Large bitcoin holders share of supply hits 9-month low amid price drop

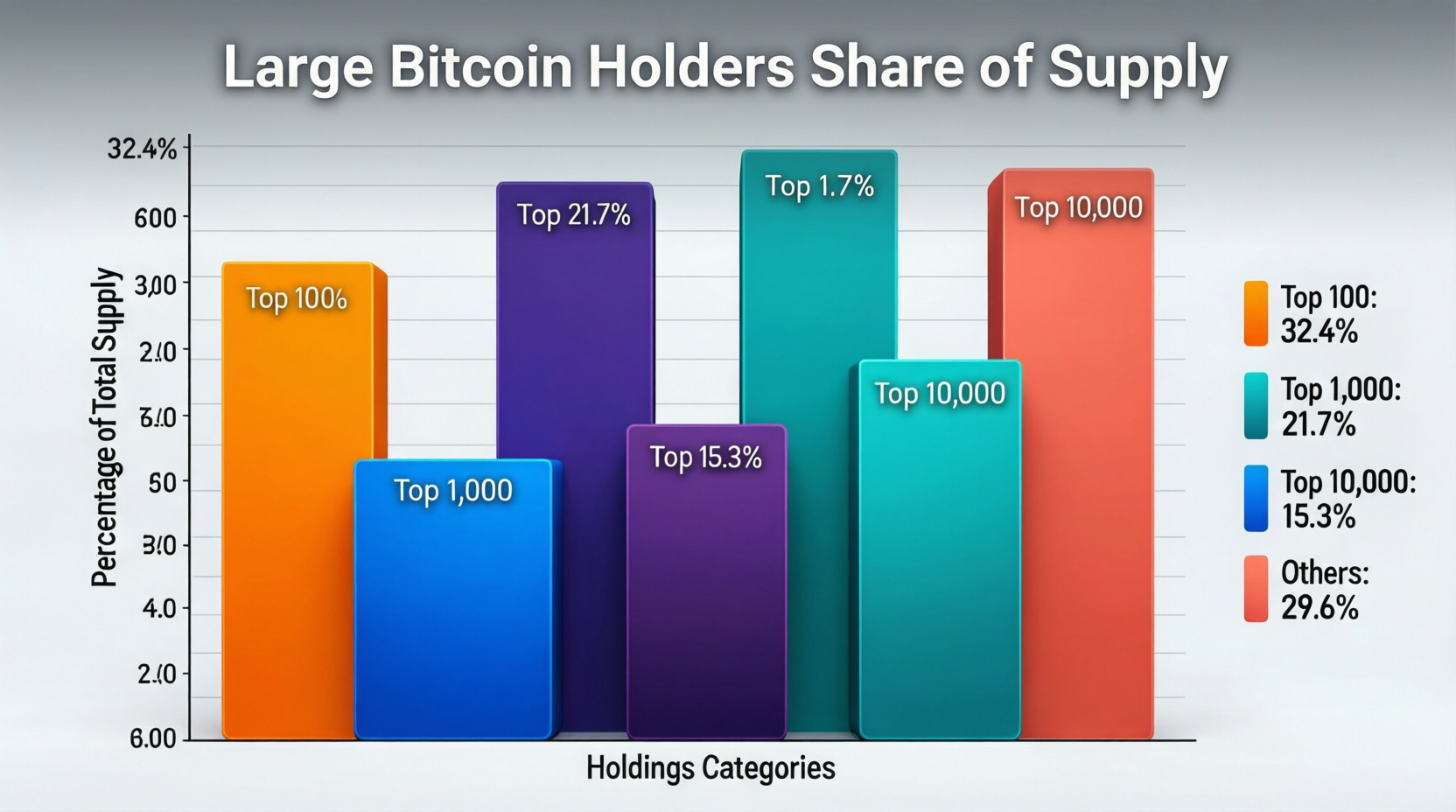

Bitcoin’s sharp sell-off this week coincided with a notable on-chain shift: the large bitcoin holders share of supply has dropped to its lowest level in nine months, according to on-chain analytics firm Santiment. The firm said “whale and shark” addresses holding 10–10,000 BTC collectively control about 68.04% of supply after distributing aggressively over the past eight days.

Spot prices reflected the stress. BTC briefly tested ~$60,000 before rebounding toward mid-$60Ks on Friday, Feb. 6 (Asia time), with intraday snapshots on CoinMarketCap showing prints around $64–66K.

Whale exits and retail bids intensify

Santiment reported a net reduction of ~81,068 BTC from whale/shark wallets over eight days, a period that saw bitcoin fall from roughly $90,000 to the mid-$60,000s. The group’s aggregate share slipped to ~68.04%, continuing a distribution trend.

Meanwhile, “shrimp” addresses small retail holders reached a ~20-month high share of supply. Santiment said this mixture of large-holder selling and retail dip-buying has historically aligned with bear-cycle dynamics.

Sentiment: “extreme fear”

The broader mood has soured. The Crypto Fear & Greed Index fell into “extreme fear,” with reports of readings near the single digits on Feb. 6 as BTC probed $60K. While methodologies differ across dashboards, the trend confirms a swift deterioration in risk appetite.

Adding to the tone, Ki Young Ju of CryptoQuant remarked on X that “every Bitcoin analyst is now bearish,” reflecting a momentum shift from early-year optimism.

Price context and market drivers

BTC’s retreat accelerated alongside a wider risk-asset sell-off this week. Price trackers show bitcoin sliding from the upper-$70Ks in early February to lows around $60K on Feb. 6, with high-profile outlets noting a break below $65K and a drawdown of more than 40% from 2025’s all-time high.

What the large bitcoin holders share of supply trend suggests

Historically, falling whale/shark ownership during price declines can signal capitulation or strategic risk reduction. If retail accumulation persists while large holders distribute, drawdowns can extend; conversely, stabilization in large-cohort holdings has preceded prior recoveries. (Interpretive context; monitor on-chain flows for confirmation.)

Tracking the large bitcoin holders share of supply in real time

To assess whether distribution is easing, watch Santiment’s whale/shark cohort charts and corroborate with exchange inflows/outflows and realized profit/loss metrics from other providers.

Context & Analysis

The confluence of whale distribution, rising retail share, and “extreme fear” readings is consistent with late-stage risk-off phases in prior BTC cycles. However, macro drivers (equities volatility, liquidity conditions) and regulatory signals can override on-chain patterns. Keeping focus on cohort stabilization and exchange flows may help identify when selling pressure abates.

Concluding Remarks

Large-cohort selling has pushed the large bitcoin holders share of supply to a nine-month low as BTC tests key support zones. Sustained retail accumulation without a halt in whale distribution would historically skew bearish; a plateau or reversal in large-wallet outflows could mark the first step toward stabilization.

FAQs

Q : What does the drop in whale/shark supply share mean?

A : It signals that large holders (whales/sharks) have recently reduced their exposure. Historically, when this happens alongside retail buying, it often aligns with bear-cycle phases or late-stage corrections.

Q : Did whales really sell 81,068 BTC in eight days?

A : Yes. According to Santiment, large holders recorded a net dump of approximately 81,068 BTC over that eight-day period.

Q : Where is Bitcoin trading now?

A : As of February 6, 2026, Bitcoin is trading in the $60,000–$66,000 range, after briefly dipping to around $60,000 in the prior 24 hours.

Q : How low did market sentiment get?

A : The Fear & Greed Index dropped into “Extreme Fear,” with reports indicating single-digit readings around February 6.

Q : Why are analysts suddenly bearish?

A : Market breadth weakened and prices broke key technical levels. As a result, several well-known commentators on X (Twitter) noted that most analysts had turned bearish.

Q : Does this trend guarantee a deeper bear market?

A : No. This is a risk signal, not a certainty. Historically, if large-cohort selling pauses or reverses, the market can stabilize or even rebound.

Q : Is the large Bitcoin holders’ share of supply tracked in real time?

A : Yes. Santiment and other on-chain analytics platforms update cohort and supply metrics regularly, providing near real-time insights.

Facts

Event

Whale/shark cohort’s BTC supply share drops to 9-month low; ~81,068 BTC sold in eight days; retail share rises.Date/Time

2026-02-06T16:00:00+05:00Entities

Santiment; CoinMarketCap; CryptoQuant; Ki Young JuFigures

68.04% (whale/shark share); 81,068 BTC (8 days); BTC ~$60K–$66K intraday prints.Quotes

“Every Bitcoin analyst is now bearish.” Ki Young Ju, CEO, CryptoQuant.Sources

Cointelegraph via TradingView (Santiment) https://www.tradingview.com/news/cointelegraph%3A515d58c51094b%3A0/ CoinMarketCap https://coinmarketcap.com/currencies/bitcoin/