Ripple’s RLUSD to Power Mastercard Credit Card Settlements on XRP Ledger

Ripple has teamed up with Mastercard, WebBank, and Gemini to launch a live pilot testing RLUSD Mastercard credit card settlements on the XRP Ledger. Announced at Ripple’s Swell 2025 event, the initiative marks a major step in bridging traditional finance with blockchain-based payments.

The pilot aims to determine if a regulated stablecoin, RLUSD, operating on a public blockchain can improve the speed, cost-efficiency, and compliance of conventional card transactions. By leveraging the XRP Ledger’s scalability and transparency, Ripple and its partners hope to demonstrate how digital assets can streamline real-world settlement processes while meeting financial regulatory standards.

How the Pilot Works

What the RLUSD Mastercard credit card settlements pilot does

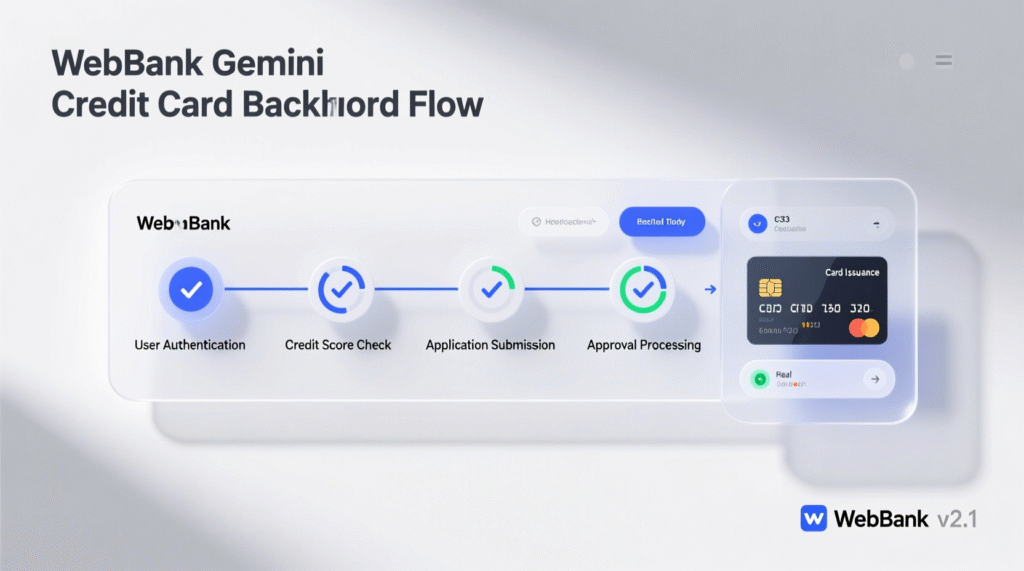

Under the pilot, WebBank the issuer of the Gemini Credit Card will explore settling Mastercard transactions in RLUSD on XRPL. The consumer experience (swiping a card) is unchanged; the back-end settlement rail could move from legacy bank-to-bank processes to a tokenized USD instrument that clears near-instantly on a public ledger, subject to regulatory approvals. CoinDesk+1

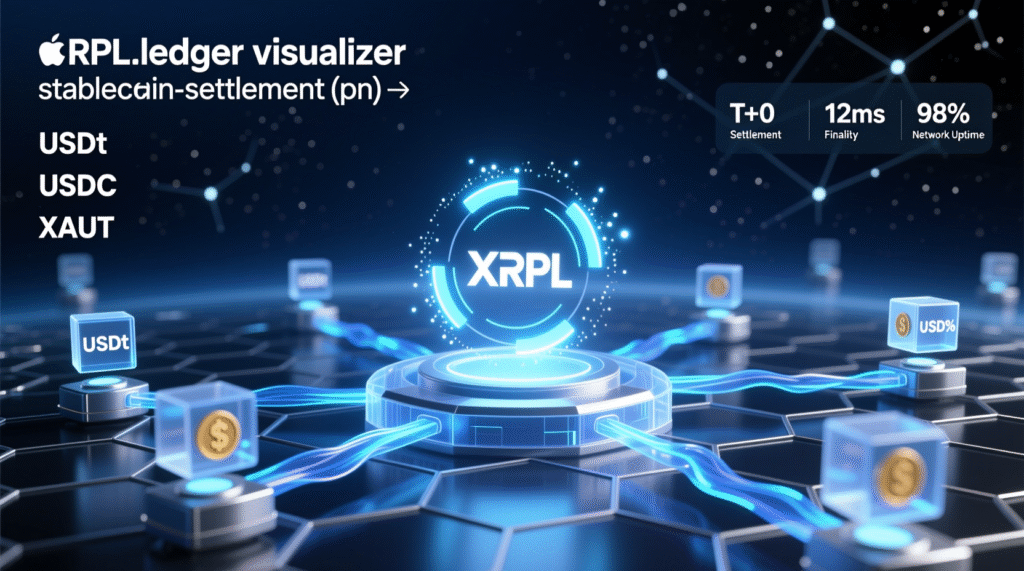

Why XRP Ledger and RLUSD?

XRPL provides a public payments network with native features for fast, low-cost transfers. RLUSD is a U.S. dollar-backed stablecoin introduced by Ripple in late 2024 under New York oversight; supply has grown to over $1B in 2025, reflecting adoption across Ethereum and XRPL.

Mastercard’s role and readiness

Mastercard has been developing end-to-end stablecoin capabilities “from wallets to checkouts,” positioning it to support pilots that integrate regulated digital assets into its global network. The company has previously partnered with Gemini on the Gemini Credit Card, issued by WebBank.

Participants and responsibilities

Ripple

RLUSD issuer; technical integration with XRPL.

Mastercard

Network partner and settlement framework.

WebBank

Regulated bank issuing the Gemini Credit Card; pilot bank counterparty.

Gemini

Card program partner; prior collaboration on an “XRP edition” card.

Potential benefits for issuers, acquirers, and merchants

Stakeholders could see reduced settlement times (from days to minutes), improved cross-border flows, and possibly lower liquidity and reconciliation costs while retaining compliance controls aligned with bank and network rules. (Mastercard’s stablecoin tooling and WebBank’s regulated status are central to this.

Timeline and next steps for RLUSD Mastercard credit card settlements

The companies indicated RLUSD onboarding to XRPL will roll out in the coming months, pending regulatory approvals. If metrics on speed, reliability, and compliance are met, the model could be extended to other card programs.

Context & Analysis

The pilot aligns with Mastercard’s stated plan to support stablecoin transactions and comes as RLUSD’s supply passes $1B less than a year after launch. If a regulated bank like WebBank can demonstrate compliant public-chain settlement at scale, it could inform broader network policies and bank risk frameworks. That said, production rollout depends on regulator comfort with stablecoin reserves, transaction monitoring, and operational resilience on public infrastructure.

Conclusion

The Swell 2025 pilot takes a practical approach keeping the familiar Mastercard interface while upgrading the settlement layer behind it. Ripple’s goal is to modernize how credit card payments are cleared and settled using blockchain and stablecoin infrastructure without disrupting user experience.

If successful, the initiative could pave the way for other issuers and payment programs to adopt similar stablecoin-based systems. These rails promise faster, cheaper, and more global settlement options, provided they meet strict regulatory and operational standards. It’s a forward-looking test of how traditional finance and digital assets can function together seamlessly.

FAQs

Q : What is being tested in this pilot?

A : Settling Mastercard credit card transactions using RLUSD on the XRP Ledger, with WebBank as the issuing bank partner.

Q : Who is participating?

A : Ripple, Mastercard, WebBank, and Gemini.

Q : Is RLUSD fully backed?

A : Ripple says RLUSD is backed by cash and equivalents; supply exceeded $1B in Nov. 2025.

Q : Will consumers notice changes at checkout?

A : No. The card experience is the same; only the settlement rail changes.

Q : When could this scale beyond the pilot?

A : After onboarding and regulatory approvals in the coming months, depending on pilot outcomes.

Q : Does Mastercard already support stablecoin integrations?

A: Yes, Mastercard has outlined end-to-end stablecoin capabilities for wallets and checkouts.

Q : Where is the exact phrase used?

A : This article covers RLUSD Mastercard credit card settlements in detail, including requirements and next steps.

Facts

Event

Ripple, Mastercard, WebBank, and Gemini pilot RLUSD settlement for Mastercard credit card transactions on XRPLDate/Time

2025-11-05T17:00:00+05:00Entities

Ripple; Mastercard; WebBank; Gemini; XRP Ledger (XRPL); RLUSD stablecoinFigures

RLUSD supply > USD 1 billion (Nov. 2025)Quotes

“The goal is to bring blockchain speed and efficiency into the back-end of a payment flow consumers already know swiping a credit card.” Monica Long, Ripple President (as reported) CoinDeskSources

CoinDesk coverage; Yahoo Finance update on RLUSD supply; Mastercard stablecoin capabilities page; Gemini docs confirming WebBank issuer. support.gemini.com+3CoinDesk+3Yahoo Finance+3