Institutional Adoption & Stablecoins: How Big Business Is Using Crypto Payments

Introduction

Stablecoin payments are moving from crypto-native to corporate-ready. In 2025, volumes and enterprise pilots have surged, making on-chain settlement a credible way to cut cross-border costs and settlement times while staying compliant under US and EU rules.

In two sentences: Stablecoin payments let businesses move tokenized cash on public blockchains with near-instant, 24/7 settlement at lower network costs than cards or SWIFT in many corridors. This guide shows you when they beat legacy rails, how to accept them (with checklists), how to choose among USDC, USDT, and PYUSD, and how to stay compliant in the US/EU.

Why Stablecoin Payments Now?

What counts as a “stablecoin payment”? (Definition Snippet Target)

A stablecoin payment is the transfer of a fiat-referenced digital token (e.g., USD-pegged USDC, USDT, PYUSD) on a blockchain network (e.g., Ethereum, Solana, Base) to settle a commercial obligation (invoice, payout, or checkout). The token is redeemable 1:1 for fiat (subject to issuer terms), and settlement finality occurs on-chain, typically within seconds to minutes, 24/7/365.

Why it matters:

Unlike card pulls or SWIFT pushes, stablecoin transfers finalize quickly, reduce intermediaries, and can be programmatically reconciled.

2025 inflection point: volumes, pilots, and enterprise interest

Scale

Annual stablecoin transaction value has exceeded $27T, up sharply over the last two years, signaling real economic usage rather than only trading.

Adoption

Chainalysis’ 2025 data shows continued mainstream adoption, with the US and India leading usage, and EU liquidity shifting post-MiCA.

Institutional moves

JPMorgan is expanding tokenized-money initiatives (JPM Coin, deposit tokens), and European banks are coordinating euro-stablecoin efforts.

Enterprise PSPs

Stripe re-enabled USDC payments and added stablecoin subscription flows in 2024–2025 an enterprise-grade signal.

When stablecoins beat cards/SWIFT: speed, cost, 24/7 finality

Speed & finality

On networks like Solana or Base, transactions often confirm in seconds; funds are usable once confirmed no weekend/holiday delays.

Cost

Network fees can be cents to a few dollars vs. card MDRs (~2.9% + $0.30) or SWIFT wires ($10–$50+) in many corridors; Stripe even priced some stablecoin flows below card rates.

Always-on

24/7/365 settlement improves working capital timing and reduces “float” in cross-border treasury operations. McKinsey expects material payments impact in 2025.

Cross-Border & Treasury Ops Use Cases

Supplier payouts and remittances

What to do

Pay international suppliers in USDC or PYUSD, convert on payout to local currency, and deliver faster than traditional rails.

Example

A US SaaS marketplace pays freelancers in the EU: Collect revenue in USD, hold as USDC, and convert only at disbursement for local EUR—reducing FX slippage.

Stat

Thunes cites global cross-border payments at $40T+ in 2024, growing ~5% annually ripe for faster rails.

How it saves

Lower network fees, fewer intermediaries, and faster delivery lower operational costs and improve supplier NPS.

On-chain settlement for B2B invoices and marketplace payouts

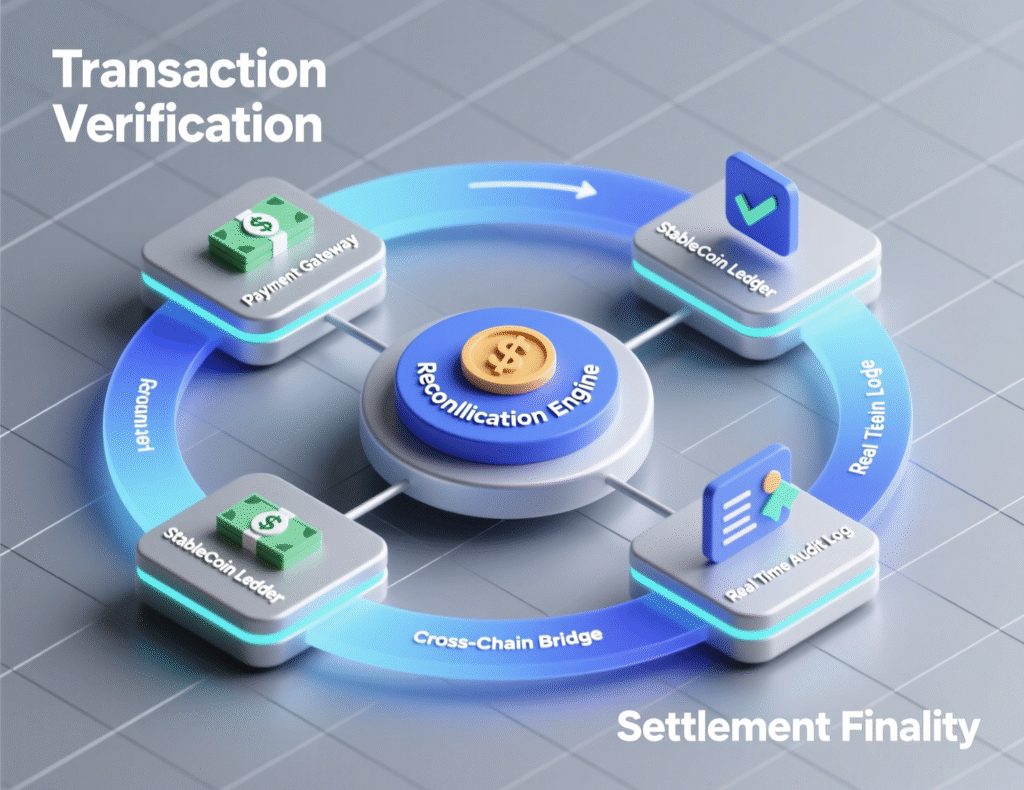

Use invoice-linked addresses and payment intents to match each invoice/payout to a unique on-chain destination. Fireblocks and BVNK provide treasury and payout tooling to orchestrate these flows with policy controls.

Example

Fireblocks reports that over 25% of its customer invoices settle in stablecoinsclear treasury adoption.

Treasury: working capital, float, and FX optimization

Tactics for CFOs

Just-in-time FX

Keep balances in USD stablecoins, convert to local currency on disbursement to reduce timing risk.

24/7 cash mobility

Move funds across entities instantly to cover payroll or AP at month-end cutoffs.

Controls

Use policy engines (MPC wallets, approvals) and analytics to track exposure, with Big-Four-attested issuers (e.g., USDC).

How to Accept Stablecoin Payments

Integration paths: hosted checkout, API, and invoices

Hosted Checkout (fastest)

Use a PSP that supports stablecoins (e.g., Stripe, Rapyd, BVNK). Advantage: rapid go-live, managed KYC/AML and Travel Rule routing.

Direct API to wallet infrastructure

Integrate custody + wallets (e.g., Fireblocks) to own the flow and approvals; ideal for mid-to-large enterprises.

Invoice Links

Generate one-time payment addresses per invoice; good for B2B. (Supported by multiple gateways and custody platforms.)

On/Off-ramp setup: KYC, wallets, bank links, and accounting

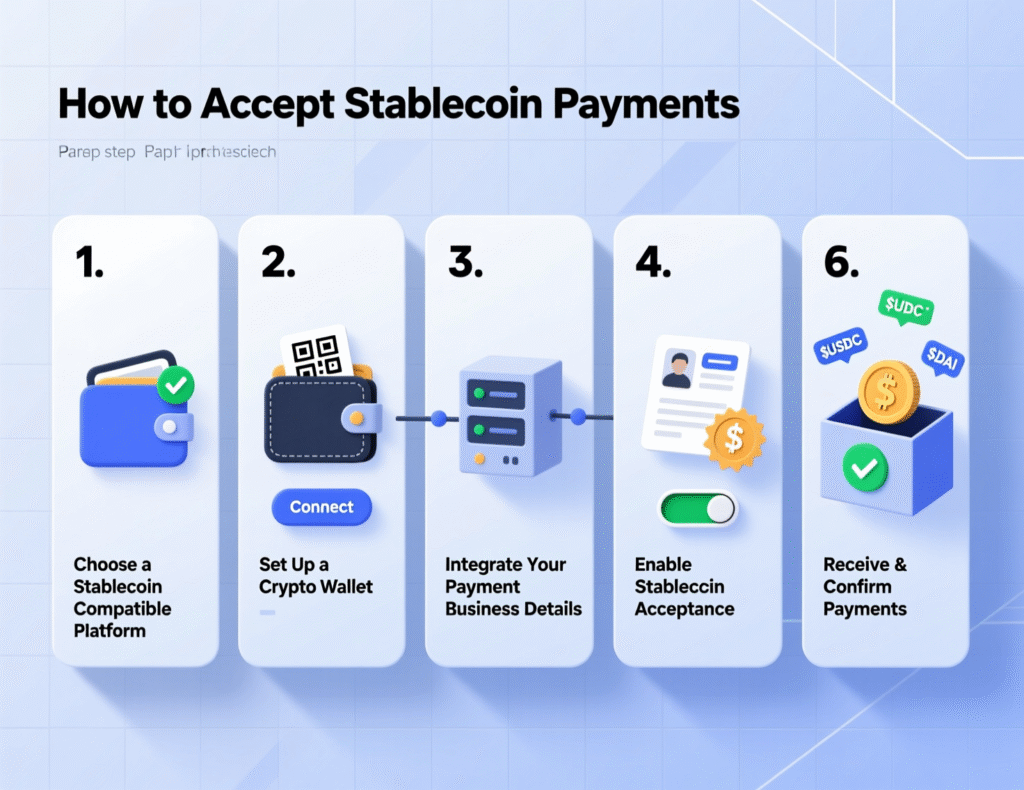

Step-by-step (visual below)

Pick a stablecoin & networks (e.g., USDC on Ethereum/Solana/Base).

Choose a gateway/custody partner (Stripe/Rapyd/BVNK for checkout & payouts; Fireblocks for wallets/treasury).

Complete KYC/KYB, Travel Rule readiness, and set sanctions screening. (FinCEN & FATF Travel Rule applies to VASPs/MSBs.)

Bank links

Set fiat settlement accounts (USD/EUR) with your PSP or off-ramp.

Wallet policy

Set spend limits, 2–3 approvals, address allowlists (MPC recommended).

Accounting

Map on-chain receipts to revenue; under IFRS/GAAP, accounting treatment depends on token rights; follow IRS digital asset reporting.

Visual: Step-by-step (for designers)

Customer selects “Pay with Stablecoin” →

PSP/wallet generates invoice-specific address/QR →

Customer sends USDC/USDT/PYUSD (network shown) →

On-chain confirmation (webhook) →

PSP/custody posts event to ERP →

Optional instant FX/off-ramp to USD/EUR →

Funds allocated by rules to GL/subledger →

Reconciliation and payout scheduling.

Typical fees, settlement times, and reconciliation flow

Fees

Network fees range from cents to a few dollars; PSP markups vary (Stripe historically priced some stablecoin flows below card MDR).

Settlement time

Seconds–minutes on Solana/Ethereum/Base; fiat settlement to bank next-day (PSP-dependent).

Choosing a Stablecoin: USDC vs USDT vs PYUSD

Reserves, transparency, and regulatory posture

USDC (Circle)

Monthly third-party assurance by a Big Four firm; reserve disclosures and attestations; Circle pursuing a US national trust bank charter. Strong transparency posture for regulated enterprises.

USDT (Tether)

Broadest circulation; large holdings of US T-bills per public reports; audits/attestations have improved but remain scrutinized by some regulators and banks.

PYUSD (PayPal/Paxos)

Issued by regulated trust company (Paxos) with monthly transparency reports and attestations; integrated into PayPal/Venmo merchant ecosystem; note October 2025 minting-error incident (resolved/burned).

Network availability and ecosystem integrations

USDC

Multi-chain (e.g., Ethereum, Solana, Base) and deeply integrated with PSPs, custody, and DeFi venues; strong enterprise tooling.

USDT

Very wide network reach; useful for liquidity in emerging corridors.

PYUSD

Best where PayPal/Venmo rails and merchant tools are embedded.

Transaction costs and enterprise support

Costs

Similar network fees by chain; enterprise pricing depends on PSP/custody.

Support

USDC often leads for auditability and compliance documentation; USDT for reach/liquidity; PYUSD for PayPal ecosystem acceptance and consumer familiarity.

Vendor-agnostic comparison table

| Criterion | USDC (Circle) | USDT (Tether) | PYUSD (PayPal/Paxos) |

|---|---|---|---|

| Reserves & Attestations | Big Four monthly assurance; detailed disclosures | Quarterly reports; large T-bill holdings; improving transparency | Monthly attestations by independent firm via Paxos |

| Regulatory Posture | Applying for US national trust bank charter | Global usage; mixed regulatory views | Issued by Paxos Trust (NY) |

| Network Coverage | Broad (ETH, Solana, Base, more) | Broadest global reach | ETH ecosystem; PayPal/Venmo rails |

| Ecosystem | Strong PSP/custody integrations (Stripe, Fireblocks, etc.) | Deep liquidity in emerging corridors | Strong for PayPal merchant flows |

| Enterprise Fit | Compliance-forward; audit-ready | Liquidity & reach | PayPal consumer/merchant integration |

Sources

Circle, Paxos, public reports and PSP announcements.

Compliance, Risk & Regulation (US/EU)

US: FinCEN Travel Rule, tax/accounting, and stablecoin policy signals

Travel Rule & BSA

VASPs/MSBs must meet FinCEN recordkeeping, reporting, and Travel Rule obligations (beneficiary/originator info transfer).

Tax & accounting

The IRS treats digital-asset income as taxable; accounting under GAAP/IFRS is evolving (cash-equivalent treatment under study). Align ERP mappings and FX remeasurement policies.

Policy signals

Congress is advancing stablecoin legislation (e.g., GENIUS/STABLE Act discussions), pushing issuers and operators into BSA/AML frameworks—watch final rules.

EU: MiCA scope, ARTs/EMTs, and corporate obligations

Scope & timeline

MiCA applies to EMT/ART issuers (from Jun 30, 2024) and CASPs (from Dec 30, 2024) with additional Level-2/3 technical standards in 2025.

Obligations

Authorizations for EMT/ART issuers; disclosures, reserve, and governance requirements; CASP conduct and safeguarding rules. National regulators (e.g., Luxembourg CSSF) expect full compliance.

Market impact

Post-MiCA, liquidity shifted toward compliant tokens (e.g., USDC/EURC) as some non-compliant tokens faced EU delistings.

Controls: custody, smart-contract risk, and audit trails

Custody & segregation

Use MPC wallets, role-based approvals, and address allowlists via enterprise infrastructure (e.g., Fireblocks).

Smart-contract risk

Prefer native, fiat-redeemable stablecoins on battle-tested chains; review issuer pause/blacklist controls.

Audit trails

Keep tx hashes, Travel Rule data, and reconciliation logs in your ERP/ledger. Consider blockchain analytics for AML screening. (See Reuters compliance overview.)

Enterprise Integration & Vendor Landscape

Gateways and PSPs supporting stablecoins

Stripe

Checkout + Billing for stablecoin subscriptions and payments (USDC, chain-specific).

Rapyd / Thunes / BVNK

Acceptance, global payouts, FX off-ramps, and treasury tooling across 100+ markets.

Infrastructure: custody, wallets, and treasury tooling

Fireblocks

Enterprise wallet, treasury automation, and stablecoin issuance/movement with policy engines and compliance connectors.

Build vs. buy

Start with gateway for speed; add custody infrastructure as volumes and control requirements grow.

Implementation playbook: timelines, SLAs, and KPIs

Timeline

Pilot in 4–8 weeks via PSP; 8–16 weeks for direct custody + ERP integrations.

SLAs

Uptime (99.9%+), incident response (<1 hour), chain congestion fallbacks, Travel Rule data interop.

KPIs

Effective cost per transaction (ECPT), average settlement time, on-time payout %, FX spread vs. benchmark, chargeback/return rate (expect low vs. cards), and reconciliation cycle time.

Adoption Signals & Case Snapshots

Financial institutions and fintech pilots

JPMorgan & banks

Deposit tokens/JPM Coin for institutional settlement; collaborations (e.g., DBS) to interoperate tokenized deposits.

EU banks

Nine-bank consortium targeting a euro stablecoin in 2026—sign of mainstream momentum.

Ecommerce/marketplace payouts and cross-border payroll

PSPs

Thunes and Rapyd enabling convert-on-payout with USDC/USDT, reducing FX and reaching 130+ countries.

Internal stat (platforms)

Fireblocks notes that >25% invoices settled in stablecoins in 2025 proof of treasury adoption.

ROI calculator: where savings show up

Fees

Compare MDR (2–3%) vs. network + PSP (~0.5–1.5% typical) varies by partner and chain. Blockworks

Time value

2–3 days faster settlement on cross-border flows can free working capital and reduce FX drift.

Ops

Automated reconciliation reduces manual processing costs and write-offs.

Summary & Key Takeaways

Quick checklist: readiness, partners, controls

Readiness

Define use cases and corridors; pick USDC/USDT/PYUSD by compliance, reach, and ecosystem.

Partners

Start with a PSP (Stripe, Rapyd, BVNK); add custody/treasury infra (Fireblocks) as volume grows.

Controls

Enforce Travel Rule, sanctions screening, dual approvals, and full audit trails; align accounting/tax with IRS/IFRS guidance.

Want to pilot stablecoin payments with enterprise guardrails? Mak It Solutions can help you stand up a compliant checkout, payouts, and treasury workflow tailored to US/EU requirements. Get a free consultation and download our integration checklist to go live in weeks, not months.

Thinking about accepting USDC, USDT, or PYUSD? Our experts at Mak It Solutions design secure, compliant payment flows that plug into your existing PSP/ERP stack. Get a free consultation today or subscribe to our newsletter for weekly playbooks on enterprise payments. ( Click Here’s )

FAQs

Q : Are stablecoin payments reversible, and how does dispute management work for B2B?

A : On-chain transfers are typically final after confirmation and are not reversible like card chargebacks. Dispute management shifts upstream: clear refund policies, invoice references, and controlled refund wallets. PSPs can provide customer support tooling, but operational reversals usually require a new outbound payment. Maintain strong KYC, Travel Rule data, and audit logs to handle disputes and compliance reviews.

Q : Which chains (Ethereum, Base, Solana) are best for enterprise stablecoin transactions?

A : Choose chains by finality time, fees, and ecosystem support. Ethereum offers deep liquidity and tooling; Solana offers very low fees and fast confirmations; Base integrates tightly with the broader Ethereum stack. Many PSPs support multiple chains (e.g., USDC on ETH/Solana), letting you route per corridor and cost. Validate chain analytics, uptime SLAs, and support with your PSP/custodian.

Q : Do stablecoin payments require a new merchant account or can I use my existing PSP?

A : Often you can add a stablecoin payment method with your existing PSP (e.g., Stripe’s re-introduced stablecoin support, Rapyd/BVNK stablecoin suites). This shortens time-to-market and ensures reporting consistency in your dashboard/ERP. For advanced treasury control, pair PSP checkout with enterprise wallets (e.g., Fireblocks)

Q : How do I handle GAAP/IFRS accounting for stablecoin receipts and FX remeasurement?

A : Under IFRS/GAAP, treatment depends on token rights and usage; IFRS research is exploring when certain payment tokens could be cash equivalents. Meanwhile, apply clear policies for initial recognition, remeasurement, and realized FX on conversion; map tx hashes to subledgers and retain IRS digital asset records for US taxes. Involve auditors early.

Q : What controls reduce smart-contract and counterparty risk in production deployments?

A : Adopt MPC wallets, dual approvals, and address allowlists; prefer fiat-redeemable, attested stablecoins (USDC/PYUSD) and evaluate issuer controls (freeze/blacklist). Use blockchain analytics for AML and adhere to Travel Rule requirements. Keep immutable logs (tx hash, invoice ID, KYC metadata) for audits. Consider insured or segregated custody for larger treasuries.