Robinhood’s Crypto Revenue Miss Tempers Solid Quarter: JPMorgan

JPMorgan described Robinhood’s third-quarter performance as “solid but lower quality,” noting that the company’s earnings beat was largely supported by temporary tax-related benefits rather than core business strength. The bank highlighted that while headline results surpassed market expectations, the underlying quality of earnings remained mixed.

A key concern for JPMorgan was Robinhood’s shortfall in cryptocurrency revenue, which it viewed as a central factor in assessing the quarter’s sustainability. Despite the weaker crypto performance, the firm raised its price target for HOOD to $130 from $122, maintaining a neutral rating. The update reflected confidence in Robinhood’s near-term stability but cautioned that growth momentum may depend on a rebound in trading volumes, especially within its crypto segment.

Q3 by the numbers

Robinhood reported $1.27 billion in total net revenue, up 100% year over year. Transaction-based revenue rose to $730 million, led by $268 million from cryptocurrencies (up over 300% YoY), alongside gains in options and equities. Despite robust activity, HOOD shares slipped roughly 11% to close near $127 as crypto revenue missed consensus. GlobeNewswire+2Investors+2

Why JPMorgan still sees limits to the quarter’s quality

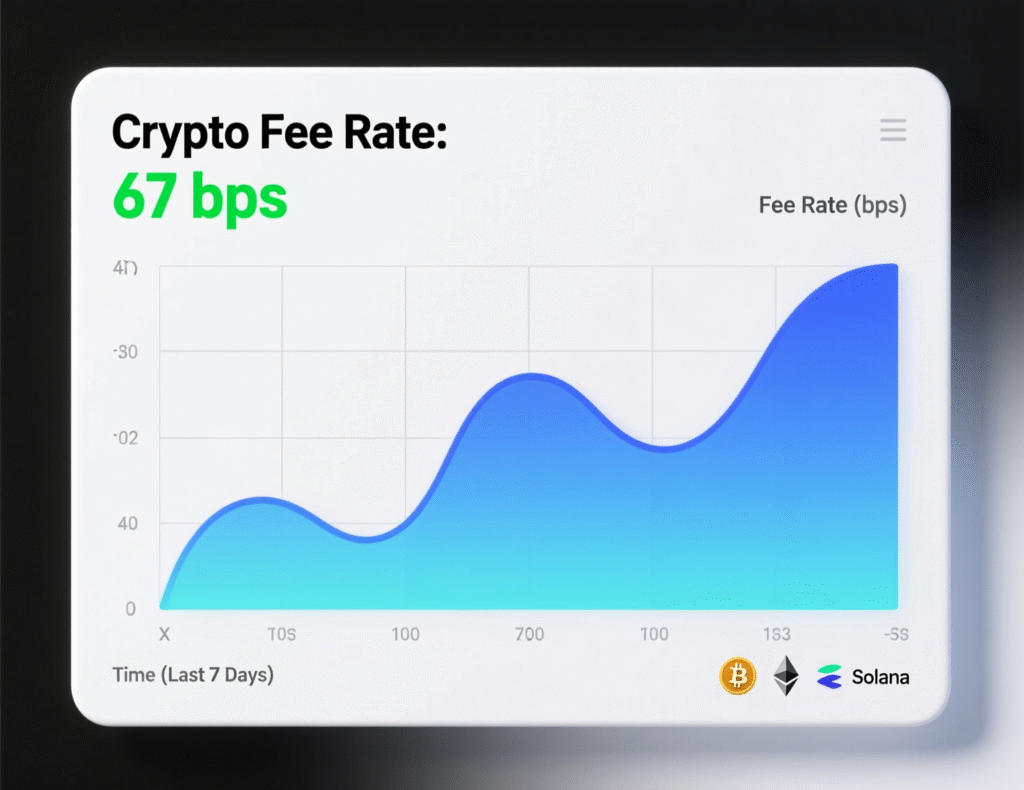

JPMorgan analysts, led by Kenneth Worthington, said the roughly 15% EPS beat was largely the result of a lower tax rate tied to stock-based compensation after the stock’s sharp rally. The bank also noted Robinhood’s crypto fee rate eased to 67 bps (vs. 68 bps expected) amid ongoing pricing adjustments.

Prediction markets helped, but concentration risk remains

JPMorgan said prediction markets provided a partial offset to crypto weakness but cautioned that the business relies on a relatively small cohort of active traders. Broader diversification efforts including prediction markets and other initiatives—were highlighted across earnings coverage, even as sustainability of growth remains a question for some analysts.

What the Robinhood crypto revenue miss means for HOOD

The crypto miss suggests take rate pressure and mix shifts can counteract volume growth. For investors, JPMorgan’s unchanged neutral stance and a $130 target imply a more balanced risk-reward after a strong year-to-date rally. Near-term catalysts include crypto market volatility, user growth, and monetization across new products like prediction markets.

Tracking the Robinhood crypto revenue miss going forward

Key metrics to watch: crypto net revenue, fee rate (bps), active users, and take rates across products. Any stabilization or improvement in fee rate, paired with sustained volumes, would help close the gap versus Street models.

Context & Analysis

Robinhood’s expanding product set is lifting aggregate revenues, but crypto monetization remains sensitive to pricing and market structure. The 67 bps crypto fee rate—just below JPMorgan’s 68 bps assumption illustrates how small shifts can meaningfully affect results at scale. If prediction markets continue to grow yet remain concentrated, revenue volatility may persist.

Conclusion

JPMorgan’s updated $130 price target and neutral stance signal cautious confidence in Robinhood’s growth path. The bank acknowledged progress in expanding the platform’s reach but remained wary of the earnings boost driven by tax benefits and softer cryptocurrency monetization.

To strengthen earnings quality, JPMorgan emphasized the importance of consistent fee rate stability and deeper user engagement. Expanding adoption across newer products and improving trading activity could help Robinhood build a more durable revenue base, reducing reliance on volatile factors like crypto volumes or one-time financial adjustments.

FAQs

Q : What did JPMorgan say about Robinhood’s Q3 results?

A : It called the quarter “solid but lower quality,” citing a tax-driven EPS beat and a crypto revenue miss, and set a $130 price target with a neutral rating.

Q : How much was Robinhood’s crypto revenue in Q3 2025?

A : $268 million, below Street and JPM estimates.

Q : Why did HOOD shares fall after earnings?

A : Shares dropped around 11% as investors focused on the crypto revenue miss despite strong headline results.

Q : What is Robinhood’s crypto fee rate and why does it matter?

A : JPMorgan cited 67 bps for Q3; small changes in fee rate can significantly impact crypto revenue.

Q : Did any businesses offset the crypto shortfall?

A : Prediction markets helped, though analysts warn the segment depends on a small group of active traders.

Q : How did Robinhood’s total revenue trend?

A : Net revenue rose to $1.27B, with transaction-based revenue at $730M.

Q : Does this mean HOOD is a buy?

A : JPMorgan remains neutral with a $130 target, implying balanced risk-reward pending crypto monetization trends.

Facts

Event

JPMorgan raises HOOD price target to $130; flags crypto revenue missDate/Time

2025-11-07T16:00:00+05:00Entities

Robinhood Markets, Inc. (HOOD); JPMorgan Chase & Co.; Kenneth Worthington; Vlad TenevFigures

Total net revenue $1.27B; transaction-based revenue $730M; crypto revenue $268M; crypto fee rate 67 bps; HOOD close ~$127 (−~11%)Quotes

“Solid but lower quality…lower tax rate tied to stock-based compensation” JPMorgan note as reported by CoinDeskSources

CoinDesk “Robinhood’s Crypto Revenue Miss Tempers Solid Quarter: JPMorgan” (coindesk.com); Robinhood IR “Robinhood Reports Third Quarter 2025 Results” (investors.robinhood.com)