Senate crypto bill adds clause to keep tokenized stocks as securities

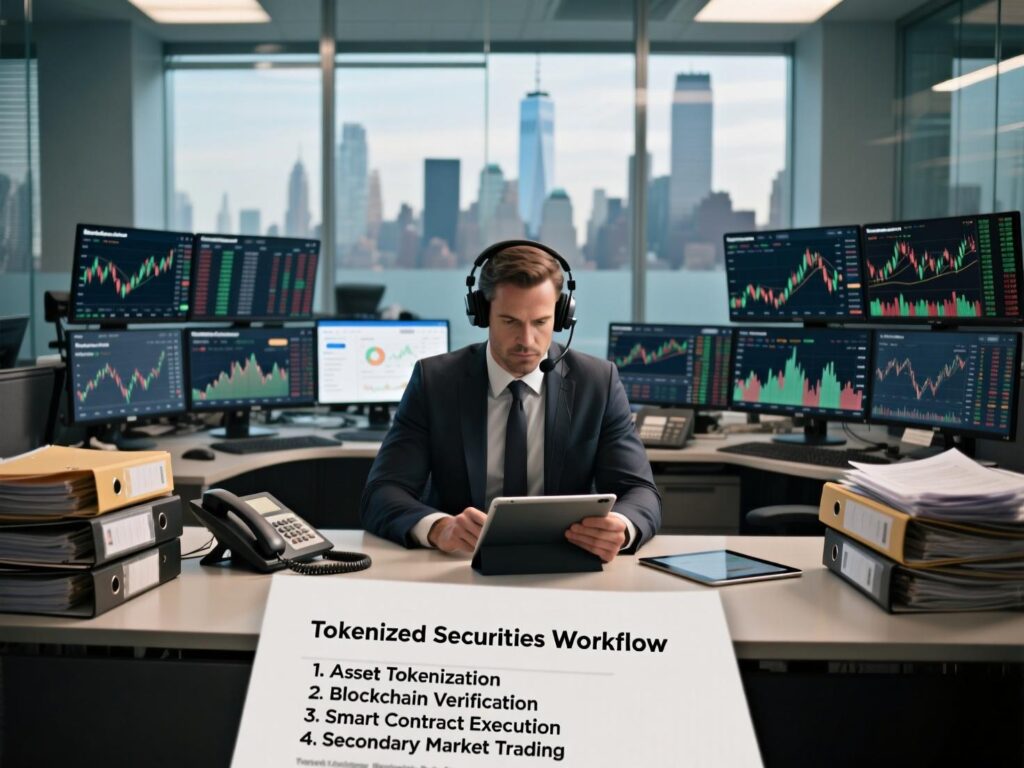

The new bill introduces clear language to confirm that tokenized stocks will still be treated as securities, regardless of whether they are issued, recorded, or settled on a blockchain. This step closes any regulatory gaps by ensuring that simply moving equities to a digital or blockchain-based format does not exempt them from existing securities laws.

In practice, this means tokenized equities must follow the same rules as traditional stocks. They remain subject to broker-dealer registration, clearing and settlement requirements, and oversight of trading platforms. By reinforcing compliance standards, the bill seeks to protect investors and maintain market integrity while allowing innovation in blockchain settlement and tokenized asset trading. It emphasizes that technology does not change the fundamental nature of securities regulation.

The clause at a glance

The bill adds language to ensure tokenized stocks remain securities, even when recorded or settled on a blockchain. In practice, that means tokenized equities must continue to comply with securities rules, including broker-dealer requirements, clearing systems, and trading platform obligations.

Why it matters for market infrastructure

Keeping the legal classification intact reduces friction for digital-asset firms that are building tokenization rails. If tokenized stocks remain securities, broker-dealers can integrate them into existing workflows (KYC/AML, custody, audits) without reinventing compliance. It also avoids turf wars over whether such instruments should migrate to commodities oversight simply because they live on-chain.

Key benefits:

Regulatory continuity: When tokenized stocks remain securities, they inherit existing investor protections and disclosure regimes.

Operational clarity: Clearing, settlement, and custody providers can adapt current processes instead of building parallel ones.

Interoperability: Firms can connect on-chain settlement to off-chain records with fewer gray areas.

SEC vs. CFTC

The “Responsible Financial Innovation Act of 2025” outlines when digital assets fall under the SEC versus the CFTC. According to Lummis, Senate Banking is expected to consider SEC-related sections in September 2025, with the Agriculture Committee taking up CFTC oversight in October 2025. A floor vote could come as early as November 2025. While Democrats haven’t formally signed on, bipartisan talks are underway to pair lawmakers on specific sub-issues.

What industry is asking for

In August, a coalition of 112 crypto companies, investors, and advocacy groups urged the Senate to protect software developers and non-custodial service providers from being miscast as intermediaries under legacy rules. Signatories including major exchanges, protocols, and venture firms warned that ambiguity is pushing builders abroad. They cited developer data showing the US share of open-source blockchain contributors sliding from 25% (2021) to 18% (2025).

For those working on tokenization, the new clause helps: if tokenized stocks remain securities, teams have clearer lines for how to design wallets, smart contracts, and interfaces without accidentally triggering the wrong regulatory regime.

ETFs, flows, and sentiment

US spot Ether ETFs logged a shortened week of net outflows around $787.6 million, including $446.8 million on Friday alone, even after a strong August of net inflows. Bitcoin ETFs, meanwhile, saw net inflows near $250.3 million over the same four days. Ether is up roughly 16% over the past month but dipped about 3% on the week, trading near $4,301 at publication time, with sentiment hovering around “Neutral.”

Long-term bulls remain vocal: Some analysts maintain high-end price targets for ETH and point to on-chain accumulation by large holders. For tokenization narratives, the regulatory clarity that tokenized stocks remain securities could catalyze more institutional pilots that tie traditional yield or equity exposures to on-chain rails.

What it means if you’re building

Broker-dealer alignment:

If tokenized stocks remain securities, your integrations, disclosures, and supervision will look like existing equity workflows just with blockchain rails.Custody design:

Securities-grade segregation and audits will be the expectation; smart-contract logic should reflect those duties.Exchange listings:

Matching engines and ATS/Exchanges can treat tokenized equities as standard securities listings, easing the path to liquidity.Compliance automation:

Expect demand for on-chain attestations and automated reporting to regulators and SROs.

What’s next

Watch the September (Banking) and October (Agriculture) committee calendars for markups, amendments, and manager’s text. If momentum holds, a November 2025 floor vote is plausible. For the ecosystem, the signal is clear: tokenized stocks remain securities, and the policy runway for compliant tokenization is lengthening.

Conclusion

The Senate’s bill makes it clear that tokenized stocks will continue to be treated as securities, ensuring that blockchain-based settlement does not bypass investor protections. This approach reflects an effort to balance innovation with regulation, keeping compliance standards intact while allowing the use of new technologies.

If passed into law, the bill could accelerate blockchain adoption across traditional finance. It may open the door to faster enterprise pilots, smoother compliance processes, and stronger connections between Wall Street systems and on-chain platforms. Ultimately, the move seeks to combine efficiency gains with the safeguards that protect market participants.

FAQs

Q1 . What does the Senate’s clause actually do?

A1 . It confirms that tokenized stocks remain securities, so they stay under securities laws even when issued or settled on a blockchain.

Q2 . Does this change SEC vs. CFTC jurisdiction?

A . The bill splits oversight and clarifies boundaries; when tokenized stocks remain securities, they fall within the SEC’s remit.

Q3 . How will this affect broker-dealers and exchanges?

A . If tokenized stocks remain securities, firms can use existing compliance, custody, and trading frameworks with on-chain rails.

Q4 . Is tokenization still useful if assets stay securities?

A . Yes, efficiency gains from programmability, faster settlement, and transparency persist even when tokenized stocks remain securities.