Paribu buys majority stake in CoinMENA in deal valuing exchange up to $240m

Paribu has acquired a majority stake in CoinMENA, marking Turkey’s largest fintech transaction and the company’s first cross-border purchase. The deal values the Bahrain- and Dubai-based crypto exchange at up to $240 million, reflecting growing confidence in regulated digital asset platforms across the region. Both companies, along with Reuters, highlighted the significance of this agreement as a milestone for Turkey’s expanding fintech ecosystem and Paribu’s broader strategic vision.

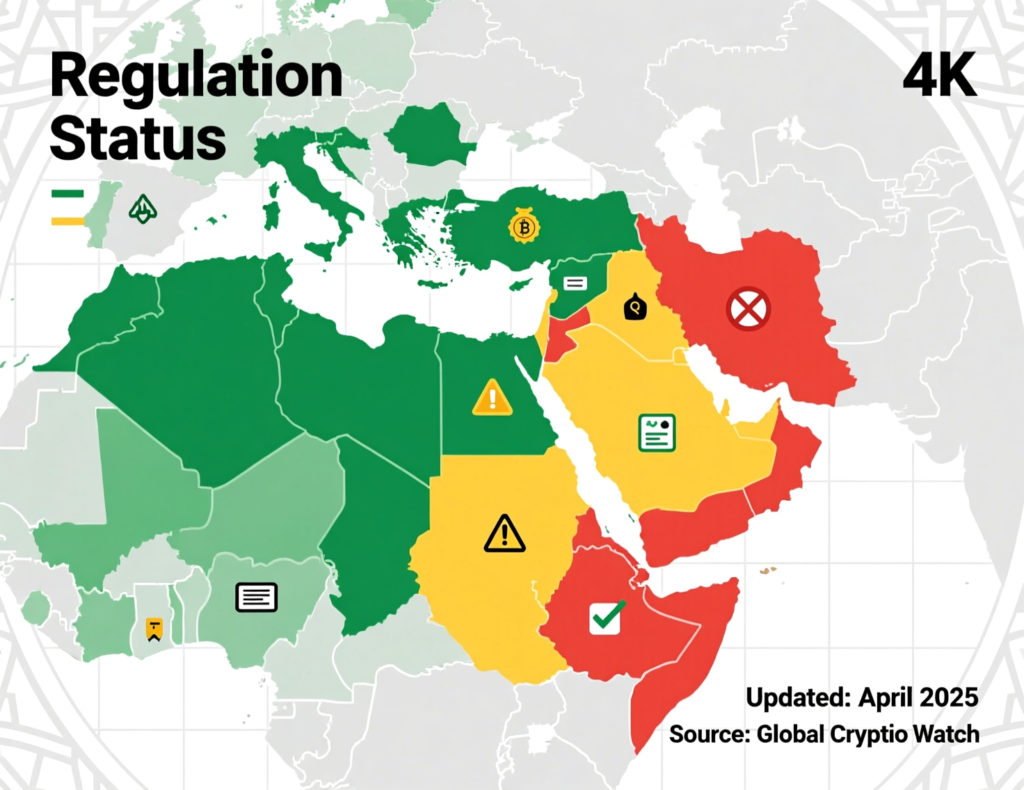

With this acquisition, Paribu aims to strengthen its regulated footprint and accelerate its expansion across the Middle East and North Africa. CoinMENA’s licenses and strong presence in key Gulf markets give Paribu a competitive edge as it pushes into new jurisdictions. The partnership is expected to enhance service offerings, support compliance-driven growth, and position Paribu as a more influential player in the regional crypto landscape.

Deal overview

Turkish digital-asset platform Paribu said it acquired a majority stake in CoinMENA, with the transaction valuing CoinMENA at up to $240 million. Financial terms such as exact stake size and consideration structure were not disclosed. Paribu framed the acquisition as a strategic expansion into highly crypto-adoptive markets across MENA. Reuters

Rationale and regulatory footprint

Paribu stated the deal broadens its licensed operations, leveraging CoinMENA’s regulatory status in Bahrain and Dubai to deepen regional access. The company emphasized scale, compliance, and market reach as drivers behind the consolidation.

Leadership remarks

“This deal is a turning point for Paribu,” founder and CEO Yasin Oral said, adding the company is “becoming a regulated player in one of the world’s most crypto-adoptive markets.”

Regional significance

According to Reuters and company statements, the transaction marks Turkey’s largest fintech transaction and first cross-border acquisition of a digital-asset platform by a Turkish firm an indicator of maturing crypto infrastructure and regional consolidation dynamics.

Paribu buys majority stake in CoinMENA

For retail and institutional clients, the combined platform could mean wider asset coverage, more fiat ramps, and unified compliance across multiple jurisdictions. Details on product migration, fee changes, or branding have not been announced at the time of writing.

Paribu buys majority stake in CoinMENA

By combining Paribu’s Turkish user base with CoinMENA’s MENA licensing, the group seeks scale and resilience amid higher global compliance standards. Any operational changes will depend on regulatory approvals and integration plans disclosed later.

Context & Analysis (Labelled)

Industry consolidation has accelerated as regional exchanges look to pair local licenses with larger liquidity networks. While the valuation (up to $240m) signals confidence in regulated growth, execution risks include cross-border compliance, technology integration, and customer communication.

Conclusion

Paribu’s majority acquisition of CoinMENA strengthens its regulated footprint across Türkiye, Bahrain, and the UAE. The move enhances Paribu’s reach in key Middle Eastern markets and supports its strategy to operate within well-regulated crypto environments. By leveraging CoinMENA’s licenses and regional presence, Paribu aims to accelerate its expansion and improve its competitive position.

In the weeks ahead, stakeholders should look out for updates on how both platforms plan to integrate. Possible adjustments may include service changes, fee structures, and brand alignment. These developments will offer clearer insight into the combined roadmap and the user experience moving forward.

FAQs

Q : What exactly changed with the Paribu CoinMENA deal?

A : Paribu acquired a majority stake in CoinMENA, valuing the company at up to $240 million.

Q : Why is the deal significant for Turkey’s fintech sector?

A : It’s considered Turkey’s largest fintech transaction and the first cross-border acquisition of a digital-asset platform.

Q : Does CoinMENA keep its licenses in Bahrain and Dubai?

A : Yes, the announcement confirms its regulated status; any changes would be officially communicated.

Q : Will user accounts or fees change?

A : No immediate changes were announced; users should follow official updates.

Q : Who commented on the deal from Paribu?

A : Founder and CEO Yasin Oral called it a “turning point” for the company.

Q : When did the deal become public?

A : It was announced on December 5, 2025, through Reuters and company statements.

Q : Is this a full acquisition or just an investment?

A : It is a majority-stake acquisition, though the exact percentage was not disclosed.

Facts

Event

Paribu acquires a majority stake in CoinMENADate/Time

2025-12-05T10:28:00+05:00 (announcement coverage) ReutersEntities

Paribu (Türkiye); CoinMENA (Bahrain & Dubai)Figures

Valuation up to USD 240 million; “largest fintech transaction” for Türkiye (per company/Reuters) Reuters+1Quotes

“With this acquisition, we have expanded our licensed operations to a wider geography, becoming a regulated player in one of the world’s most crypto-adoptive markets.” Yasin Oral, CEO, Paribu. ReutersSources

Reuters (link below); Company/PR (link below)