Multicoin supports “Aave Will Win,” wants clear definition of “100% revenue”

Multicoin Capital has publicly backed the Aave Will Win framework, signaling support for routing protocol-generated revenue directly to the Aave DAO. The firm agrees with the principle that value created by Aave-branded products should accrue to the DAO, strengthening long-term sustainability and aligning incentives between builders, tokenholders, and governance participants.

At the same time, Multicoin Capital argues that any transfer of funds should be phased in gradually rather than deployed all at once. It also calls for clearer disclosures around how revenues are calculated, transferred, and ultimately used. While endorsing **Aave Labs’ proposal, Multicoin emphasizes transparency and pacing to reduce risk, improve accountability, and give the DAO sufficient oversight as treasury inflows scale over time.

What Multicoin said, and why it matters

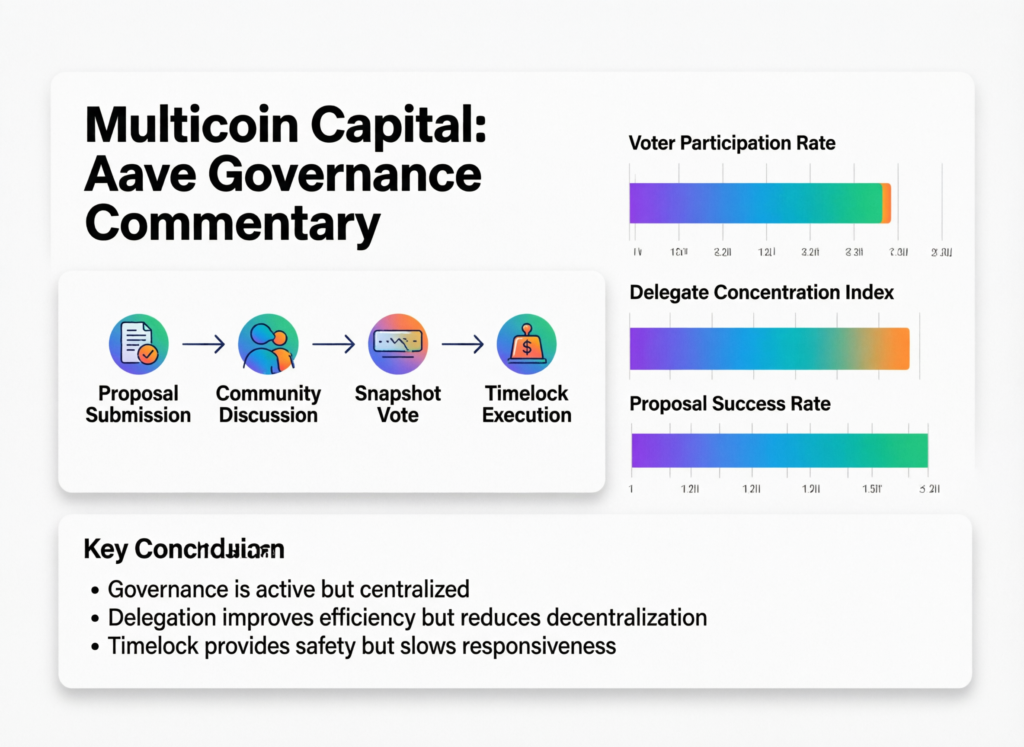

Multicoin Principal Vishal Kankani wrote that routing product revenue to the DAO and having the DAO fund an execution organization’s budget would be “a meaningful shift toward a token-centric economic model.”

Multicoin also noted it holds a large amount of AAVE tokens, a position that could give it meaningful influence in governance outcomes.

Aave Will Win framework to route Aave revenue to the DAO.

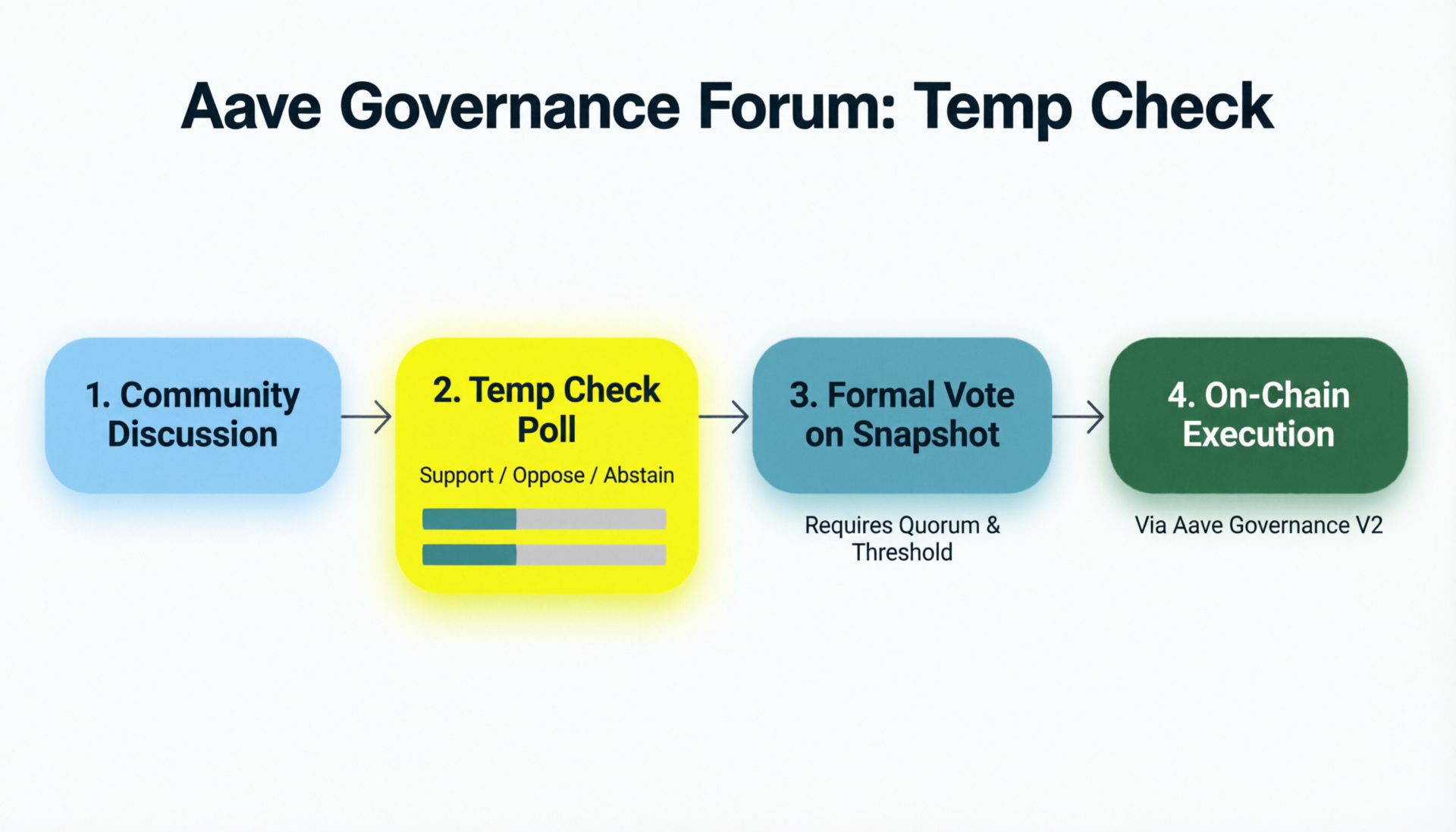

Aave Labs’ “Aave Will Win” proposal, posted as a temperature check, argues for expanding the DAO’s value capture beyond protocol fees by directing revenue from Aave-branded products to the DAO treasury.

The post positions the next-generation Aave v4 as a core foundation of the ecosystem’s roadmap.

Aave Will Win framework to route Aave revenue to the DAO: Multicoin’s conditions

Kankani’s support came with conditions focused on treasury risk and accounting clarity:

Phase the payouts

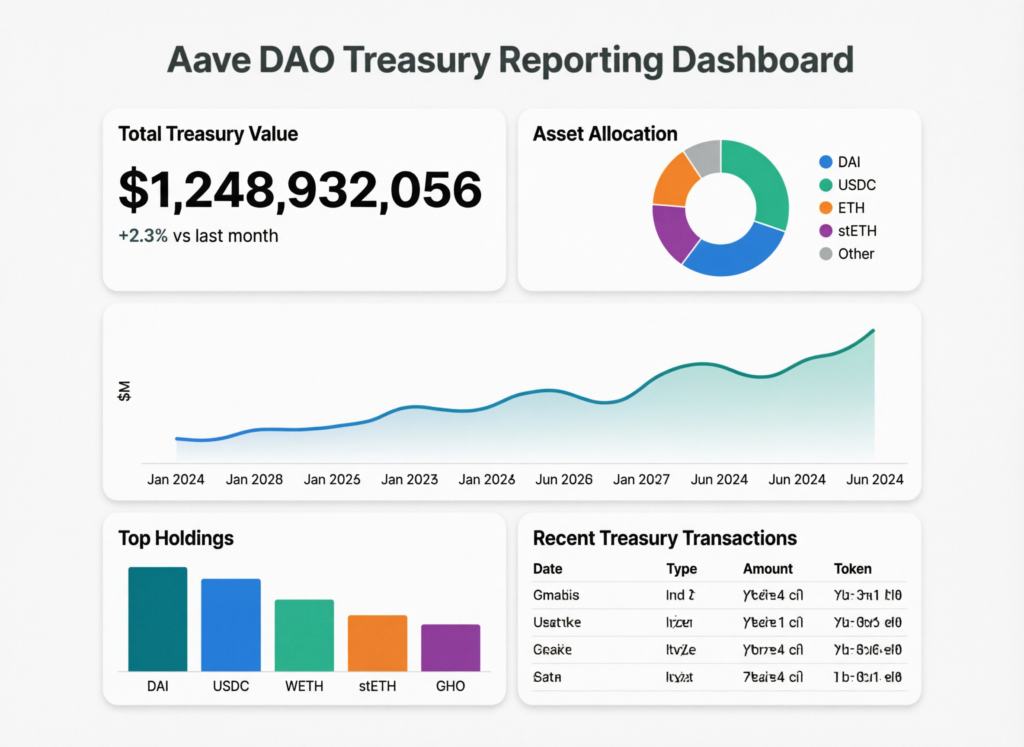

Kankani said that because the proposed support could represent a substantial share of the DAO treasury, funds should be disbursed in phases rather than all at once, paired with a clearly stated plan and rationale.

Define “100% of revenue”

He warned that ambiguity could weaken “practical effect of attribution,” calling for transparent definitions of deductible items and the reporting framework.

Context & Analysis

The debate highlights a core governance tension: token holders may favor maximum value accrual to the DAO, while also demanding guardrails that prevent budget over-commitment and ensure revenue attribution is auditable. In practice, phased disbursements and standardized reporting can reduce governance risk by tying funding to delivery and measurable performance especially when large holders could sway outcomes.

Bottom Lines

Multicoin Capital’s position strengthens the momentum behind the Aave Will Win temperature check, while highlighting key negotiation priorities. The firm emphasizes two main points: first, any substantial treasury outflows should be phased gradually, and second, a clear, enforceable definition of what constitutes “100% of revenue” is essential to ensure transparency and accountability.

The next steps hinge on whether Aave Labs and the broader Aave DAO community refine the accounting and reporting framework. Only once these clarifications are in place can the proposal move beyond the temporary temperature check stage toward full implementation.

FAQs

Q : What is the “Aave Will Win” framework?

A : It is a governance proposal from Aave Labs that seeks to redirect revenue from Aave-branded products to the Aave DAO treasury and align incentives around the AAVE token.

Q : What did Multicoin Capital say about the plan?

A : Multicoin said it supports the framework but wants phased disbursements and clearer definitions and reporting around “100% of revenue.”

Q : Why does phased disbursement matter?

A : Multicoin argued the proposed support could represent a substantial share of the DAO treasury, so staged payouts can reduce concentration and execution risk.

Q : What does “100% of revenue” mean in this context?

A : Multicoin warned the term could be weakened if deductions or attribution rules are unclear, and called for transparent deductible items and a reporting framework.

Q : Where is the proposal being discussed?

A : It is posted as a “temperature check” on the Aave governance forum.

Q : How could Multicoin influence the outcome?

A : Multicoin said it holds a large amount of AAVE tokens, which could translate into governance influence depending on participation and delegation patterns.

Q : What is the Aave Will Win framework trying to change?

A : It aims to ensure revenue from Aave-branded products flows to the DAO treasury, reinforcing a token-centric value capture model.

Facts

Event

Multicoin Capital backs Aave Labs framework to route Aave-branded product revenue to the Aave DAO treasury, urging phased disbursements and clearer revenue definitions/reporting.Date/Time

2026-02-14T13:56:33+05:00 (verification time)Entities

Multicoin Capital; Vishal Kankani; Aave Labs; Aave DAO; AAVE token; Aave v4Figures

“100% of revenue” from Aave-branded products (as proposed)Quotes

“A structure in which the DAO directly captures product revenue and funds the execution organization’s budget represents a meaningful shift toward a token-centric economic model.” Vishal Kankani“Given that the proposed level of support would account for a substantial share of the DAO treasury, the funds should be disbursed in phases…” Vishal Kankani

Sources

Bloomingbit report; Aave governance temp-check post; crypto.news summary