Payments Infrastructure Meets Crypto

Payments move trillions every day, yet merchants still wait days to settle, juggle costly cross-border fees, and wrestle with fragmented rails. Enter PayFi short for Payment Finance a new stack that blends modern payments infrastructure with crypto primitives like stablecoins, tokenized cash, and on-chain settlement.

At its core, PayFi reimagines how value flows: real-time, programmable, and global. It doesn’t replace everything you use today; it routes value across the best rail for the job sometimes card networks, sometimes bank rails, and increasingly, on-chain stablecoins.

Analysts and networks now treat stablecoins as serious settlement media, and major brands are piloting or expanding programs to settle obligations with USDC and other regulated stablecoins. Visa publicly describes a “stablecoin settlement” pilot and showcases crypto-based payments research, while consultancies outline how tokenized cash could power next-gen payments.

Against that backdrop, PayFi offers a practical blueprint for merchants and PSPs to reduce costs, speed settlement, and unlock new financing flows. This guide explains PayFi, the building blocks, architectures, compliance considerations, and how to stand up a pilot.

Citations

Visa stablecoin settlement overview; McKinsey on tokenized cash/stablecoin rails; Stellar/OSL/CoinMarketCap Academy definitions of PayFi.

What is PayFi?

PayFi is an on-chain payments and financing stack that integrates traditional payments infrastructure (gateways, acquirers, processors) with decentralized technology and stablecoins. It connects authorization, clearing, and settlement processes to programmable money, enabling instant or near-instant settlement, composable financing (escrow, factoring, yield routing), and global reach without intermediaries in each corridor. Think of PayFi as the bridge where existing rails meet on-chain money.

Core outcomes PayFi targets

Faster settlement

Move from T+2/T+3 to near-real time via stablecoins. (See Visa pilots/expansions.

Lower cross-border frictions

Reduce correspondent banking hops by using tokenized fiat on public chains.

Programmable finance

Trigger payouts, escrow releases, or supplier financing on settlement.

Global acceptance options

Combine card, bank, and on-chain payment options at checkout; merchants still receive local fiat. (Examples emerging in APAC and EMEA.)

The Payments Infrastructure Layer (and where PayFi plugs in)

Traditional payments infrastructure includes gateways, processors, acquirers, card networks, and bank rails (ACH/SEPA/FPS). It handles tokenization, authorization routing, risk, and settlement. PayFi plugs in at two key junctures:

Funding & Settlement Layer

Replace or augment settlement currency with stablecoins (e.g., USDC) and sweep to fiat. Visa’s stablecoin programs illustrate how issuers/acquirers can fulfill obligations in stablecoins across networks like Ethereum and Solana with more chains being added over time.

Payouts & Treasury Layer

Use stablecoins for supplier payouts, marketplaces, gig workers, or cross-border branches; then convert locally. Enterprise platforms have built “stablecoin payout” offerings that settle to fiat automatically.

Definition refreshers

See industry glossaries and explainers on “payment infrastructure.”

PayFi vs. Web3 Payments vs. Crypto Payments

Crypto payments

Accept any crypto asset (BTC, ETH, etc.) at checkout. Volatility risk if not auto-converted.

Web3 payments

Wallet-native flows (signing, gas abstraction), may include NFTs or dApps.

PayFi

A payments + financing architecture that primarily uses stablecoins/tokenized cash as settlement media and integrates with card/bank rails not a replacement.

TL;DR

PayFi = interoperable, compliance-aware, stablecoin-first settlement & treasury layer for merchants and PSPs. McKinsey & Company

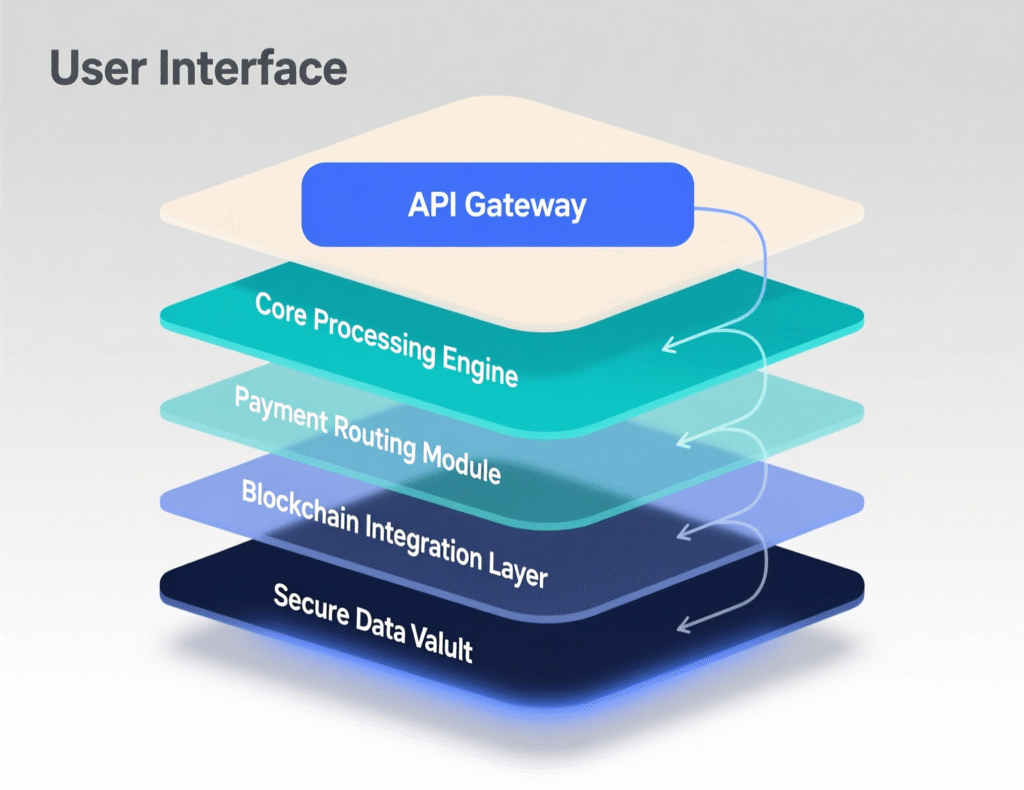

The PayFi Stack: Components & Reference Architecture

At a glance

Front-end acceptance:

Cards, wallets, bank transfers, stablecoin checkout.

Risk & compliance:

KYC/KYB, sanctions screening, travel rule where applicable.

Settlement engine (on/off-ramps):

Stablecoin mint/redeem, FX routing, liquidity.

Treasury orchestration:

Automated sweeps (USDC → USD), yield/escrow logic.

Developer platform:

APIs/SDKs, webhooks, event logs.

Reference flow (merchant payout example)

Customer pays in card or local wallet.

PSP or merchant acquirer batches settle.

PayFi module converts net settlements into USDC (or receives net in USDC via network program).

On-chain smart contract allocates: X% supplier payout, Y% reserve, Z% treasury sweep.

Suppliers choose payout rail (USDC, bank, mobile money).

Reconciliation exports map on-chain txids to order IDs.

Enterprises like BVNK illustrate cross-border and payout patterns using stablecoins under compliance programs.

Why PayFi now? Market signals to watch

Network adoption

Visa has run stablecoin settlement pilots and announced expanded multi-chain support in 2025 earnings commentary, signaling maturing rails for issuers/acquirers.

Merchant experiments

APAC pilots are bringing stablecoins to mainstream wallets/merchant networks (e.g., Singapore’s GrabPay ecosystem via partners.

Banking & interbank moves

SWIFT has announced a blockchain initiative to support tokenized payments alongside major banks evidence that cross-border messaging is evolving toward ledgers.

Ecosystem education

Definitions and explainers from reputable crypto academies and L1 foundations (Stellar, CoinMarketCap) codify PayFi as a concept.

Stablecoins: The lifeblood of PayFi

Stablecoins (USDC, EURC, etc.) provide unit-of-account stability and on-chain finality. They can be redeemed for fiat through regulated issuers and used across multiple chains. Industry reports and analyses position stablecoins as the pragmatic bridge for real-time commerce and treasury.

Design considerations

Reserves & attestations

Prefer transparent issuers with audited/attested reserves. (USDC/EURC publish attestation dashboards.

Chain selection

Balance fees, throughput, and ecosystem tooling (e.g., Ethereum, Solana, Stellar, Avalanche). Networks/names in Visa programs point to a multi-chain reality.

Compliance hooks

Embed KYC/KYB and sanctions screening at payout endpoints.

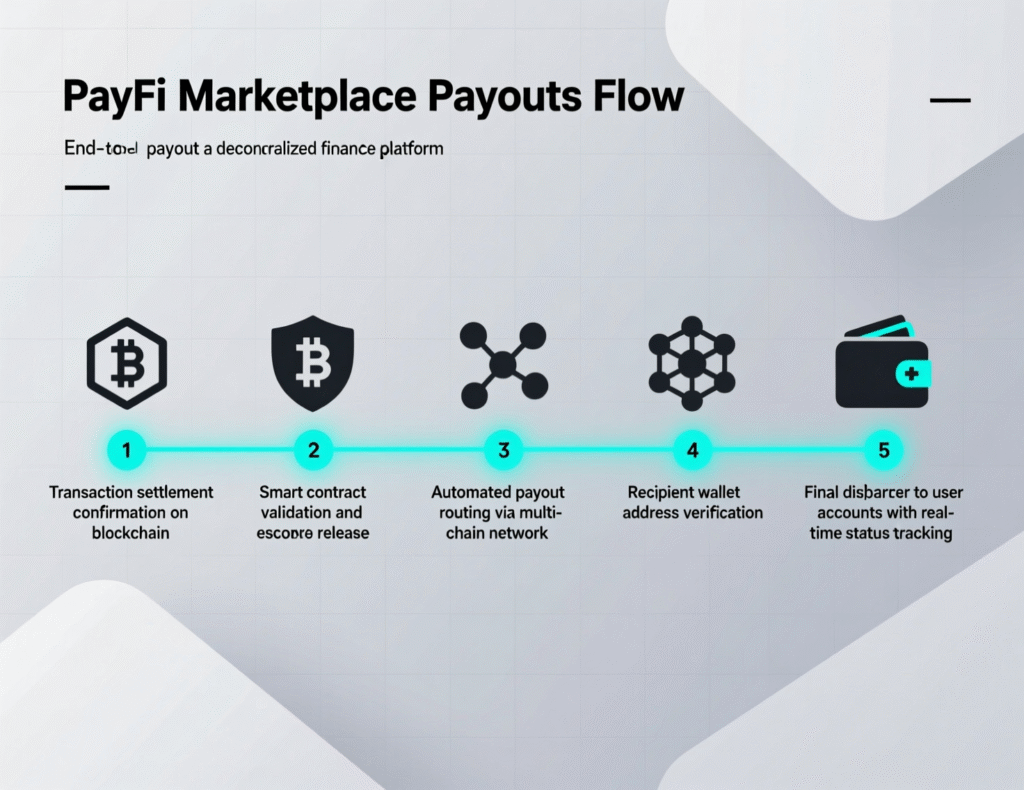

Real-World Example #1: Marketplace Payouts

A global freelancer marketplace routes weekly payouts to 100+ countries. Today, it loses margin to FX rails and sees T+2 delays. By adding a PayFi module:

Batch settles in USDC daily.

Splits payouts by smart contract: 70% to workers (USDC or local fiat via off-ramp), 20% to vendors, 10% to reserve.

Reconciliation maps txids to invoice IDs.

Result:

Near-real time cross-border payouts and lower FX spread. (Outcomes vary; verify with pilots.

(Comparable patterns are described by enterprise stablecoin platforms.

Real-World Example #2: APAC Retail Pilot

A Singapore merchant network enables stablecoin checkout via a partnered wallet. Consumers pay in USDT/USDC; funds convert to XSGD and settle to SGD for merchants. Early signs show faster access to working capital and lower fees than some cross-border cards.

PayFi and Compliance: What good looks like

KYB/KYC layers for counterparties; require proof of beneficial ownership for large payouts.

Sanctions screening

For addresses and beneficiaries; retain logs.

Travel Rule

When required for VASP-to-VASP transfers.

Accounting standards

Mark stablecoin holdings as cash equivalents only where policy/auditor permits; otherwise, current assets.

Jurisdictional awareness

Some regions have specific stablecoin rules; keep policy watchlists current. (See evolving bank and network initiatives as context.

Building a PayFi Pilot: A 30-Day Plan

Week 1: Design

Choose corridors and payout cohorts (e.g., contractors in PH, suppliers in MX).

Select stablecoin(s) and chains; define auto-convert thresholds.

Draft policy for treasury sweeps (e.g., daily USDC→USD via regulated off-ramp).

Week 2: Integrations

Connect on/off-ramps and KYC/KYB providers.

Implement address screening and travel-rule messaging where applicable.

Add webhook-based reconciliation into ERP.

Week 3: Dry runs

Simulate orders; verify txid mapping and accounting entries.

Run failovers: chain congestion, oracle downtime, liquidity limits.

Week 4: Limited go-live

10–50 participants, capped limits.

Daily finance stand-ups; measure settlement times, basis-point costs, and support tickets.

Market reference: network and PSP moves toward stablecoin settlement indicate readiness for controlled production pilots.

PayFi vs. Legacy Rails: Cost & Time (Qualitative)

Settlement speed

PayFi can achieve minutes to hours vs. T+2/T+3 in some card/bank contexts. (Pilots show feasibility.

Cross-border costs

Reduced intermediary fees via tokenized cash; exact bps depend on corridor liquidity and off-ramp pricing. (Benchmark in your pilot; verify live.)

Reconciliation

On-chain txids + webhooks simplify audit trails.

Risks & Mitigations

Regulatory change

Maintain a policy tracker; engage counsel early. (SWIFT/bank initiatives show the landscape is dynamic.

Issuer risk

Diversify stablecoins/issuers; monitor attestations.

Chain risk

Use multi-chain strategy and fallback rails; pre-fund liquidity on primary/secondary chains.

Operational risk

Build kill-switches, circuit breakers, and strict role-based controls.

The Future: Networks, Banks, and PayFi Convergence

Card networks are evolving from card-only to rail-agnostic settlement orchestrators. Banks and SWIFT are piloting blockchain rails. Exchanges and wallets are integrating stablecoin checkout. This convergence hints at a future where PayFi becomes a default treasury backbone not just a niche option for cross-border payouts and B2B settlement.

Last Words

If your business is multi-country, marketplace-driven, or payout-heavy, PayFi merits a pilot. Start with a limited corridor, pick one or two stablecoins, and integrate compliance from day one.

Measure settlement times, total landed cost (including conversion), and finance ops overhead. As networks and banks add stablecoin support, PayFi offers a pragmatic way to lower costs, speed up cash flow, and make treasury programmable.

Call to action

Want a turnkey PayFi blueprint? Use the 30-day plan above, or reach out to your PSP and treasury partners to scope a corridor pilot this quarter.

FAQs

Q : How does PayFi differ from accepting crypto at checkout?

A : PayFi focuses on settlement/treasury using stablecoins and integrates with existing rails. You can still accept cards/bank transfers while settling payouts in USDC or converting instantly to fiat.

Q : How can a merchant start a PayFi pilot?

A : Pick one corridor, one stablecoin, and a regulated on/off-ramp. Add KYC/KYB and address screening, reconcile txids in your ERP, and launch with 10–50 users for 30 days.

Q : How do stablecoins reduce cross-border costs?

A : They remove multiple intermediaries and batch FX steps. Actual savings vary by corridor and liquidity benchmark during your pilot.

Q : How is compliance handled in PayFi?

A : Add KYC/KYB, sanctions screening, and travel-rule messaging where required; keep logs and policies updated with local guidance.

Q : How do I manage volatility risk?

A : Use fiat-redeemable stablecoins and automate sweeps to bank accounts daily to minimize exposure.

Q : How quickly can PayFi settle funds?

A : On-chain settlement can be near-instant depending on chain and counterparties; treasury conversion to fiat depends on off-ramp SLAs.

Q : How does PayFi interact with card networks?

A : Networks can allow members to fulfill settlement obligations using supported stablecoins on select chains. PayFi modules plug into those programs.

Q : How do banks and SWIFT fit into PayFi?

A : Banks and SWIFT are exploring blockchain rails and tokenized payments; PayFi can interoperate with these systems as they mature.

Q : How can I reconcile on-chain transactions?

A : Use webhooks to map txids to order/invoice IDs and export to your ERP; keep an immutable audit trail.