Robert Kiyosaki says cash crunch driving crash, stays bullish on Bitcoin, gold

Amid a steep sell-off in risk assets, Robert Kiyosaki’s warnings about a potential cash crunch and market crash have resurfaced. The “Rich Dad Poor Dad” author shared with his followers that he currently holds Bitcoin and gold, positioning himself for the ongoing downturn. He emphasized that the recent market weakness reflects a broader global need for liquidity, suggesting that many investors and institutions are scrambling for cash in the face of uncertainty.

Kiyosaki also reiterated his long-standing “Big Print” thesis, pointing to continued government money creation as a driving force behind market instability. He indicated plans to increase his holdings in Bitcoin and gold once the market stabilizes, reinforcing his belief that these assets serve as a hedge against inflation and financial turbulence.

Market Crash Framed as a Liquidity Squeeze

Kiyosaki described today’s environment as an “everything bubble” bursting and linked selling pressure to cash demands rather than conviction changes. While he has repeatedly warned of a historic crash, his stance remains to hold hard assets (Bitcoin, gold; often silver) through the turmoil.

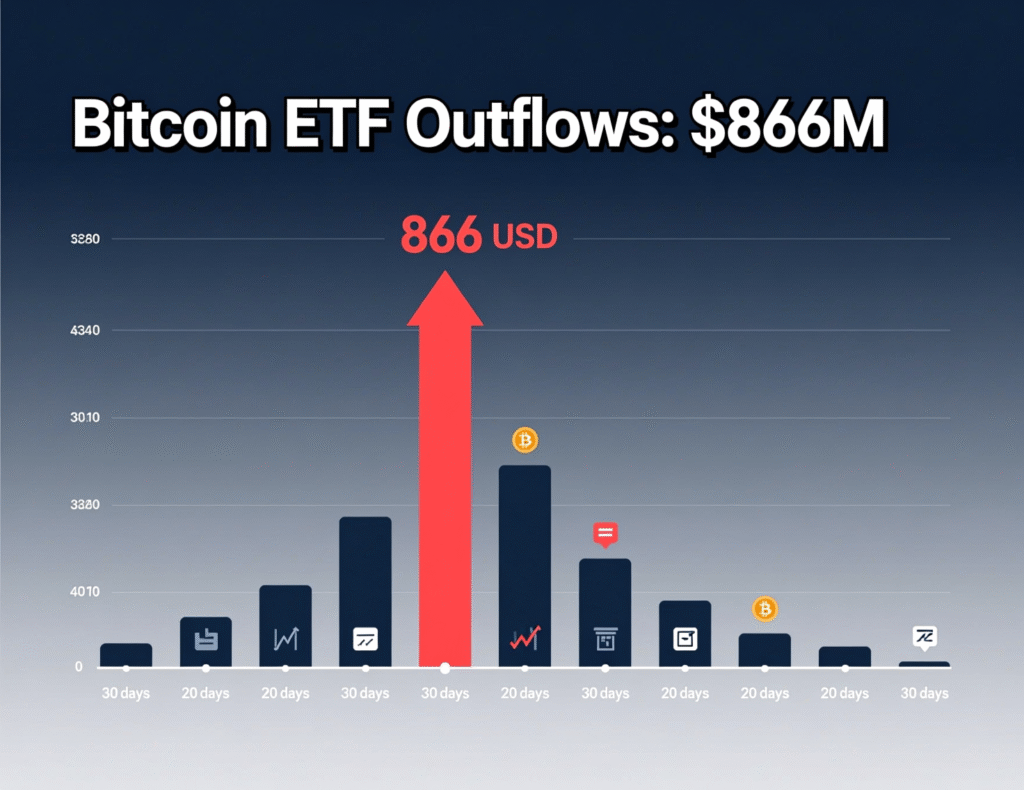

Recent flows and sentiment align with risk-off dynamics: U.S. spot Bitcoin ETFs recorded ~$866 million in net outflows in one session, and fear gauges slid to Extreme Fear (~16). Both data points reflect constrained liquidity and investor de-risking.

‘Big Print’ Thesis and Hard-Asset Hedge

Kiyosaki’s “Big Print” view popularized in conversations with investor Lawrence Lepard posits that governments will lean on large money creation to service debts, eventually debasing fiat and favoring scarce assets like Bitcoin and gold. His social posts and media appearances have revisited this theme throughout 2024–2025. X (formerly Twitter)+1

Why Kiyosaki says Robert Kiyosaki cash crunch market crash is different

The argument centers on liquidity, not just valuation: when funding dries up, forced selling begets more selling. Kiyosaki frames the resolution as policy-driven i.e., money printing benefiting assets with fixed or constrained supply (BTC’s 21M cap; finite gold).

Positioning now: hold stance, buy after bottom (Robert Kiyosaki cash crunch market crash)

Kiyosaki says he is not selling and plans to buy more Bitcoin after the crash, consistent with prior posts urging patience during panics and accumulation on deep pullbacks.

Sentiment & Bottom-Calling Risks

With fear high and prices volatile, traders are debating whether a bottom is in. Santiment warns that market lows “rarely occur” when social feeds are full of confident bottom calls historically, durable lows form when most expect further declines.

Related Market Signals

Extreme Fear reading (~16) on the Bitcoin Fear & Greed Index has historically coincided with value zones though not guarantees.

Technical commentary notes BTC testing high-90Ks/low-90Ks areas, with bears eyeing deeper support. (Market levels vary intraday.)

Context & Analysis

Kiyosaki’s messaging is consistent: own scarce assets, be patient into sell-offs, and anticipate policy responses that may later re-inflate prices. Critics note the timing risk sentiment can stay fearful and liquidity tight longer than expected. Meanwhile, on-chain and flow metrics are mixed (ETF outflows vs. opportunistic accumulation), and calling precise bottoms is notoriously unreliable, echoing Santiment’s caution.

Conclusion

Robert Kiyosaki is holding his positions in Bitcoin and gold amid the ongoing market sell-off, signaling plans to add more BTC once the downturn ends. He frames these moves as strategic, using the current volatility to reinforce his belief in these assets as protection against economic uncertainty.

For investors, Kiyosaki’s approach highlights the importance of liquidity discipline and measured execution. Rather than chasing a single “bottom” day, he advocates staying patient and making calculated additions, emphasizing steady, informed decision-making over all-in bets during market turbulence.

FAQs

Q : What does Kiyosaki mean by a global cash crunch?

A : He suggests forced selling is driven by immediate cash needs, not conviction shifts, until policy eases liquidity.

Q : Is he selling his Bitcoin or gold?

A : No. He says he’s holding and plans to add BTC after the crash.

Q : Did he reference a “Big Print”?

A : Yes Kiyosaki has highlighted Lawrence Lepard’s “Big Print” idea about large-scale money creation.

Q : What is the Bitcoin Fear & Greed Index and why is 16 notable?

A : It’s a sentiment gauge (0–100). A reading near 16 indicates “Extreme Fear,” often seen near value zones but not guarantees.

Q : Are bottoms typically called correctly on social media?

A : Santiment cautions that bottoms rarely form when most people say they already have.

Q : How does ETF flow affect price?

A : Large net outflows (e.g., ~$866M in a day) can exacerbate selling pressure.

Q : Does the article’s thesis guarantee future gains?

A : No. It summarizes public commentary and data; markets remain volatile and unpredictable.

Facts

Event

Kiyosaki reiterates hold on Bitcoin/gold, tying crash to global cash crunch; plans to buy BTC post-downturnDate/Time

2025-11-15T14:30:00+05:00Entities

Robert Kiyosaki; Bitcoin (BTC); Gold; Lawrence Lepard; Santiment; Bitcoin ETFsFigures

Bitcoin ETF outflows ~USD 866M (daily); Fear & Greed Index ~16 (“Extreme Fear”)Quotes

“THE EVERYTHING BUBBLE is bursting. I am afraid this crash may be the biggest in history.” Robert Kiyosaki, on X. X (formerly Twitter)Sources

Cointelegraph (ETF flows via TradingView mirror) https://www.tradingview.com/news/cointelegraph%3A40a8bbd6c094b%3A0-bitcoin-etfs-bleed-866m-in-second-worst-day-on-record-but-some-analysts-still-bullish/ ; Bitcoin Fear & Greed Index on X https://x.com/BitcoinFear/status/1989264572868411394