Nomura-Owned Laser Digital Plans Crypto License Application in Japan: Bloomberg

Nomura-owned Laser Digital is moving closer to securing a crypto license in Japan as it prepares a formal application with the Financial Services Agency (FSA). The step follows pre-consultation discussions, signaling Laser Digital’s intent to expand its regulated presence in one of Asia’s key financial markets. Based in Switzerland, the unit has been actively building a reputation for providing institutional-grade digital asset solutions.

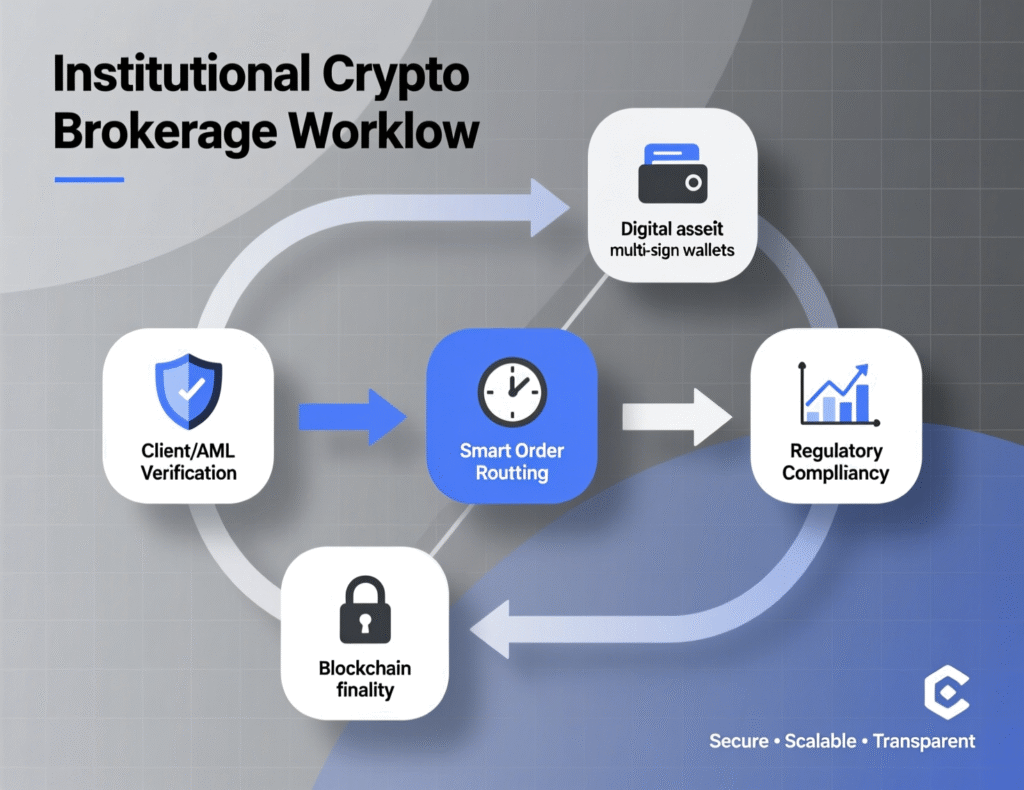

The planned license would allow Laser Digital to introduce institutional crypto trading services tailored for the Japanese market. This aligns with Nomura’s broader strategy to strengthen its digital-asset offerings at a time when institutional demand for regulated crypto services is steadily rising. By pursuing the FSA pathway, Laser Digital is positioning itself to meet the needs of professional investors seeking secure, compliant access to crypto markets.

What we know about Laser Digital crypto license Japan

Bloomberg reported that Laser Digital Holdings AG wholly owned by Nomura has begun pre-consultation with the FSA, a step that typically precedes a formal filing. The company’s initial scope targets brokerage-style services for institutional customers. CoinDesk corroborated the plan and quoted CEO Jez Mohideen: “Our entry into Japan reflects our optimism in the Japanese digital-asset ecosystem.”

Timeline for Laser Digital crypto license Japan

Pre-consultation

Underway with the FSA, per Bloomberg.Formal application

Expected following regulator feedback; no date disclosed.Operational launch

Contingent on license approval and supervisory sign-off.

Market context and competitive landscape

Laser Digital’s move comes as Japanese incumbents integrate digital assets into traditional finance workflows. Daiwa Securities recently began introducing clients to crypto-backed loans allowing yen borrowing against BTC and ETH via partner Fintertech highlighting growing institutional use cases. For Nomura, adding a licensed Japan footprint would complement Laser Digital’s existing regulated presence and global strategy. Finance+1

Who is Laser Digital?

Launched by Nomura in 2022 and headquartered in Switzerland, Laser Digital focuses on trading, asset management and digital-asset solutions. Leadership includes Chairman Steven Ashley and CEO Jez Mohideen. The firm positions itself at the intersection of TradFi risk frameworks and crypto-native market structure.

<section id=”howto”> <h3>How to track Laser Digital’s Japan application process</h3> <ol> <li id=”step1″><strong>Step 1:</strong> Check the FSA’s official lists and notices for newly registered crypto-asset service providers.</li> <li id=”step2″><strong>Step 2:</strong> Monitor Bloomberg and CoinDesk for updates on regulatory milestones or timeline shifts.</li> <li id=”step3″><strong>Step 3:</strong> Follow Nomura and Laser Digital newsroom pages for corporate disclosures and Japan-specific announcements.</li> <li id=”step4″><strong>Step 4:</strong> Review industry press or exchange circulars for any market connectivity or brokerage service launches.</li> <li id=”step5″><strong>Step 5:</strong> Track FSA consultation outcomes or public comments that might affect institutional crypto licensing.</li> </ol> <p><em>Note: Process may vary by jurisdiction/provider. Confirm requirements before acting.</em></p> </section>

Analysis (clearly labeled)

Japan’s regulatory clarity and institutional distribution networks make it a logical expansion market for Nomura’s digital-asset ambitions. Pre-consultation does not guarantee approval, but it often signals a credible pathway. Daiwa’s collateral initiative underscores competitive momentum; if Laser secures a license, Nomura could leverage deep client relationships to scale institutional crypto services. (Analysis)

Conclusion

Laser Digital’s upcoming application highlights Nomura’s strategy to build a regulated, institution-focused crypto presence in Japan. The move reflects its commitment to expanding digital-asset services under a compliant framework, tailored specifically for professional investors.

Key next steps include receiving the Financial Services Agency’s (FSA) feedback from the pre-consultation stage and finalizing the timeline for a formal filing. Should approval be granted, it could accelerate traditional financial institutions’ entry into Japan’s digital-asset sector, strengthening market confidence and driving greater institutional adoption of crypto under regulated structures.

FAQs

Q : What is Laser Digital applying for?

A : A Japan crypto trading license to serve institutional clients, following FSA pre-consultation.

Q : Who owns Laser Digital?

A : It is wholly owned by Nomura Holdings, Inc.

Q : Where is Laser Digital based?

A : Switzerland, chosen for its robust digital-asset regulatory regime.

Q : How does this relate to competition in Japan?

A : Daiwa Securities has begun enabling clients to borrow yen using BTC/ETH as collateral via Fintertech, indicating rising TradFi–crypto integration.

Q : When will services launch?

A : No date disclosed; a formal application and regulatory approval are still pending.

Q : Does this affect retail investors?

A : The plan targets institutional clients; any retail access would depend on product design and licensing scope.

Q : Is the exact phrase “Laser Digital crypto license Japan” relevant for search?

A : Yes use it to find updates on Laser Digital’s Japan licensing progress and related regulatory news.