How Bitcoin and XRP Traders Are Positioning Themselves in a Choppy Market Environment

In a market lacking clear direction and driven largely by headlines, recent block trade data highlights contrasting approaches among major crypto players. On the Bitcoin front, desks are increasingly paying for optionality, employing strategies like strangles and straddles. This approach allows them to remain neutral on the asset’s directional movement while positioning for potential swings in volatility. It suggests that even amid uncertainty, Bitcoin traders are actively hedging for movement rather than betting on a specific trend.

Meanwhile, in the XRP market, some participants are taking the opposite stance by selling volatility. This indicates confidence in price stability or a strategy to capture premium from options buyers. Together, these moves show that while market participants may be cautious about direction, they are actively engaging with volatility as a core part of their trading strategies.

BTC block flows favor non-directional volatility bets

Over the past week on Deribit, strangles accounted for roughly 16.9% of BTC option block trades and straddles 5%, lifting non-directional structures above 20% of block activity unusually high, according to Deribit CEO Luuk Strijers. “This suggests a market grappling with uncertainty, where traders anticipate significant price moves but remain unsure about the direction,” Strijers told CoinDesk.

Mechanics: strangles, straddles, and risk

A long strangle pairs OTM call and put at equidistant strikes (e.g., spot $104,700 with a $105,000 call and $104,400 put), seeking large moves either way. A long straddle buys the ATM call and put, costing more but giving greater vega exposure. Both lose the net premium if realized volatility undershoots pricing; they do not imply a bullish or bearish view only a volatility view. (General definitions; flows per Deribit/CoinDesk.)

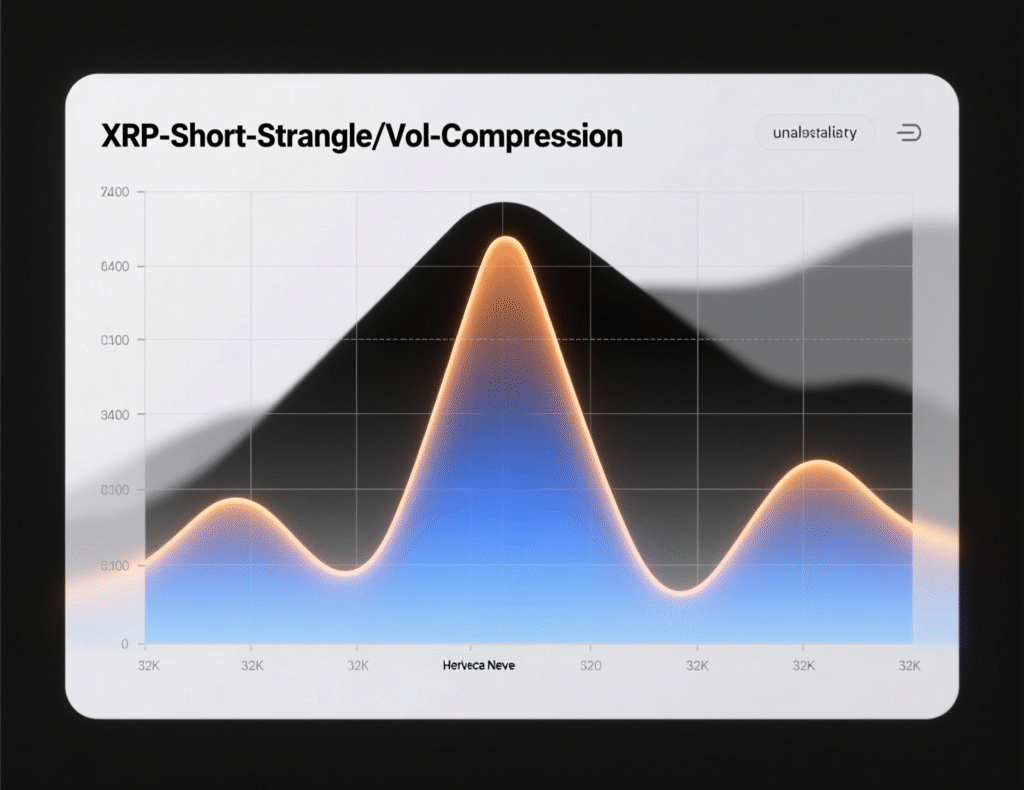

XRP desks lean into short-vol

Contrasting BTC, recent XRP block flow included a short strangle executed OTC at Paradigm and booked on Deribit selling equal-distance OTM call/put to wager on range-bound price (vol compression). One cited example: selling 40,000 contracts each of the $2.2 call and $2.6 put expiring Nov. 21, for ~80,000 XRP notionally, at an average premium of 0.0965 USDC.

Why the divergence?

BTC’s macro sensitivity and deeper listed options market make long-vol hedges/speculative buys appealing in choppy tape. XRP participants, by contrast, may see realized vol lagging implieds and prefer harvesting premium accepting tail risk with defined risk management. For broader context, recent derivatives analytics also flagged tightening positioning after October’s liquidations, which aligns with split volatility views across assets.

Bitcoin and XRP options strategies in context of market structure

Elevated BTC options open interest and growing reliance on block venues help institutions express volatility views without telegraphing direction or moving screens. In 2025, options flows have increasingly influenced spot dynamics, underscoring why non-directional structures matter for price discovery.

Bitcoin and XRP options strategies: what it signals

Taken together, the BTC long-vol tilt and XRP short-vol stance point to cross-asset dispersion in volatility expectations common in uncertain regimes where catalysts may hit assets unevenly.

Conclusion

Block flow trends indicate that institutional players are seeking convexity in Bitcoin while fading price movements in XRP. Bitcoin option buyers stand to gain if realized volatility rises significantly, reflecting a preference for strategies that profit from larger swings rather than directional bets.

Conversely, XRP participants are leaning into short-volatility positions, benefiting if price ranges remain tight. However, these positions are vulnerable to sudden tail events that could quickly reprice risk. Traders should monitor weekly flow patterns and watch the spread between implied and realized volatility, as shifts here could signal the next major catalyst in the crypto markets.

FAQs

Q : What are traders signaling with BTC strangles and straddles?

A : They’re buying volatility without taking a directional view, expecting sizable moves either way.

Q : Why would XRP desks short a strangle?

A : To bet on volatility compression and collect premium if price stays within a range.

Q : Are these positions risky?

A : Yes. Long-vol can lose the entire premium if volatility underdelivers; short-vol faces tail-risk losses if price breaks the range.

Q : Where do these flows occur?

A : Often via OTC block venues (e.g., Paradigm) and then booked on Deribit for clearing and margining.

Q : How do I track Bitcoin and XRP options strategies over time?

A : Follow weekly exchange/venue summaries and compare implied vs. realized volatility metrics.

Q : Do options flows impact spot prices?

A : Growing evidence suggests options flows increasingly shape spot dynamics, especially around expiries and hedging flows.

Q : Is this a bullish or bearish signal?

A : It’s primarily a volatility signal; direction depends on subsequent catalysts and realized moves.

Facts

Event

Divergent BTC/XRP options positioning via block trades (Deribit).Date/Time:

2025-11-13T14:35:00+05:00Entities

Deribit (exchange); Paradigm (OTC venue); Luuk Strijers (CEO, Deribit). CoinDeskFigures

BTC block strangles ~16.9%; BTC block straddles ~5% (past week); combined non-directional >20%; Example XRP short strangle sold ~40k $2.2 calls + 40k $2.6 puts (exp. Nov 21) at avg. 0.0965 USDC. CoinDeskQuotes

“This suggests a market grappling with uncertainty, where traders anticipate significant price moves but remain unsure about the direction.” Luuk Strijers to CoinDesk. CoinDeskSources

CoinDesk (article) + URL; FXLeaders (recap) + URL. CoinDesk+1