increasingly rely on bank-grade custody, such as offerings launched by Standard Chartered and partners in the UAE.

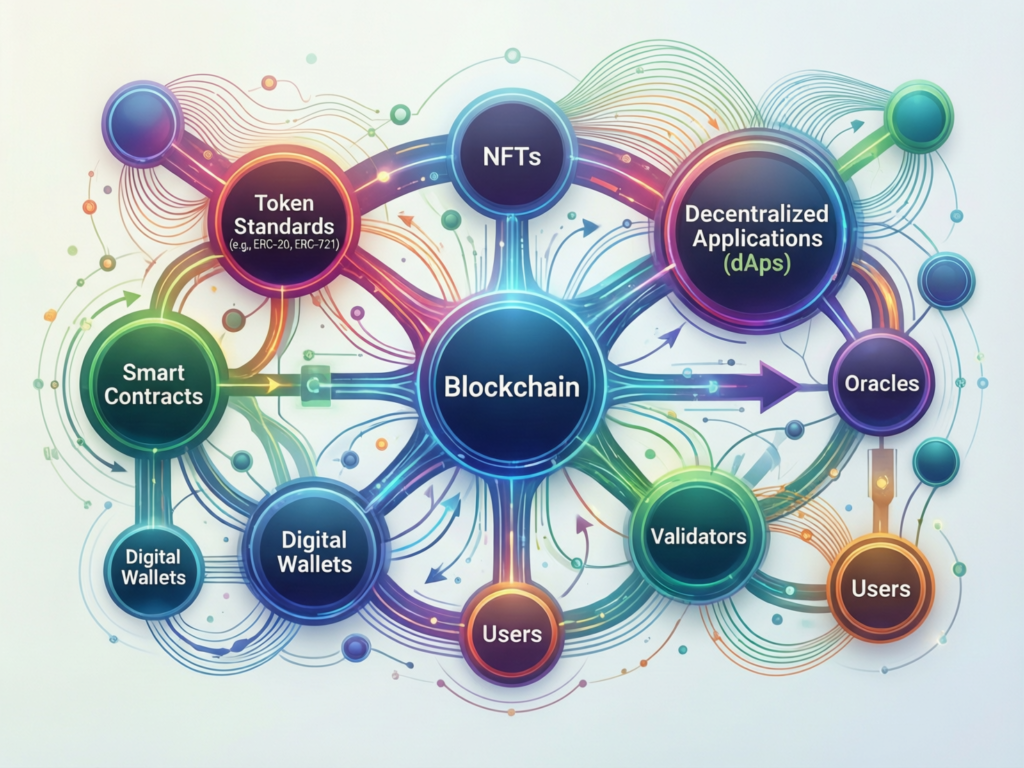

When we talk about blockchain adoption in the MENA region, we’re talking about a layered stack: end-user wallets, exchanges, DeFi, tokenisation platforms and the cloud and payments infrastructure beneath them.

Data Sources and Methodology for This Forecast

Our MENA crypto market forecast draws on.

On-chain analytics from Chainalysis and similar providers for regional transaction volumes, ticket sizes and segment splits.

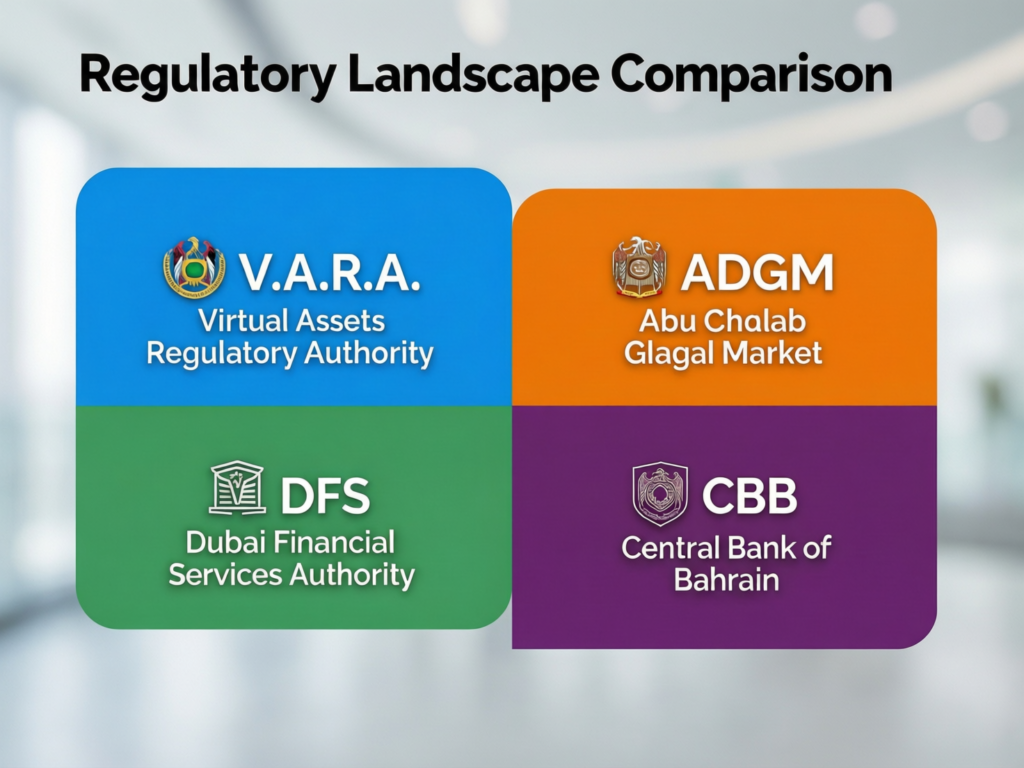

Regulatory and central-bank material from bodies such as the Virtual Assets Regulatory Authority (VARA), Abu Dhabi Global Market (ADGM)’s FSRA, the Dubai Financial Services Authority (DFSA), and the Central Bank of Bahrain to understand licensing pipelines and regulatory clarity.

Disclosures and news from licensed VASPs, banks and market-infrastructure providers (for example, Binance, Zodia Markets and regional derivatives venues)

Macro and policy inputs (inflation, FX regimes, capital-control status, cross-border payments data).

We then apply scenario analysis baseline, bull and bear cases for MENA’s share of global crypto activity anchored to assumptions about global market cycles, regulatory implementation and institutional risk appetite. Gaps to keep in mind:

OTC and P2P stablecoin flows are still under-measured.

Some local exchanges and wallets publish limited transparency.

Regulation is fast-moving; any long-dated forecast should be updated at least annually.

MENA Crypto Market Forecast 2026–2030

Baseline, Bull and Bear Scenarios for MENA Growth

AEO answer:

What is the MENA crypto market forecast to 2030?

In our baseline case, MENA’s on-chain transaction volume grows in the mid-teens annually to 2030, taking its share of global crypto flows from roughly 7–8% today toward 9–10% by the end of the decade.

In a bull case, faster tokenisation and institutionalisation could lift that share toward 11–12%.

In a bear case, tighter rules or prolonged global risk-off could cap it around today’s levels.

Think of these as portfolio-planning rails for US, UK and EU investors: they help frame capacity, rather than predict exact numbers.

Indicative scenario ranges (illustrative, not investment advice)

Baseline scenario (CAGR ~15–20%)

Regional on-chain volumes roughly double by 2030, into the high-$600B to ~$900B range annually if global markets also expand.

GCC (UAE, Saudi, Qatar, Bahrain) outgrows North Africa as tokenisation, custody and derivatives businesses scale.

Bull scenario (CAGR ~25–35%)

A strong global cycle, rapid tokenisation of real-world assets in GCC markets and broader regulatory convergence under MiCA and FATF could push MENA volumes toward ~$1.2–1.5T by 2030, with a clear double-digit share of global activity.

Bear scenario (CAGR ~5–10%)

Global markets stagnate, and local enforcement plus sanctions risk keep many institutions on the sidelines; MENA still grows from a low base, but market share stays around 7–8%.

Turkey, UAE, Saudi Arabia, Egypt, Morocco

Turkey.

High and persistent inflation plus FX volatility have pushed households and SMEs toward stablecoins and crypto to preserve purchasing power. Expect continued strong grassroots adoption, but with policy risk as Ankara balances capital-flow controls, tax revenues and consumer protection.

UAE.

Dubai and Abu Dhabi are positioning as institutional hubs, combining clear virtual-asset frameworks with tax and lifestyle advantages. Regulatory clarity from VARA, ADGM and DFSA has already attracted global exchanges, custodians and derivatives venues from Binance to GFO-X and Zodia Markets and this pipeline is likely to grow

Saudi Arabia.

Under Vision 2030, Riyadh is incubating digital-asset and CBDC pilots through the central bank and Capital Market Authority. Expect a measured but decisive path: tight control of retail speculation, but openness to tokenised capital markets, trade and infrastructure financing.

Egypt.

Macro pressure, capital controls and a huge diaspora in Europe and the Gulf make Egypt a natural corridor for stablecoin remittances and trade flows but also a higher-risk jurisdiction from a sanctions and FX-policy perspective.

Morocco.

Despite a historically cautious stance on crypto, Morocco repeatedly ranks among the top 20 countries globally for grassroots adoption, driven by remittances, youth unemployment and digital-native entrepreneurs.

For European family offices and wealth platforms searching for “Turkey and UAE crypto transaction volume forecasts” or “MENA digital asset adoption trends,” the practical takeaway is that country paths are divergent, even if the regional aggregate looks smooth.

Why MENA Crypto Growth Matters for US, UK and EU Capital

AEO answer: Why does MENA crypto growth matter for US, UK and EU investors?

Because it combines three elements that global portfolios rarely find in one place.

High-growth digital-asset hubs with rising institutional depth.

Regulatory experimentation that often moves faster than Western frameworks.

Direct links to energy, trade and real-estate economies.

Under the EU’s Markets in Crypto-Assets Regulation (MiCA), crypto-asset service providers (CASPs) can be authorised to operate across the bloc under common rules on disclosure, governance and safeguarding.That means a London or Frankfurt-based platform can, in time, route client flows into MENA assets via EU-regulated entities, provided they also comply with local rules in Dubai, Abu Dhabi or Bahrain.

For US investors, especially those in hubs like New York, MENA offers:

A differentiated growth story versus North American and East Asian exchanges.

Access to tokenised infrastructure, trade and energy projects aligned with Gulf sovereign-wealth strategies.

The option to co-invest alongside global banks (such as Standard Chartered) and digital-asset banks building in the region

In other words, the MENA crypto market forecast 2030 under EU MiCA rules is not just about more volume it’s about a larger investable and compliant universe for transatlantic capital.

Adoption Trends, Use Cases and Behaviour in the MENA Crypto Market

Retail vs Institutional Flows in Turkey, UAE, Saudi Arabia and Beyond

Chainalysis data and regional newsflow show that MENA retail vs institutional crypto transaction volumes are steadily converging.

In the UAE, small retail (<$10k), professional ($10k–$1m) and institutional (> $1m) transfer sizes have all grown strongly year-on-year, with some segments posting 40–80%+ growth.

Turkey remains heavily retail-driven but is seeing more high-value flows as local businesses and OTC desks institutionalise.

Saudi Arabia and Qatar show some of the fastest growth from a smaller base.

US-dollar stablecoins dominate, but euro-denominated stablecoins are emerging as tools for EU–MENA treasuries and remittance providers looking to minimise FX slippage in stablecoin remittances and cross-border payments. For institutional allocators in London or Frankfurt, that mix of ticket sizes is a useful indicator of market maturity: rising large-ticket flows usually signal improving regulatory comfort and bank connectivity.

Inflation Hedge, Remittances and Cross-Border Trade

Three use cases dominate current blockchain adoption in the MENA region:

Inflation hedge.

“Turkey crypto adoption as inflation hedge” is now a cliché, but the data backs it: persistent inflation near or above 50% pushed many households into stablecoins and crypto as alternative savings vehicles.

Remittances.

Gulf–North Africa and EU–MENA corridors (for example, London–Cairo, Paris–Casablanca, Berlin–Istanbul) increasingly use stablecoins as back-end rails, even when front-end apps brand flows as traditional remittances.

Cross-border trade.

Importers and exporters in the UAE, Saudi Arabia, Egypt and Turkey experiment with stablecoin settlements for high-value goods, often via OTC desks embedded in trade hubs like Dubai and Istanbul.

AEO answer

What are the fastest-growing MENA countries for crypto adoption in 2025–2026?

Based on recent Chainalysis work and regional reports, the fastest growth is concentrated in Saudi Arabia, Qatar and the UAE, which combine strong regulatory momentum with rising institutional and professional-sized transfers, while Turkey and Morocco remain leaders on grassroots adoption.

DeFi, Tokenisation and Web3 Infrastructure

Looking to 2030, three themes shape ongoing blockchain adoption in the MENA region.

DeFi as institutional plumbing.

Rather than replacing banks, DeFi protocols in Dubai and Abu Dhabi are increasingly used for collateral management, liquidity provision and structured products targeting qualified investors..

Tokenisation of real-world assets in GCC markets.

Expect more tokenised sukuk, funds and real estate in GCC markets, building on pilots in ADGM and DIFC and linked to flagship projects under Vision 2030 and UAE economic-diversification programmes.

Web3 infrastructure on hyperscale clouds.

Regulated exchanges, custodians and analytics platforms increasingly host core systems on hyperscalers such as Amazon Web Services (AWS), Microsoft Azure and Google Cloud Platform (GCP), leveraging PCI DSS- and SOC 2-aligned architectures that institutional risk teams already understand.

For firms building analytics, risk and onboarding tools around these themes, partners like Mak It Solutions can help design the web front-ends, data pipelines and BI layers behind institutional Web3 platforms, drawing on our web development services and business intelligence services.

Regulation, Compliance and Risk.

MENA Regulatory Landscape.

AEO answer.

How are new MENA crypto regulations and FATF standards shaping forecasts?

In short, jurisdictions that align quickly with FATF standards and provide clear licensing routes (Dubai, Abu Dhabi, Bahrain) are expanding the investable part of the market, while others remain sizeable but harder to access for regulated funds.

Key pillars.

Dubai (VARA)

VARA is the dedicated virtual-asset regulator for Dubai, responsible for licensing and supervising VASPs across most of the emirate.

Abu Dhabi (ADGM FSRA).

ADGM’s FSRA operates a detailed digital-asset framework where only “Accepted Virtual Assets” can be used for regulated activities like trading, custody and investment management.

DIFC (DFSA).

The DFSA’s crypto-token regime, first rolled out in 2022 and updated in 2024–2026, governs crypto-tokens in the Dubai International Financial Centre, with specific rules for funds, custody and marketing.

Bahrain (CBB).

The CBB’s Crypto-Assets Module gives a full framework for exchanges, custody, brokerage, advisory and other services, making Bahrain a pioneer in the region.

Saudi, Qatar, Egypt, Turkey, Morocco.

These markets rely more on sandbox pilots, central-bank circulars and securities-regulator guidance, with full-scope regimes still evolving.

Across these regimes, alignment with the updated guidance of the Financial Action Task Force (FATF) on virtual assets and Travel Rule supervision is a core determinant of cross-border bank comfort.

US, UK and EU Rules That Affect MENA Exposure (MiCA, GDPR/DSGVO, FCA, OFAC)

From the foreign-investor side, three rule clusters are key.

MiCA and EU oversight.

The European Securities and Markets Authority (ESMA) and European Banking Authority (EBA) share supervisory roles under MiCA, with rules on white papers, governance, reserve management and staff competence.

Data protection (GDPR/DSGVO, UK-GDPR).

Personal data processed for KYC, AML and travel-rule purposes must comply with GDPR in the EU and UK-GDPR in Britain, including lawful bases, data-minimisation and cross-border-transfer rules.

Sanctions and AML (FCA, SEC/CFTC, OFAC, FATF).

For US investors, agencies such as OFAC, the SEC and CFTC drive expectations around counterparty due-diligence, sanctions screening and derivatives exposure. FATF’s Travel Rule guidance sets the global minimum for cross-border AML data-sharing.

When you hear the phrase “cross-border AML compliance for EU–MENA cryptocurrency transfers,” this is what it means in practice: MiCA-compliant CASPs, GDPR-compliant data handling, and FATF-aligned Travel Rule implementation, wrapped around licensed MENA VASPs.

Risk Map for Institutional Investors.

For a US bank in New York, a UK wealth platform in London or a German insurer in Frankfurt, a simple risk map helps:

Legal & regulatory.

Is the counterparty licensed under VARA, ADGM, DFSA or CBB? Is there clear guidance on permitted products, client categories and cross-border marketing?

Operational.

Does the platform meet standards like SOC 2 and PCI DSS (via bodies such as the PCI Security Standards Council)? How are keys stored? What are the disaster-recovery and segregation arrangements?

Financial crime & sanctions.

How does the VASP implement FATF standards, Travel Rule, sanctions screening and adverse-media checks?

Reputational.

Is the jurisdiction seen as a “fast-moving but serious” hub (for example, Dubai, Abu Dhabi, Manama), or a regulatory grey area?

From a forecasting standpoint, jurisdictions that score strongly on these dimensions are more likely to capture the lion’s share of MENA digital asset ecosystem growth that is actually investable for regulated institutions.

Exchanges, Wallets and Access Routes into the MENA Crypto Market

Licensed MENA Exchanges and Wallet Providers to Watch

A non-exhaustive landscape for “best MENA crypto exchanges” includes.

Home-grown platforms such as BitOasis and CoinMENA, which have pursued licences in Dubai and Bahrain respectively.

Global exchanges such as Binance, which have secured or are seeking VARA and ADGM approvals for regional operations.

Institutional brokers and market-makers like Zodia Markets and GFO-X, now licensed in Abu Dhabi to serve professional clients.

The MENA crypto wallet market forecast 2024–2032 is closely tied to smartphone penetration and local banking access. Expect non-custodial wallets and mobile-first exchanges to keep dominating retail adoption, while bank-integrated custodial wallets grow among high-net-worth investors and family offices.

How US, UK and EU Investors Can Access MENA Digital Asset Growth

AEO answer.

How can European and UK asset managers gain regulated exposure to the MENA crypto market?

In practice, they combine EU/UK-regulated vehicles (funds, ETPs, mandates) with exposure to MENA-domiciled assets and VASPs that are licensed under VARA, ADGM, DFSA or CBB, either directly or via sub-advisory and white-label arrangements.

Common pathways include.

Direct accounts with licensed MENA exchanges.

For larger hedge funds and proprietary desks, particularly in London and New York, this means opening institutional accounts with regulated platforms in Dubai, Abu Dhabi or Bahrain subject to home-country approvals and internal governance. This is the straightforward answer to “how US hedge funds can access MENA digital asset growth.”

ETPs and funds.

EU and UK asset managers can use crypto ETPs, funds-of-funds or dedicated MENA digital-asset funds that in turn allocate to regional exchanges, tokenised securities or venture investments all under MiCA/FCA umbrellas.

Tokenised securities and RWAs.

As tokenisation of real-world assets in GCC markets accelerates, European and UK investors can buy tokenised sukuk, funds or real-estate units issued within the EU but referencing GCC projects.

VC and private-equity funds.

Many family offices in Germany and the wider EU prefer to back regional Web3 infrastructure, exchanges and middleware via VC/PE funds based in Dubai, Abu Dhabi or Luxembourg.

For German investors asking how to access UAE and Saudi crypto markets, a practical playbook is: MiCA-regulated EU intermediary → due diligence on VARA/ADGM-licensed VASPs → allocation via EU-domiciled fund or ETP rather than direct retail accounts.

Mak It Solutions can support this by building the investor portals, reporting dashboards and mobile apps that sit on top of your chosen route, combining Next.js development, mobile app development and digital marketing to reach target LPs and clients.

On/Off-Ramps, Fiat Currencies and Stablecoin Bridges

Operationally, three layers matter.

Fiat rails.

US dollar (SWIFT, Fedwire), euro (SEPA, TARGET) and pound-sterling (Faster Payments) rails are used to fund MENA exchanges, often via correspondent banks in London, Frankfurt or New York.

Stablecoin bridges.

For many corporate treasuries, it’s cheaper and faster to use USDC/USDT or regulated euro-stablecoins as “bridge currencies,” then convert to local fiat or keep balances on-chain.

Payment initiation.

Open-banking APIs in the UK and EU, and increasingly in the Gulf, make it easier to embed compliant on/off-ramps into fintech and Web3 apps.

For US-compliant on/off-ramps into MENA and euro deposits into regional exchanges, institutional investors should verify that intermediaries work with Travel-Rule-compliant VASPs, hold appropriate licences, and are ready to evidence GDPR and PCI DSS compliance to internal audit and regulators.

Strategic Takeaways and Scenario Planning for 2026–2030

Portfolio Playbook for US, UK and EU Investors

From the perspective of a MENA crypto market forecast 2026–2030 for US investors, a pragmatic portfolio playbook looks like this:

Treat MENA digital assets as a satellite allocation within an already-approved crypto or alternatives bucket, not a standalone asset class.

Use jurisdictional tiers: Dubai/Abu Dhabi/Bahrain (regulated hubs) as core; Turkey/Egypt/Morocco as higher-beta, more policy-volatile exposures.

Balance liquid trading strategies (spot, derivatives, basis trades) with illiquid tokenisation, infra and VC exposure linked to real-world assets and regional digitisation for example, GCC smart-city and digital-twin projects where we already support GCC smart cities.

For EU investors, the MENA crypto market forecast 2030 under EU MiCA rules implies that much of this exposure will eventually sit inside MiCA-compliant structures, with explicit CASP due-diligence and cross-border risk controls built in.

Monitoring Indicators to Update Your MENA Crypto Thesis Annually

To keep your thesis current, build an annual review cycle around:

Country-level transaction volumes and rankings in global adoption indices.

Stablecoins’ share of MENA flows vs volatile assets.

DeFi share and growth rates, especially in the UAE and Saudi Arabia.

Regulatory milestones (new licences, enforcement actions, MiCA technical standards, FATF evaluations).

Banking partnerships (global custodians, transaction banks, local champions).

Tokenisation pilots linked to infrastructure, real estate and trade finance.

Macroeconomic triggers: inflation spikes, FX-regime shifts, sanctions headlines.

Much of this can be tracked via dashboards that combine on-chain data, regulator RSS feeds and news sentiment the sort of BI stack Mak It Solutions designs for public-sector and fintech clients using our back-end development services and SEO and analytics expertise.

Deep Dives on Adoption, Regulation and Exchanges

If this article is your primer, the next step is a deeper “MENA cryptocurrency market report” that:

Quantifies your exposure ranges and risk appetite under different regulatory and macro scenarios.

Benchmarks specific exchanges, custodians and tokenisation platforms on licensing, governance and technology.

Maps cross-border data-protection and AML obligations for your home jurisdiction.

You can then plug that into a product and engineering roadmap: new crypto ETPs, digital-asset desks, or Web3-enabled payment and remittance products backed by robust web, mobile and BI infrastructure from Mak It Solutions.

Key Takeaways

MENA already accounts for a mid-single-digit share of global crypto flows and could plausibly reach ~10–12% by 2030 if current trends hold.

GCC hubs led by Dubai, Abu Dhabi, Riyadh, Doha and Manama will likely capture most institutional growth, thanks to clear virtual-asset regimes and strong bank participation.

Turkey, Egypt and Morocco remain powerful grassroots markets, particularly for inflation hedging and remittances, but carry higher policy and FX risk.

Regulatory convergence (MiCA, FATF, data-protection rules) is gradually expanding the investable slice of the MENA crypto universe for US, UK and EU investors.

Successful investors will treat MENA as a diversified stack infrastructure, tokenisation, payments and DeFi rather than a single “bet on exchanges.”

If you’re planning a data-driven expansion into MENA digital assets whether via exchanges, tokenised products or Web3 infrastructure you’ll need clean architecture, compliant data flows and investor-grade reporting, not just a slide deck.

The team at Mak It Solutions works with clients across the USA, UK, Germany and wider Europe to design and build the web, mobile and BI layers that sit underneath institutional crypto and fintech products. Share your thesis and constraints with us, and we’ll help you scope a practical roadmap or prototype tailored to your MENA crypto strategy.( Click Here’s )

FAQs

Q : Which MENA country is likely to lead crypto adoption by 2030?

A : By 2030, the UAE is the most likely overall leader in MENA crypto adoption, measured by institutional depth, regulatory clarity and tokenisation activity. Reports already place the UAE among the top global jurisdictions for digital-asset adoption and DeFi usage, with Dubai and Abu Dhabi acting as hubs for exchanges, custody banks and derivatives venues. Turkey and Morocco should remain leaders in grassroots usage, but the UAE’s combination of policy, capital and infrastructure gives it the edge for institutional-grade growth.

Q : Is it possible for US-regulated funds to hold assets on MENA crypto exchanges?

A : Yes, but only under strict conditions. US-regulated funds need internal and external legal opinions confirming that any MENA exchange or custodian is properly licensed, aligned with FATF standards, and compatible with SEC, CFTC and OFAC expectations on custody, sanctions and disclosure. In practice, many managers prefer to use EU or UK-domiciled funds that allocate to MENA exchanges indirectly, or to hold exposure via regulated ETPs and structured products instead of opening direct exchange accounts.

Q : How will MiCA change the way EU investors access MENA digital assets?

A : MiCA introduces a harmonised regime for crypto-asset issuers and service providers across the EU, including licensing, disclosure, reserve management and conduct-of-business rules. Once fully implemented, EU investors will increasingly access MENA digital assets via MiCA-authorised CASPs, funds and ETPs that in turn partner with licensed VASPs in Dubai, Abu Dhabi or Bahrain. This should reduce fragmentation, improve transparency on risks and fees, and make it easier for compliance teams in Frankfurt, Paris or Luxembourg to approve MENA exposure, although cross-border marketing, data protection and AML frameworks must still be assessed carefully.

Q : What are the main AML and sanctions risks when sending stablecoins between Europe and MENA?

A : The biggest risks are dealing with unlicensed or poorly supervised VASPs, failure to collect and transmit originator and beneficiary information under the FATF Travel Rule, and inadvertently transacting with sanctioned individuals, entities or jurisdictions. Institutions should therefore transact only with CASPs and VASPs supervised under MiCA-compatible or FATF-aligned regimes, implement robust sanctions-screening and blockchain-analytics tools, and document their Travel-Rule compliance end-to-end, with enhanced due diligence for higher-risk corridors.

Q : How often should institutional investors update their MENA crypto market assumptions and forecasts?

A : Given the pace of regulatory and market change, most institutional investors should update their MENA crypto market assumptions at least once a year, and more frequently in periods of regulatory or macro stress. An annual review typically refreshes transaction-volume data, country rankings, regulatory developments (MiCA, FATF evaluations, new rules from VARA, ADGM, DFSA or CBB), bank-partnership news and tokenisation pilots. Many funds combine this with a quarterly risk dashboard that tracks leading indicators like stablecoin share, DeFi usage and enforcement actions.