KRWQ launches as first Korean won stablecoin on Base

IQ, in collaboration with Frax, has launched KRWQ, a Korean won–pegged stablecoin, on Base, Coinbase’s Ethereum Layer-2 network. This marks the first-ever KRW-backed token on Base, expanding the ecosystem’s fiat diversity. The token’s debut includes a KRWQ–USDC trading pair on Aerodrome, allowing users to trade between Korean won and U.S. dollar stablecoins seamlessly.

Built using LayerZero’s OFT standard and integrated with the Stargate bridge, KRWQ is designed as a multichain asset for smooth transfers across networks. The launch aligns with IQ and Frax’s broader vision of enhancing global stablecoin accessibility, offering Korean and international users a decentralized, efficient option for cross-border payments and DeFi participation within the Base ecosystem.

What launched and where

KRWQ is a won-pegged stablecoin live on Base with an initial liquidity pair against USDC on Aerodrome. IQ and Frax say the design aims for regulatory rigor to meet institutional due-diligence needs while enabling cross-chain portability. TradingView

Availability and controls

The issuers state KRWQ is not marketed or offered to South Korean residents while lawmakers finalize a domestic framework. Minting and redemption are limited to eligible KYC’d counterparties such as exchanges, market makers, and integrated institutional partners.

Multichain design and infrastructure

KRWQ’s contracts are built to the LayerZero Omnichain Fungible Token (OFT) standard and connect via Stargate for transfers across supported chains, making it one of the first won-denominated multichain tokens.

Market context: South Korea’s stablecoin push

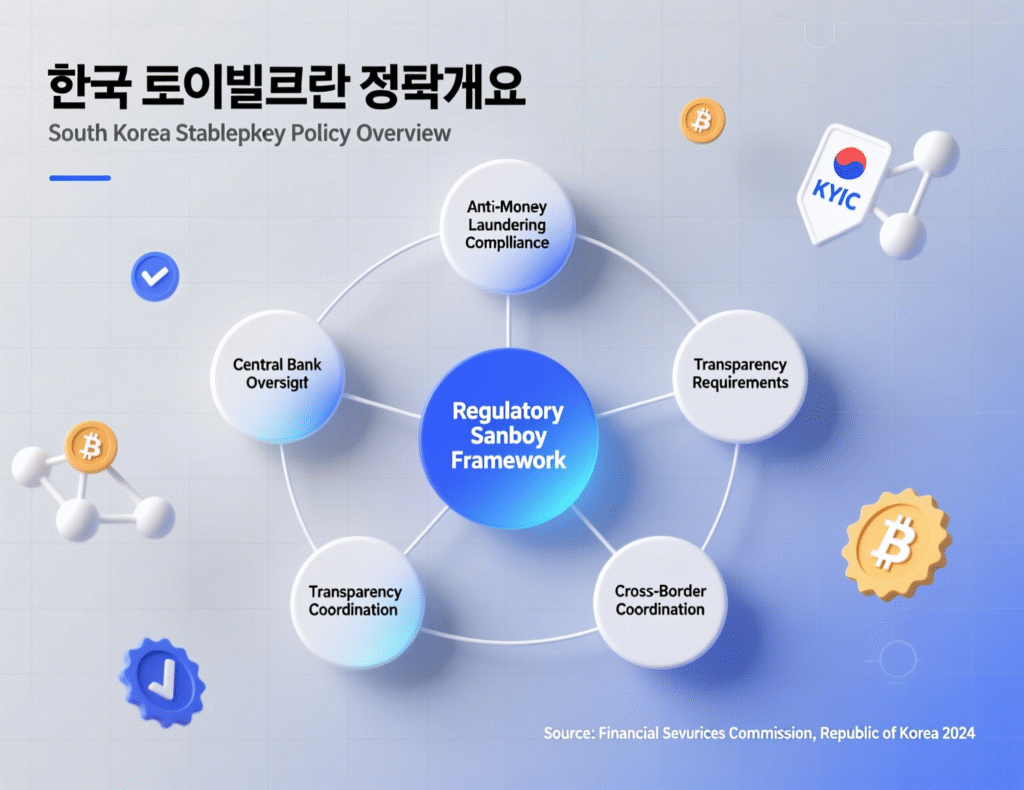

South Korea is advancing legislation to recognize and regulate stablecoins; the Bank of Korea has argued for a phased, bank-led rollout to safeguard monetary policy and financial stability. Meanwhile, BDACS launched KRW1 on Avalanche in September as a proof-of-concept backed by Woori Bank custody arrangements.

Regulatory positioning

IQ and Frax describe KRWQ as “developed in anticipation of forthcoming stablecoin legislation,” signaling a compliance-first posture ahead of any Korean sales. This aligns with the central bank’s gradualism and the National Assembly’s ongoing work to craft rules for won-pegged tokens.

Why it matters for DeFi liquidity

A credible KRW stablecoin could reduce FX friction for Asia-based market makers, enable KRW-quoted pairs on L2 DEXs, and diversify stablecoin exposure beyond USD pegs—provided liquidity, compliance, and reserves transparency meet institutional thresholds. (Analysis)

KRWQ Korean won stablecoin on Base: launch details

Network: Base (Ethereum L2)

Pair: KRWQ–USDC (Aerodrome)

Access: Institutions/eligible counterparties; no Korea marketing yet

Bridging: LayerZero OFT + Stargate

Context & Analysis

KRWQ arrives amid a broader policy pivot in Seoul to expand digital-asset market infrastructure, but practical usage in Korea will hinge on reserve attestations, on-chain liquidity, and the final shape of the stablecoin regime especially if issuance is restricted to banks or bank-sponsored vehicles.

Conclusion

The launch of KRWQ on Base introduces a Korean won rail to the Layer-2 DeFi ecosystem, expanding currency options for global users. However, the project remains geofenced from Korean residents until clear regulatory guidelines are established, reflecting ongoing caution in the domestic market.

In the near term, KRWQ’s growth will hinge on institutional adoption, cross-chain user experience, and regulatory clarity from Korean authorities. Success in these areas could position KRWQ as a key bridge between Korean financial infrastructure and the broader decentralized finance ecosystem operating on Ethereum’s Layer-2 networks.

FAQs

Q : What is KRWQ?

A : A KRW-pegged stablecoin launched by IQ with Frax, initially live on Base.

Q : Is KRWQ available to South Korean residents?

A : No. The issuers say it’s not marketed or offered in Korea pending regulation.

Q : How is KRWQ bridged across chains?

A : Via LayerZero’s OFT standard and Stargate liquidity routes.

Q: What pairs exist today?

A : KRWQ–USDC on Aerodrome at launch.

Q : How does KRWQ compare to KRW1?

A : KRW1 by BDACS launched on Avalanche as a proof-of-concept; KRWQ launched on Base with a multichain design.

Q : What is Korea’s policy stance on stablecoins?

A : Authorities are drafting rules; the central bank favors a gradual, bank-led approach.

Q : Where can I learn more about the KRWQ Korean won stablecoin on Base?

A : See issuer announcements and coverage linked in Sources below.

Facts

Event

Launch of KRWQ, a KRW-pegged stablecoin, on Base with KRWQ–USDC pair; multichain via LayerZero/Stargate.Date/Time

2025-10-30T10:00:00+05:00Entities

IQ (issuer/AI agent platform); Frax (stablecoin protocol); Base (Ethereum L2); LayerZero; Stargate Finance; Aerodrome; BDACS; Bank of Korea.Figures

N/A at launch (no reserves/market cap disclosed in sources).Quotes

“KRWQ fills a critical gap in the market… no credible won-denominated stablecoin has ever launched at scale.” Navin Vethanayagam, IQ. TradingViewSources

TradingView/Cointelegraph summary (cointelegraph via TradingView) + URL; CryptoBriefing BDACS KRW1 + URL; Reuters (Bank of Korea stance) + URL. TradingView+2Crypto Briefing+2