Bitcoin to Altcoin Explosion: Dominate Altseason: Follow the Money Flow Blueprint

The Path to Altseason: A Reminder

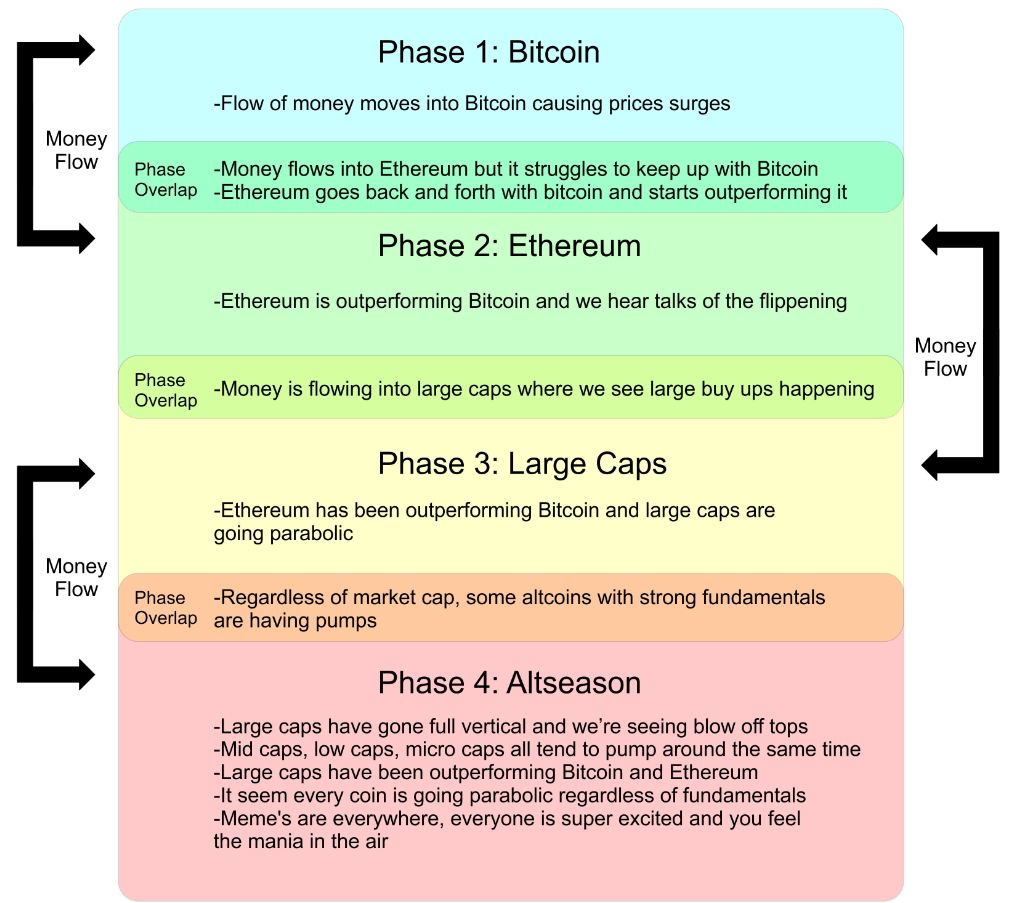

Many people often forget how the money flows in the crypto market, so here’s a quick reminder on why Ethereum needs to outperform Bitcoin before we can see an altseason.

Sure! Here’s an expanded explanation of each phase and overlap in the flow of money within the crypto market, leading up to alt season:

PHASE 1: BITCOIN

This is the initial phase where most of the money in the crypto market flows into Bitcoin. Bitcoin is typically seen as the most stable and trusted cryptocurrency, often being the first choice for both new and seasoned investors. As demand for Bitcoin increases, its price surges, leading to a significant rally. This phase often marks the beginning of a broader market movement. In 2024, we have already seen Bitcoin reach its all-time high during this phase.

Key Point:

This phase is all about Bitcoin dominance. Most capital is concentrated in BTC, pushing its price higher and setting the stage for the rest of the market.

—

PHASE OVERLAP: Bitcoin to Ethereum

After Bitcoin has made its significant gains, investors begin to look for other opportunities in the market. This is when money starts to flow from Bitcoin into Ethereum. Ethereum begins to outperform Bitcoin as investors speculate that it has more room to grow. This overlap phase is crucial because it marks the transition from Bitcoin’s dominance to Ethereum gaining more traction and market share.

Key Point:

This is a transitional phase where Ethereum starts to gain momentum, and we see a shift in market interest from Bitcoin to Ethereum.

—

PHASE 2: ETHEREUM

In this phase, Ethereum takes the lead and outperforms Bitcoin. This period often sees increased discussions about Ethereum possibly surpassing Bitcoin in terms of market cap, a concept known as “the flipping.” Ethereum’s strength during this phase often attracts more attention to the altcoin market as a whole.

Key Point:

Ethereum’s strong performance fuels speculation and excitement in the market, leading to increased interest in altcoins.

—

PHASE OVERLAP: Ethereum to Large Caps

As Ethereum continues to perform well, investors begin to look for opportunities in other large-cap cryptocurrencies (often referred to as “blue-chip” altcoins). These are well-established projects with significant market caps. Money flows into these large caps, leading to increased trading volumes and price gains across the market, excluding Bitcoin and Ethereum.

Key Point:

This is another transitional phase where the market begins to broaden its focus beyond Ethereum, leading to large-cap altcoins gaining traction.

—

PHASE 3: LARGE CAPS

In this phase, large-cap altcoins go parabolic, experiencing rapid price increases. Ethereum continues to outperform Bitcoin, but now the broader market is participating as well. This phase is characterized by significant gains in large-cap coins, which are generally seen as safer bets compared to smaller, more speculative altcoins.

Key Point:

Large-cap altcoins see explosive growth as the market’s focus shifts from Bitcoin and Ethereum to other well-established cryptocurrencies.

—

PHASE OVERLAP: Large Caps to Altcoins

As large-cap altcoins rally, investors begin to take profits and move their capital into smaller, more speculative altcoins. This includes lower-cap coins and even meme coins with little to no fundamental value. During this overlap, we start to see these smaller coins pump as well, regardless of their market cap or project fundamentals.

Key Point:

The market becomes increasingly speculative, with investors chasing gains in smaller and riskier altcoins.

—

PHASE 4: ALTSEASON

This is the final and most euphoric phase of the cycle. During alt season, almost every coin in the market—whether large-cap, mid-cap, low-cap, or micro-cap—experiences significant price increases. The market becomes extremely speculative, with even coins lacking strong fundamentals pumping rapidly. Meme coins, driven by social media hype, also see massive gains. The overall sentiment is one of euphoria, with everyone in the market feeling the “mania in the air.”

Key Point:

Altseason is marked by widespread gains across the entire market, often driven by hype and speculation rather than fundamentals. This phase typically signals the peak of the market cycle.

—

Understanding these phases helps traders and investors anticipate market movements and better time their entry and exit points. The flow of money from Bitcoin to Ethereum, then to large caps, and finally to smaller altcoins, is a pattern that has repeated itself in previous market cycles, making it a valuable framework for navigating the crypto market.

We also provide multiple trading setups in our premium discord server, you can take great benefit from it.