Ripple, Immunefi Launch $200K Bug Hunt for XRPL’s New Institutional Lending Protocol

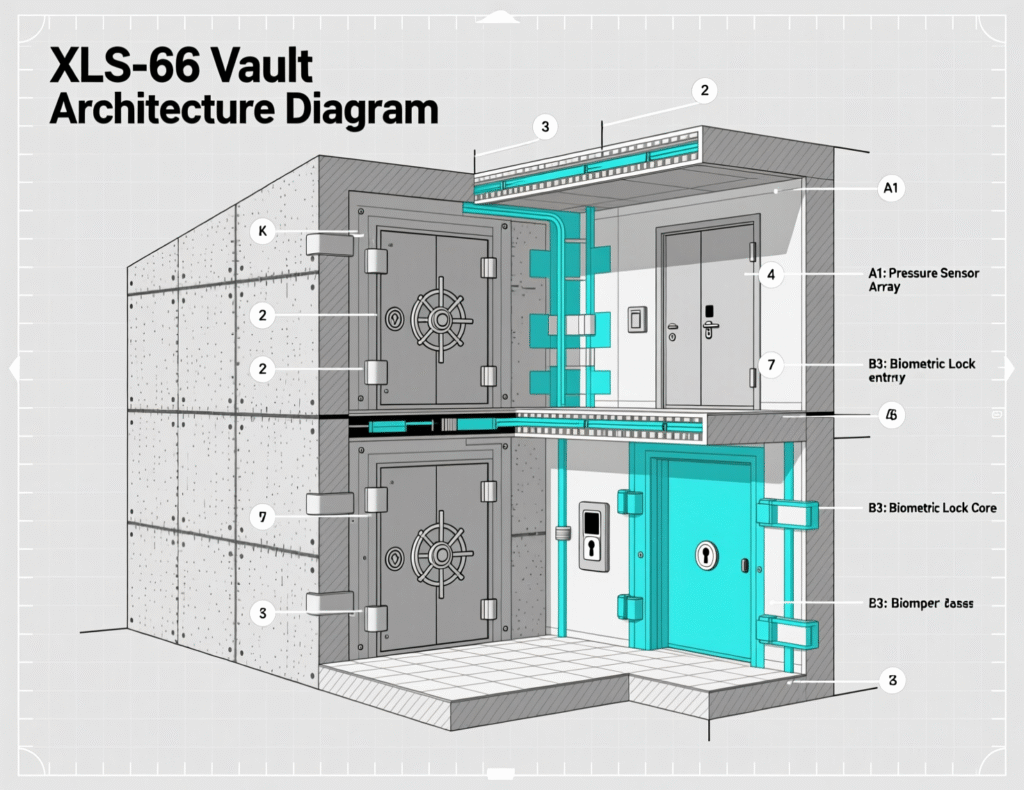

Ripple has teamed up with Immunefi to launch the XRPL Lending Protocol Attackathon, a specialized bug-hunting program focused on the XRP Ledger’s proposed institutional lending framework (XLS-66). The initiative aims to rigorously test the protocol’s design, which introduces uncollateralized, fixed-term lending supported by off-chain underwriting and on-ledger settlement mechanisms.

The program combines a two-week academy to educate participants on XRPL’s technical model with a multi-week competition challenging developers and security researchers to uncover potential vulnerabilities. By engaging the broader blockchain security community, Ripple seeks to enhance the reliability and resilience of XLS-66 before institutional deployment, ensuring that the framework meets the highest standards of trust and performance for on-chain lending.

What the program includes

Reward pool & rules

A flat $200,000 pool in RLUSD, unlocking in full if any valid bug is found; otherwise a $30,000 fallback for meaningful findings. “All Star” and “Podium” sub-pools are included. KYC and step-by-step PoCs are required.Timeline

Education (“Attackathon Academy”) from Oct. 13–27 with Q&A, walkthroughs, and Devnet access; the competition starts Oct. 27 (end date listed as Nov. 29 on Immunefi’s blog and Nov. 24 on the program page see Clarifications). Immunefi+1Scope

XLS-66 Lending Protocol plus related components: XLS-65 Single-Asset Vaults, XLS-33 Multi-Purpose Tokens, XLS-70 Credentials, XLS-80 Permissioned Domains (and Deepfreeze/XLS-77 per blog). Priority targets include liquidation, interest accrual, clawback/deepfreeze, administrative attacks, vault interactions, and permissioned access controls.

Why it matters for institutional DeFi

The XRPL lending design avoids smart contracts and on-chain collateral. Credit assessment occurs off-chain using institutional risk models, while funds and repayments are recorded natively on XRPL for auditability. Advocates say this bridges traditional credit markets with on-chain execution while preserving compliance workflows.

Program mechanics and security priorities

In-scope components (high impact)

Vault logic (XLS-65): share accounting, deposits/withdrawals, solvency protections.

Liquidation & interest: debt representation, accrual accuracy, and triggers under stress.

Permissioned access & credentials (XLS-70/XLS-80): preventing bypass of lender/borrower restrictions and domain-gated participation.

Off-chain underwriting, on-ledger settlement

Underwriting: institutions assess creditworthiness off-chain; XRPL records loan terms and repayments, aiming to separate risk modeling from settlement rails.

How the XRPL Lending Protocol Attackathon rewards are structured

Flat pool

$200,000; any valid bug unlocks the full pool.Fallback:

$30,000 if no bugs are found but valid insights are submitted.Distribution

Includes All-Stars/Podium recognition.

Submission rules for the XRPL Lending Protocol Attackathon

PoC

Working proof-of-concept required; step-by-step.Triage

Managed by Immunefi; KYC enforced; C/C++ target code (~35.5k lines).

Context & Analysis

Immunefi’s Attackathon format has become a common pre-deployment hardening step in crypto projects. For XRPL, the emphasis on off-chain underwriting plus ledger-native settlement differs from EVM-based lending markets, shifting the attack surface toward accounting correctness, permissioning, and edge-case state transitions rather than smart-contract logic. A successful program should tighten solvency guarantees and clarify operational guardrails for institutional participants. (Analysis)

Conclusion

The Attackathon serves as a focused effort to test and validate the XRPL lending layer before its institutional launch. By engaging developers and researchers, the program seeks to identify weaknesses within the proposed XLS-66 framework, which enables uncollateralized, fixed-term lending on the XRP Ledger.

Through a blend of structured education, clear testing scope, and a flat bounty model, Ripple and Immunefi aim to surface key security and design issues early. The insights gathered will help refine the standard, ensuring it can securely support real-world credit and lending applications across institutional and enterprise use cases.

FAQs

Q : What is the XRPL Lending Protocol Attackathon?

A : A time-boxed Immunefi competition to find vulnerabilities in XRPL’s proposed lending standard (XLS-66).

Q : When does it run?

A : Education: Oct. 13–27; competition starts Oct. 27. End date is listed as Nov. 29 (blog) vs. Nov. 24 (program page).

Q : How big is the reward pool?

A : $200,000 in RLUSD with All-Stars/Podium sub-pools.

Q : What if no critical bug is found?

A : A $30,000 fallback is distributed to contributors with valid insights.

Q : What are priority targets?

A : Vault solvency, liquidation, interest accrual, deepfreeze/clawback, admin and permissioned access controls.

Q: Does the protocol use smart contracts?

A : No. It’s ledger-native with off-chain underwriting; funds and repayments are recorded directly on XRPL.

Q : Where was this first reported?

A : CoinDesk reported the launch on Oct. 16, 2025.

Facts

Event

Ripple & Immunefi launch bug-hunting Attackathon for XRPL Lending ProtocolDate/Time

2025-10-16T10:20:00+05:00Entities

Ripple; Immunefi; XRP Ledger (XRPL); XLS-66; XLS-65; XLS-33; XLS-70; XLS-80Figures

$200,000 reward pool (RLUSD); 35,498 lines of C/C++ code (target)Quotes

“If even one valid bug is found during the program, the full $200,000 is unlocked and will be distributed.” Immunefi (program blog) ImmunefiSources

Immunefi program blog; Immunefi program page; CoinDesk launch report; RippleX Dev article. DEV Community+3Immunefi+3Immunefi+3