More than half of hedge funds invested in crypto, global survey says

Over half of global hedge funds now invest in cryptocurrencies, signaling growing integration of digital assets into mainstream finance. According to a joint AIMA–PwC survey, 55% of funds report some level of crypto exposure, marking a sharp rise from previous years as institutional confidence strengthens.

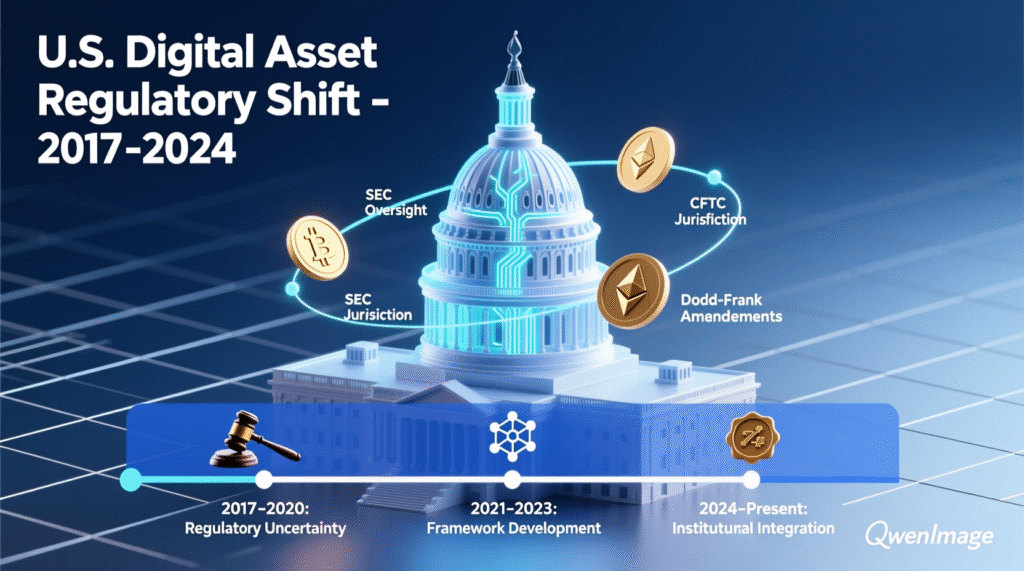

Most hedge funds maintain limited direct holdings, preferring exposure through derivatives such as futures and options to manage risk and liquidity. The report links this trend to clearer regulations and a more supportive tone from U.S. authorities in 2025, which have helped normalize digital asset investment within traditional portfolios.

Who is investing and how much?

The AIMA–PwC survey of 122 investors and fund managers conducted in H1 2025 reports 55% of hedge funds hold crypto (vs. 47% in 2024). Average allocation is 7%, but over half of the crypto-invested funds commit <2% of assets, indicating cautious exposure.

Why more than half of hedge funds invested in crypto now

Respondents cite 2025’s price gains led by bitcoin and a perceived U.S. regulatory shift as key drivers. The report describes the past year as a turning point and suggests the U.S. may be laying long-term regulatory stability for digital assets, spurring institutions to tiptoe further in. Reuters

How are funds getting exposure?

A majority (67%) of crypto-invested hedge funds use derivatives to express views without holding spot coins, aligning with risk management, custody, and mandate constraints. The report also flags risks highlighted by an October flash crash tied to leverage and infrastructure gaps.

What “more than half of hedge funds invested in crypto” means for markets

While exposures are generally small, broader participation can deepen liquidity and tighten the link between digital assets and traditional finance prompting financial-stability concerns regulators have raised as the two systems intertwine.

Industry Backdrop: Record hedge fund assets

Hedge fund capital reached nearly $5 trillion in Q3 2025 amid renewed inflows—the strongest since 2007 providing fresh dry powder for niche strategies, including digital assets.

Context & Analysis

The steady rise from 21% in 2021 to 47% in 2024 and 55% in 2025 tracks periods of improving clarity (e.g., U.S. policy signals) and market infrastructure maturation. Yet the small median allocations and preference for derivatives underscore that most managers are still testing liquidity and counterparty depth rather than embracing directional spot risk. Continued regulatory harmonization and exchange-grade risk controls will likely determine whether allocations broaden beyond low-single-digit percentages.

Conclusion

Hedge fund involvement in crypto has become mainstream, though current positions remain relatively small. Many funds continue to treat digital assets as experimental allocations, focusing on risk management and liquidity as they test integration within broader strategies.

If regulatory clarity improves and market infrastructure continues to mature, these tentative allocations could expand significantly. What began as small pilot positions may evolve into core portfolio components, signaling a long-term commitment to digital assets within institutional investment frameworks.

FAQs

Q : What share of hedge funds hold crypto in 2025?

A : 55%, up from 47% in 2024, per AIMA–PwC.

Q : How much do they allocate on average?

A : Around 7% of holdings, with many keeping under 2% in practice.

Q : How are funds getting exposure?

A : Mostly through crypto derivatives, which make up the majority of invested funds’ exposure.

Q : Why the increase now?

A : Improving U.S. policy signals and strong 2025 price gains.

Q : What risks are highlighted?

A : Leverage and infrastructure gaps, underscored by an October flash crash.

Q : Does “more than half of hedge funds invested in crypto” mean allocations are big?

A : No, most allocations remain small and exploratory.

Q : How large is the hedge fund industry right now?

A : About $5 trillion in AUM as of Q3 2025.

Facts

Event

AIMA–PwC survey finds majority of hedge funds now invested in cryptoDate/Time

2025-11-06T19:38:00+05:00Entities

Alternative Investment Management Association (AIMA); PwC; global hedge funds; U.S. government; President Donald Trump; bitcoinFigures

55% invested; 47% (2024); avg. allocation 7%; majority invest <2%; 67% via derivatives; industry AUM ~$5tn (Q3 2025)Quotes

“The past year has marked a turning point for US crypto regulation… laying the groundwork for long-term regulatory stability.” AIMA–PwC report (as summarized by Reuters) ReutersSources

Reuters article + URL; AIMA press release + URL