Middle East Bitcoin Adoption and the Rise of Digital Gold

Middle East bitcoin adoption is rising fast as households, traders and institutions across Türkiye, the Gulf and wider MENA use BTC as a liquid, cross-border store of value during inflation, currency stress and geopolitical risk. For US, UK and European investors, the region increasingly acts as a “digital gold” satellite market that is best accessed through global bitcoin holdings, regulated ETFs and carefully chosen GCC platforms not through lightly regulated, direct exposure.

Middle East bitcoin adoption is no longer a side note in global crypto. From Istanbul and Cairo to Dubai and Riyadh, BTC now sits alongside gold, offshore accounts and real estate as one of the tools families and institutions use to protect and grow wealth. The question for Western investors is simple: is this a genuine “digital gold” story, or just another hype cycle in a volatile region?

Introduction

Crypto use in MENA is now measured in the hundreds of billions of dollars, with the UAE and Türkiye emerging as regional leaders thanks to clear rules and real-world demand such as remittances, merchant payments and inflation hedging. Chainalysis estimates that MENA crypto volumes grew about 33% in the latest 12-month window, with total regional volume above half a trillion dollars.

Zoom out and the Middle East crypto story is no longer a niche retail experiment. Estimates suggest the broader Middle East crypto market was roughly $110 billion in 2024 and could grow around 9% a year this decade. GCC-specific research puts the regional cryptocurrency market at about $744 million in 2024, rising to roughly $3.5 billion by 2033 at a CAGR near 17%.

From Türkiye to the Gulf.

Türkiye is the volume giant. Chainalysis data show nearly $200 billion in yearly crypto transactions by mid-2025, driven by years of lira weakness and double-digit inflation. Crypto has evolved from a speculative side bet into an alternative rails system for remittances, savings and high-risk trading. Retail activity has cooled, but institutional and large-ticket flows have remained resilient even through drawdowns.

Across the Gulf, the UAE, Saudi Arabia and Qatar have seen steady growth, helped by dollar-linked currencies, strong banking systems and ambitious digital-asset strategies. This mix of crisis-driven adoption in Türkiye and innovation-driven adoption in the GCC keeps regional volumes high even when global markets are choppy. For US and European observers used to seeing crypto as “risk-on tech,” the MENA picture is more about survival, utility and diversification.

UAE, Saudi Arabia and GCC.

In the GCC, the UAE is the clear front-runner. Chainalysis estimates the UAE received around $56 billion in crypto value in the most recent period, growing roughly 33% year-on-year, with strong institutional flows and fast-growing merchant payments.

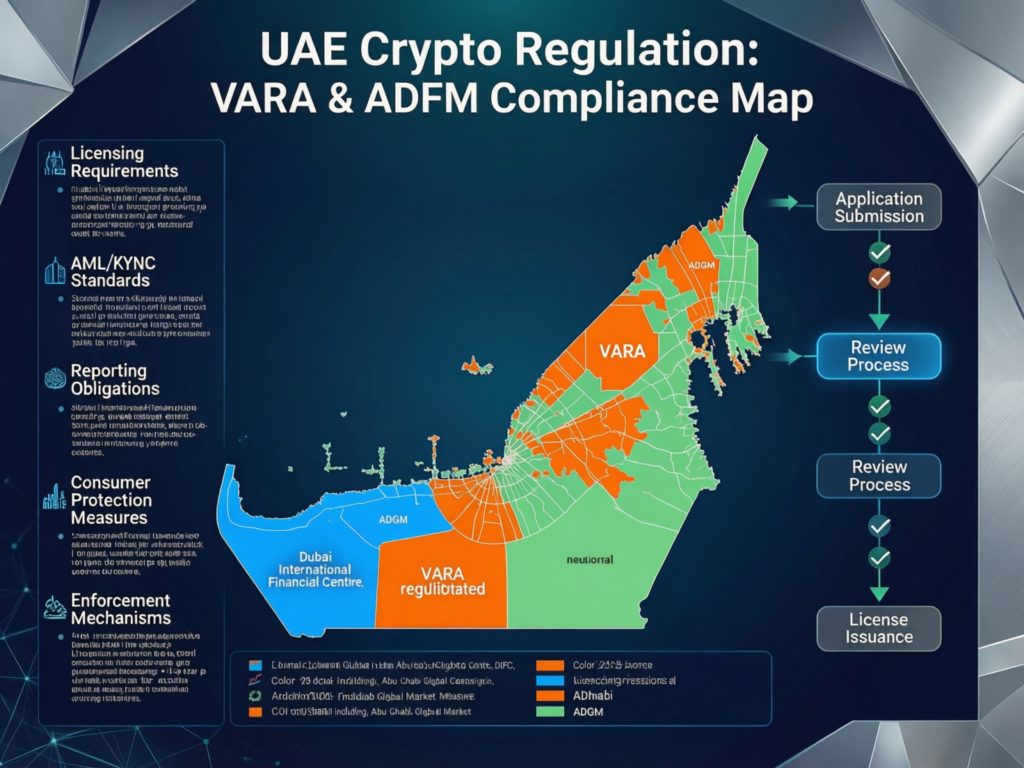

Dubai’s VARA regime and Abu Dhabi’s ADGM FSRA rules mean exchanges, brokers and custodians can obtain clear licences and operate inside a familiar financial-centre framework. That’s one reason Dubai and Abu Dhabi show up strongly in global crypto adoption rankings and “digital asset hub” indices. Saudi Arabia is quieter on the retail side but is scaling fintech and crypto pilots under SAMA and the Capital Market Authority, often connected to Vision 2030 and sovereign-wealth initiatives.

If you’re mapping hubs from London, New York or Frankfurt, the GCC increasingly looks like a parallel cluster to Singapore and Hong Kong: institutional money, sovereign capital and regulated innovation not just speculative retail trading.

What US, UK and European Investors Should Read in the MENA Numbers

In the Chainalysis geography report, MENA’s roughly 33% on-chain growth trails APAC and Latin America but still beats Europe’s traditional capital-markets growth by a wide margin. For global allocators, that makes the region a high-beta satellite rather than the core of the crypto universe.

Family-office surveys now show around three-quarters of ultra-wealthy family offices globally allocating to or exploring digital assets, with a noticeable proportion using GCC hubs for funds, venture deals and infrastructure. Western capital increasingly treats Dubai or Abu Dhabi like a “crypto Luxembourg”: specialist jurisdictions for structures, exchanges and tokenisation, while core bitcoin exposure stays in US or European vehicles.

If you’re working on MENA strategy or infrastructure, Mak It Solutions’ pieces on the MENA venture capital landscape and Middle East cloud providers are helpful context on how tech, capital and regulation intersect in the region.

Why Middle Eastern Investors Buy Bitcoin as “Digital Gold”

In the Middle East, Bitcoin is attractive not just as a speculative trade but as a liquid, cross-border store-of-value asset that helps households and businesses navigate inflation, currency risk and capital controls. For many investors from Istanbul to Cairo to Riyadh, BTC sits somewhere between offshore bank account, gold bar and high-risk tech stock.

Inflation, Currency Devaluation and Dollar Risk

In Türkiye, Egypt and parts of North Africa, repeated currency devaluations and imported inflation have pushed savers toward anything that feels less fragile than local cash. Chainalysis links spikes in Turkish and Egyptian crypto volumes to periods of FX stress and high inflation, as people try to protect purchasing power or move into dollar-linked stablecoins.

In these environments, the “digital gold” narrative is more literal: BTC and sometimes ETH are treated as portable, 24/7 assets that can be swapped into dollars or stablecoins quickly. Wealth-management research comparing gold and Bitcoin notes that in volatile FX regimes, gold still wins on stability but Bitcoin wins on divisibility and speed. A Cairo small-business owner or Istanbul freelancer with clients in London or Berlin may use Bitcoin as part of their working-capital stack, not just a moon-shot bet.

Geopolitical Tension, Sanctions and Wealth Preservation

Across the Levant, Iran and parts of the Gulf, geopolitical tension and sanctions create a strong incentive to keep part of family wealth outside local banking systems. Academic work shows that when sanctions tighten or capital controls bite, some flows migrate into Bitcoin and especially into dollar stablecoins that can move across borders without intermediaries.

This is where Western compliance risk kicks in. US and EU investors must consider OFAC sanctions, the FATF Travel Rule and heightened KYC/AML when dealing with counterparties that may be routing funds through MENA exchanges or OTC desks. For a New York hedge fund or a London family office, using regulated, analytics-driven platforms in the UAE or Bahrain is very different from sending BTC peer-to-peer into a high-risk jurisdiction.

Demographics, Digitisation and the Appeal of Self-Custody

MENA also has one of the youngest, most mobile-first populations in the world, with very high smartphone penetration in GCC cities like Riyadh, Dubai and Doha. This underpins huge remittance flows from Gulf states to countries such as Egypt, Pakistan

For some segments tech workers in Tel Aviv, freelancers in Istanbul, founders in Dubai the idea of “self-sovereign” money and self-custody wallets is philosophically attractive. For older, more conservative wealth in Riyadh or Abu Dhabi, the instinct is still to work through banks, Sharia-screened funds and trusted custodians. That tension between self-custody and institutional custody is shaping product design for wealth managers and fintechs across the region, including those that partner with firms like Mak It Solutions to build secure, compliant crypto interfaces and Middle East data-centre infrastructure.

Is Bitcoin Really a Safe-Haven Asset vs Gold?

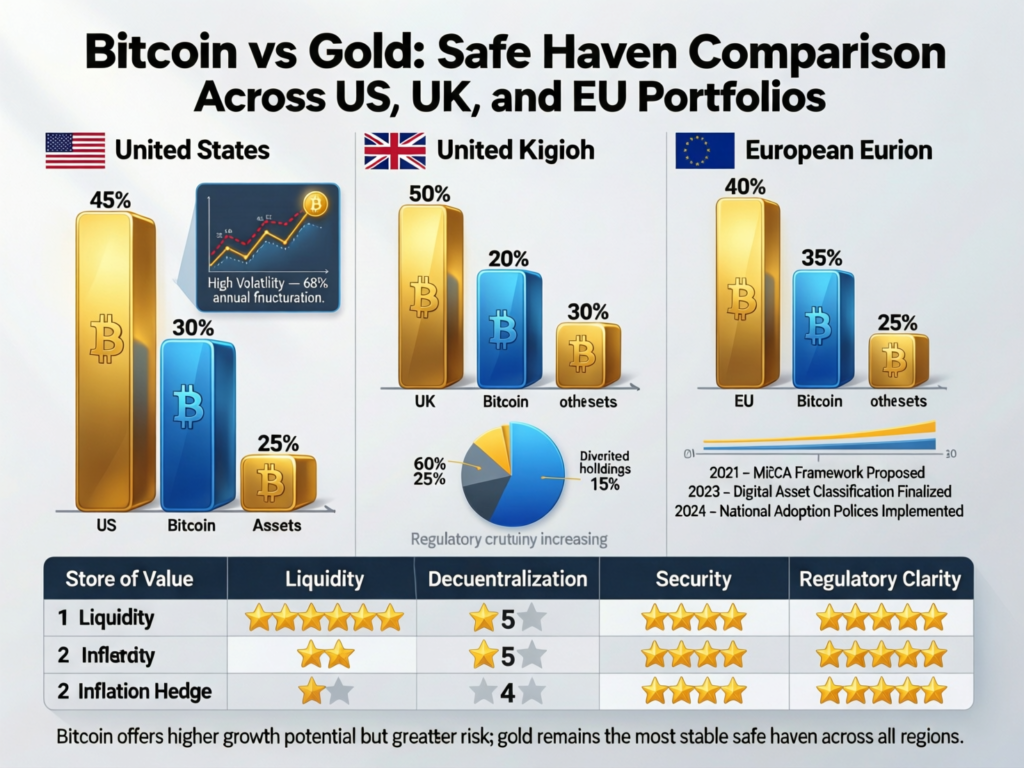

Bitcoin sometimes behaves like a risk asset and sometimes like “digital gold,” while physical gold has a far more consistent record as a safe haven during crises. Most recent research and market data say BTC can diversify portfolios but cannot reliably replace bullion as a crisis hedge especially for institutional allocators in the US, UK and EU.

Bitcoin as Digital Gold in Volatile Markets

Recent studies comparing Bitcoin’s behaviour with gold, FX and bonds find that BTC occasionally offers short-term safe-haven characteristics but often trades more like a high-beta tech stock tied to global risk appetite. During major shocks in 2024–25 wars, rate scares, bank-liquidity wobbles bitcoin sometimes rallied with gold, but it also saw 20–30% drawdowns within weeks when broader risk assets sold off.

For many Middle Eastern investors, that’s still useful. If your baseline is a weak local currency and limited access to global markets, Bitcoin can look like a flexible, globally traded proxy for “outside money,” even if it’s not perfectly defensive.

Bitcoin vs Gold Investment for US, UK and European Portfolios

For Western portfolios, gold’s case is straightforward: lower volatility, smaller drawdowns, and a long history of holding value during equity sell-offs. Bitcoin offers higher upside and liquidity but with much steeper drawdowns and correlation spikes during stress.

Research comparing risk/return shows that small BTC allocations (1–3% of a diversified portfolio) can improve long-term returns but add significant short-term volatility, while similar allocations to gold or gold ETFs tend to improve drawdown characteristics with more modest return impact. For a CIO in London or Frankfurt, that often leads to a “core gold, satellite Bitcoin” approach.

When the Digital Gold Narrative Breaks Down

There have been moments March 2020, parts of 2022 and late 2025 when bitcoin fell sharply just when investors wanted safety, even as gold was flat or rising. That’s why some recent academic work describes Bitcoin as a long-duration risk asset with embedded optionality rather than a pure hedge.

For MENA allocators, that framing is actually helpful. Bitcoin looks more like high-volatility, equity-like exposure that also gives access to emerging digital-asset ecosystems in Dubai, Abu Dhabi or Riyadh not a substitute for physical gold held under Sharia screens or in regulated ETFs in London or Zurich.

Rules, Sharia and Compliance.

The Gulf is moving toward clear but strict crypto rules, with the UAE leading on licensing while neighbours like Saudi Arabia and Qatar pursue cautious, sandbox-style approaches shaped by global standards and Islamic finance. For US, UK and EU investors, the message is: regulated GCC platforms can be workable partners — but Western AML, sanctions and investor-protection rules still apply.

If you’re building or auditing crypto platforms in the region, Mak It Solutions’ dedicated guide to cryptocurrency regulation in the UAE and GCC dives deeper into licensing mechanics.

UAE as a Case Study VARA, ADGM and “Regulated Innovation”

Dubai’s VARA regime and Abu Dhabi’s ADGM FSRA have built full frameworks for exchanges, brokers, custody and tokenisation, aligned with FATF standards and with strong emphasis on KYC/AML, technology governance and consumer protection.

That combination appeals to UK, EU and US firms looking for a regional hub where.

Virtual-asset licences sit alongside familiar financial-centre rules.

Data-residency and GDPR/UK-GDPR concerns can be managed via local cloud and Middle East data-centre strategies; and

It’s feasible to connect to EU MiCA and UK FCA regimes without operating from completely offshore structures.

Saudi Arabia, Qatar, Bahrain and Others.

Saudi Arabia is running fintech and digital-asset experiments largely through SAMA sandboxes and CMA-overseen pilots, focusing on payments, tokenised assets and cross-border rails rather than speculative retail trading. Qatar, Bahrain and Oman are experimenting with selective licensing via QFC and central-bank/EDB initiatives, trying to attract asset managers and infrastructure providers without encouraging unregulated speculation.

For Western investors, these markets often show up indirectly through GCC funds, infrastructure projects or Sharia-compliant ETFs rather than via direct exchange accounts.

Is Bitcoin a Halal Investment? Islamic Finance Perspectives

There is no single Sharia view on Bitcoin. Some scholars argue that cryptocurrencies lack intrinsic value and resemble gambling (maysir), while others see them as acceptable digital assets if used transparently and with proper risk controls. Sharia boards and organisations like AAOIFI emphasise that new instruments must be assessed under principles like riba (interest), gharar (excessive uncertainty) and maysir.

Practically, this has led to a rise in Sharia-screened crypto funds, staking products and partnerships such as Sharia-compliant earn accounts or tokenised sukuk platforms. Western investors co-investing with Gulf LPs should understand these filters, because they shape which tokens, leverage structures and yield strategies are acceptable in Riyadh or Dubai.

Western Compliance Overlay.

Even if an exchange is fully licensed in Dubai or Abu Dhabi, US, UK and EU investors still have to layer on Western rules:

FATF Travel Rule and local implementations requiring originator/beneficiary data on crypto transfers.

OFAC and EU sanctions screening for flows touching Iran, Russia or other high-risk entities.

MiCA rules for EU-based crypto-asset service providers, including restrictions on marketing and third-country platforms.

FCA financial-promotion rules and BaFin guidance on cross-border crypto services.

For any London or Frankfurt-based firm that wants to plug into GCC platforms, documenting this overlay in policies and procedures is now non-negotiable.

How US, UK and European Investors Can Play Middle East Bitcoin Growth

Western investors usually gain exposure to Middle East bitcoin adoption indirectly, by combining core BTC holdings or ETFs with positions in GCC exchanges, funds or infrastructure aligned with local regulatory regimes. This is less about making a “bet on Dubai” and more about structuring diversified, compliant exposure to digital gold and the ecosystems around it.

Nothing in this section is investment advice; it’s educational only. Always take professional advice for your specific situation.

Direct Bitcoin, ETFs or Middle East-Focused Funds?

For most US investors, the cleanest route to Bitcoin remains spot BTC ETFs, regulated futures funds or direct spot holdings with qualified custodians. European and UK investors have a broader menu of ETPs and exchange-listed trackers.

To add a “Middle East adoption” tilt, you might.

Allocate to funds with GCC mandates or MENA digital-asset infrastructure themes;

Co-invest in vehicles domiciled in Abu Dhabi or Dubai, subject to MiCA and FCA marketing rules.

Back tokenisation or data-centre plays via partners building out GCC infrastructure (for example, projects like those discussed in Mak It Solutions’ guide to public-private tech partnerships in MENA).

Positioning Bitcoin as Digital Gold Alongside Physical Gold

One popular framework in both London wealth offices and Dubai family offices is a “barbell” between physical gold and Bitcoin.

Gold (bullion, ETCs/ETFs) anchors the safe-haven side of the barbell;

Bitcoin sits on the growth/optionality side, with the understanding that it can behave like a risk asset.

Very roughly (and again, not advice), you might see illustrative ranges like:

Cautious: 5–10% gold, 0–1% BTC;

Balanced: 5–10% gold, 1–3% BTC;

Growth-oriented: 5–15% gold, 3–5% BTC.

What changes with a Middle East bitcoin adoption lens is where some of that BTC exposure is held for example, via a VARA-licensed platform in Dubai plus a core ETF position in New York or Frankfurt.

Using GCC Platforms, Custodians and Asset Managers Safely

If you do use GCC platforms, you’ll want a due-diligence checklist that covers:

Licensing

VARA, ADGM, Central Bank of Bahrain, QFC or equivalent;

Security

SOC 2, PCI DSS where relevant, independent penetration testing and robust key-management processes;

Data

Clear policies on data-residency (for example, hosting in UAE or KSA plus GDPR/DSGVO controls for EU clients)

Compliance

Strong sanctions screening, Travel Rule implementation and on-chain analytics.

Family offices and wealth managers documenting MENA crypto exposure increasingly treat these points like any other manager-selection process something Mak It Solutions often sees when helping investors build or audit DevSecOps and security practices into their digital platforms.

How Middle East Bitcoin Adoption Could Reshape Global Flows

If current trends continue, the Middle East could become a structural hub for Bitcoin trading, mining and tokenisation, influencing everything from energy markets to cross-border capital flows by the early 2030s. That doesn’t mean the region replaces the US or Europe, but it could become a critical bridge between Global South utility users and Western capital markets.

MENA as a Strategic Hub for Mining, Liquidity and Tokenisation

Energy-rich states in the Gulf are exploring how to monetise surplus power via data centres and, in some cases, Bitcoin mining especially where flared gas or stranded renewables can be used. At the same time, Dubai, Abu Dhabi and Riyadh are pushing tokenisation of real-world assets (RWA), from real estate to sukuk, which can deepen BTC and stablecoin liquidity by making them settlement assets in tokenised markets.

Implications for the US Dollar, Euro and Regional Currencies

No one credibly expects Bitcoin to replace the dollar or euro as reserve currencies any time soon. But rising BTC and stablecoin usage for remittances and some trade flows could slowly chip away at the dominance of traditional correspondent banking in certain corridors. That’s why regulators emphasise robust AML, Travel Rule compliance and reporting: they want innovation without undermining monetary policy or sanctions regimes.

Three Scenarios for 2030.

Boom

GCC becomes a leading global crypto hub, with strong Sharia-compliant products, deep liquidity and tight alignment between MiCA, FCA, BaFin and Gulf regulators.

Base Case

Bitcoin remains a niche but important diversifier; GCC hubs grow steadily but stay one of several regional centres alongside Singapore and Hong Kong.

Backlash

A major exchange failure, sanctions scandal or regulatory pivot triggers a clampdown, pushing activity into smaller, more fragmented venues and slowing institutional flows.

Right now, the base case looks most plausible but portfolio builders need to be ready for all three.

Key Takeaways

Middle East bitcoin adoption is real and sizeable, with MENA crypto volumes above half a trillion dollars and GCC markets growing in mid-teens percentages annually.

Investors buy BTC as “digital gold” to hedge inflation, FX risk and geopolitical uncertainty, especially in Türkiye, Egypt and the Levant.

Bitcoin is not a perfect safe haven; gold still wins on crisis stability, while BTC offers asymmetric upside and access to digital-asset ecosystems.

UAE and GCC hubs combine innovation with increasingly mature regulation, but Western AML, sanctions and promotion rules still apply.

Practical exposure for US/UK/EU investors is usually a mix of core BTC (spot/ETFs), gold, and selective GCC platforms or funds, supported by strong due diligence and documentation.

Checklist Before Allocating to Middle East Bitcoin Exposure

Governance

Update your investment policy statement to define allowed instruments, exchanges and jurisdictions.

Risk Limits

Set maximum BTC and digital-asset weights, plus rebalancing bands, recognising BTC behaves like a high-volatility risk asset.

Legal & Tax

Get US, UK and EU advice on cross-border marketing, reporting and fund structures touching GCC hubs.

Operations

Run formal due-diligence on GCC partners’ licensing, security and data-residency, ideally involving independent tech reviews (Mak It Solutions often supports this for clients across New York, London and Berlin).

Monitoring

Implement ongoing monitoring of sanctions lists, Travel Rule compliance and regulatory changes in both MENA and your home market.

When to Walk Away.

Unlicensed platforms claiming “offshore” exemptions but serving UK/EU or US clients;

Guaranteed yields or “risk-free” staking products with vague underlying strategies;

Complex offshore shells in secrecy jurisdictions with no clear auditor or custodian;

Pressure to bypass KYC/AML or to use mixers and privacy tools to “optimise” tax or sanctions outcomes.

If something feels like a shortcut around OFAC, MiCA or FCA rules, assume it’s a risk, not an edge.

If you’re planning a bitcoin or broader digital-asset strategy that touches the Middle East, it’s worth getting both the technology and the regulatory plumbing right from day one. Mak It Solutions can help you design compliant trading platforms, data-centre strategies and analytics dashboards that align with VARA, ADGM, MiCA and FCA expectations.

Share your current architecture or roadmap, and the Editorial Analytics Team can work with our consultants to map a realistic path from idea to audit-ready implementation across the US, UK, Germany and the Gulf.( Click Here’s )

FAQs

Q : Is Bitcoin legal in all Middle Eastern countries, or are some markets still restricting it?

A : No, Bitcoin is not treated the same way across the Middle East. The UAE (via VARA and ADGM) has comprehensive licensing regimes, while Bahrain and Qatar allow selected firms under central-bank or QFC oversight. Saudi Arabia mainly uses sandboxes and pilots and still warns retail users about risks. Some jurisdictions, such as parts of North Africa or Iran, rely on ad-hoc rules or banking restrictions rather than clear investor-protection laws. Always check local regulations and avoid treating “MENA” as a single legal block.

Q : Do Sharia scholars agree on whether Bitcoin is halal, or is the opinion still divided?

A : Opinion is still divided. Some scholars and research papers argue Bitcoin is haram because of high volatility, speculation and lack of intrinsic value; others see it as halal or at least potentially permissible if used as a medium of exchange or investment with clear disclosure and no interest (riba).Many Sharia boards now assess crypto on a case-by-case basis, and Sharia-screened funds only admit tokens and structures that meet their ethical criteria. Muslim investors should consult qualified scholars rather than relying solely on marketing claims.

Q : Can a US or UK investor open an account on a UAE crypto exchange, and what checks are required?

A : In principle, yes many UAE platforms accept non-resident clients but the exchange must onboard you under both UAE rules and its own interpretation of US/UK expectations. Expect full KYC, source-of-funds checks, sanctions screening and sometimes enhanced due diligence for higher-risk jurisdictions or business models. You are still responsible for following SEC/IRS or FCA/HMRC reporting, and MiCA rules if you’re in the EU. Many family offices therefore combine local GCC accounts with global ETFs and qualified custodians.

Q : How does rising Middle East bitcoin adoption affect global mining, hash rate and network security?

A : Middle East bitcoin adoption mainly affects hash rate and security indirectly, through energy and infrastructure investments. Energy-rich Gulf countries exploring mining and data-centre projects can host a growing share of global hash rate, especially where they can use stranded gas or cheap renewables. As more jurisdictions compete to host miners, Bitcoin’s network becomes geographically more distributed, which generally improves resilience. However, any large concentration of hash rate whether in North America, Central Asia or the Gulf still raises governance and regulatory questions.

Q : What are the main risks of breaching US/EU sanctions when sending or receiving Bitcoin with Middle East counterparties?

A : The biggest risks arise when flows touch sanctioned persons, entities or jurisdictions such as parts of Iran or Syria. Even if you transact with a seemingly legitimate MENA counterparty, funds could be routed through high-risk wallets, especially if that platform lacks strong on-chain analytics and sanctions screening. US and EU authorities increasingly treat crypto transfers like wire transfers: you’re expected to know your counterparty, document due diligence and avoid mixing services designed to obscure origin. Using regulated GCC exchanges with robust compliance tools is far safer than peer-to-peer transfers or opaque OTC desks.