How the Ethereum vs Solana war ended quietly not with a bang but a whimper

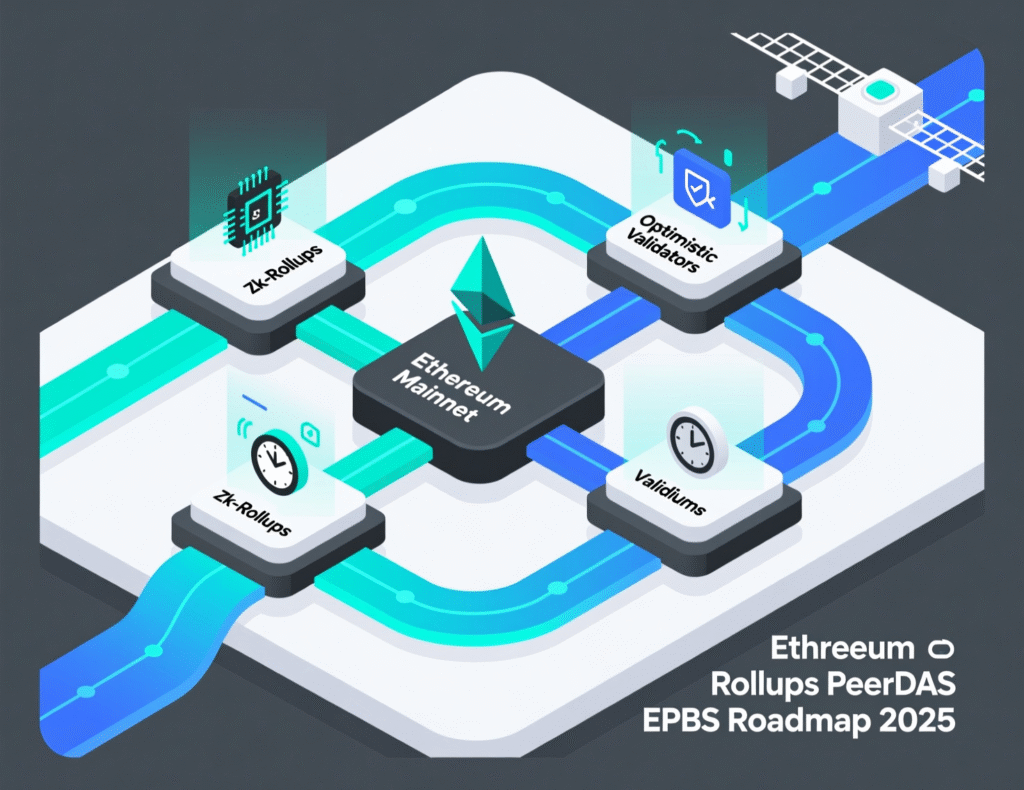

In 2025, the “which L1 wins?” debate shifted toward a focus on architectural fit rather than rivalry. Ethereum matured into a global settlement layer, delegating most execution to rollups that enhance scalability and customization. This modular design prioritized flexibility, interoperability, and security for developers building across ecosystems.

Meanwhile, Solana advanced its monolithic architecture, pursuing a unified, high-performance ledger that delivers exceptional speed and efficiency without relying on external layers. Its approach emphasized simplicity, real-time performance, and seamless user experiences. The conversation between Ethereum and Solana is no longer a cultural divide it’s now about choosing the right technical foundation for each project’s goals.

Monolithic speed vs modular finality

Solana collapses inclusion, confirmation, and finality into tight windows: ~400–600 ms slots and confirmations that feel instant to end users, with finality on the order of seconds to a dozen seconds when the network is healthy. solana.com

By contrast, Ethereum separates concerns. L2 sequencers give sub-second soft confirmations while economic finality arrives when the rollup posts to L1 and dispute/validity windows close. Rollup clocks are fast Arbitrum at ~250 ms blocks and OP Stack at ~2s so UX feels instant for most apps even if settlement trails.

What users actually feel during congestion or failure

Solana fees & flow

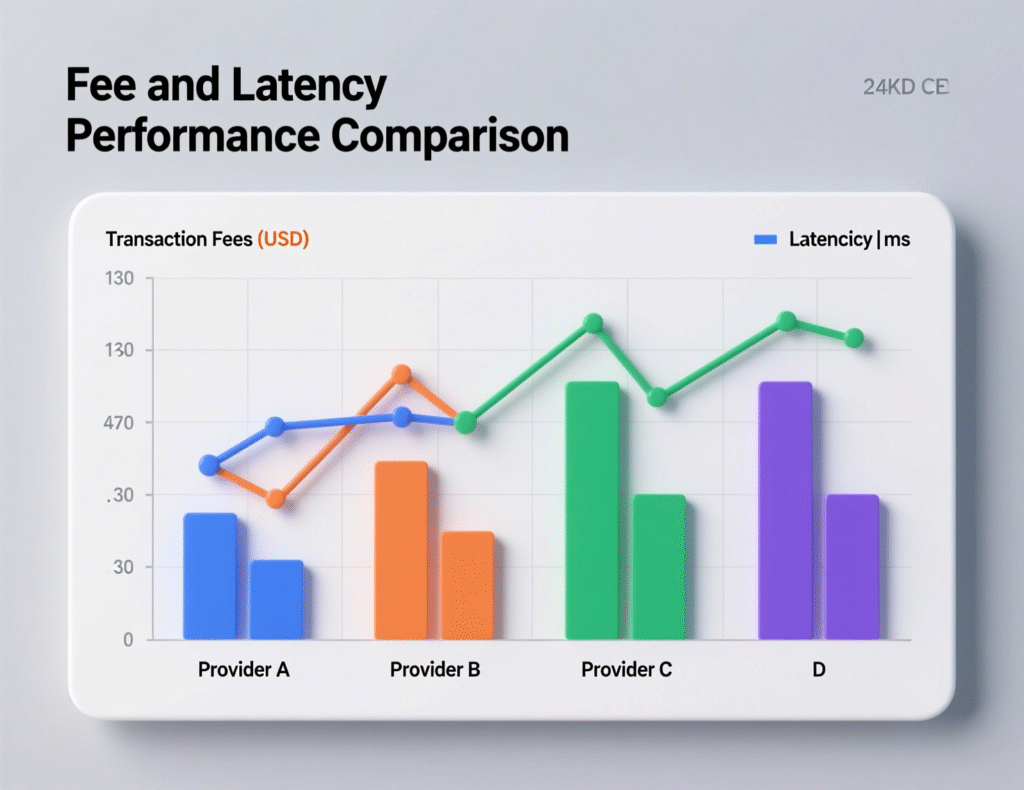

A fixed base signature fee with priority fees and stake-weighted QoS smooths inclusion during spikes. Most retail transactions remain under a cent; when failures happen, impact is global, as seen in the Feb. 6, 2024 halt later resolved by a validator restart.

Rollup fees & flow

Post-Dencun and Pectra, blob capacity increases helped push typical L2 “send” costs to low cents, but sequencer outages can pause a single rollup even when Ethereum L1 is fine localized rather than systemic.

Challenge windows and withdrawal reality

Optimistic rollups (e.g., OP Stack chains, Arbitrum) keep ~7-day challenge periods before L1 withdrawals finalize security by fraud-proof time. ZK rollups eliminate the fraud-proof wait by proving correctness, enabling minute-to-hour withdrawals.

Inclusion guarantees and roadmap hardening

Ethereum’s near-term path strengthens protocol-level inclusion with enshrined proposer-builder separation (ePBS) and inclusion lists under active specification improving censorship resistance and predictability even if SSF remains a longer-term goal. Targeted items line up for Fusaka (PeerDAS) in 2025 and subsequent Glamsterdam workstreams around ePBS/inclusion lists.

Firedancer vs modular maturity

Solana’s Firedancer introduces an independent validator client to boost throughput and add client diversity, aiming to reduce single-implementation risk and push latency ceilings lower; community materials highlight sustained performance gains and reliability focus. On Ethereum, PeerDAS (Fusaka) reduces bandwidth for blob verification lowering L2 costs and improving data availability economics.

Where each model fits best in 2026

Latency-sensitive trading & market-making

Favor Solana’s single-slot path when milliseconds matter and state locality is critical.

On-chain games/social with rare L1 settlement

Ethereum L2s provide low-cost, fast UX; settlement can batch to L1 as needed.

Payments & consumer DeFi

If bridging to L1 is rare, L2 UX competes directly; if frequent L1 settlement or atomic composability across many accounts is required, Solana’s unified state simplifies design.

Context & Analysis

Both ecosystems converged on the same user promise fast, cheap, reliable clicks with different security envelopes. Ethereum optimizes for modular specialization and evolving inclusion guarantees; Solana optimizes for global shared state and tight timing loops. The “winner” depends on your app’s composite metric: perceived confirmation time × cost × reliability.

Conclusion

The Ethereum vs Solana debate has evolved from competition to specialization. Rather than seeking a clear winner, builders now focus on matching architectural strengths to project needs. Ethereum’s modular ecosystem excels at secure settlement and composability, ideal for applications that prioritize trust and interoperability.

Solana, by contrast, thrives on performance and simplicity. Its monolithic design delivers low latency and high throughput, making it well-suited for real-time, consumer-facing apps. In 2026, the smarter choice isn’t about allegiance it’s about aligning your workload’s latency, settlement rhythm, and fault tolerance with the platform built to handle it best.

FAQs

Q : What does “modular Ethereum” mean?

A : Execution happens on L2s; Ethereum L1 provides settlement and data availability.

Q : How fast are Solana confirmations in practice?

A : Slots target ~400–600 ms with confirmations that feel instant; finality typically lands within seconds to ~12s in normal conditions.

Q : Why do optimistic rollups have a 7-day withdrawal?

A : Fraud proofs require time for challenges; the window protects users and the protocol.

Q : Do ZK rollups avoid the week-long delay?

A : Yes, validity proofs let withdrawals complete in minutes to hours once proofs are verified.

Q : What’s changing with Ethereum’s inclusion guarantees?

A : Upcoming ePBS and inclusion-list work aim to make inclusion more predictable and censorship-resistant.

Q : How did Pectra and Dencun affect L2 fees?

A : Blob capacity and related changes pushed typical L2 fees to low cents in 2024–2025.

Q : Does this mean the ‘Ethereum vs Solana modular vs monolithic’ debate is over?

A : It’s reframed: pick the stack that matches your app’s latency, settlement, and operational profile.

Facts

Event

Architectural divergence Ethereum as settlement for L2s; Solana as unified execution L1Date/Time

2025-11-01T13:00:00+05:00Entities

Ethereum (L1), Arbitrum (L2), OP Stack (L2), Solana (L1), Firedancer (Solana client), ePBS/Inclusion Lists (Ethereum roadmap)Figures

Arbitrum ~250 ms block time; OP Stack ~2s; Solana slot ~400–600 ms; optimistic withdrawal ~7 days; ZK withdrawal minutes-hours. StarkWare+3docs.syndicate.io+3solana.com+3Quotes

“Preconfirmations … 200ms is already imperceptible to most users.” — Will Papper (context: L2 UX discussion). CryptoSlateSources

See below.