Solana’s $2.85B Revenue Rivals Palantir, Robinhood Amid Waning Memecoin Craze

ZURICH — 2025-10-07 Solana’s estimated $2.85 billion annual revenue highlights how the network’s economy has matured beyond speculative phases. According to 21Shares strategist Matt Mena, Solana generated this amount between October 2024 and September 2025, reflecting sustained growth across diverse sectors within its ecosystem.

The report notes that Solana’s revenue streams now extend beyond trading speculation, covering decentralized exchanges, lending platforms, wallets, and emerging areas like DePIN and AI-driven applications. Monthly revenues have stabilized between $150 million and $250 million, showing steady user engagement even after the late-2024 memecoin boom. This stability underscores Solana’s expanding real-world utility and evolving role as one of the leading blockchain ecosystems in the post-memecoin market cycle.

What’s driving Solana’s revenue mix

Mena’s breakdown shows trading tools such as Photon and Axiom collectively accounted for about $1.12B (39%) of the total, underscoring how execution-focused products anchor on-chain activity even as memecoin volumes fade. DeFi protocols, wallets and new app categories rounded out the remainder.

Why Solana 2.85 billion annual revenue matters

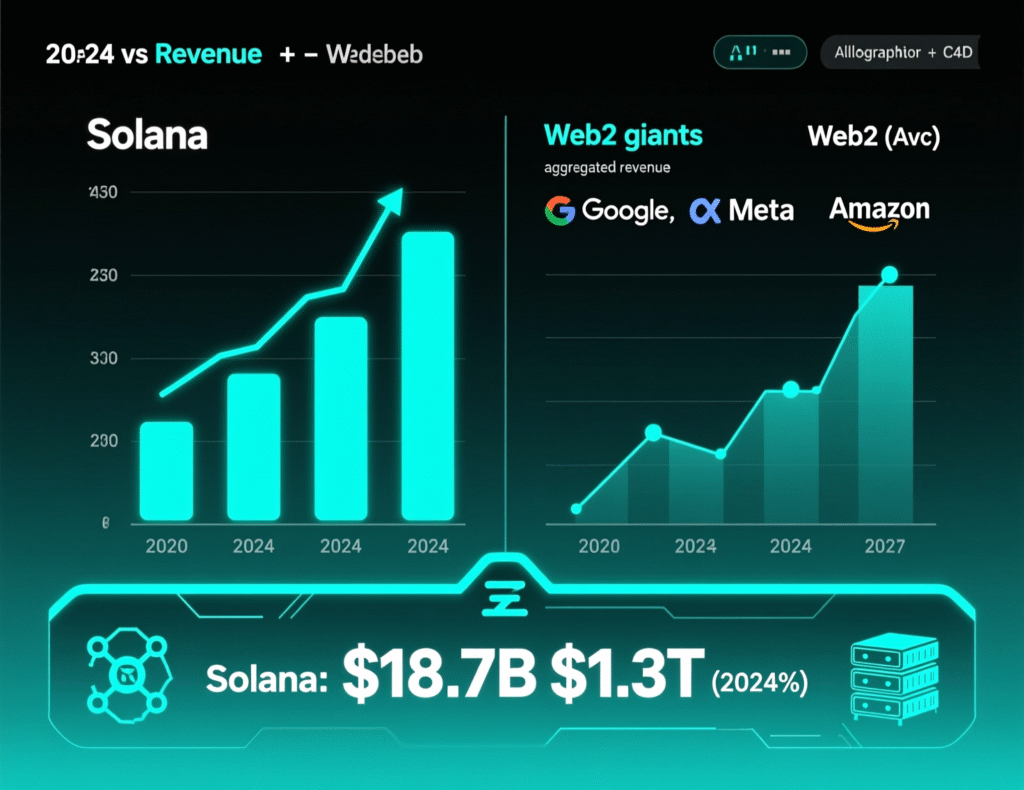

The 12-month revenue tally puts Solana’s on-chain economy in the neighborhood of established Web2 firms: Palantir booked about $2.9B in 2024, while Robinhood reported $2.95B. The comparison is instructive for scale though business models differ highlighting Solana’s rapid monetization of network usage. Palantir Investors+2SEC+2

Breaking down Solana 2.85 billion annual revenue by sector

Trading tools (~39%)

Order-flow and swap optimizers (e.g., Photon, Axiom).DEXs / DeFi

Spot/derivatives, lending/borrowing.Wallets & infra

End-user activity and fee generation.Emerging

DePIN and AI-driven apps.

How Solana stacks up to Ethereum’s early stage

Compared with Ethereum four to five years post-launch, Solana’s average monthly revenue is markedly higher (ETH averaged < $10M/month at that stage, per Mena’s analysis). Attribution centers on Solana’s high throughput, low fees and a broader 2025 market.

Upgrades on deck: Firedancer and Alpenglow

Two major upgrades are slated to improve performance and resilience. Firedancer, a new validator client from Jump Crypto, targets higher throughput and network robustness. Alpenglow aims to cut time-to-finality dramatically (industry write-ups suggest ~100–150 ms), laying groundwork for bigger blocks and Web2-like responsiveness.

<section id=”howto”> <h3>How to verify Solana revenue figures using public data</h3> <ol> <li id=”step1″><strong>Step 1:</strong> Choose a 12-month window (e.g., Oct 2024–Sep 2025) to match cited periods.</li> <li id=”step2″><strong>Step 2:</strong> Pull monthly fee/revenue metrics from respected analytics providers (token-level and chain-level).</li> <li id=”step3″><strong>Step 3:</strong> Segment by category (trading tools, DEXs, lending, wallets, DePIN/AI) where dashboards allow.</li> <li id=”step4″><strong>Step 4:</strong> Sum monthly totals; reconcile any differences across data sources and methodologies.</li> <li id=”step5″><strong>Step 5:</strong> Cross-check findings against primary research (e.g., 21Shares) and recent media coverage.</li> </ol> <p><em>Note: Process may vary by provider; definitions of “revenue” and “fees” differ. Confirm methodology before citing.</em></p> </section>

Context & Analysis

Equating network “revenue” to corporate sales isn’t apples-to-apples, but the comparison helps contextualize scale and traction. If Firedancer and Alpenglow deliver meaningfully lower latency and higher resiliency, Solana’s addressable use cases (e.g., real-time trading, payments, gaming) could expand, reinforcing the current revenue mix beyond speculative cycles.

Conclusion

Solana’s revenue base has become more balanced and resilient compared to its memecoin-driven peak. The network now benefits from consistent demand across trading platforms, DeFi protocols, and emerging application sectors, reflecting a shift toward sustainable ecosystem growth.

Looking ahead, upcoming network upgrades are expected to enhance efficiency and scalability, further strengthening Solana’s position in the market. These improvements could attract greater institutional participation, signaling confidence in the blockchain’s long-term potential and its ability to support diverse, high-performance applications beyond speculative cycles.