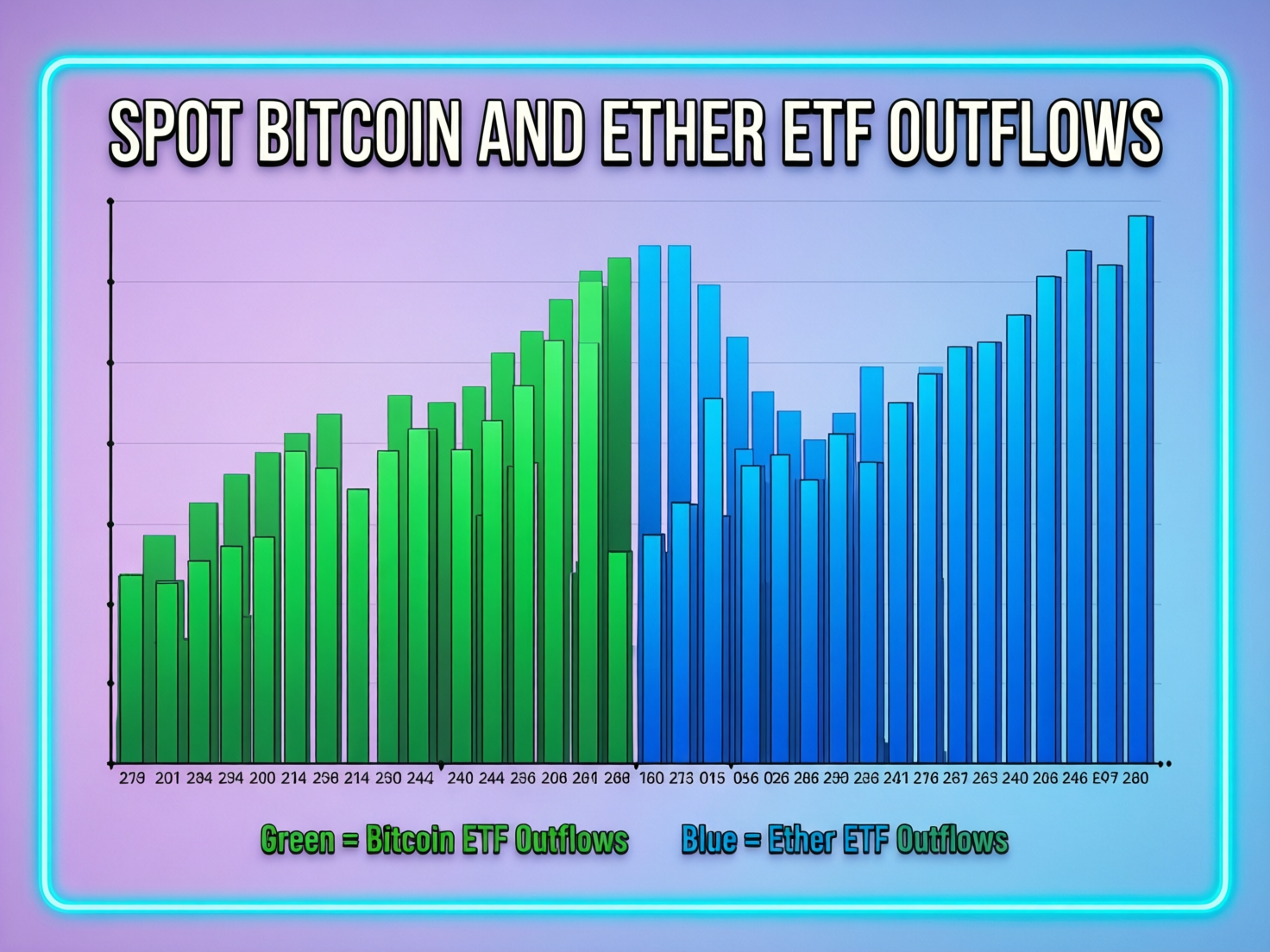

Nearly $1B exits as spot bitcoin and ether ETF outflows accelerate

Institutional de-risking triggered a sharp turnaround in crypto fund flows on Wednesday, as investors pulled large amounts of capital from spot bitcoin and ether exchange-traded funds. Market sentiment shifted toward caution, reflecting growing uncertainty across risk assets. The sudden wave of selling highlighted how quickly institutional money can react to changing macro conditions, adding short-term pressure on digital asset prices. Analysts noted that this pullback signals a defensive stance among large investors rather than a fundamental shift in long-term crypto adoption.

According to provisional data from aggregators cited by industry sources, bitcoin ETFs recorded outflows of around $708.7 million, while ether products saw approximately $286.9 million exit the market. Combined, total withdrawals approached the $1 billion mark in a single session. Such heavy redemptions underscore heightened volatility and sensitivity to global financial trends, reminding traders that institutional flows remain a key driver of momentum in the crypto market.

Market Moves and Flows

Industry trackers reported the largest single-day exit in two months for U.S. spot bitcoin ETFs, led by outflows from BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund (FBTC). For ether, BlackRock’s iShares Ethereum Trust (ETHA) was the main source of redemptions. While notable, similar bouts of outflows have historically coincided with risk-off macro backdrops and have not, on their own, changed longer-term adoption trends.

Fund-Level Detail

Bitcoin ETFs

IBIT (~$356.6m out) and FBTC (~$287.7m out) paced the withdrawals, alongside additional outflows at several peers.

Ether ETFs

Aggregate net outflows of about $286.9m, with BlackRock’s ETHA leading redemptions. (Product details: iShares Ethereum Trust.)

Contrasts

Spot XRP ETFs (~+$7.16m) and Solana ETFs (~+$2.92m) saw modest inflows the same day, underscoring dispersion across assets.

Macro Lens and Analyst Views

Multiple episodes over the past year show large single-day outflows can accompany price volatility and macro shocks (rates, geopolitics) without signaling structural damage to product demand. Recent precedents such as record single-day outflows at IBIT amid broader risk-off stretches were followed by periods of stabilization and renewed inflows.

Why spot bitcoin and ether ETF outflows may not signal a trend

Heavy outflow prints often reflect short-term positioning resets by institutions. Analysts note that context asset prices, liquidity, macro news matters more than one day’s tape. Over longer windows, net asset growth and cumulative inflows remain the stronger indicators to watch.

Reading spot bitcoin and ether ETF outflows alongside cumulative AUM

Investors should compare daily flows with each fund’s historical net inflows and current assets to assess whether withdrawals are tactical or persistent. Public dashboards (e.g., CoinGlass, issuer pages) help visualize this relationship.

Context & Analysis

The breadth of redemptions across bitcoin and ether funds points to a portfolio-level risk trim rather than product-specific issues. Notably, dispersion with XRP and Solana inflows suggests investors are rebalancing rather than exiting the asset class entirely. Historical episodes of large outflows such as those reported at IBIT have occurred amid broader market turbulence and did not preclude subsequent net inflow streaks.

Concluding Remarks

A single day of heavy outflows is important, but it does not provide a complete picture of market direction. Investors should closely monitor whether these withdrawals continue over several trading sessions and how digital asset prices respond. Short-term movements can often reflect temporary positioning rather than a lasting shift in sentiment or fundamentals.

It is also essential to track cumulative inflows and overall assets under management to understand the broader trend. If these indicators remain stable, the recent pullback may simply represent tactical de-risking. For now, the available data suggests cautious repositioning within a still-developing and maturing ETF market structure, rather than a structural change in investor confidence.

FAQs

Q : What caused the latest ETF outflows?

A : Institutional de-risking amid macro uncertainty, which is common during periods of higher interest rates or increased market volatility.

Q : Do one-day outflows signal a long-term problem?

A : Not necessarily. Market context and multi-day flow trends provide a clearer picture than a single day’s data.

Q : Which funds saw the biggest moves?

A : Among bitcoin ETFs, IBIT and FBTC recorded the largest outflows, while for ether ETFs, ETHA led the decline.

Q : How large were the withdrawals?

A : Approximately $708.7 million exited bitcoin ETFs, and around $286.9 million flowed out of ether ETFs on the cited day.

Q : Did any crypto ETFs see inflows?

A : Yes, reports indicated modest inflows into XRP and Solana ETFs during the same session.

Q : Where can I track flows live?

A : You can follow real-time dashboards on CoinGlass and industry summaries citing SoSoValue, along with issuer product pages.

Q : Is it normal to see big outflows after strong inflows?

A : Yes, ETF flows often fluctuate based on macro conditions, investor positioning, and short-term risk sentiment.

Facts

Event

Heavy single-day redemptions from U.S. spot bitcoin and ether ETFsDate/Time

2026-01-22T12:00:00+05:00Entities

BlackRock iShares Bitcoin Trust (IBIT); Fidelity Wise Origin Bitcoin Fund (FBTC); iShares Ethereum Trust (ETHA); XRP and Solana spot ETFsFigures

Bitcoin ETFs net outflow ~$708.7m; Ether ETFs net outflow ~$286.9m; IBIT outflow ~$356.6m; FBTC outflow ~$287.7m; XRP +$7.16m; Solana +$2.92m (all per media citing SoSoValue)Quotes

Analyst commentary frames the move as de-risking during macro stress rather than structural weakness (context from prior episodes).Sources

The Block spot ETF outflows report; CryptoNews IBIT/FBTC outflow details; BlackRock ETHA product page; CoinGlass ETF dashboards.