Is Crypto Legal in UAE? 2026 Guide for US & Europe

Yes, crypto is legal in the UAE in 2026, but it sits inside tightly regulated “virtual asset” frameworks that differ between Dubai, Abu Dhabi and the federal level. Individuals can own and trade crypto using licensed platforms, while businesses generally need a VARA, ADGM or DIFC licence and must follow strict AML, sanctions and consumer-protection rules.

Over the last few years, the United Arab Emirates has gone from “interesting experiment” to one of the world’s most proactive crypto and Web3 hubs, just as the United States, United Kingdom and parts of the European Union tightened enforcement and advertising rules. While Washington debates how to classify tokens and London refines its crypto-asset regime, Dubai and Abu Dhabi have built specialist virtual asset regulators, public rulebooks and clear licensing paths.

So, is crypto legal in UAE? In 2026, the short answer is yes. Individuals can own, trade and use crypto, and businesses can operate exchanges, brokers or custody platforms but only inside regulated perimeters with the right licences and robust AML controls. Crypto is treated as a “virtual asset” or “crypto token” depending on the regime, and unlicensed activity can trigger enforcement rather than being treated as a harmless loophole.

This guide is written for.

US retail traders and founders wondering if a Dubai or Abu Dhabi structure feels safer than living with SEC uncertainty;

UK-authorised (FCA-regulated) firms eyeing a DIFC or ADGM presence;

German and wider EU founders and compliance teams comparing UAE crypto laws with BaFin and MiCA expectations.

Everything here reflects public sources as of early 2026, but it’s not legal, tax or financial advice. Regulations move quickly always check current local rules and speak to qualified UAE and home-country counsel before moving funds or structuring a business.

Is Crypto Legal in the UAE in 2026?

Crypto is legal in the UAE for both individuals and companies, provided activity happens through properly licensed platforms and within the virtual-asset, securities and AML frameworks that vary by emirate and free zone. In plain language: holding Bitcoin or ETH is not banned, but running an exchange, custody solution or DeFi platform without authorisation is a regulatory problem.

What is the current legal status of cryptocurrency in the UAE?

Across the country, owning, trading and using crypto is permitted and treated as a regulated “virtual asset” (Dubai / VARA) or “crypto asset” / “crypto token” (FSRA / DFSA / SCA) rather than as legal tender.UAE federal law and Dubai Law No. 4 of 2022 on Virtual Assets created a formal legal perimeter and established the Virtual Assets Regulatory Authority (VARA) for the emirate of Dubai.

For everyday users in Dubai, Abu Dhabi or visiting from New York, London or Berlin, that means.

You can buy, hold and sell crypto.

You should use UAE-licensed or otherwise properly regulated platforms.

“Legal” does not mean “risk-free”: volatility, hacks, scams and enforcement still apply.

For businesses, crypto sits firmly in a regulated bucket. Exchanges, custodians, brokers, token issuers and similar businesses must be authorised as virtual asset service providers (VASPs) under VARA, ADGM FSRA, DIFC DFSA or relevant federal SCA/CBUAE rules.

How does legality differ for individuals vs businesses?

Individuals

Using licensed exchanges, OTC desks and brokers is generally permitted, whether you are based in Dubai, Abu Dhabi or simply visiting.

You can expect full KYC at onboarding, proof-of-funds checks and monitoring of larger withdrawals or stablecoin flows, especially if you move USD or EUR.

UAE crypto adoption is high: some estimates suggest roughly 30% of the UAE population holds at least one crypto asset, among the highest rates globally. (Verify this percentage against latest surveys.)

Businesses

Most business models spot exchange, brokerage, custody, institutional OTC, token issuance and some DeFi-style products require a VASP-style licence. Operating from Dubai without VARA authorisation, or from DIFC/ADGM without DFSA/FSRA licences, can lead to administrative or even criminal consequences.

Large global exchanges and custodians have pursued UAE licences to serve regional and sometimes global clients, including Binance under the ADGM framework. (Confirm the latest licensing status.)

What does “legal but regulated” mean for US/UK/EU readers?

The UAE is not a “no-rules tax haven” for crypto. Its frameworks are explicitly aligned with Financial Action Task Force (FATF) standards, especially on AML/CTF and the Travel Rule, and regulators actively coordinate with international peers.

For different audiences, that means.

US retail users & founders

Using a UAE platform doesn’t exempt you from SEC, CFTC, FinCEN or IRS rules; US securities and AML views can still “follow” you if you target or on-board US persons.

UK-authorised firms (FCA)

A DIFC or ADGM entity can complement, not replace, FCA permissions. UK rules on financial promotions and crypto marketing still apply when you communicate with UK customers.

German/EU entities (BaFin / MiCA)

BaFin expectations on crypto custody and trading, plus the EU-wide MiCA regime, remain relevant if you serve EU clients, even via a UAE hub. The bigger the cross-border flow, the less safe any “regulatory arbitrage” story becomes.

UAE Crypto Regulators and Zones Explained

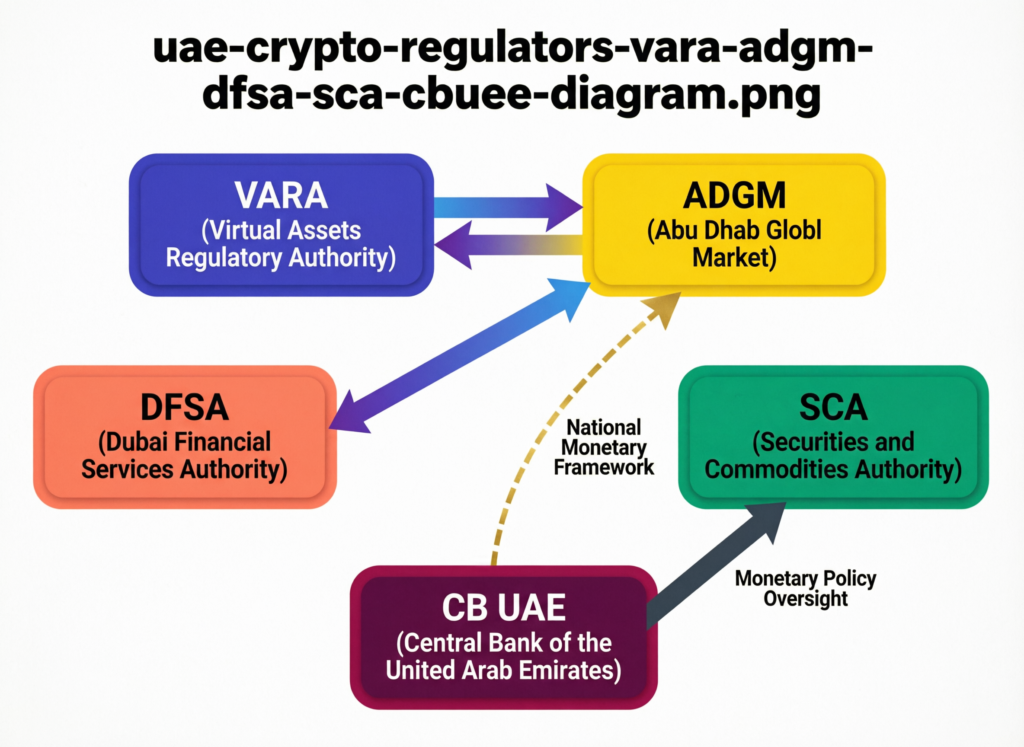

The UAE uses multiple regulators: Dubai’s VARA for most virtual-asset activity in the emirate, Abu Dhabi’s FSRA in ADGM, the DFSA in DIFC, and federal oversight from the Securities and Commodities Authority (SCA) and Central Bank of the UAE (CBUAE) for certain tokens, securities and payments use-cases.

Map of UAE crypto regulators and free zones

At a high level, the map looks like this.

Dubai (onshore + most free zones)

Regulated by VARA for virtual assets, under Dubai Law No. 4 of 2022 and VARA rulebooks.

Dubai International Financial Centre (DIFC)

A separate common-law financial centre with its own regulator, the Dubai Financial Services Authority (DFSA), and a dedicated Crypto Token regime.

Abu Dhabi Global Market (ADGM)

A financial free zone regulated by the Financial Services Regulatory Authority (FSRA), home to one of the region’s first digital-asset frameworks.

Federal layer (mainland UAE)

SCA and CBUAE regulate crypto assets and security tokens at federal level, including payment tokens and certain securities.

Dubai’s specialist virtual-asset regime (VARA)

VARA is the dedicated virtual-asset regulator for all of Dubai’s mainland and free zones, except DIFC.

Oversees licensing and supervision for exchanges, brokers, custodians, lending platforms and certain DeFi-like activities.

Regulates marketing and promotions of virtual assets into and from Dubai under 2024 marketing regulations.

Enforces tech, governance and information-security requirements through compulsory rulebooks, including a Technology and Information Rulebook.

Certain high-risk assets face restrictions. For example, algorithmic stablecoins and privacy-enhancing tokens are limited or prohibited in some VARA rulebooks, aligning with global risk concerns.

ADGM FSRA and DIFC DFSA digital-asset frameworks

In ADGM, the FSRA’s digital-asset framework covers exchanges, custodians, brokers and, increasingly, staking and fiat-referenced tokens. Amendments in 2025 streamlined how virtual assets are accepted within ADGM and refined capital requirements and fees.

In DIFC, the DFSA’s Crypto Token regime (phased in from 2022) defines Crypto Tokens, Fiat Crypto Tokens and certain NFTs, and was significantly updated with new rules effective 12 January 2026 to strengthen market integrity and move toward a “suitable crypto token” framework.

For a UK FCA-regulated fintech in London or a German BaFin-supervised bank in Frankfurt, these frameworks feel familiar: highly specified permissions, risk-based capital and clear expectations on governance, technology and AML.

Licensing Pathways VARA vs ADGM vs DIFC

Foreign founders usually choose between VARA (Dubai), ADGM (Abu Dhabi) or DIFC (DFSA) licences based on their business model, target clients and risk appetite, not just on which skyline they prefer.

Typical business models and where they fit

Broadly (not exhaustively), you’ll see patterns like.

Retail spot exchange / broker / OTC desk

VARA

Often chosen by retail-focused exchanges and Web3 platforms targeting Dubai residents and global users, with strong marketing into MENA.

ADGM

Favoured by more institutional or cross-border players serving family offices and funds.

DIFC

Attractive to firms already in DFSA’s orbit (for other financial services) and now adding Crypto Tokens.

Custody and institutional services

ADGM FSRA and DIFC DFSA often lead here due to their existing institutional client base and explicit custody rules.

Token issuance / launchpads / RWA platforms

Can sit under VARA (Dubai VA Issuance Rulebook) or ADGM/DIFC securities frameworks depending on structure, investor base and whether tokens are securities.

DeFi-style protocols and staking services

ADGM FSRA is experimenting with staking frameworks; VARA and DFSA each consult on DeFi-adjacent activity but are cautious where retail is involved.

How can a foreign founder choose between regimes?

Key decision filters for a US Delaware C-corp, a UK Ltd or a German GmbH include.

Home-country status

If you already hold permissions (e.g., FCA, BaFin, SEC-registered entities), regulators will expect you to explain how the UAE entity fits into the group risk picture.

Target client base

Are you focused on UAE onshore, the wider MENA region, or global users with US/UK/EU customers? The more cross-border retail you serve, the more scrutiny on marketing and suitability.

Licensing timelines & capital

ADGM and DIFC may feel more familiar to traditional financial institutions; VARA may appeal to Web3-native teams willing to build around its evolving rulebooks.

Governance expectations

All three regimes expect real substance in the UAE: local directors, MLRO/Compliance, documented risk and tech governance not just a mailbox.

If you’re thinking about launching an exchange, issuing tokens or running a custodial DeFi protocol, a short scoping exercise with UAE counsel (for example, firms like NeosLegal or other crypto-native practices) is essential before locking in a free zone or spending on entity incorporation.

What is a UAE virtual asset licence in practice?

A UAE virtual-asset or VASP licence typically bundles permissions such as.

Operating a virtual asset exchange or MTF.

Broker-dealer or OTC dealing.

Custody and safekeeping.

Investment advisory or portfolio management.

Lending, staking or other yield products (where allowed)

Applications normally include.

Adetailed business plan and financial projections.

Token-listing and product-governance policies.

An AML/KYC and sanctions framework, including FATF Travel Rule compliance from around USD/EUR 1,000 equivalent.

Technology, cybersecurity and outsourcing documentation.

Governance documents (board, risk, compliance, internal audit)

Compliance, AML and Cross-Border Risk

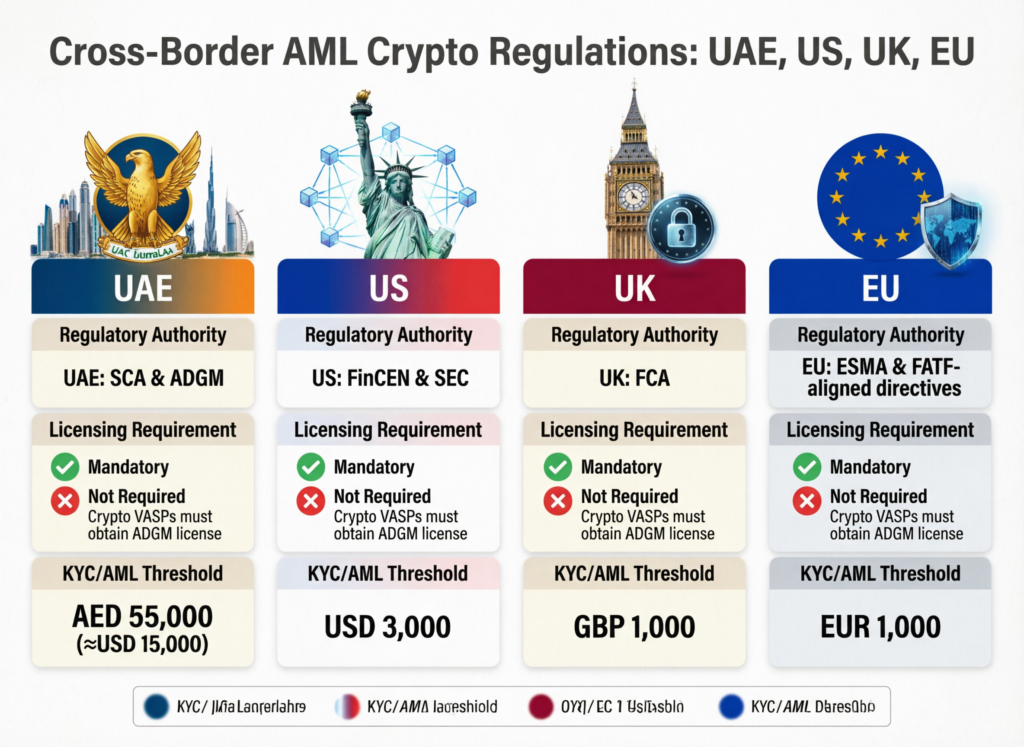

UAE virtual-asset regimes are built around FATF standards, so US, UK and EU users still need to think about home-country AML, sanctions and tax rules when they use UAE platforms or move their business there.

Core UAE AML/CTF expectations for crypto businesses

Whether you are licensed under VARA, FSRA or DFSA, the AML basics look familiar:

Customer Due Diligence (CDD) for new clients, with enhanced checks for higher-risk profiles and cross-border flows;

Ongoing monitoring of transactions and behaviour, with risk-based triggers and alerts;

Suspicious Transaction Reports (STRs) to UAE intelligence units;

Travel Rule compliance when transferring virtual assets above the de-minimis threshold, including sharing originator/beneficiary data with counterpart VASPs.

From a London, New York or Berlin perspective, this means UAE-regulated exchanges should not feel like the “wild west” they will ask for documents, and they will sometimes say no.

How do UAE rules interact with US, UK and EU requirements?

US (SEC / CFTC / FinCEN / IRS)

If US persons trade on your UAE platform, US regulators may view your token or product under US securities or derivatives law, and FinCEN may treat your UAE entity as a money-services business for AML purposes. You also still owe US tax reporting on realised gains as a US person.

UK (FCA, HMRC)

The UK’s crypto-asset financial promotions and AML regime bite when you market into the UK or have UK customers, even if trades settle in Dubai or Abu Dhabi.

Germany/EU (BaFin, MiCA, GDPR)

BaFin’s long-standing views on crypto custody, plus the EU-wide MiCA VASP framework and GDPR/DSGVO, affect how you structure data flows and permissions for EU clients.

In short: a UAE licence can be a strong compliance anchor, but it doesn’t immunise you from obligations where your clients live.

Sanctions, high-risk users and proof-of-funds

International pressure and earlier FATF grey-listing have pushed UAE authorities and VASPs to tighten controls on sanctions, politically exposed persons and high-risk jurisdictions.

US, UK and EU users can expect to provide.

Clear proof of funds (exchange statements, bank records, sale agreements) for larger inflows;

Explanation of ties to any higher-risk jurisdictions;

More frequent reviews if flows look unusual, even if you are based in Dubai or Abu Dhabi.

Practical Setup Exchanges, Banking and Entities

To use the UAE legally and efficiently, most serious users combine a regulated UAE exchange, a compliant UAE or international entity, and a bank or payment partner that understands virtual-asset flows.

Using regulated UAE crypto exchanges from abroad

A “regulated exchange” is one authorised by VARA, FSRA or DFSA (or in some cases by SCA/CBUAE), appearing on the regulator’s public register and subject to ongoing supervision.

Typical onboarding for a non-resident from the US, UK or EU includes.

Full KYC (passport, proof of address, sometimes video verification)

Source-of-wealth and proof-of-funds documentation;

Questions about residency, tax status and whether you are acting for yourself or clients.

If you’re building or integrating such flows, a partner like Mak It Solutions can help with secure account portals, KYC flows and data integrations, drawing on their work for regulated and security-sensitive industries.

Setting up a crypto company in Dubai or Abu Dhabi

For founders, the steps are more involved but repeatable.

Choose your zone and regulator

Decide between VARA (Dubai mainland/free zones), ADGM (FSRA) or DIFC (DFSA) based on your business model and target clients.

Define your activities clearly

Spot exchange? OTC brokerage? Custody? Staking? Regulators licence specific activities, not “crypto” in general.

Run a legal scoping exercise

Work with UAE counsel (e.g., NeosLegal or similar firms) to map whether you need a full VASP licence, a financial-services permission or something narrower such as proprietary trading.

Incorporate and build substance

Form your entity in the chosen zone, appoint local officers, and document governance (board, risk, AML, tech)

Prepare and submit your licence application

Pull together business plan, financials, AML/CTF policies, Travel Rule controls, token-listing and tech documentation

Implement your tech and AML stack, then go live under supervision

Integrate Travel Rule providers, blockchain analytics, secure custody and strong logging/monitoring to keep regulators comfortable.

For US Delaware C-corps relocating core operations, UK or EU startups opening a UAE hub, or German fintechs adding a MENA entity, the principles are similar but tax, substance and group-risk treatment differ that’s where specialised cross-border tax and legal advice becomes mandatory.

Banking, fiat on/off-ramps and stablecoins

Banking remains one of the hardest parts of any crypto setup globally, and the UAE is no exception. Licensed virtual-asset firms can access a growing but still selective pool of UAE banks and international payment providers, with better access where they demonstrate strong governance and clear AML controls.

In practice

AED, USD and EUR rails often run via a relatively small number of UAE and international banks comfortable with virtual-asset flows.

Regulators distinguish between fiat-backed tokens (e.g., regulated stablecoins) and algorithmic stablecoins, with the former increasingly recognised and the latter often restricted or banned.

Why the UAE Became a Global Crypto Hub vs US/Europe

The UAE’s crypto advantage comes from combining clear, dedicated licensing regimes with a national strategy to grow its digital economy, as opposed to the more fragmented or enforcement-driven approaches of some Western markets.

Regulatory clarity and speed vs uncertainty and fragmentation

VARA, FSRA and DFSA publish detailed rulebooks, FAQs and regular updates for example, VARA’s 2024 marketing rules and DFSA’s 2025/2026 Crypto Token enhancements.

ADGM and DIFC lean into public consultations, including on staking and fiat-referenced tokens, whereas the US still often relies on enforcement “by example”.

Tax, lifestyle and time-zone advantages for global teams

Personal income tax remains low or zero for many profiles (subject to home-country rules), and corporate tax is relatively competitive though this is a fast-moving space where bespoke advice is essential.

Dubai’s time zone lets teams serve London, Berlin and much of Asia in the same working day, which matters for 24/7 crypto markets.

For founders who also care about broader digital strategy cloud, AI, data analytics partnering with engineering firms like Mak It Solutions can help align product, security and regulatory needs across US, UK, EU and GCC footprints.

Key risks and misconceptions about “easy regulation”

Despite the hype, UAE regulators are not “light-touch”.

VARA, FSRA and DFSA have each taken enforcement or public action where firms failed to meet conditions or mis-marketed products.

Reputationally, unlicensed activity in Dubai can harm your standing with institutional investors in New York, London or Frankfurt more than a slower but fully compliant path would.

Concluding Remarks

Before you decide whether the answer to “is crypto legal in UAE for me in practice?” is yes, walk through this checklist.

Confirm the legality and tax treatment of crypto in your home country (SEC/IRS, FCA/HMRC, BaFin/Finanzamt, etc.)

Map your business model to VARA, ADGM or DIFC permissions.

Decide if you need a full VASP licence or a narrower activity.

Check sanctions and high-risk country exposure in your user base.

Design an AML/CTF framework aligned with FATF and UAE rules.

Choose a banking / payment partner willing to support virtual-asset flows.

Align data protection with GDPR/DSGVO and UK-GDPR where you serve EU/UK users.

Plan a cloud and security architecture that meets SOC 2 / PCI DSS and local expectations an area where Mak It Solutions’ cloud and cybersecurity experience can help.

Build a board and leadership team regulators will trust.

Set up processes for ongoing monitoring of regulatory updates and enforcement trends.

When you absolutely need bespoke legal and tax advice

DIY is rarely enough if you.

Operate an exchange or large OTC desk.

Custody client assets.

Raise institutional capital from US/UK/EU investors.

Serve retail in multiple high-regulation markets.

In these cases, you’ll need coordinated advice from UAE counsel plus US, UK and EU tax/regulatory specialists. Many founders pair that with technical partners like Mak It Solutions to make sure the implemented stack (wallets, KYC, analytics, reporting) actually meets what lawyers put in the memo.

Where to monitor ongoing regulatory updates

Make this article your starting hub, then follow.

Official sites: VARA, ADGM FSRA, DFSA, SCA, CBUAE, and the UAE government’s digital-properties guidance.

FATF updates on virtual assets and the Travel Rule

High-quality law-firm and specialist insights (including NeosLegal and other crypto-native practices)

And remember: regulation can tighten without much warning. Building conservatively and documenting your decisions now is cheaper than a messy unwind later.

Key Takeaways

Yes, crypto is legal in UAE, but only within regulated frameworks you must distinguish personal investing from operating a business.

Multiple regulators (VARA, FSRA, DFSA, SCA, CBUAE) share the map; your activities and client base determine which licences you need.

US, UK and EU rules don’t disappear when you move to Dubai or Abu Dhabi; cross-border AML, sanctions and tax obligations still apply.

Licensing choice (VARA vs ADGM vs DIFC) depends on whether you target retail vs institutional, trading vs custody vs tokenisation, and your governance appetite.

Compliance and technology are inseparable getting AML, Travel Rule, custody and security right is as important as marketing and UX.

Working with the right partners, from specialist UAE lawyers to implementation teams like Mak It Solutions, can turn the UAE from a regulatory maze into a scalable base for your global crypto business.

If you’re a US, UK or EU founder or compliance lead trying to decide whether the UAE is the right jurisdiction for your next crypto move, you don’t have to piece it together from scattered PDFs and Telegram threads.

Share your current architecture, target markets and regulatory constraints, and Mak It Solutions can help you map the technical side secure exchanges, portals, KYC flows and analytics to the licensing path your legal team chooses.

When you’re ready to stress-test your UAE plan, reach out via the Mak It Solutions contact page or explore their services overview to align your licensing roadmap with a practical, compliant build.

FAQs

Q : Can I legally buy Bitcoin in Dubai as a non-resident tourist?

A : Yes. As a non-resident visiting Dubai, you can generally buy Bitcoin and other cryptocurrencies from UAE-licensed exchanges or OTC desks, subject to KYC checks and any geo-restrictions those providers apply. You’ll still need to verify your identity and may face limits if your home country is considered higher-risk or subject to sanctions. Always make sure the platform appears on the relevant regulator’s public register (VARA, FSRA, DFSA or SCA) before sending funds.

Q : Are UAE-regulated crypto exchanges accessible to US or UK residents, and are there geo-blocking limits?

A : Many UAE-regulated exchanges can technically on-board US or UK residents, but some choose to geo-block or restrict services to reduce exposure to SEC, CFTC or FCA rules. You might be allowed to open an account but face limits on certain tokens, derivatives or yield products, or be required to self-certify that you’re an eligible professional client. Always read the platform’s terms and consider home-country rules on using overseas exchanges.

Q : Do I need a UAE company to get a virtual asset licence, or can I apply as a foreign entity?

A : VARA, ADGM FSRA and DIFC DFSA typically require you to have a locally incorporated entity with real substance board oversight, compliance and operations rather than licensing a purely foreign company. Foreign groups often set up a UAE subsidiary or holding structure, then apply for VASP or financial-services permissions from that local entity. This also helps with banking and staffing, but increases governance and tax-planning complexity, so professional advice is essential.

Q : How risky is it to trade on unlicensed offshore exchanges while living in the UAE?

A : Trading on unlicensed offshore platforms is risky everywhere, and the UAE is no exception. You may find it harder to prove source of funds to banks or regulators, and if the exchange suffers a hack or disappears, you have limited recourse. UAE authorities increasingly emphasise using licensed providers and have taken action where local entities marketed or operated unlicensed platforms. From a risk and compliance perspective, especially if you’re a regulated professional in New York, London or Frankfurt, sticking to authorised UAE or major regulated offshore exchanges is far safer.

Q : What happens if my home regulator (SEC, FCA, BaFin) later changes its view on UAE-based crypto activity?

A : If your home regulator tightens its stance, you may need to adjust or even restrict how you use UAE platforms or entities for example, limiting services to professional clients, exiting certain tokens, or changing where you book trades and custody. In serious cases, regulators can require divestment, client off-boarding or additional capital and controls. Building your UAE strategy on conservative assumptions, documenting decisions and keeping your home-country advisers in the loop reduces the chance of painful surprises later.