Microsoft Deal Supercharges IREN’s AI Ambitions, Canaccord Says

Canaccord Genuity highlighted that Iris Energy (IREN) is making a significant strategic shift beyond traditional bitcoin mining with its multi-year agreement to supply AI compute for Microsoft’s $9.7 billion GPU cloud contract. The move positions IREN as a player in hyperscale AI infrastructure, reflecting the growing demand for advanced computing capacity. The analyst noted that this deal underscores Iris Energy’s transition into diversified, high-value computing services, signaling long-term growth potential beyond cryptocurrency mining.

The broker maintained its Buy rating on IREN and raised the price target to $70. Key factors include Microsoft’s 20% upfront prepayment, a projected 32% levered internal rate of return, and the company’s accelerated data center expansion in Texas. These elements collectively support a positive outlook for Iris Energy’s future revenue and strategic positioning in AI infrastructure.

Why the deal matters for IREN

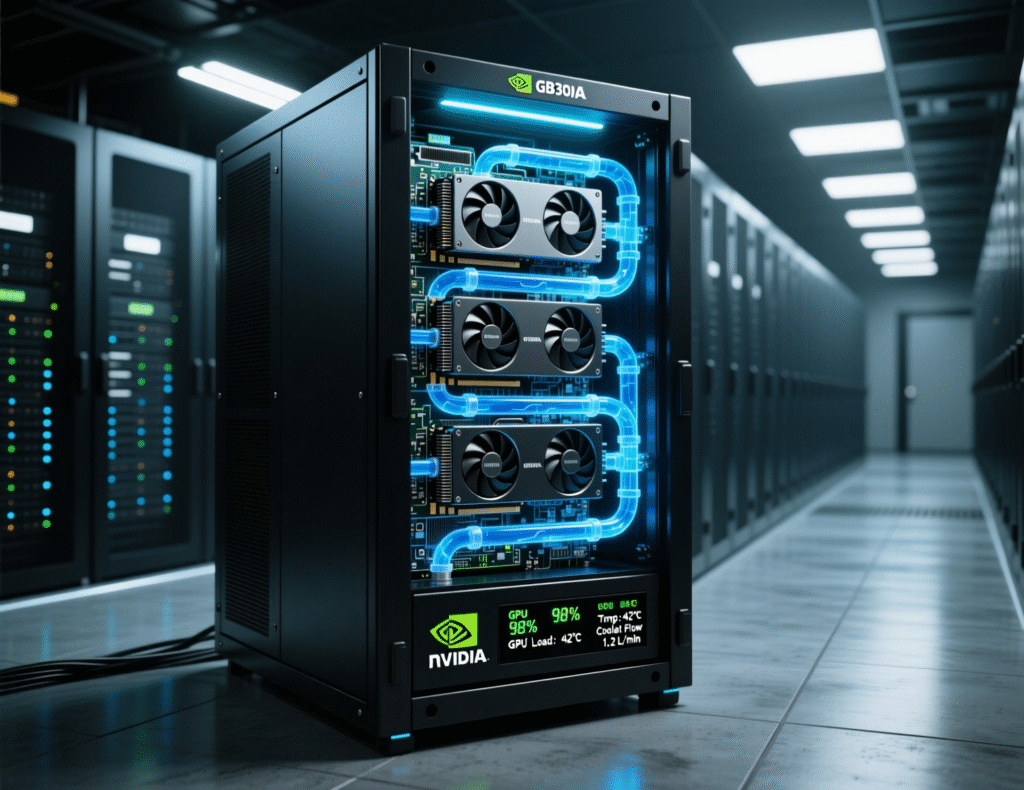

The five-year agreement gives Microsoft access to Nvidia GB300 GPUs via IREN’s Texas sites, enabling the software giant to expand AI capacity without immediately building new data centers. IREN, in turn, benefits from upfront cash flows that de-risk procurement and construction schedules. A separate $5.8B arrangement with Dell is set to supply GPUs and ancillary gear for deployments through 2026.

Contract structure and timeline

Data center capacity will be delivered in tranches from IREN’s Horizon/Childress campus (targeting ~200MW IT load in 2026), with prepayments applied as credits after month 24 of service for each tranche. Microsoft’s prepayment and credit profile mitigate chip and power-sourcing risks highlighted by Canaccord. TechInformed+1

Market reaction and fundamentals

Despite the bullish broker note, IREN closed at $62.38 (-6.8%) on Friday. IREN’s latest quarter showed $240.3M revenue (+355% YoY) as the firm leans on low-cost power and integrated build-operate expertise bridging crypto and AI.

Sweetwater 1: the next catalyst

Canaccord highlighted Sweetwater 1 a planned 2GW site slated to start coming online in 2026 as the next major milestone as power scarcity tightens supply for hyperscalers. The broker lifted its Sweetwater valuation to $32 per share.

What the Microsoft IREN $9.7 billion GPU cloud contract signals for AI supply

The deal underscores surging demand for cutting-edge GPUs and the rise of specialist “AI cloud” providers that aggregate power, land, and cooling at scale. For Microsoft, third-party capacity helps bridge a supply gap that could extend into mid-2026. For IREN, long-term take-or-pay-style economics and prepayments support capex and reduce demand risk.

Inside the Microsoft IREN $9.7 billion GPU cloud contract: chips, cash flows, and sites

IREN will provision Nvidia GB300 capacity at Horizon/Childress with liquid cooling and new buildouts; Microsoft provides 20% prepayment, and IREN sources hardware through Dell under a $5.8B pact. The tranche-credit design aligns milestones to cash collections while maintaining service-level obligations.

Context & Analysis

The contract structure multi-year, prepaid, tranche-based resembles the hyperscaler colocation playbook, but applied to GPU clouds amid constrained supply. Execution hinges on GB300 availability and power delivery in Texas. If timelines slip, credits and milestone gating help cushion cash-flow risk; if they hold, IREN could re-rate toward AI infrastructure comps rather than bitcoin miners. (This section is analytical context.

Conclusion

Canaccord’s $70 price target reflects confidence that Microsoft’s prepayment, the Horizon data center buildout, and the Sweetwater 1 pipeline will transform Iris Energy’s (IREN) story toward stable, long-term AI cloud revenue. The firm views these initiatives as key drivers for shifting the company’s narrative beyond bitcoin mining and into high-value, hyperscale AI infrastructure.

While short-term volatility may persist, investors are now closely watching IREN’s progress against its 2026 milestones. Execution on these targets will be critical in validating the company’s transition and supporting sustained growth in AI cloud services.

FAQs

Q : What is the Microsoft IREN $9.7 billion GPU cloud contract?

A : A five-year agreement granting Microsoft access to IREN-hosted Nvidia GB300 capacity, with a 20% prepayment.

Q : How will IREN fund the hardware?

A : Through a separate $5.8B equipment deal with Dell, supported by Microsoft’s prepayment.

Q : When will capacity come online?

A : Tranches target 2026 deployments at the Horizon/Childress campus, with credits applied after month 24 of each tranche.

Q : Why did Canaccord raise its target to $70?

A : Due to improved visibility on AI revenue, a projected 32% levered IRR, and catalysts including Sweetwater 1.

Q : Is IREN still a bitcoin miner?

A : Yes, but the company is expanding into AI cloud services, potentially shifting investor focus from mining to AI infrastructure.

Q : How did the stock react last week?

A : IREN closed at $62.38 (-6.8%) on Friday.

Q : What risks could affect the rollout?

A : Potential chip supply and power availability risks in Texas; prepayments and milestone credits partly mitigate these.

Facts

Event

Canaccord lifts IREN target to $70 after Microsoft AI contract; reiterates BuyDate/Time

2025-11-10T14:30:00+05:00Entities

Microsoft (MSFT); IREN Limited (IREN); Canaccord Genuity; Dell Technologies; Nvidia (GB300)Figures

Contract value $9.7bn (5 years); 20% prepayment; 32% levered IRR; IREN quarterly revenue $240.3mn (+355% YoY); stock close $62.38 (-6.8%) on FridayQuotes

“The contract includes a 20% prepayment from Microsoft, a projected 32% levered IRR.” Canaccord note via CoinDeskSources

CoinDesk analysis; Reuters; Associated Press; DataCenterDynamics. Data Center Dynamics+3CoinDesk+3Reuters+3