South Korea Crypto Money Laundering Scheme: Customs Busts $102M Network

South Korean customs officials say they have dismantled a South Korea crypto money laundering scheme that routed roughly 148.9 billion won ($101.7 million) through digital assets and local bank accounts, referring three individuals to prosecutors for alleged violations of the Foreign Exchange Transactions Act.

The action follows the Korea Customs Service’s (KCS) decision to run year-round inspections aimed at illegal FX transactions after authorities flagged an unusually large gap about $290 billion in 2025 between bank-handled trade payments and customs-reported trade values.

How the operation allegedly worked

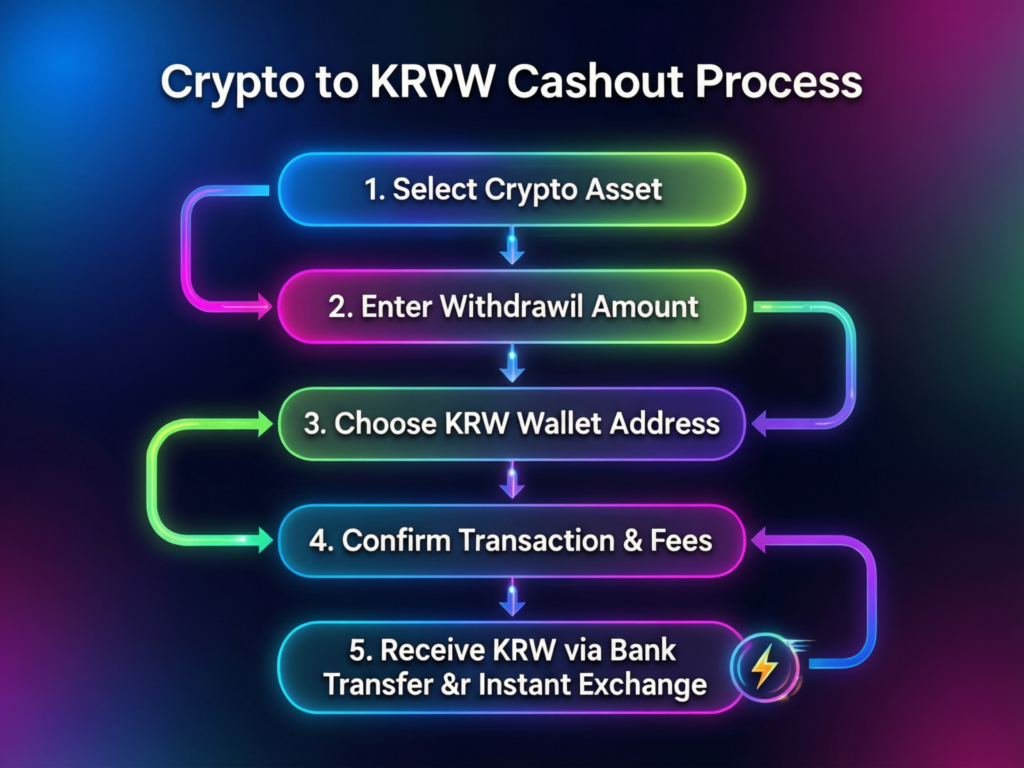

KCS alleges the ring operated from September 2021 through June 2025. According to reporting, suspects disguised transfers as legitimate outlays such as cosmetic surgery or tuition, purchased crypto in multiple jurisdictions, moved coins to wallets in South Korea, converted to won, and dispersed funds via numerous local bank accounts.

Policy backdrop and the $290bn discrepancy

On Jan. 13, KCS announced “intensive, year-round” inspections of underground money-exchange activity that could threaten exchange-rate stability. The crackdown was prompted by a roughly $290 billion (about 427 trillion won) mismatch between trade payments processed by banks and values reported to customs its widest in five years. Authorities said the program will continue until FX conditions stabilize.

Market context

The enforcement wave arrives as South Korea’s crypto market remains sizable: official data cited by multiple outlets put domestic virtual-asset market capitalization near 95 trillion won ($64.6bn) as of June 2025, with multi-billion-dollar daily volumes—keeping compliance and FX leakage under scrutiny.

What this means for enforcement of the South Korea crypto money laundering scheme

KCS’s case signals broader coordination between customs, financial intelligence, and banking channels to monitor crypto-linked cross-border flows. Officials have indicated inspections will prioritize firms and transactions with high FX-risk profiles, escalating to investigations where evidence supports criminality, while minimizing disruptions to legitimate trade.

Red flags tied to the South Korea crypto money laundering scheme

Frequent small-value cash-outs from multiple local accounts after inbound crypto transfers

Use of personal remittance categories (e.g., tuition, medical) inconsistent with underlying activity

Crypto purchases in foreign venues followed by rapid transfer to domestic wallets and KRW conversion

(Indicators summarized from case reporting and KCS inspection focus.)

Context & Analysis

The KCS action reflects a broader pivot to FX risk amid won volatility and complex crypto rails. By framing crypto-enabled flows within trade-payment discrepancies, authorities can use customs analytics, bank data, and on-chain tracing in tandem. That raises enforcement certainty but also puts the onus on traders and SMEs to document cross-border payments thoroughly.

Concluding Remarks

KCS’s $101.7 million case highlights how cryptocurrency is increasingly being misused for underground foreign exchange activities. Criminal networks exploit digital assets to move money quickly across borders, avoiding traditional banking systems and regulatory checks. In response, customs and banks are strengthening coordination and sharing data to detect suspicious transactions more effectively and close loopholes used for illegal remittances.

With year-round inspections now in place, authorities are expected to continue aggressive investigations. Future probes will likely focus on hidden remittance channels and fast crypto-to-KRW cash conversions. These measures aim to curb financial crimes, improve transparency, and ensure stronger enforcement against digital currency misuse.

FAQs

Q : What did Korean authorities allege in the $102m case?

A : That an international network laundered approximately ₩148.9 billion through cryptocurrency and local bank accounts, disguising the flows as legitimate business expenses.

Q : When did the activity occur?

A : Reportedly between September 2021 and June 2025.

Q : Which law is at issue?

A : The Foreign Exchange Transactions Act, as stated by KCS.

Q : Why did KCS intensify inspections in 2026?

A : A roughly $290 billion gap between bank-processed trade payments and customs-reported values raised concerns about possible illegal financial flows.

Q : How big is South Korea’s crypto market?

A : Around ₩95 trillion ($64.6 billion) as of June 2025, based on data cited by multiple sources.

Q : Does this affect legitimate remittances?

A : Authorities say investigations focus only on high-risk cases and aim to avoid disrupting lawful trade and normal remittance activities.

Q : Is the term “South Korea crypto money laundering scheme” used officially?

A : No. It is mainly an SEO phrase. Officials instead refer to illegal foreign exchange transactions involving virtual assets.

Facts

Event

KCS disrupts alleged crypto-enabled illegal FX network; three referred to prosecutorsDate/Time

2026-01-19T00:00:00+05:00Entities

Korea Customs Service (KCS); Yonhap (reporting); suspects (unidentified)Figures

₩148.9bn (~$101.7m); trade payments gap ≈ $290bn (2025)Quotes

“Year-round intensive inspections” KCS (policy announcement)Sources

The Block (Yonhap report) ; KBS World (KCS inspections, $290bn gap)