Indonesia’s digital rupiah CBDC to get ‘stablecoin’ companion backed by government bonds

Bank Indonesia plans to issue tokenized versions of government bonds (SBN) as digital central bank securities, integrated with its upcoming digital rupiah. Governor Perry Warjiyo described this initiative as part of the “Indonesia digital rupiah stablecoin” concept, highlighting its role in modernizing the country’s financial infrastructure.

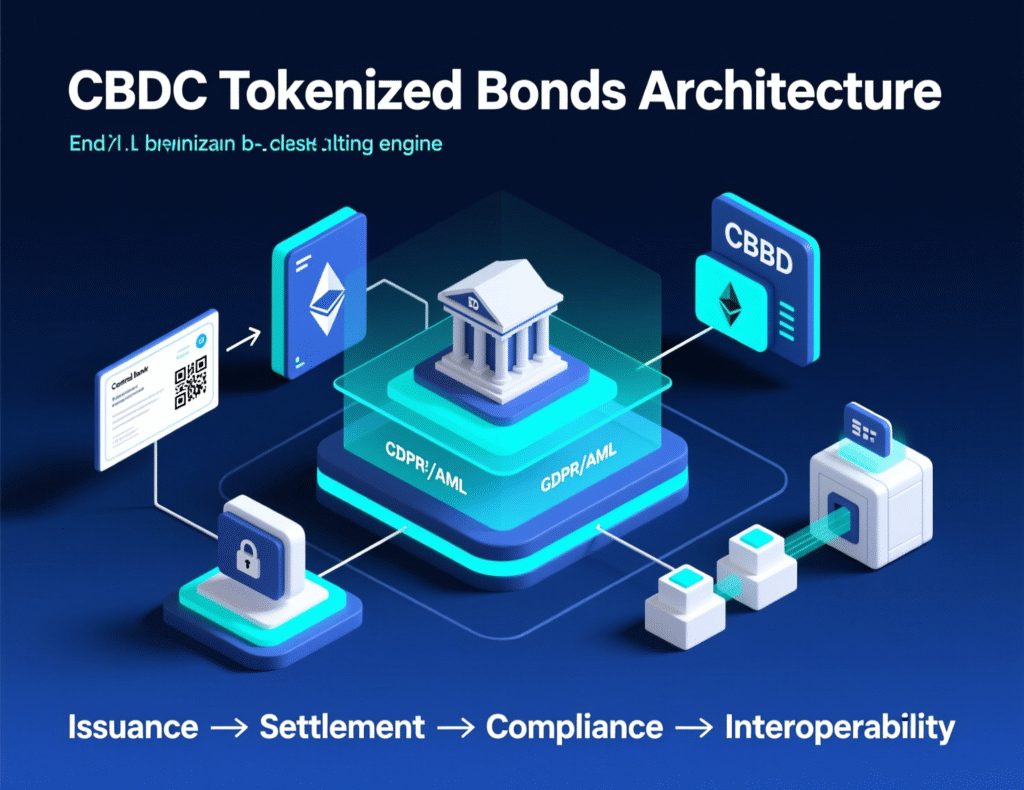

The project combines blockchain-based tokenization with central bank monetary operations, allowing for more efficient and transparent transactions. Each tokenized security will remain backed by high-quality sovereign assets, ensuring stability and trust. This move positions Indonesia among the leading economies exploring blockchain technology to enhance liquidity management, support financial innovation, and strengthen the integration between digital currency systems and traditional monetary tools.

What is the plan? BI’s tokenized SBN as a “stablecoin version”

BI intends to create digital central bank securities by tokenizing SBN and issuing them on infrastructure tied to the digital rupiah CBDC. In the governor’s words: “We will issue Bank Indonesia securities in digital form — the digital rupiah with underlying SBN, Indonesia’s national version of a stablecoin.” The framing stresses: (1) central bank issuance, (2) SBN collateralization, and (3) integration with BI’s evolving payment/money system strategy.

How the Indonesia digital rupiah stablecoin would work

Underlying asset

Indonesian government bonds (SBN).

Issuer/Operator

Bank Indonesia, leveraging the digital rupiah CBDC rails.

Design intent

Provide a price-stable, on-chain instrument for settlement/liquidity management, with programmability and auditability.

Legal-tender note

Stablecoins are not legal tender in Indonesia; fiat rupiah and (in future) the digital rupiah remain sovereign money.

Why now?

Market reality

Stablecoins already see use for hedging and transfers; oversight is tightening with AML and reporting requirements.

Adoption context

Indonesia ranks among the top countries in global crypto adoption, including strong DeFi participation.

Policy arc

Part of BI’s long-running payment-system modernization and CBDC (digital rupiah) roadmap.

Oversight, legality, and market structure

Legal tender

Only rupiah (and ultimately digital rupiah) is legal tender. Privately issued stablecoins are not legal tender, though monitored.

Regulatory perimeter

OJK is stepping up oversight on stablecoin use cases for payments/remittances under AML/CFT and reporting obligations, reflecting growing market activity.

Tax climate (2025 changes)

Indonesia updated crypto taxation this year raising certain income tax rates on crypto sales (with different rates domestically vs. offshore platforms), revising mining VAT/PPN treatment, and streamlining rules. This shapes incentives for domestic platforms and users.

Macroeconomic and payment-system implications

Liquidity & settlement

Tokenized SBN on CBDC rails could enable near-instant, atomic settlement for interbank and capital-market workflows.

Transparency/control

On-chain issuance lets BI trace flows and enforce policy constraints while preserving monetary sovereignty.

Risk management

SBN backing plus central bank governance aim to curb volatility typical of private stablecoins.

Interoperability

Potential cross-border uses would hinge on standards and bilateral arrangements (e.g., wholesale CBDC corridors).

Potential use cases if implemented

Interbank collateral & repo

Programmable, tokenized SBN for intraday liquidity.

Capital markets

Faster primary issuance/secondary settlement for sovereign debt.

Treasury & corporate payments

On-chain cash management with reduced counterparty/settlement risk.

Retail spillovers (future-dependent)

If policy permits, wallets could hold tokenized SBN claims as safer value stores.

Context & Analysis

By anchoring the instrument to SBN and issuing it via the central bank, BI places itself at the core of Indonesia’s tokenization stack rather than ceding settlement layers to private stablecoins. That can reduce currency substitution risk and keep seigniorage/monetary policy transmission intact, while still delivering programmable settlement. The effectiveness will depend on technical design (wholesale vs. retail access), interoperability, and clear legal frameworks distinguishing CBDC, tokenized securities, and private stablecoins.

Outlook

Bank Indonesia’s “stablecoin version” marks a major move toward bringing sovereign debt onto the blockchain and enabling settlements through its digital rupiah. This approach reflects the central bank’s intent to merge traditional financial instruments with next-generation digital infrastructure.

If pilot programs advance smoothly and legal as well as tax frameworks mature, Indonesia could set a benchmark for the region. The initiative may demonstrate how tokenized public debt can operate within a central bank managed digital currency system, potentially reshaping how governments issue, trade, and settle sovereign assets in the digital economy.

FAQs

Q : What is BI’s “stablecoin version”?

A : A tokenized, SBN-backed digital security issued on digital rupiah CBDC rails, designed for stable value and settlement use.

Q : Is it legal tender?

A : No. Only rupiah (and future digital rupiah) is legal tender. The instrument is a digital security backed by SBN.

Q : How is this different from private stablecoins?

A : It’s issued and managed by the central bank and backed by government bonds, not by private reserves.

Q : When will it launch?

A : BI has announced intent; detailed timelines, pilots, and access models are pending official releases.

Q : Will it replace other stablecoins in Indonesia?

A : Not automatically. OJK oversees market conduct; private stablecoins remain non-legal tender and subject to compliance.

Q : How does taxation affect usage?

A : 2025 rules adjusted taxes on crypto transactions/mining and classification; exact impacts depend on activity and platform.

Q : Does this relate to the keyword “Indonesia digital rupiah stablecoin”?

A : Yes. That term refers to BI’s plan for SBN-backed digital securities on CBDC rails.

Facts

Event

BI outlines tokenized SBN-backed digital securities on digital rupiah CBDC (“national stablecoin version”).Date/Time

2025-10-30T10:00:00+05:00Entities

Bank Indonesia (BI); Perry Warjiyo (Governor); OJK (Financial Services Authority); Government of Indonesia; Chainalysis (Index).Figures

Rankings in 2025 Global Crypto Adoption Index: Indonesia overall 7th; DeFi value received 4th (per Chainalysis).Quotes

“We will issue Bank Indonesia securities in digital form — the digital rupiah with underlying SBN, Indonesia’s national version of a stablecoin.” — Perry Warjiyo.Sources

CNBC Indonesia (news), Chainalysis (index), Indonesian MoF/Reuters (tax changes).