Institutional-Grade Crypto

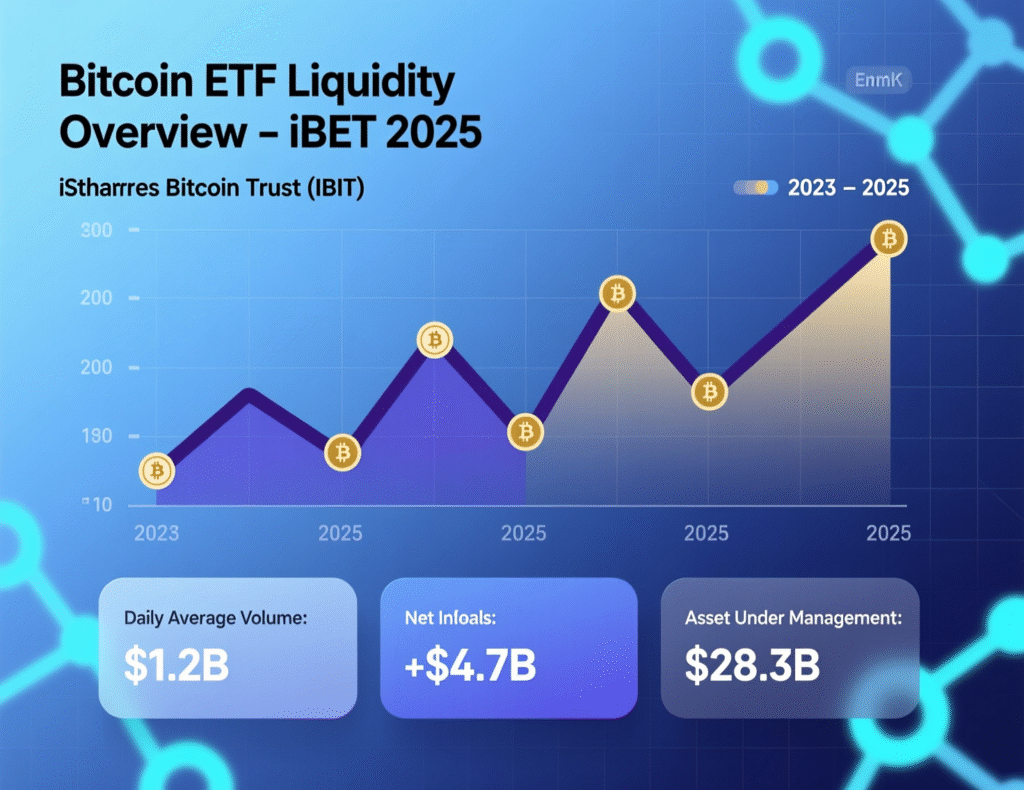

Institutional-grade crypto has moved from “pilot” to “program.” In 2025, hedge funds, pensions, endowments and increasingly sovereign wealth funds now access bitcoin and ether through regulated spot ETFs, institutional custody, and exchange-cleared derivatives. BlackRock’s iShares Bitcoin Trust (IBIT) is closing in on $100B AUM, a historic scale that signals mainstream portfolio inclusion and deep secondary-market liquidity.

At the same time, survey data show a decisive shift in intent: 59% of institutional investors plan to allocate over 5% of AUM to digital assets or related products. And sovereign wealth funds are beginning to move: Luxembourg’s FSIL publicly disclosed a 1% allocation to Bitcoin ETFs a first in the Eurozone and a watershed in policy signaling for state capital.

This guide distills what institutional-grade crypto means in practice across governance, custody, liquidity, risk, regulation, and reporting and maps concrete allocation paths for hedge funds through to sovereign wealth funds. You’ll find a pragmatic checklist, reference architectures, and case snapshots to de-risk design choices while aligning with frameworks like Basel’s crypto-exposure treatment and ADGM’s updated digital-asset regime.

What “Institutional-Grade Crypto” Really Means

Institutional-grade crypto is a standards-driven operating model that lets large allocators access digital assets with the same rigor they apply to public equities, fixed income, or commodities. Core dimensions:

Governance & Policy

Investment policy statements (IPS) that define eligible assets (e.g., BTC, ETH, tokenized T-bills), wrappers (ETF, ETP, SMA, fund), benchmarks, and rebalancing rules.

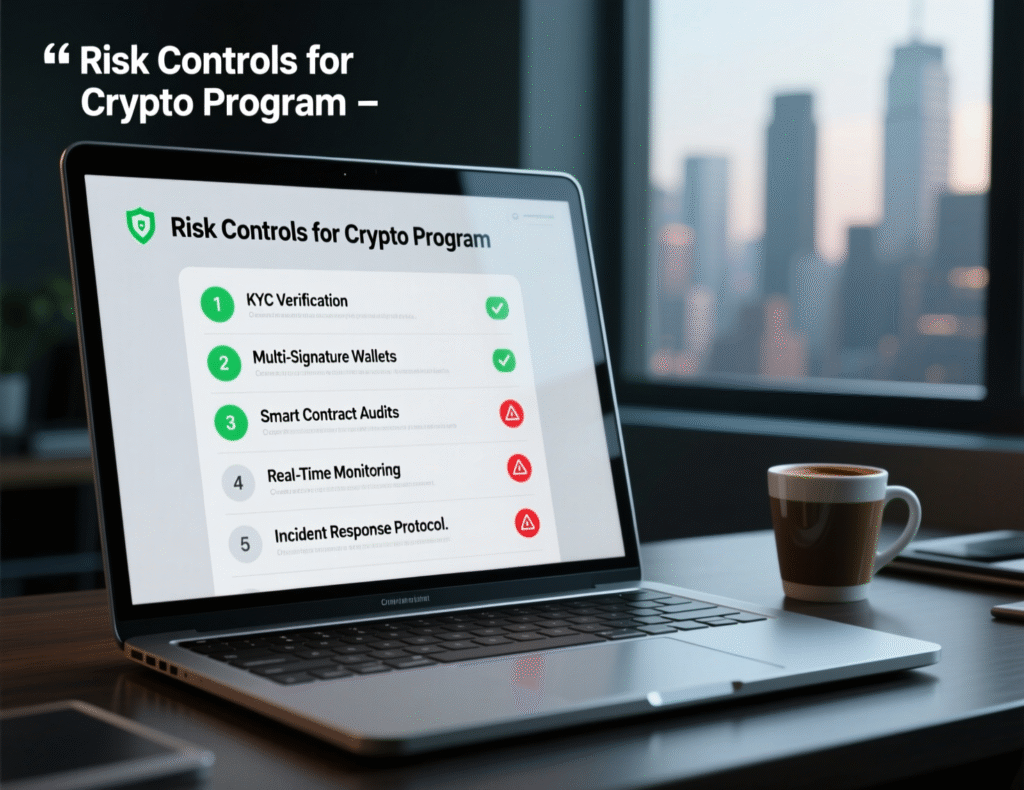

Risk Management

Market, liquidity, counterparty, operational, cyber, and compliance risks quantified with VaR/stress; Basel-aligned bank interactions for financing and collateral.

Custody & Controls

Qualified custodians, segregation of duties, SOC 2 / ISO 27001, MPC wallets, disaster recovery, and real-time reconciliation. (Examples: BlackRock’s IBIT uses Coinbase Prime as affiliate custodian partner; Fidelity Digital Assets custodies FBTC.)

Liquidity & Execution

Access across ETFs, CME futures/options, spot venues, RFQ/primes, with TCA and slippage controls.

Compliance & Reporting

KYC/AML, audit trails, NAV strikes, price sources (CME CF), board reporting.

Market Reality in 2025: Why Institutions Are Comfortable Now

Scale & Access

IBIT’s march toward $100B AUM demonstrates both demand and robust primary/secondary liquidity; comparable spot funds from Fidelity (FBTC) and others round out choice.

Demand Signals

In EY & Coinbase’s 2025 survey, 59% of institutions plan to allocate >5% AUM to digital assets; 83% plan to increase allocations.

Regulatory Clarity

Basel’s published chapter on cryptoasset exposures and regimes like ADGM’s 2025 updates reduce ambiguity for banks and allocators.

Sovereign Signposts

Luxembourg’s FSIL invests 1% via ETFs policy acceptance at the state-fund level.

Allocation Paths by Institution Type

Hedge Funds: Opportunistic to Multi-Strat

Use cases

Directional BTC/ETH, basis trades (ETF/futures), options overlays, alt-beta baskets, relative value, event-driven around protocol upgrades.

Typical wrappers

Spot ETFs for mandate-friendly exposure; CME futures for leverage and cash-settled hedging; segregated custody for active strategies.

Why now

Depth/liquidity and derivatives access; survey evidence of increased crypto allocations among hedge funds through 2024–2025.

Controls checklist (HF)

Prime brokerage with segregated collateral and rehypothecation controls

Daily independent pricing (CME CF), T+0 cash/position reconciliations, trade-level TCA

Counterparty scorecards across exchanges, RFQ desks, and clearers

Derivatives mandates aligned to risk limits (e.g., delta notional caps, Vega limits)

Pensions & Endowments: Programmatic, Low Friction

Use cases

1–3% policy sleeve in Institutional-Grade Crypto via spot ETFs to minimize ops complexity; tokenized T-bill funds for yield and settlement efficiency (policy-dependent).

Why now

ETF structure fits board oversight, transparent fees, familiar operational models.

Controls checklist (PE)

IPS addendum: eligible ETFs, liquidity tiers, rebalancing bands

Benchmark selection (e.g., CME CF BRR-NY) and tracking-error limits

Annual custodian due diligence; SOC 2 Type II attestation

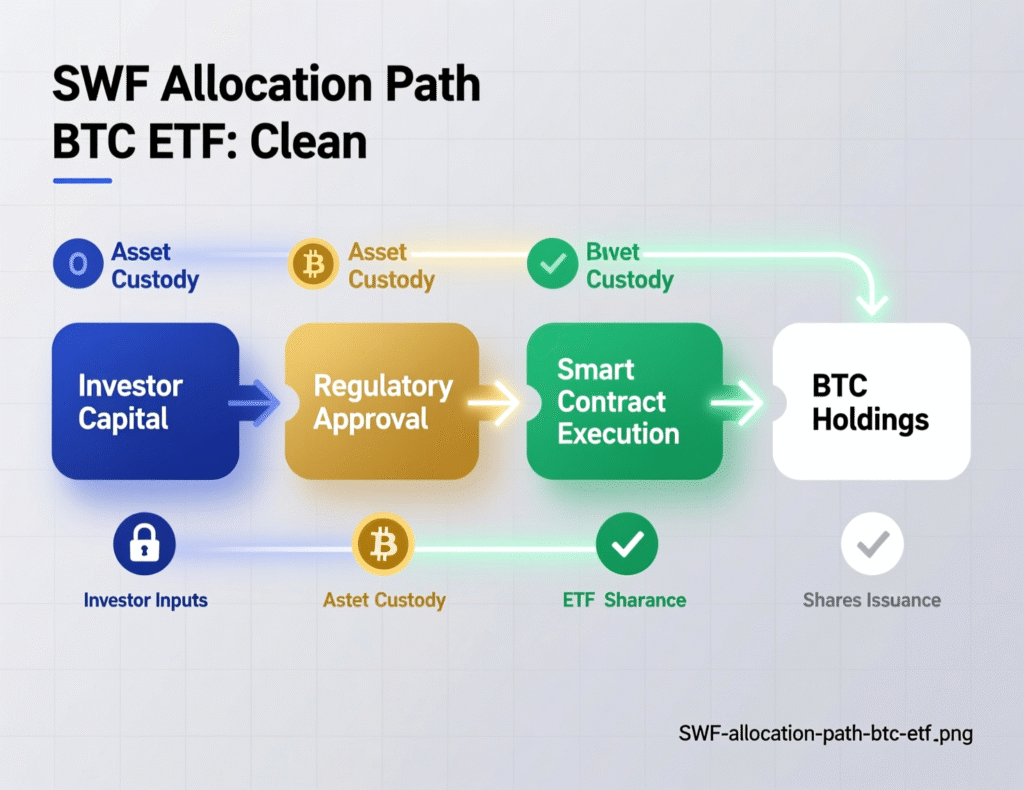

Sovereign Wealth Funds: Strategic & Policy-Signaling

Use cases.

ETF pathway

(Luxembourg model): regulated exposure with minimized custody frictionIndirect exposure

Via public equities holding BTC on balance sheet (e.g., MSTR)—historically used by some SWFs as a bridge stepDirect + Co-Invest

Later stage data centers, tokenization platforms, or digital-asset exchanges in regulated hubs (e.g., ADGM), subject to national policy

Why now

Policy frameworks maturing; peer signaling (FSIL 1% allocation).

The Institutional-Grade Crypto Stack (People, Process, Tech)

Governance & Risk (H2: includes main keyword)

Board-level policy for institutional-grade crypto exposure

Asset scope, max weights, wrappers, liquidity SLAsRisk

VaR, stressed VaR with crypto-specific scenarios; pre-trade checks; daily factor attributionCapital & Collateral

Engage banking partners aligned to Basel’s crypto treatment (Group 1/2 assets, risk weights, add-ons).

Custody Architecture

Qualified Custodian with

Cold/warm MPC, role-based approvals, key-ceremony logs, SOC 2/ISO 27001, insurance, and segregated on-chain accountsETF Route

Leverage regulated fund custody (e.g., Coinbase Prime for IBIT; Fidelity Digital Assets for FBTC).

Liquidity & Execution

ETFs/ETPs for policy-friendly exposure and intra-day liquidity (IBIT nearing $100B).

Futures & Options (CME) for hedging, basis, and overlays

RFQ/Block for large spot; TCA to prove best execution

Compliance & Audit

KYC/AML at counterparties, travel-rule compliance for direct on-chain flows

Independent pricing (CME CF), NAV control, audit-ready logs

Regime mapping: MiCA (EU) for ETP issuers/custody; ADGM updates in 2025 for digital-asset activities; local licensing where applicable.

Case Snapshot #1: ETF-First Hedge Fund, Q1–Q3 2025

Mandate

2% NAV in institutional-grade crypto beta, options overlay ±50 bps tracking error

Implementation

Core via IBIT + FBTC; hedge with CME futures

Outcomes

Tight tracking, improved liquidity during rebalances; documented best-ex via TCA. IBIT depth/liquidity reduced implementation shortfall as AUM scaled toward $90B+.

Case Snapshot #2: Sovereign Wealth Fund (Luxembourg)

Mandate:

1% strategic allocation, ETF-only

Rationale:

Regulatory clarity, simplified custody, political risk management

Outcome:

Public disclosure catalyzed peer review; policy framework now a template for other EU SWFs. globalgovernmentfintech.com+1Deep-Dive: What Can Still Go Wrong?

Liquidity Gaps

Weekend moves; ETF/underlying dislocations manage with circuit breakers and “trade windows.”

Counterparty/Operational

Exchange outages; ensure multi-venue redundancy and warm-wallet runbooks.

Valuation

Use CME CF as primary; define fallbacks; document price challenge process.

Regulatory Drift

Track updates to Basel, MiCA RTS, and regional regimes (e.g., ADGM consultations on staking 2025).

Building Your Institutional-Grade Crypto Program (Step-by-Step)

Policy & Mandate Design

Define objectives (inflation hedge, diversification, uncorrelated return). Set max allocations, drawdown triggers, derivatives permissions.

Wrapper Selection (ETF vs Direct vs SMAs)

ETF/ETP

Fastest, highest governance fit; tight ops. (IBIT/FBTC scale supports liquidity.) Direct Custody

Needed for staking/active strategies; higher ops burden; use qualified, audited custodians.

SMAs / Funds-of-Funds

For specialized mandates or multi-manager diversification.

Counterparty & Custody DDQ

SOC 2 Type II, insurance, MPC details, key ceremonies, segregation proofs, incident history, service-level metrics.

Execution & Hedging

RFQ panels, algos, pre-trade risk; futures for beta/hedge; options for downside protection.

Reporting & Oversight

Board dashboards: exposures, VaR, slippage, realized/unrealized P&L, compliance flags.

Annual policy review; scenario drills and tabletop cyber exercises.

Advanced Topics for 2025

Tokenization & Cash Management

The emergence of tokenized T-Bills and money-market funds enables on-chain settlement with off-chain yields appealing for treasurers seeking instant collateral mobility. (Assess policy constraints and domicile risks.)

Nation-State & SWF Adoption Watch (H2: includes main keyword)

Luxembourg FSIL

1% via BTC ETFs (first Eurozone SWF to disclose)

Norway’s GPFG (NBIM)

Increased indirect bitcoin exposure via equities holding BTC, per 2025 analyses; SWFs globally manage ~$13–14T in assets.

Expect more ETF-based institutional-grade crypto allocations as regulatory clarity and ETF liquidity deepen.

Tools & Benchmarks You Can Trust

ETF Fact Pages: IBIT (AUM, benchmark, basket data).

Issuer-Custody Notes: Fidelity Digital Assets custody model for FBTC.

Surveys: EY/Coinbase Institutional Investor Survey 2025 for allocation intent.

Regulatory: BCBS Cryptoasset Exposures, ADGM framework updates and consultations.

Concluding Remarks

Institutional-grade crypto has matured into a repeatable operating model: defined policy, qualified custody, liquid wrappers, and audit-ready reporting. Hedge funds use it for basis and overlays; pensions and endowments prefer ETFs for governance fit; sovereign wealth funds are starting to allocate as Luxembourg’s FSIL illustrates signaling durable policy acceptance.

With Basel-level guidance, ADGM-style regimes, and ETF liquidity approaching blue-chip scale, CIOs can treat bitcoin and ether as program assets rather than experiments. The practical path is clear: start with ETF exposure sized to risk tolerance, industrialize controls, then expand to direct custody or tokenized instruments if policy and capability warrant. Build it once, govern it always that’s institutional-grade crypto.

CTA:

Want a tailored blueprint for your investment committee? Get our Institutional-Grade Crypto Program Pack policy templates, DDQs, and implementation checklists.

FAQs

Q : How do we start with institutional-grade crypto if our board is cautious?

A : Begin with a small ETF sleeve (e.g., IBIT/FBTC) governed by an IPS addendum, tracking a transparent benchmark (CME CF). This minimizes custody complexity and offers audit-ready reporting while you build risk and operations muscle.

Q : How much should hedge funds allocate initially?

A : Common practice is 0.5–2% NAV for beta, with derivatives overlays. Scale after demonstrating process-discipline, TCA, and drawdown management tied to risk-budget. (See hedge-fund adoption trends through 2024–2025.)

Q : How does custody for institutional-grade crypto differ from retail?

A : Institutions use qualified custodians with MPC, role-segregation, insurance, SOC 2 audits, and formal key ceremonies—plus independent pricing and reconciliation. ETF wrappers outsource most of this to the issuer’s ecosystem (e.g., Coinbase Prime, Fidelity DA).

Q : How can we hedge crypto exposure?

A : Use CME futures for beta control, options for tail-risk, and disciplined rebalancing around corridors. Document overlays and stress tests in the IPS. (Benchmarks: CME CF indices.)

Q : How do sovereign wealth funds approach crypto?

A : Most start with ETF exposure for policy optics and custody simplicity. Luxembourg’s FSIL disclosed 1% via BTC ETFs in Oct-2025, a model peers can examine.

Q : How does Basel treat bank crypto exposures?

A : BCBS sets prudential treatment for cryptoasset exposures—capital, risk weights, and classification informing bank relationships and financing terms.

Q : How can we prove ‘best execution’?

A : Adopt multi-venue RFQ, algorithmic execution with slippage limits, and produce TCA reports comparing fills to composite benchmarks.

Q : How do tokenized cash instruments fit?

A : They can improve settlement speed and collateral mobility. Start with limited pilots within your policy constraints and domicile rules.

Q : How can we measure adoption momentum?

A : Use ETF AUM (e.g., IBIT trending toward $100B) and institutional surveys (EY/Coinbase) as leading indicators alongside your own liquidity screens.