Japan regulations prompt Bybit to phase out local access from 2026

Bybit has announced that it will begin phasing out its services for Japanese residents starting in 2026. According to the exchange, this step aims to ensure full compliance with Japan’s regulatory requirements. Users who might be incorrectly categorized will receive notifications and may be asked to complete additional identity verification to confirm their residency status. Bybit emphasized that the transition will be gradual so customers can adjust smoothly.

This development comes after the platform’s earlier decision in October 2025 to stop accepting new registrations from Japan while it reviewed its compliance processes. The exchange stated that these measures are part of a broader effort to strengthen operational transparency and align with local laws. Existing users are encouraged to stay updated on upcoming changes and follow any instructions provided by the platform.

Why Bybit to discontinue services for Japanese residents

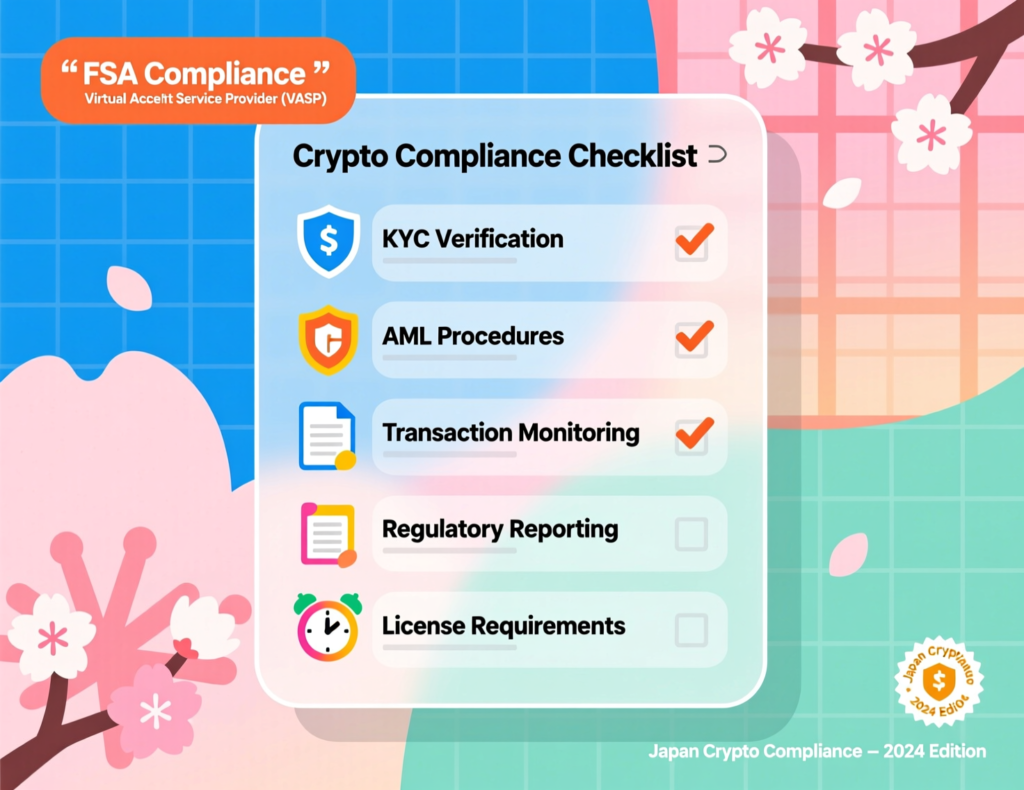

Japan requires any platform serving domestic customers to register as a Crypto-Asset Exchange Service Provider with the Financial Services Agency (FSA). Bybit is not listed among registered entities, and the exchange says it is introducing “gradual restrictions” to comply. Financial Services Agency+2Financial Services Agency+2

What “Bybit to discontinue services for Japanese residents” means for users

Users classified as Japanese residents will face rolling limitations from 2026. Those who believe they have been flagged incorrectly are instructed to complete additional KYC checks. Existing accounts otherwise remain active until restrictions apply; new sign-ups have already been paused since Oct. 31, 2025.

Market context and regulatory backdrop

Japan has tightened oversight of unregistered overseas exchanges. On Feb. 7, 2025, the FSA asked Apple and Google to block downloads of five exchange apps, including Bybit, KuCoin, Bitget, MEXC and LBank. Ongoing policy discussions could further reshape market access.

Bybit’s scale

Bybit frequently ranks among the largest centralized exchanges by trading volume; CoinGecko data shows the exchange’s current 24-hour spot volume around $4.3–$4.4 billion today, with broader research placing it second by market share in 2024.

Compliance and consumer protection

Japan’s rules aim to ensure custody standards, disclosures and Travel-Rule compliance. Exchanges must register, maintain internal controls and meet reporting obligations before serving domestic users.

Analysis

If restrictions begin in 2026 as stated, Japanese users may gradually migrate to FSA-registered platforms. Liquidity fragmentation could affect traders who relied on Bybit’s derivatives markets, but the impact will depend on how quickly local providers expand product breadth.