Is Bitcoin Halal or Haram? Islamic Crypto Rulings Explained

Most contemporary scholars say the ruling on cryptocurrency is “it depends” some view major coins like Bitcoin as a halal digital asset or commodity, while others consider them haram due to speculation (maysir), uncertainty (gharar) and risks. In practice, Muslims are usually advised to distinguish between different crypto use cases (payments vs day trading vs interest-like products) and to follow trusted local scholars and Islamic finance experts in their own country.

Introduction

For Muslims asking “is cryptocurrency halal or haram in 2025?”, there is no single global answer. Some respected scholars and Shariah boards see Bitcoin and certain crypto assets as a halal digital asset or commodity, while others judge them to be haram or highly problematic because of extreme volatility, speculative trading and widespread scams.

Most contemporary Islamic finance bodies land on a middle position: the permissibility of crypto depends on the specific coin or token, the intention and behaviour of the investor, and the regulatory context (for example, SEC rules in the US, FCA in the UK and BaFin/MiCA in the EU). Muslims are therefore encouraged to treat this as a serious fiqh issue, seek qualified fatwa from trusted scholars, and avoid gambling-like behaviour even on “halal” projects.

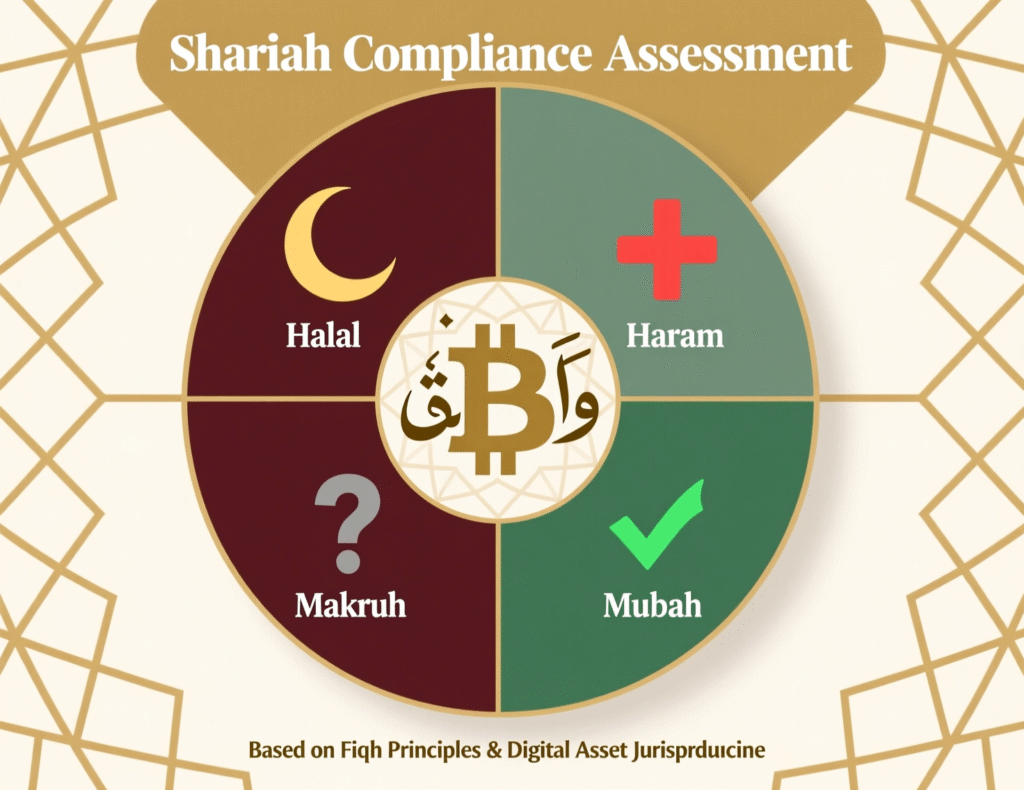

Short Summary of the Main Scholarly Views

In short

Permissible view

Bitcoin and other major cryptoassets can be treated as a kind of digital mal (asset/commodity) that can be owned, transferred and priced, so simple spot buying and holding may be halal if done responsibly.

Prohibited view

Crypto is viewed as too speculative, lacking clear intrinsic value and heavily used for gambling-like trading, so many or all tokens are viewed as haram to trade.

Conditional view (most common)

“It depends” some use cases and structures are closer to halal, others are clearly problematic; Muslims should assess each coin and platform and follow recognised Shariah authorities in their region.

Why There Is No Single Global Fatwa on Crypto

Classical fiqh never dealt with decentralised, borderless digital tokens, so scholars must analogise from gold/silver, fiat money, commodities and financial contracts. Different Shariah boards weigh technology, volatility, regulation and public harm (mafsadah) differently, which explains why scholars in Saudi Arabia, Malaysia, Turkey, Pakistan or the UK sometimes reach different conclusions on the same asset

On top of that, regulation is moving quickly: the EU’s MiCA framework became fully applicable for most crypto-asset service providers in late 2024, with transitional rules running to 2026.The FCA in the UK has also tightened crypto financial promotion rules, and BaFin has been licensing crypto custodians in Germany.These differences in law and consumer protection strongly influence how scholars in New York, London or Berlin assess risk and permissibility.

Educational Content, Not a Fatwa

This guide is educational only. It does not issue a Shariah ruling (fatwa) and does not provide personalised investment advice or tax advice. Every Muslim should:

Consult qualified local scholars or recognised Islamic finance boards.

Consider their own risk tolerance and financial situation.

Comply with local law and tax regulations (IRS in the US, HMRC in the UK, local tax offices in Germany, France, Netherlands, Spain and wider Europe).

How Cryptocurrency Fits into Islamic Finance Concepts

What Counts as Money, Asset or Commodity in Shariah

In classical fiqh, three concepts are key

Money (thaman)

Gold, silver and later state-backed currencies used mainly as a medium of exchange and unit of account.

Property/asset (mal)

Anything lawful, valuable and ownable, including goods, livestock, and today’s shares or real estate.

Ribawi items

Certain categories (like gold, silver and staple foods) subject to strict rules around riba when exchanged.

Most scholars today analyse whether a cryptocurrency is:

functioning more like money (used widely for payments),

treated as a digital asset or commodity (like a digital collectible or infrastructure token), or

effectively a security (profit-sharing or debt-like instrument).

Where it lands affects whether classical riba and sarf (currency exchange) rules apply directly.

Coins, Tokens, Stablecoins, Security Tokens

Not all crypto is the same, so Islamic rulings often differ by type

Coins (e.g., Bitcoin)

Native assets of their own blockchains. Bitcoin is often treated as a kind of digital commodity; some scholars see spot ownership as halal, others object due to speculation.

Utility tokens

Give access to a platform or service; their permissibility depends on the underlying economic activity.

Stablecoins (e.g., USDT, USDC)

Pegged to fiat currencies and backed (in theory) by reserves. Here, scholars scrutinise reserve quality, governance and whether the structure resembles interest-bearing debt.

Security/security-like tokens:

Convey profit-sharing, voting rights or revenue claims. These are analysed much like shares or sukuk screens for haram sectors, high interest income and excessive leverage are applied.

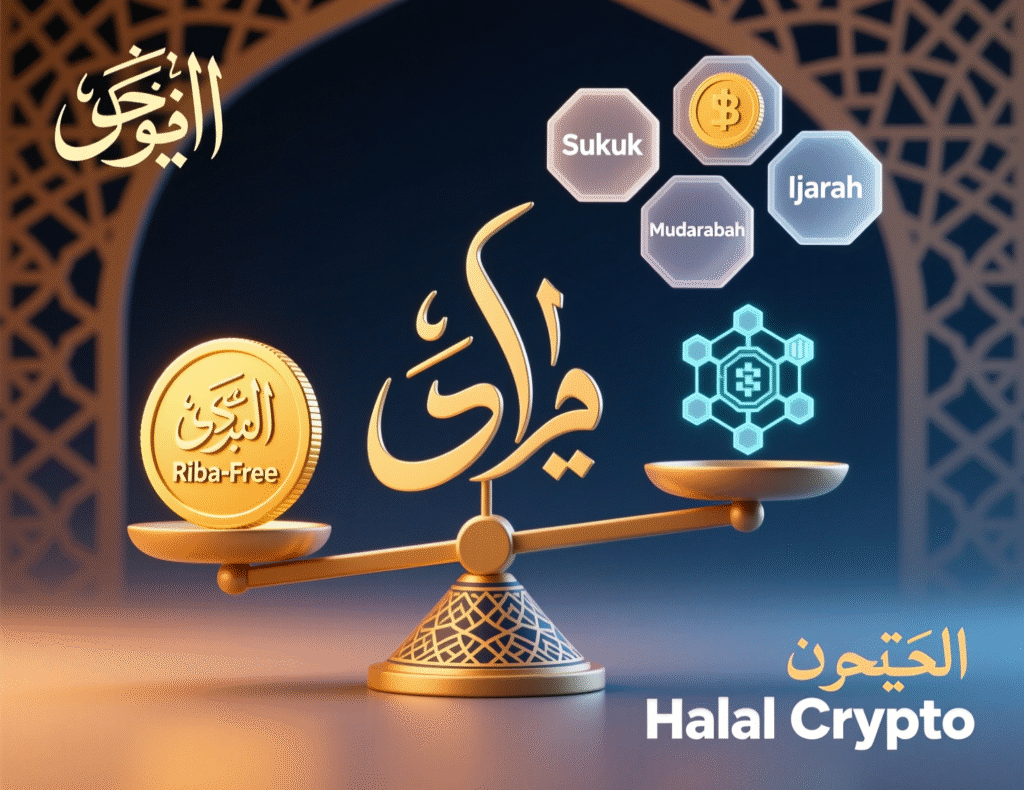

Key Shariah Principles Applied to Crypto: Riba, Gharar, Maysir & Asset-Backing

When assessing Shariah-compliant cryptocurrency projects, scholars repeatedly use the same lenses:

Riba (interest)

Any guaranteed return purely for lending money is riba. Crypto lending platforms paying a fixed “yield” raise immediate red flags.

Gharar (uncertainty)

Very high uncertainty in the subject matter or contract for example, unclear token rights, opaque smart contracts or unverifiable reserves.

Maysir (gambling)

Day-trading with little analysis, meme-coin chasing and leverage purely for thrill can all feel uncomfortably close to maysir.

Real economic activity & asset-backing

Many Shariah-compliant crypto initiatives try to link tokens to tangible assets, real projects, or clearly defined utilities to reduce gharar and maysir.

Scholarly Opinions on Bitcoin & Cryptocurrency

Views That Consider Bitcoin/Crypto Halal or Conditionally Permissible

Scholars and researchers who lean towards permissibility typically argue:

Bitcoin behaves like a digital asset/commodity that people voluntarily buy and sell.

Ownership, transfer and total supply are transparent on the blockchain, reducing certain kinds of gharar.

The Bitcoin protocol does not embed interest (riba); returns come from price movement or productive use, not guaranteed lending.

Several contemporary Shariah councils and research groups in Malaysia, the Gulf, Turkey and Indonesia have published nuanced papers that allow certain crypto dealings while setting strict conditions on speculation, fraud and illegal use. Platforms like Islamic Finance Guru summarise these “pro” opinions to help Muslim investors navigate the space.

Views That Consider Bitcoin/Crypto Haram or Problematic

On the other side, major scholars, including well-known jurists in Pakistan and the Arab world, have issued very cautious or negative views, especially about trading. Common concerns include.

Extreme volatility and speculative manias.

Limited intrinsic value beyond belief and hype.

Widespread use in scams, rug pulls and illegal activity.

Heavy promotion of gambling-like day trading to inexperienced users.

These scholars fear that the harms to individuals and society may outweigh any theoretical benefits, especially in countries where regulation is weak.

“It Depends on the Coin, Use Case and Regulation”

The most common real-world position today is a nuanced middle:

Some coins and use cases (e.g., transparent, well-regulated payment or infrastructure tokens) can be closer to halal.

Other practices (e.g., 100x leverage trading or meme-coin gambling) are very hard to reconcile with Islamic finance principles.

Micro-answer what many Shariah boards require

✅ Real underlying economic activity or utility, not pure hype.

✅ Clear token rights and ownership; transparent governance and audits.

✅ Compliance with local regulation (FCA, BaFin, SEC/IRS, MiCA) and avoidance of interest-based lending or extreme speculation.

Is Bitcoin Halal or Haram in Practice?

Bitcoin’s Features vs Shariah Principles

When Muslims ask specifically “is Bitcoin halal or haram?”, scholars usually analyse the technology first

Fixed supply and decentralisation

Bitcoin’s capped supply and decentralised consensus can be seen as reducing certain political risks in fiat money.

No built-in interest

The protocol does not pay interest; returns depend on price, mining rewards or business use.

Risks

Its price can swing tens of percent in weeks; between late 2024 and late 2025, Bitcoin lost roughly a third of its value over a six-week period, highlighting how volatile it remains.

So, some scholars see Bitcoin as a high-risk but potentially halal asset when bought in modest amounts with long-term intent. Others believe that volatility and speculation make even this too close to maysir.

Owning vs Using vs Trading Bitcoin

It helps to separate use cases.

Buying and holding (HODLing)

Buying small, affordable amounts as a long-term store of value, without leverage, is usually closer to the “conditionally halal” view, especially if it forms a small part of a diversified halal portfolio.

Using Bitcoin for payments/remittances (US–UK–EU)

Paying a freelancer in London from New York, or sending funds from Houston to Berlin using Bitcoin, can be seen as using it as a payment rail. The Shariah question shifts from price speculation to what is being paid for and how transparent/regulated the provider is.

Short-term trading/day trading

Rapid in-and-out trades, using news and memes more than analysis, often looks very close to maysir. Many scholars in the US, UK and Europe warn Muslims against this behaviour even if they consider Bitcoin itself potentially halal.

Bitcoin and Islamic Finance in USA, UK, Germany & Europe

Muslim investors in New York, Chicago, Houston or Dearborn, and in London, Birmingham, Manchester, Berlin, Frankfurt, Paris, Luxembourg or Dublin, face different regulatory landscapes.

In the UK, organisations like Islamic Finance Guru publish fatwa overviews and educational content focused on British Muslims

In Europe, MiCA’s harmonised rules and BaFin’s supervision in Germany are making licensed crypto custody and trading more comparable to regulated investment services.

Across these regions, the pattern is similar: scholars are more open to Bitcoin when investors use regulated, audited platforms, pay taxes correctly, and avoid highly speculative behaviour.

Crypto Trading, Staking & Earning What Is Halal vs Haram?

Spot Buying, Holding & Dollar-Cost Averaging

From a Shariah perspective, simple spot purchases (no leverage, you own real units) are the least problematic:

You buy actual Bitcoin or another asset on a spot market.

You hold it in your own wallet or with a trusted custodian.

You accept gains and losses without guaranteed return.

Many scholars who accept crypto at all see this as the closest to halal, especially if you size positions modestly and treat them more like a speculative satellite allocation than a core holding.

From an Islamic amanah (trust) view, custody matters. Platforms that use robust security frameworks (e.g., cloud providers such as AWS and strong controls comparable to SOC 2 or PCI DSS in the payments world) can give more comfort that your assets are not being recklessly exposed. Mak It Solutions regularly helps SaaS and fintech teams design secure, compliant cloud architectures for this exact kind of use case.

Futures, Leverage, Margin & Perpetual Contracts

This is where many scholars draw a hard line:

Leverage and margin often involve paying or receiving interest on borrowed funds (clear riba).

Perpetual swaps and futures can involve selling what you don’t yet own, very high gharar, and behaviour that closely resembles gambling.

Micro-answers.

“Is crypto trading halal or haram?”

Buying and holding real coins on a spot basis may be closer to halal; high-leverage derivative trading is widely considered impermissible.

“Is leverage trading Bitcoin halal?”

In most scholarly opinions today, using interest-based leverage or margin to trade Bitcoin is not halal because it combines riba, gharar and maysir.

Staking, Lending, Yield Farming & Mining

These activities each need separate analysis

Staking

In some proof-of-stake networks, staking rewards can be viewed as a share of protocol fees or block rewards more like profit-sharing in a joint venture.

In other cases, “staking” is simply locking tokens for a fixed, guaranteed yield that behaves like interest. The structure and source of returns are crucial.

Lending & yield farming

Many DeFi lending protocols pay a variable interest-like return for letting others borrow your crypto; that looks very close to riba for most scholars.

Mining

Mining is easier to justify; miners are paid for work, hardware and electricity. It resembles being paid for providing infrastructure or security rather than lending capital.

Micro-questions addressed

“Is staking halal or riba?” It depends on whether returns are clearly tied to genuine risk-sharing and economic activity or are simply interest by another name.

“Is mining cryptocurrency halal?” Many scholars see mining, done legally and transparently, as closer to halal because it is payment for service and infrastructure.

Regional Lens USA, UK, Germany & Europe Under MiCA

USA Muslim Investors Under SEC Rules and Tax Laws

In the US, crypto exchanges are monitored primarily by the SEC, CFTC and state regulators. The IRS treats most cryptocurrencies as property, meaning capital gains tax applies.

For Muslim investors in New York, Chicago or Houston this means:

Using registered platforms and reporting gains/losses honestly is part of fulfilling both legal and Islamic obligations.

Because roughly 14% of US adults now own some cryptocurrency, Muslims are already participating, intentionally or not.

From a technology perspective, it’s reasonable to favour platforms that run on secure cloud infrastructure and follow rigorous security practices – the same way hospitals follow HIPAA or payment companies follow PCI DSS. Mak It Solutions works with US and European teams to design such architectures, including secure data pipelines and analytics dashboards for compliance reporting.

UK & Wider Europe FCA Rules, Open Banking & MiCA

In the UK, the FCA’s financial promotion rules now apply to anyone marketing crypto to UK consumers, whether or not they are based in the UK. For Muslims in London, Birmingham or Manchester this means

Only engage with platforms that are transparent about FCA registration and risk warnings.

Be wary of aggressive social-media promotions that may breach promotion rules.

Across the EU, MiCA (Regulation (EU) 2023/1114) now provides a harmonised regime for crypto-asset issuers and service providers, with stablecoin rules in force since June 2024 and broader CASP rules applying from December 2024 with a transition into 2026.For Muslims in Paris, Amsterdam or Madrid, MiCA can make it easier to identify firms that meet minimum capital, disclosure and conduct standards.

When signing up to any “halal crypto” platform, look for GDPR/UK-GDPR and DSGVO compliance and transparent data practices, just as you would with banks or health providers.

Germany & Eurozone BaFin Supervision and Local Islamic Finance

Germany is one of the stricter European jurisdictions:

BaFin treats crypto custody as a regulated financial service, requiring licences and ongoing supervision.

MiCA now overlays this with EU-wide rules, giving more clarity to Muslims in Berlin and Frankfurt considering “halal Krypto Investitionen in Deutschland”.

For Shariah-conscious investors in Germany, platforms with clear BaFin licences, audited custody and MiCA-aligned disclosures are a natural starting point though a licence alone does not automatically make an investment halal.

Halal Investing Alternatives & Shariah-Compliant Crypto Checklist

Bitcoin vs Halal Investments Like Sukuk, Stocks, ETFs and Gold

Even if some crypto use cases are potentially halal, it’s important to compare them with more established Islamic finance tools:

Sukuk: typically offer defined cash flows from real assets or projects, screened and certified by Shariah boards.

Halal equity funds & Islamic ETFs (US/UK/EU) invest in screened stocks, excluding interest-heavy and haram sectors.

Gold: long accepted as a store of value, though it still has price risk.

By contrast, Bitcoin and other cryptoassets.

Have far higher volatility (large booms and crashes)

Have less mature Shariah screening frameworks, though this is improving in hubs like the UAE and Malaysia.

For many Muslims in the USA, UK, Germany and wider Europe, it can make sense to treat crypto, if used at all, as a small, high-risk allocation alongside sukuk, screened stocks and gold rather than a replacement.

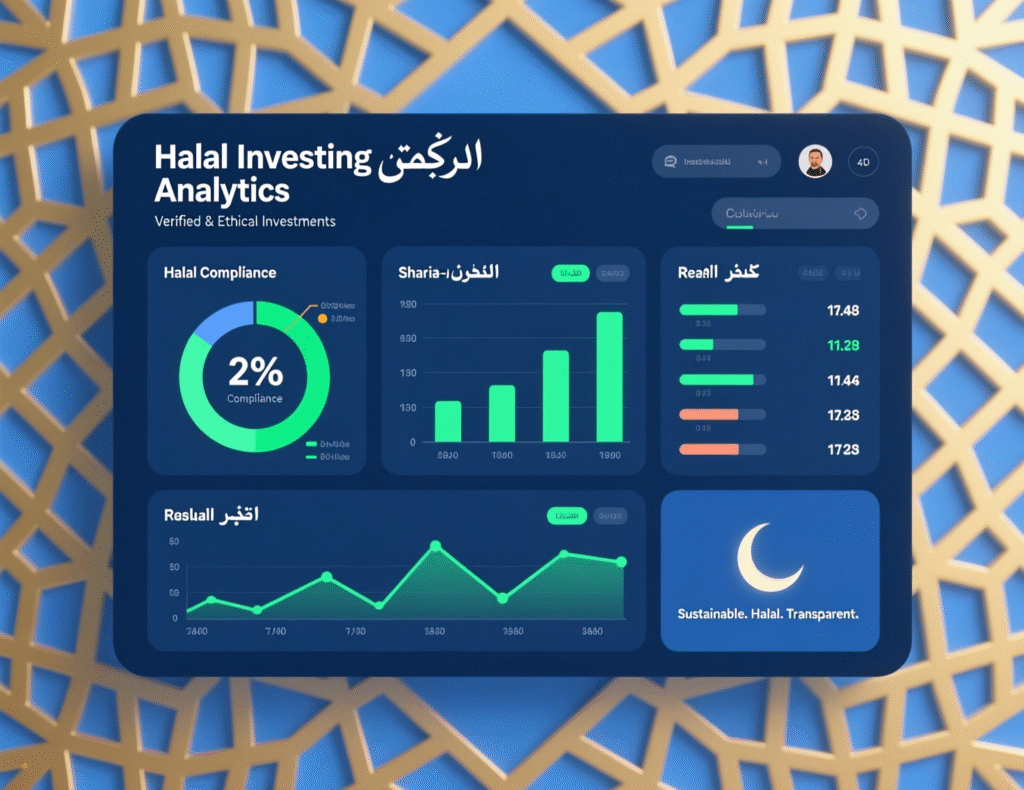

Checklist How to Check If a Crypto Project or Platform Is Halal

Use this practical checklist whenever you assess a coin, DeFi protocol or exchange:

Purpose & real economic activity

What useful product, service or infrastructure does this project provide?

Is it solving a real problem (payments, remittances, identity, finance) or is it mostly hype and memes?

Tokenomics riba, gharar, maysir check

Are returns fixed and guaranteed (suspiciously like interest)?

Is there extreme uncertainty in what token holders actually own?

Does marketing push gambling-style behaviour (lotteries, meme pumps)?

Shariah governance

Is there a credible Shariah board or advisory panel with named scholars?

Are fatwas or Shariah reviews published and kept up to date?

Regulatory status

In the US, does the platform respect SEC and IRS rules?

In the UK, is it registered or clearly interacting with FCA rules?

In Germany/EU, is it BaFin-licensed or MiCA-aligned (e.g., clearly listed as a CASP)?

Tech & data trust markers

Does it run on reputable infrastructure (e.g., AWS, Azure, GCP) with secure architecture and monitoring?

Are there signs of strong security controls (encryption, penetration testing, independent audits) similar in spirit to PCI DSS or SOC 2?

Does the privacy policy clearly reference GDPR/DSGVO or UK-GDPR where applicable?

Platforms that score poorly on multiple checklist items are usually not worth the risk, even if someone claims they have a “halal fatwa”.

When to Avoid Crypto and Focus on Other Halal Options

You should strongly consider walking away when.

The project cannot be explained simply and transparently.

Marketing focuses more on overnight riches than real-world benefit.

Shariah endorsements are anonymous or impossible to verify.

Regulation is weak or actively being bypassed.

In that case, it’s often wiser to focus on well-screened halal equities, sukuk and gold, and to speak with your local imam or Islamic finance expert.

Mak It Solutions doesn’t issue fatwas, but we do help financial organisations in the USA, UK, Germany and wider EU build transparent, compliant data and analytics tools so Muslim investors can see exactly what they own, how it performs and how it interacts with regulations like GDPR and MiCA.

Conclusion Navigating Crypto Halal/Haram Questions in the US & Europe

Key Takeaways for Muslim Crypto Users

Crypto is not universally halal or haram; rulings depend on asset type, structure, behaviour and local regulation.

Spot ownership of major coins like Bitcoin, without leverage or interest, is closer to the potentially halal side – but still high risk.

Leverage, interest-based lending, and gambling-like trading are widely considered impermissible.

Regulatory frameworks like MiCA, FCA rules and BaFin licences can reduce certain harms, but they do not replace Shariah analysis.

For most Muslims in the USA, UK, Germany and wider Europe, crypto (if used) should be a small, carefully evaluated component alongside more established halal options.

Talk to Trusted Scholars and Use Local Guidance

Islamic finance is rooted in accountability and local context. A fatwa appropriate for a retail investor in Dubai might not apply unchanged to someone in New York or Berlin facing different laws and risks. Use trusted scholars, organisations like Islamic Finance Guru for UK-centric education, and local Islamic centres or academic bodies (for example, Islamic finance programmes at universities like King’s College London) to understand the reasoning behind rulings rather than just the headlines.

How Our Platform Supports Shariah-Aware Investing Journeys

At Mak It Solutions, our role is technical, not theological:

We design and build secure SaaS, analytics and mobile platforms that can support Shariah-screening workflows, audit trails and transparent reporting.

We help teams architect cloud environments that are ready for regulations like GDPR, MiCA and local financial-services rules.

Think of it as combining NHS-style governance, Apple-grade user experience and bank-level security for your Islamic-finance or halal-investing products while your scholars and Shariah boards focus on the rulings themselves.

Key Takeaways

There is no single global fatwa on whether cryptocurrency is halal or haram; many scholars take a conditional “it depends” position.

Distinguish clearly between owning, using and trading crypto; not all use cases carry the same Shariah ruling.

Treat leverage, futures, perpetuals, and interest-like yields as red-flag areas that are generally not Shariah-compliant.

Use a structured checklist (purpose, tokenomics, Shariah governance, regulation, tech/security) before trusting any “halal crypto” claim.

Consider keeping crypto, if you use it at all, as a small, high-risk allocation beside more established halal investments such as sukuk, screened equities and gold.

Work with platforms and partners that take compliance, data protection and security as seriously as you take Shariah compliance.

If you’re building tools or platforms for Muslim investors in the USA, UK, Germany or wider Europe, you need a partner who understands both cloud-native fintech and the governance expectations around Shariah-aware products.

Mak It Solutions can help you design secure, analytics-driven platforms that make it easier for scholars, compliance teams and end users to see exactly how crypto and other digital assets fit into their halal investing journey. Explore our services or reach out for a no-obligation discovery call about your roadmap.

FAQs

Q : Can I pay zakat using Bitcoin or other cryptocurrencies?

A : Most scholars who recognise crypto as a form of mal (wealth) say you can pay zakat using it if: (a) you value your holdings at their current fair market value on your zakat date, (b) you meet nisab and one lunar year has passed, and (c) your recipient is eligible to receive zakat. Some scholars still prefer zakat to be paid in local currency to avoid volatility and liquidity issues, so it’s wise to check with your local imam or Shariah board.

Q : Are stablecoins like USDT or USDC considered halal in Islamic finance?

A : Stablecoins are not automatically halal just because they track the US dollar. Scholars examine how reserves are held, whether there is any interest-bearing structure, and how transparent the issuer is. Some see fully reserved, well-audited stablecoins as more acceptable for payments, while others remain cautious due to counterparty risk and potential riba exposure in how reserves are invested.

Q : Does using a regulated exchange (for example under FCA or BaFin) make crypto trading more likely to be halal?

A : Using a regulated exchange supervised by bodies like the FCA in the UK or BaFin in Germany can reduce fraud, custody risk and compliance problems, which is positive from a Shariah risk-management perspective. However, regulation alone does not make an investment halal; the underlying asset, contract structure and your own behaviour (e.g., avoiding leverage and gambling-like trading) still need to meet Islamic finance principles.

Q : Is it permissible to receive my salary or freelance payments in cryptocurrency?

A : Many scholars consider it permissible in principle to be paid in crypto if both parties agree, the work itself is halal, and your local law allows it. The key practical issues are volatility (your income can swing in value), tax reporting (IRS, HMRC or EU tax authorities still expect accurate declarations) and your ability to convert into fiat when needed. If those are manageable and the asset itself is judged halal by scholars you trust, receiving payment in crypto can be acceptable.

Q : How should Muslim investors treat crypto profits and losses for zakat and tax purposes in the US, UK and EU?

A : For zakat, most contemporary scholars treat crypto similarly to other investment assets: you calculate the market value of your holdings on your zakat date and pay zakat if you meet nisab, while real trading profits are included in your total wealth. For tax, you must follow local law for example, capital gains treatment in the US and UK. Getting this wrong can create legal issues, which is itself problematic Islamically, so it’s prudent to work with a tax professional familiar with crypto in your jurisdiction.