How Ripple plans to bridge crypto and Wall Street in its $4B expansion

Ripple is pursuing an institutional “full-stack” approach pairing custody, prime brokerage, treasury connectivity and stablecoin settlement to move traditional financial workflows onto public blockchain rails.

In interviews around Swell 2025 and subsequent announcements, the company outlined acquisitions and pilots totaling about $4 billion that it says will let institutions operate like banks with crypto infrastructure. This is how Ripple plans to bridge crypto and Wall Street within existing banking and corporate systems.

The $4B build: what each piece does

Ripple agreed to acquire multi-asset prime broker Hidden Road for about $1.25B, bringing unified market access, clearing and credit plus the option, where supported, to post RLUSD as collateral.

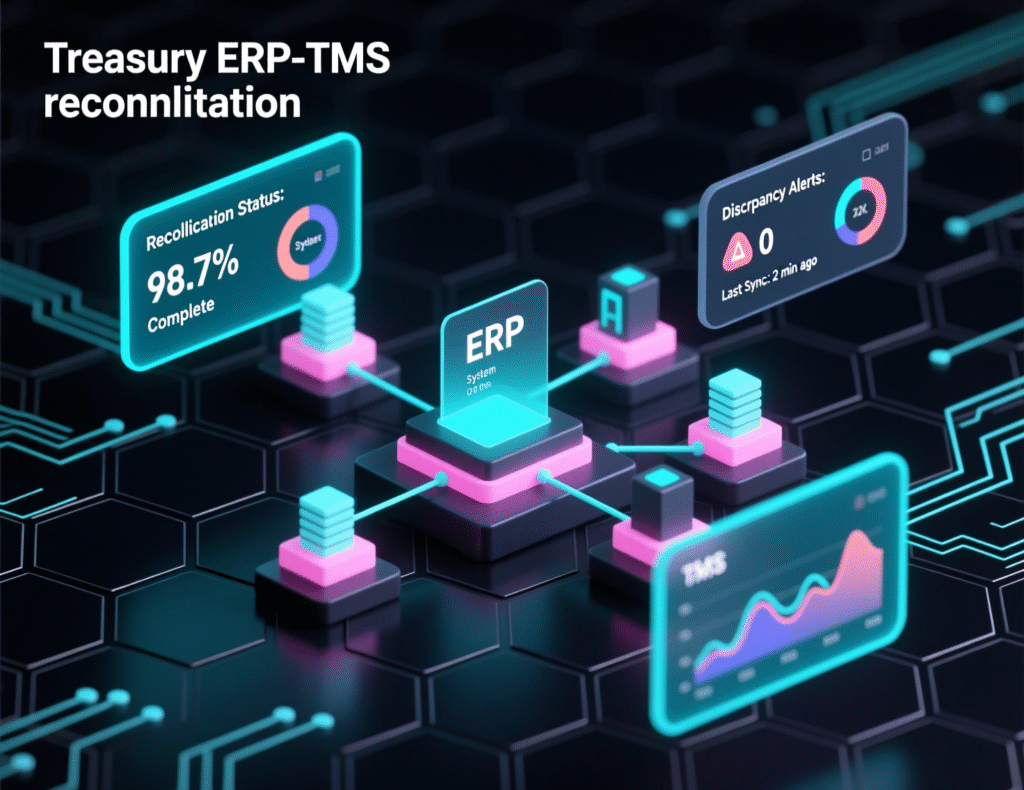

A $1B deal for GTreasury plugs on-chain settlement into corporate TMS/ERP workflows (cash positioning, FX, reconciliation), reducing manual batch imports and month-end effort. PYMNTS.com+1

Ripple also moved to buy Rail for roughly $200M, adding virtual accounts, automated back-office tools and cross-border stablecoin payouts for B2B flows.

For safekeeping, Metaco provides segregation of duties, policy engines and institutional key management acquired by Ripple in 2023.

Finally, Ripple raised $500M at a $40B valuation to support integration and distribution across banks, brokers and large corporates.

Pilot: card and merchant settlement with RLUSD

In a pilot with Mastercard, WebBank and Gemini, the card acquirer nets daily merchant transactions and settles the batch in RLUSD on XRPL, with optional same-day fiat conversion at the sponsor bank. The companies say the goal is to improve fiat settlement while mapping 1:1 to existing card-network rules for disputes and chargebacks.

How institutions would use the stack

Corporate treasurer payouts

Treasury sets approval limits and currency caps in the TMS, funds RLUSD/XRP via connected banks or prime access, routes cross-border payouts through Ripple’s payments stack, and auto-syncs ledger events back to ERP/TMS for reconciliation.

Broker-dealer liquidity and financing

A desk connects to venues via prime APIs, centralizing clearing, credit and collateral. RLUSD/XRP can be posted as collateral (subject to platform haircuts and margin priority). Positions net to custody daily; excess cash sweeps to treasury.

Card & merchant settlement

The acquirer prepares a single batch; net amounts settle in RLUSD on XRPL; the treasury team imports the batch file and updates receivables and cash positions as usual.

Controls, compliance and accounting (the scale levers)

Reserves & attestations

Independent look-throughs to RLUSD reserve assets, stress tests and intraday liquidity frameworks will be gating requirements.

Travel Rule & sanctions

Standardized beneficiary payloads, purpose codes and reliable VASP data exchange must plug directly into compliance stacks.

Accounting treatment

Clear policies for when RLUSD is cash, restricted cash or a digital asset; FX recognition and fee accounting; ERP connectors and sub-ledgers to support month-end.

What changes with a charter and Fed access?

If Ripple (or an affiliate) secures a U.S. bank charter and a Federal Reserve master account, RLUSD reserves could sit directly at the Fed, tightening finality windows and reducing counterparty/settlement risk for clients. Ripple has applied for a national bank charter, with master-account access in scope.

How this differs from rivals

While many firms specialize (stablecoin issuance, custody, payments, treasury, prime), Ripple’s bet is an integrated stack with one client setup, unified controls and a shared data model—aiming for fewer reconciliation breaks and lower end-to-end cost/latency. The trade-off: specialists may still outperform in their niches.

The tells that this is working

RLUSD flows in merchant batches and supplier payouts

Prime, treasury and payments components under one contract

Concrete movement on charter/master-account status

Data showing corridor-level performance surpassing SWIFT/ACH on cost and speed

Context & Analysis

Ripple’s consolidation comes as capital re-enters crypto infrastructure and stablecoin settlement finds mainstream pilots. The strategy’s success will be proven less by headlines and more by routine artifacts ERP entries, batch files and auditor sign-offs showing measurable cost/latency improvements and sustained volume.

Conclusion

Ripple’s vision to connect crypto with Wall Street depends on flawless execution. The company aims to prove that digital assets can operate within traditional finance by offering bank-grade compliance controls, transparent reserve reporting, and smooth integration with enterprise systems like ERP and TMS. These elements are designed to make Ripple’s solutions practical for financial institutions rather than just theoretical.

Beyond infrastructure, Ripple’s ongoing push for a charter or master account could anchor its position in mainstream banking. If card payments, treasury operations, and prime services demonstrate stronger economics and efficiency at scale, Ripple’s bridge between crypto and traditional finance will become tangible embedded in everyday financial operations, not limited to conference discussions or industry projections.

FAQs

Q : What is RLUSD and how is it used?

A : RLUSD is Ripple’s U.S.-dollar stablecoin used for settlement, collateral, and payouts on XRPL in pilots and institutional workflows.

Q : How does prime brokerage fit into Ripple’s plan?

A : Hidden Road centralizes market access, credit, clearing, and settlement, with potential to accept RLUSD as eligible collateral.

Q : Does this change existing treasury and ERP processes?

A : Yes on-chain settlements can auto-generate entries back into ERP/TMS, reducing manual reconciliation while preserving policy controls.

Q : Is card settlement really happening on-chain?

A : A pilot with Mastercard, WebBank, and Gemini is testing RLUSD batch settlement on XRPL for credit card transactions.

Q : Will Ripple become a bank?

A : Ripple has applied for a U.S. national bank charter and is exploring a Federal Reserve master account, which could affect reserve custody and finality.

Q : What are the main risks?

A : Breadth vs. depth trade-offs, regulatory approvals, reserve transparency, and the need for robust compliance and accounting policies.

Q : How Ripple plans to bridge crypto and Wall Street what proves it’s working?

A : Consistent RLUSD volumes in merchant and supplier batches, unified contracting across prime/treasury/payments, and better cost/latency vs. SWIFT/ACH.

Facts

Event

Ripple outlines integrated institutional stack; acquisitions and pilots to run traditional workflows on crypto railsDate/Time

2025-11-13T00:00:00+05:00Entities

Ripple Labs Inc.; Hidden Road; GTreasury; Rail; Metaco; Mastercard; WebBank; Gemini; XRP Ledger (XRPL)Figures

~$4B total expansion; $1.25B (Hidden Road); $1B (GTreasury); ~$200M (Rail); $500M funding at $40B valuationQuotes

“The collaboration will leverage Ripple’s stablecoin, RLUSD, on the XRP Ledger (XRPL) to enhance how fiat-based payments are processed with the Gemini Credit Card.” Ripple press release (Nov. 5, 2025) RippleSources

Ripple press release + URL; Reuters on Hidden Road + Rail + URLs; PYMNTS/Ledger Insights on GTreasury + URL; FT on $500M raise + URL