Shocking Volatility in Wall Street Mirrors Crypto Market Volatility

Wall Street ended the week with a mixed session, reflecting a volatility pattern that now closely resembles the crypto market. Major stock indexes moved in different directions—Nvidia surged, Microsoft declined, and the Nasdaq closed at a record high.

Trading Economics data from yesterday reveals that the S&P 500 closed at 6,114.63, down 0.01% from the previous session. Over the past four weeks, the index has lost 2.77%, yet it remains 21.57% higher over the past year.

Market fluctuations align with crypto trends

The Nasdaq 100, which tracks major US tech stocks, gained 0.4% to close at a record 20,026.77 points. Meanwhile, the Dow Jones Industrial Average dropped 0.37%, settling at 44,546.08 points.

Most of the 11 S&P 500 sector indexes declined, with seven posting losses. Consumer staples led the fall at 1.16%, followed closely by healthcare, which dipped 1.11%.

In individual stocks, Nvidia rose 2.6%, and Apple gained 1.3%. Microsoft experienced a minor 0.5% decline, while Amazon slipped 0.7%. Trading volume remained below the 20-session average, with 14.4 billion shares exchanged against the usual 15 billion.

On the fixed-income side, bond yields trended downward due to weakening US retail sales. Data showed a sharper-than-expected 0.9% decline in January, following a revised 0.7% increase in December.

The 10-year Treasury yield fell by 7 basis points to 4.44%, signaling investor caution amid economic slowdown concerns.

Despite this, the S&P 500 and Nasdaq still posted gains of 1.5% and 2.6% for the week, respectively, while the Dow added 0.5%. The market saw heightened volatility following President Trump’s executive order on reciprocal tariffs, which economists warn could introduce further uncertainty.

Crypto market shows resilience amid stock market fragility

Conversely, the crypto market experienced gains, with the global market cap rising 2.8%, moving from $3.15 trillion at the start of the week to $3.36 trillion by the close, per Coingecko data. Bitcoin, the leading cryptocurrency by market cap, recorded an intraweek gain of 0.7%, surpassing $97,500.

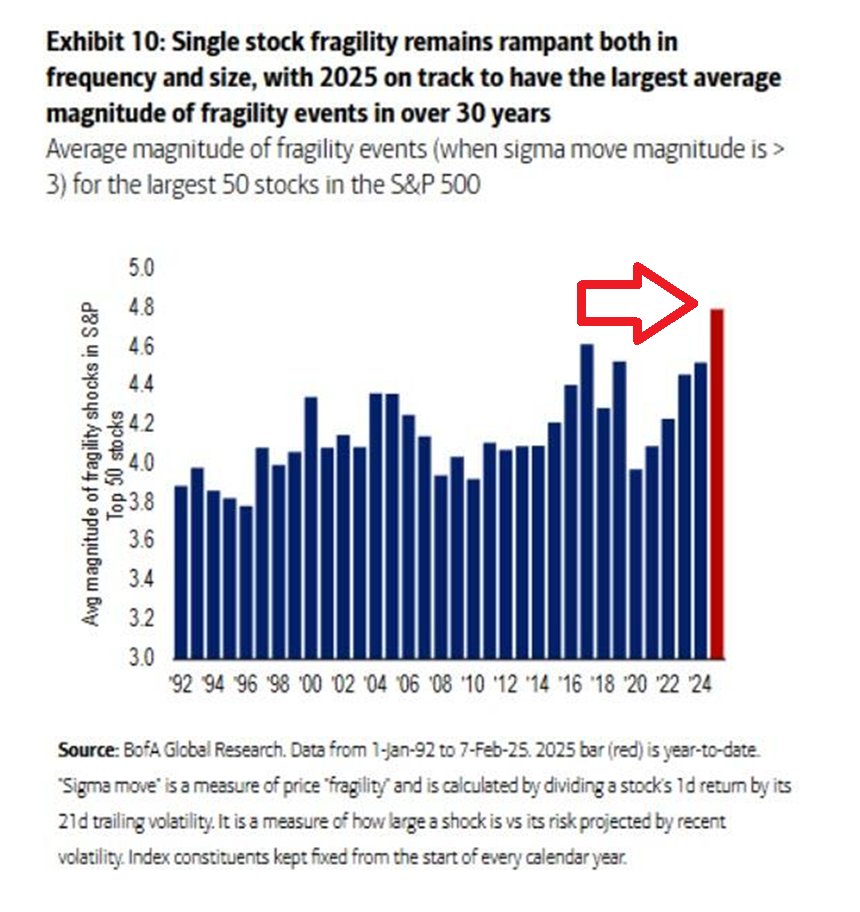

Stock fragility, a measure of daily share price movement relative to recent volatility, reached an all-time high among the 50 largest stocks in the S&P 500, according to analysts at Global Markets Investor group.

In a February 14 post on X, the group highlighted that current market vulnerability surpasses previous instability levels.

Despite a bearish crypto market, Wall Street mirrors its volatility, with gains from early 2024 largely erased in both markets. The sharp price swings observed in traditional finance now resemble those seen in the digital asset space.