SGX Derivatives Debuts Bitcoin, Ether Perpetual Futures Tied to iEdge CoinDesk Crypto Indices

Singapore Exchange’s derivatives arm will list SGX Bitcoin and Ether perpetual futures on Nov. 24, 2025, marking one of Asia’s first regulated, exchange-cleared perpetual crypto contracts.

The contracts are benchmarked to the iEdge CoinDesk Crypto Indices, bringing institutional governance and clearing to a product long dominated by offshore venues. Access is initially limited to accredited and institutional investors.

What the SGX Bitcoin and Ether perpetual futures offer

SGX says the new BTC and ETH perpetuals will combine the no-expiry flexibility popular with crypto traders with traditional margining and central clearing. By referencing iEdge CoinDesk indices, SGX aligns price discovery to benchmarks designed for institutional use. SGX cited global perpetuals activity above US$187 billion in average daily volumes.Reuters+2PR Newswire+2

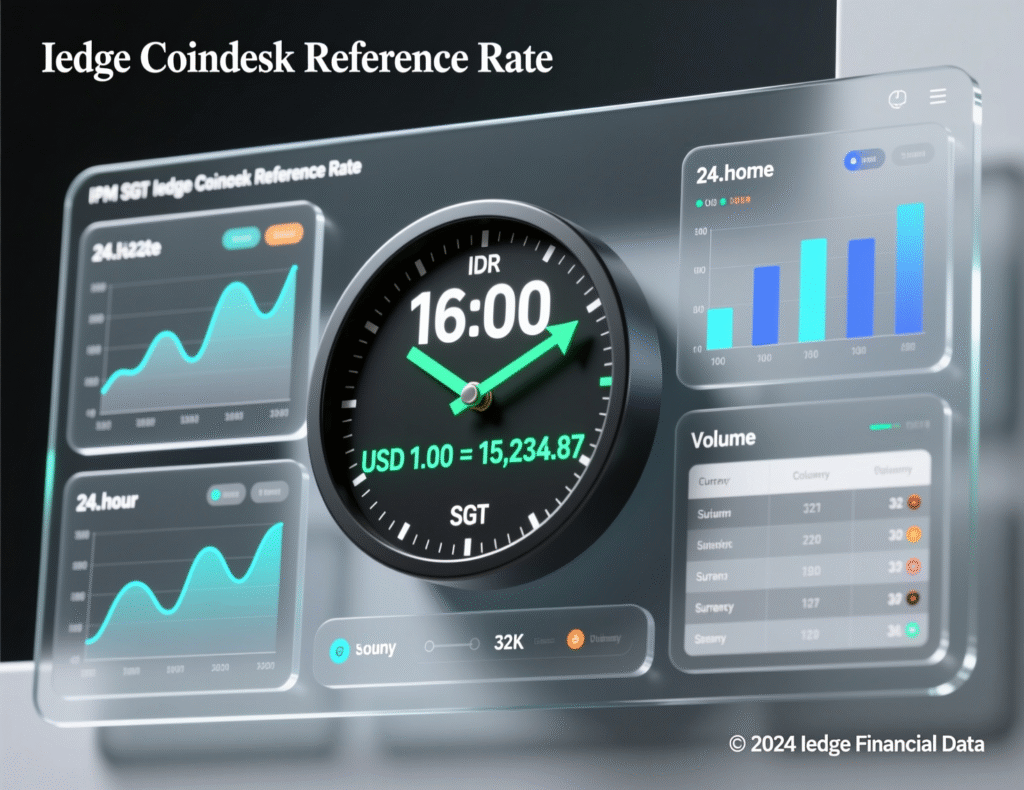

Benchmarking and index mechanics

The iEdge CoinDesk suite provides daily reference rates published 4 p.m. SGT using a 3–4 p.m. SGT window and real-time indices publishing every second. CoinDesk Indices documents describe reference rates as VWAPs over a one-hour window across qualified exchanges, aiming for robust, BMR-compliant benchmarks.

Who can trade the SGX Bitcoin and Ether perpetual futures

Accredited and institutional investors can participate from launch. This aligns with earlier SGX guidance and Singapore’s investor-classification regime administered under the Securities and Futures Act and MAS guidance.

Industry response and significance

Market participants including DBS, OKX (Singapore), and others publicly welcomed the initiative, pointing to the benefits of on-exchange clearing, regional benchmarks, and institutional risk standards for scaling crypto derivatives participation in Asia.

Analysis

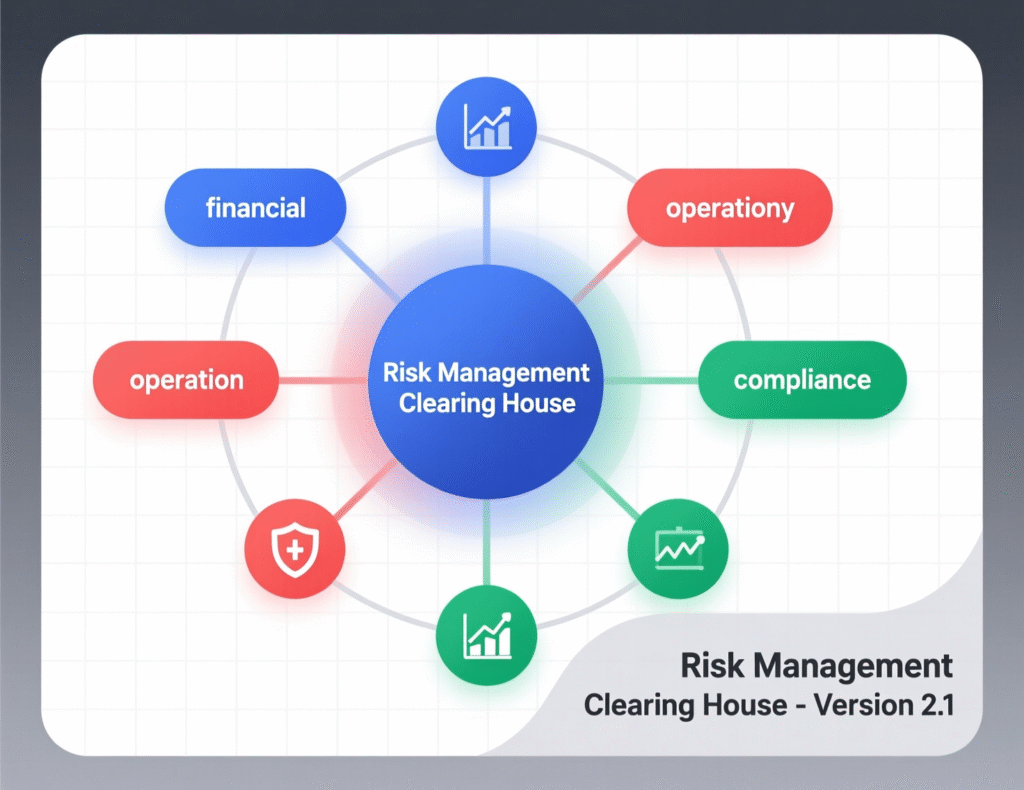

Bringing perpetuals onshore with exchange clearing addresses a key objection institutions have with offshore venues counterparty and operational risk while preserving the instrument’s flexibility. The link to iEdge CoinDesk rates also localizes benchmark timing to SGT, which could matter for Asia-centric portfolios.

Conclusion

SGX is set to launch its Bitcoin and Ether perpetual futures on November 24, offering a regulated avenue for institutional investors to trade the crypto market’s most actively used derivatives. These contracts will be anchored to the iEdge CoinDesk benchmarks, providing transparent pricing, and will benefit from established clearing and margining infrastructure, which adds an extra layer of security and confidence for participants.

As the launch approaches, investors will be closely monitoring key details such as contract specifications, which define trading parameters, the range of brokers offering access, and the liquidity that develops in the early days. These factors will be critical in shaping adoption and ensuring the contracts become a reliable tool for market exposure and risk management.

FAQs

Q : When do the contracts start trading?

A : Nov. 24, 2025.

Q : Who can access them?

A : Accredited and institutional investors per SGX; retail access is not offered.

Q : What benchmarks are used?

A : iEdge CoinDesk Crypto Indices (daily reference rates at 4 p.m. SGT; real-time indices every second).

Q : How do perpetual futures track spot?

A : Through periodic funding rate payments between longs and shorts.

Q : Are these contracts cleared like other SGX derivatives?

A : Yes; SGX emphasizes exchange clearing and traditional margining standards.

Q : Do these involve physical crypto custody?

A : No; they are derivatives referencing indices, not spot custody.

Q : Does the FAQ include the exact phrase ‘SGX Bitcoin and Ether perpetual futures’?

A : Yes; this answer confirms the term used in the article.

Facts

Event

Launch of Bitcoin and Ether perpetual futures by SGX DerivativesDate/Time

2025-11-24T00:00:00+05:00 (launch date; trading hours per SGX/brokers)Entities

Singapore Exchange (SGX); SGX Derivatives; CoinDesk Indices; iEdge (SGX Index brand); DBS Bank; OKX (Singapore)Figures

>US$187 bn daily average global perpetuals volume (industry estimate cited by SGX)Quotes

“We have taken the next logical and deliberate step applying the same institutional discipline that underpins global markets to crypto’s most traded pay-off.” Michael Syn, President, SGX GroupSources

SGX press release (PR Newswire) + URL; Reuters story + URL. PR Newswire+1