Key Indicators to Watch in Q4: Bitcoin Seasonal Trends, XRP/BTC, Dollar Index, Nvidia, and More

As traders move into the final quarter of 2025, Bitcoin enters a period that has historically leaned positive, though key technical and macro factors remain critical. Seasonal patterns suggest a supportive backdrop, but conviction hinges on levels that could either confirm momentum or stall further gains.

This briefing highlights the most relevant charts shaping sentiment. Bitcoin’s 50-week SMA stands out as a long-term guidepost, while compression in the XRP/BTC pair signals potential rotation. Beyond crypto, the SMST inverse MSTR ETF offers a hedge-linked signal, and the U.S. Dollar Index (DXY) remains a macro driver for risk appetite. Nvidia (NVDA) adds another dimension, reflecting tech-sector strength that often bleeds into digital assets. Together, these triggers frame the roadmap traders are watching into year-end.

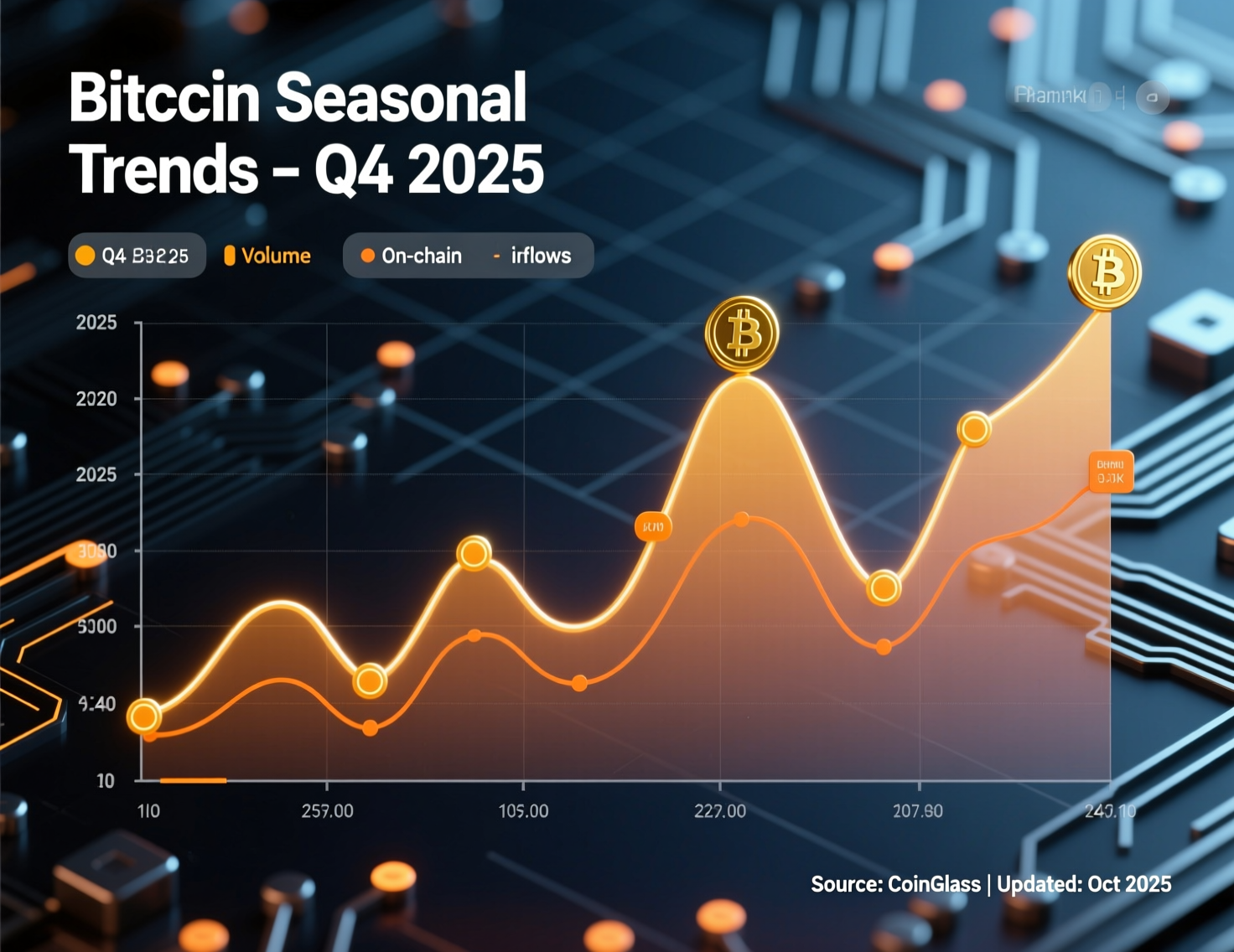

What history says: bitcoin seasonal trends Q4 2025

Across cycles, Q4 has been Bitcoin’s most constructive quarter, with November historically the standout month (avg. ~46% gain), followed by October (~21%). While seasonality isn’t a signal by itself, it frames risk for trend-following setups and volatility breakouts into year-end. Ether often benefits too, though its strongest returns have skewed to Q1.

BTC’s cycle context and the 50-week line

BTC is coming off late-September chop near $109k–$113k. The 50-week simple moving average around $98,900 has repeatedly acted as “pullback-end” support during the 2023–25 bull phase. A weekly close below would raise the odds of a deeper mean-reversion; holding above keeps the higher-low structure intact. Nearby spot pivots cited by technicians include late-August lows (~$107.3k) and the 200-day SMA (~$104.2k). The Economic Times+2The Economic Times+2

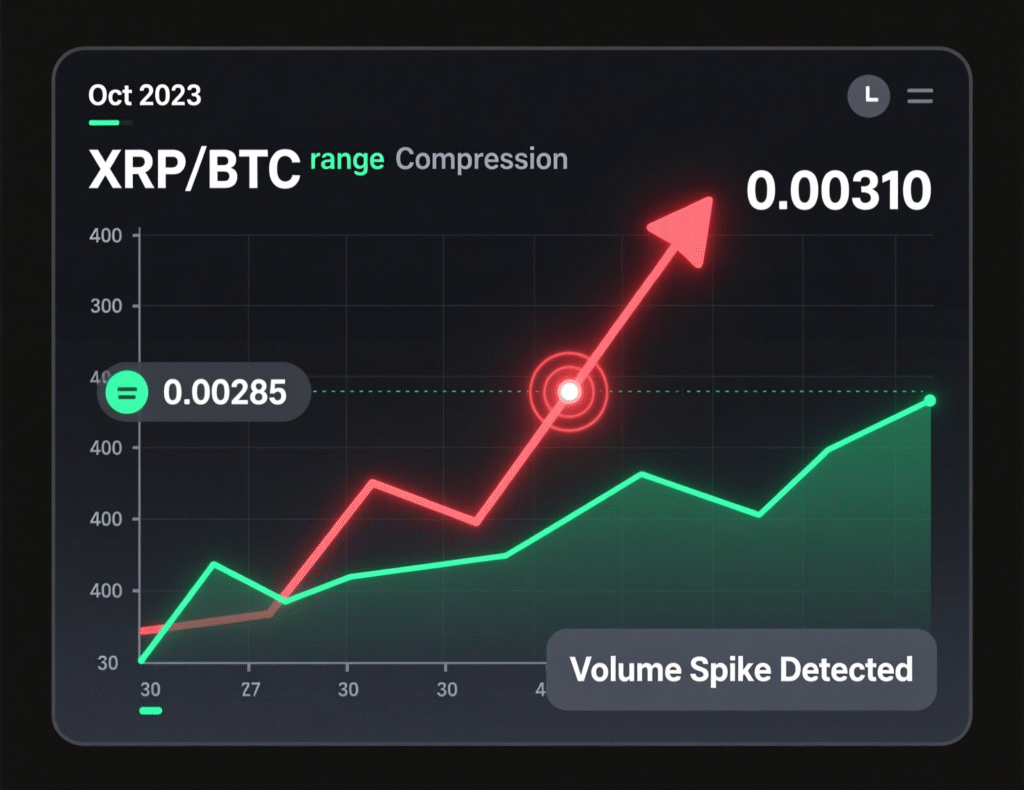

XRP/BTC: four years of compression

The XRP/BTC pair has been locked in a multi-year range since early 2021, producing low volatility and narrowing swings. Recent tests of the upper boundary suggest building pressure; a decisive breakout could favor XRP on a relative basis, while failure keeps range-trade tactics in play.

The cautionary charts

The “anti-MSTR” tell: SMST turns up

The Defiance Daily Target 2x Short MSTR ETF (SMST) seeks –2x the daily move of Strategy Inc. (ticker: MSTR) the largest corporate holder of BTC. When SMST bases and starts trending higher, it often coincides with weakness in MSTR (and, by extension, beta-to-BTC). Pattern claims (e.g., inverse H&S) are tactical, but the fund’s objective is explicit and verifiable.

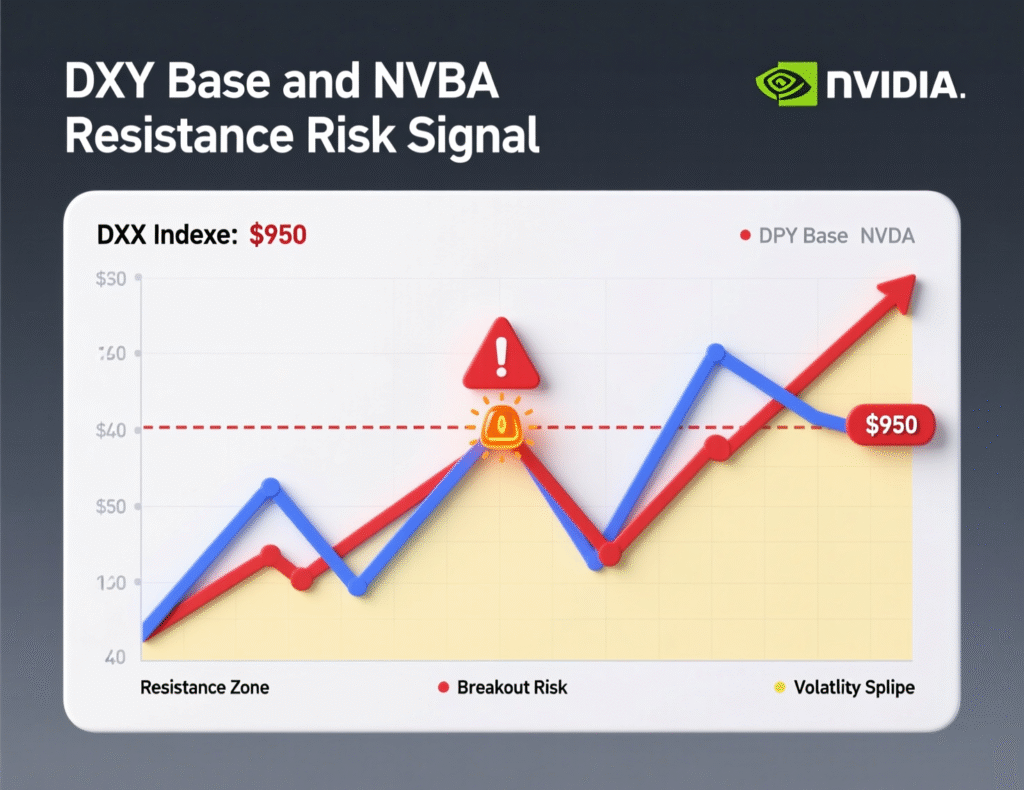

Dollar bid: DXY base-building

DXY firmed into the upper-90s this week after stronger U.S. data. A break above nearby recovery highs would validate a base and typically tightens financial conditions—historically a headwind for high-beta risk assets, including crypto. Conversely, a roll-over would relieve pressure.

NVDA at resistance: why it matters for crypto

As the world’s most valuable company by market cap in 2025, Nvidia (NVDA) has been a bellwether for risk appetite. With price flirting near recent highs/resistance, a rejection could telegraph broader “risk-off” rotations that spill into crypto; a breakout would support risk-on.

How to turn these signals into a Q4 trading checklist

<section id=”howto”> <h3>How to build a disciplined Q4 plan from seasonal and macro charts</h3> <ol> <li id=”step1″><strong>Step 1:</strong> Map seasonality windows (Oct–Dec) and pre-define position sizing/outliers for volatility spikes.</li> <li id=”step2″><strong>Step 2:</strong> Track BTC’s weekly close vs. the 50-week SMA (~$99k) and set alerts ±1% around it.</li> <li id=”step3″><strong>Step 3:</strong> Monitor XRP/BTC for a weekly range break; plan conditional entries with invalidation back inside range.</li> <li id=”step4″><strong>Step 4:</strong> Use SMST and MSTR as cross-checks: rising SMST + falling MSTR = reduce BTC beta.</li> <li id=”step5″><strong>Step 5:</strong> Watch DXY’s trend vs. 98–100; rising dollar = trim risk; falling dollar = allow adds.</li> <li id=”step6″><strong>Step 6:</strong> Tie NVDA’s break/reject at resistance to your crypto risk budget for the week.</li> <li id=”step7″><strong>Step 7:</strong> Reassess weekly; don’t carry losing positions through weekend illiquidity without intent.</li> </ol> <p><em>Note: Process may vary by jurisdiction/provider. Confirm requirements before acting.</em></p> </section>

How the bitcoin seasonal trends Q4 2025 fit the setup

Seasonality supports dip-buying bias, but confirmation should come from price: BTC holding the 50-week; XRP/BTC breaking out; DXY not breaking higher; NVDA risk-on signals intact. Conflicts (e.g., bullish BTC but rising DXY) argue for smaller size and tighter risk.

Context & Analysis

Strategy Inc. (MSTR) lens

Strategy’s BTC stack (recent updates show ~639,835 BTC) makes MSTR a leveraged proxy for BTC’s path; SMST is the inverse vehicle of that equity exposure. Use both as “tape-reads,” not as primary crypto allocations.Positioning risk

Late-Q3 deleveraging and macro event risk (rates, inflation data) can whipsaw trend signals; lean on weekly closes over intraday noise.

Conclusion

Seasonal patterns give Bitcoin a bullish tilt heading into year-end, but traders will need to navigate carefully. The setup hinges on how price reacts around a few crucial inflection points that could determine whether momentum follows through or fades.

Key levels and signals include Bitcoin’s 50-week SMA as a long-term trend marker, the XRP/BTC range for rotation cues, and the SMST inverse MSTR ETF as a hedge-driven check. On the macro side, the U.S. Dollar Index (DXY) is testing its base, while Nvidia (NVDA) trades near resistance. Plans should center on confirmation or invalidation—letting the market set direction.

FAQs

Q1 . Does history support a bullish BTC case in Q4?

A : Yes, November is historically the strongest month for BTC, and Q4 skews positive overall, though past performance is not a guarantee.

Q2 . Why is the 50-week average so important for Bitcoin?

A : It has marked pullback-ends through the 2023–25 cycle; holding above ~$98.9k keeps the uptrend structure intact.

Q3 . What would confirm strength in XRP relative to BTC?

A : A weekly close above the multi-year range top on XRP/BTC would signal a momentum regime shift.

Q4 . How do SMST and MSTR help my crypto view?

A : SMST targets –2x MSTR daily moves. Rising SMST often coincides with pressure on BTC-beta proxies; use as a cross-check, not a primary signal.

Q5 . What dollar levels matter for crypto now?

A : DXY strength toward/above ~100 tends to pressure risk assets; weakness eases conditions.

Q6 . Is Nvidia relevant to crypto positioning?

A : Yes, NVDA’s leadership makes it a proxy for broader risk appetite; rejection/breakout at resistance can tilt crypto beta.

Q7 . Where do bitcoin seasonal trends Q4 2025 fit in risk management?

A : Use it as context only; act on price confirmations (e.g., BTC vs. 50-week SMA) and invalidate quickly when levels fail.