This Content Is Only For Subscribers

Technical Analysis for Chainlink (LINK) Chart

LINK Technical Analysis

Welcome back to another edition of The Crypto City Trading Newsletter, your go-to source for in-depth technical analysis and expert insights into the dynamic world of cryptocurrency trading. Today we are focusing on the Daily and Weekly price action of LINK/USDT.

We also provide multiple trading setups in our limited-time free premium discord server, you can take great benefit from it,

Join us and reach your financial freedom.

Our Discord Link (https://discord.gg/pYWa2cJC8E)

Total LINK Market Cap: $8,772,356,283

Circulating Supply: 608,099,970 LINK

Total Supply: 1,000,000,000 LINK

Max Supply: —

This technical analysis provides an in-depth look at the ChainLink (LINK). The analysis focuses on identifying key support and resistance levels, recent price movements, and possible future scenarios. By analyzing these factors, traders will gain insight into the current market condition and make better trading decisions.

Key support zones (Green) between $12.596 and $13.003 have been highlighted, showing areas of significant buying activity. However, a resistance zone (Pink) at $14.528 – $14.742 and a major resistance zone (Yellow) at $17.388 – $18.471 have been identified, indicating where selling pressure may limit upward momentum.

The analysis also discusses recent price action, which has been marked by a downturn and a period of consolidation between support and resistance. The descending trendline highlights the bearish sentiment.

Volume analysis shows relatively not much trading activity, indicating a lack of significant momentum in either direction. This may indicate potential volatility when important support or resistance levels are tested.

The analysis discusses both bullish and bearish scenarios, outlining potential outcomes depending on price movements above important resistance levels or below critical support levels. The objective is to provide traders with an extensive understanding of current market dynamics, allowing them to predict price movements and adjust their trading strategies accordingly.

We are now moving toward the chart.

Weekly Chart

In the weekly chart, LINK is trading on the major support zone (Green) at $12.192 – $13.527. The price is consolidating between the support zone in Green and the resistance zone (Blue) at $19.061 – $20.857 for approximately 238 days. The support zone (Green) is holding the price if it fails we might see it to the next support zone (Yellow) at $8.261 – $8.928 and that is the best buying area. However, according to our analysis, we are not expecting the price to break the major support zone (Green). If it does we add more LINK/USDT to our spot bags because this is a good coin fundamentally to hold.

4 Hour Chart

Now we are zooming in on a 4-hour chart.LINK is trading within a defined range, with the support zone (Green) at $12.596 — $13.003 and the resistance zone (Pink) at $14.528 – $14.742. This range is held for approximately 13 days and the price was trading under the descending trend line for approximately 32 days. Now the price breaks out from the descending trend line and currently is in the resistance zone (Pink). When the price reached the resistance zone (Yellow) at $17.388 – $18.471, we saw a correction in the market. The decreasing volume during this pullback indicates the bullish trend could still have potential. Several key technical elements and zones are marked, providing a comprehensive view of the market’s structure and potential future movements.

Key Zones and Levels

Support Zone (Blue) $8.709 – $9.748

This level has seen significant price interaction in the past, acting as both support and resistance. It’s a critical level where the market has previously reversed direction. The frequent testing of this level signifies its importance in the eyes of traders, making it a crucial support level in the current context.

Support Level $10.891

This level has provided support during several trading periods, helping to contain downward movements. It’s not as strong but still significant for short-term trading decisions. Major Support Zone (Green) $12.596 – $13.003 This zone acts as strong support and has been tested multiple times, indicating strong buying interest. Every time they tested this zone we saw a massive bounce from here.

Resistance Zone (Pink) $14.528 – $14.742

This is another significant resistance level. Historically, it has been a tough barrier for the price to cross, suggesting that many traders are looking to sell at this level. Frequent testing without a successful break indicates the strength of this resistance.

Major Resistance Zone (Yellow) $17.388 – $18.471

This level marks a major resistance point where previous uptrends have faced rejection. It’s a critical level that needs to be broken for any significant upward movement.

Trend Line

ChainLink (LINK) has been experiencing a downward trend, indicated by a descending trendline on the chart. Recently, the price has broken out from the trend line.

Volume Analysis

Currently at the time of writing the trading volume is at $521M, indicating a lack of strong buying interest at the current levels. A significant increase in volume would be necessary to confirm any potential reversal or breakout.

Potential Scenarios

Bullish Scenario

If the price breaks above the resistance zone (Pink) at $14.528 – $14.742 with significant volume, it could move towards the next resistance zone (Yellow) at 17.388 – 18.471.

Sustained buying pressure above the Yellow zone could move the price to the new highs

Bearish Scenario

If the price fails to break above the resistance zone (Pink) at $14.528 – $14.742 and falls below the Major Support Zone (Green) at $12.596 – $13.003

A break below the Green zone could lead to a decline towards 10.891 or even lower levels.

Technical Indicators

Based on technical indicators on a daily time frame

The relative Strength Index (RSI) value is at 48.374 (Neutral)

Momentum (10) is at 0.677 signaling a (Buy)

MACD Level (12, 26) is at -0.505 signaling (Buy)

Exponential Moving Average (50): 15.193 (Sell)

Exponential Moving Average (100): 15.661 (Sell)

Simple Moving Average (100): 15.733 (Sell)

Exponential Moving Average (200): 15.288 (Sell)

Ichimoku Base Line (9, 26, 52, 26): 15.203 (Neutral)

Volume Weighted Moving Average (20): 14.325 (Buy)

Hull Moving Average (9): 14.119 (Buy)

Interpretation

The current technical analysis for LINK/USDT shows a mixed picture. Most of the oscillators are neutral, meaning there’s no strong push-up or down, though the Momentum and MACD indicators suggest a possible short-term rise. However, moving averages mostly give a sell signal, especially for the medium to long term, indicating a likely downward trend over those periods. On the other hand, shorter-term moving averages and the Hull Moving Average suggest a buy signal, indicating potential short-term gains. Overall, while there may be some short-term opportunities for gains, the longer-term outlook is cautious. Traders should watch key levels closely and consider these mixed signals when making decisions.

Liquidation Heatmap

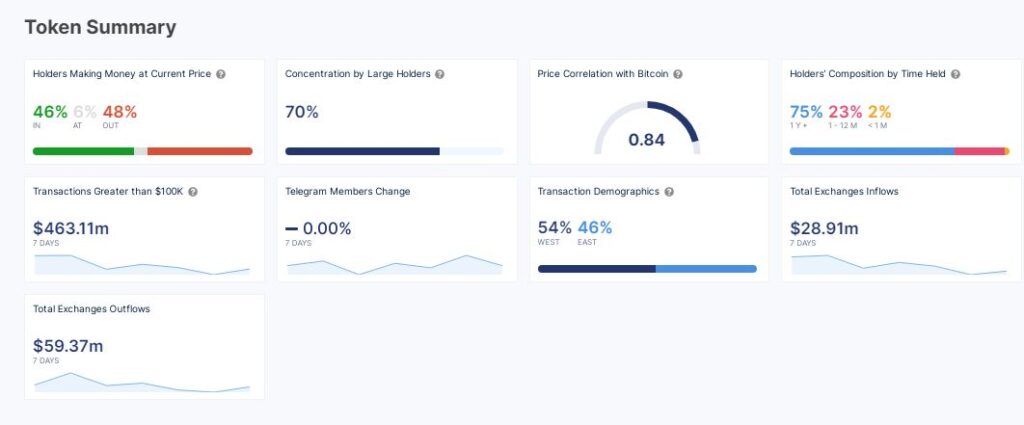

Token Summary

Interesting on-chain metrics that provide a rapid understanding of the state of ChainLink

A mix of positive and negative signs. About 46% of holders are making money, while 48% are losing money. Large holders control 70% of the token, and its price moves closely with Bitcoin. Most people (75%) have held the token for over a year. There’s been a lot of big transactions ($463.11 million), and more tokens are being moved out of exchanges ($59.37 million) than into them ($28.91 million), suggesting people are holding onto them. Overall, the market is stable but heavily influenced by a few big players and Bitcoin.

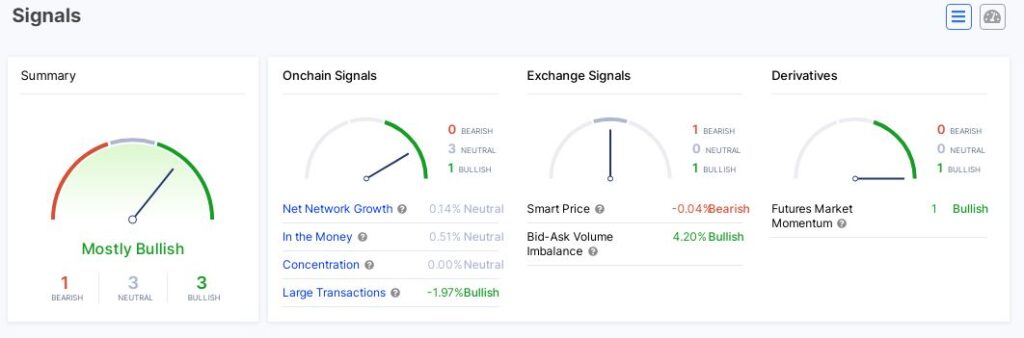

Actionable Signals

Momentum and value signals that will help you better judge the on-chain sentiment of ChainLink The signals show that the cryptocurrency token is mostly positive. Onchain data like steady network growth and more significant transactions suggest good momentum. The exchanges indicate strong buying interest, although there’s a slight concern about price expectations. The futures market looks positive, but there are also neutral signs suggesting a balanced market sentiment. Overall, things look promising, but it’s wise to keep an eye on these factors for a clearer picture.

LINK Trade Setup.

After a confirmed breakout from the green zone, we could take entry at $14.928.

Remember stop loss is your friend. Everything is on the chart.

Entry $14.928

S.L $13.775

T.P 1 $15.911

T.P 2 $16.997

T.P 3 $18.035

Conclusion

The current price action suggests mixed signals, a period of consolidation with key levels to watch. Traders should look for a breakout above the Pink zone or a breakdown below Green zone to determine the next significant move. Monitoring volume during these potential breakouts will be crucial to confirm the strength of the move.

Investment Outlook

Given the current market conditions, LINK presents both opportunities and risks. The identified key levels should guide investors in making informed decisions. Caution is advised until a clear trend is established.

Your Essential Trading Newsletter

This detailed analysis provides a comprehensive understanding of the current market structure and potential scenarios. Traders can use these insights to make informed decisions and effectively navigate the market.

Stay tuned to The Crypto City Trading Newsletter for more in-depth analyses, market insights, and expert guidance. As always, we strive to empower you with the knowledge and tools needed to navigate the fast-paced world of cryptocurrency trading. Happy trading!

Thank you for being a valued subscriber. We hope you find our insights helpful and informative. For more detailed analysis and updates, visit our website or follow us on social media.

Warm regards,

The Crypto City Trading Team