M2 Capital Invests $20M in Ethena to Expand Digital Assets in Middle East

M2 Capital has invested $20 million in Ethena, securing ENA tokens to back the growth of the protocol’s synthetic dollar products in the Middle East. The move reflects M2’s strategy to expand access to innovative digital asset solutions in a region where demand for stable, transparent financial products continues to rise.

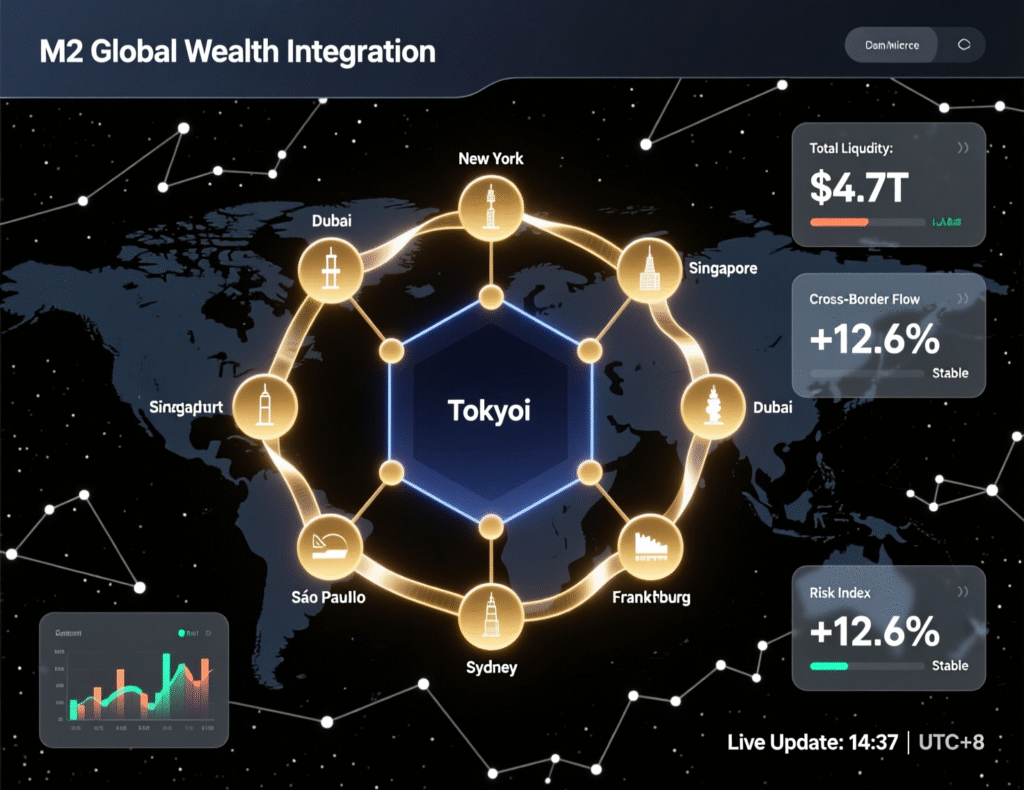

In parallel, M2 Global Wealth, an affiliate of M2 Capital, intends to integrate Ethena into its wealth management platform, offering clients exposure to these synthetic dollar solutions. The development comes as regulators in the UAE refine virtual asset frameworks, creating a favorable environment for institutional adoption and positioning the region as a hub for digital finance.

M2 Capital invests $20M in Ethena

M2 Capital Limited, the investment arm of UAE-based M2 Holdings, has committed $20 million to Ethena’s governance token, ENA. The transaction comes alongside plans by M2 Global Wealth an affiliate of M2 Holdings to integrate Ethena products into client offerings, positioning the firm to channel regional investors into crypto-native yield instruments. Ethena’s design centers on USDe, a synthetic dollar, and sUSDe, a reward-bearing version that employs collateralization and hedging to dampen volatility. CoinDesk

Ethena has drawn rapid deposit growth since its 2024 launch, with USDe/sUSDe surpassing $14 billion in TVL a marker of appetite for stablecoin-like products that also generate yield.

Market impact of M2 Capital invests $20M in Ethena

By aligning with Ethena, M2 aims to offer custody, yield, and liquidity services within a regulated wealth framework potentially accelerating adoption of synthetic dollars among high-net-worth and institutional clients in the region. The move also follows CoinDesk’s note that M2 participated in a Sui ecosystem funding push earlier this year, underscoring the group’s broader digital-asset strategy.

Why it matters for the Middle East wealth market

Dubai and the wider UAE continue to refine virtual-asset oversight, with the Virtual Assets Regulatory Authority (VARA) updating activity rulebooks to bolster market integrity and risk oversight. A clearer framework can make it easier for wealth platforms to curate tokenized yield and cash-management products for clients, provided risk controls and disclosures keep pace.

TVL and product context

Ethena’s TVL milestone (> $14B) situates USDe among the most adopted synthetic dollar instruments. Independent industry coverage also cites combined Ethena-stable assets above $16B, with USDe accounting for the majority evidence of strong demand for yield-bearing, dollar-tracked assets that bridge DeFi and wealth platforms.

<section id=”howto”>

<h3>How to access Ethena exposure via a regulated wealth platform</h3> <ol> <li id=”step1″><strong>Step 1:</strong> Confirm eligibility and residency requirements with your wealth adviser or platform.</li> <li id=”step2″><strong>Step 2:</strong> Complete KYC/AML onboarding and risk questionnaires specific to digital assets.</li> <li id=”step3″><strong>Step 3:</strong> Review product materials for USDe/sUSDe (structure, collateral, hedging, fees, liquidity).</li> <li id=”step4″><strong>Step 4:</strong> Select custody and execution options (segregated custody, order size, settlement).</li> <li id=”step5″><strong>Step 5:</strong> Execute allocation, set monitoring alerts, and schedule periodic portfolio reviews.</li> </ol> <p><em>Note: Process may vary by provider and jurisdiction. This is not investment advice; assess risks and suitability.</em></p> </section>

Analysis

The investment advances a pattern: Middle Eastern wealth platforms are curating institutional-grade access to tokenized cash and yield products. For Ethena, a regulated distribution channel can broaden USDe’s user base beyond crypto-native funds to family offices and treasuries. Regulatory follow-through especially on disclosures, reserve transparency, and market-abuse controls will determine the pace of adoption.

Conclusion

M2’s $20 million ENA acquisition and planned integration through M2 Global Wealth highlight a growing connection between regional wealth platforms and synthetic dollar infrastructure. This step underlines the firm’s commitment to expanding digital asset exposure in a market seeking stable and innovative financial solutions.

As Dubai’s VARA refines its regulatory frameworks and Ethena continues to show strong TVL momentum, the Middle East is positioned to emerge as a central hub for institutional-grade access to on-chain yield. The combination of regulatory clarity and rising adoption could accelerate the region’s role in shaping the next phase of digital finance.

FAQs

Q : What does the deal involve?

A : M2 Capital purchased $20M of Ethena’s ENA token and plans distribution via M2 Global Wealth.

Q : Why is Ethena attracting deposits?

A : USDe/sUSDe target dollar stability while offering yield through collateral and hedging strategies.

Q : How will clients access Ethena products?

A : M2 Global Wealth intends to integrate Ethena into its regulated wealth offerings, subject to onboarding and suitability.

Q : What’s the regulatory backdrop in the UAE?

A : Dubai’s VARA has updated activity rulebooks to enhance market integrity and risk oversight.

Q : How large is Ethena’s footprint today?

A : TVL has surpassed $14B since 2024; some coverage cites >$16B combined across related stable assets.

Q: Does this mean guaranteed returns?

A : No. Synthetic dollar yields carry market, counterparty, and liquidity risks; review disclosures before investing.

Q : Is “M2 Capital invests $20M in Ethena” a sign of institutional adoption?

A : It signals growing institutional interest in regulated access to on-chain yield products in the Middle East.