How a 2026 crypto bailout under Trump might unfold

A new Breakingviews scenario suggests that a potential Trump-led crypto bailout in 2026 is becoming more realistic, especially if an event similar to the FTX collapse or a major stablecoin losing its peg triggers widespread market instability. Analysts argue that such a crisis could push the administration to intervene in order to prevent shockwaves across both the financial system and the broader economy.

This prediction is built on three key factors: the Trump administration’s increasing openness toward digital assets, the introduction of new U.S. legislation aimed at regulating stablecoins, and the Trump family’s rising business and political alignment with the crypto industry. Together, these elements strengthen the possibility that a large-scale bailout could emerge as a strategic move to stabilize markets and protect supporters heavily invested in crypto.

Breakingviews’ call and the setup for 2026

Reuters Breakingviews contrasts the Biden-era firewall after FTX’s 2022 collapse with 2025’s friendlier posture, including new legislation, closer industry ties, and larger potential spillovers into traditional markets. If a major failure hits in 2026, the column argues, the White House would likely move to contain damage and reassure holders. Reuters+1

What a Trump crypto bailout 2026 could look like

Policy options floated by analysts include emergency liquidity or confidence measures aimed at stablecoins or key market rails. Given the GENIUS Act’s federal framework for dollar-pegged tokens, officials would face pressure to prevent knock-on effects in payments and the Treasury market if a large issuer faltered. Tools might range from supervisory coordination to extraordinary facilities, depending on legal authority and market stress.

Political incentives behind a Trump crypto bailout 2026

Reuters has documented substantial Trump-family crypto revenues in 1H 2025, suggesting reputational and political incentives to avoid a protracted slump. If volatility deepens, swift action could be framed as protecting retail savers and the payments ecosystem especially if a leading stablecoin’s reserves and redemptions come under strain.

Why stablecoins are the pressure point

Stablecoins connect crypto to the dollar and short-term U.S. debt. The GENIUS Act requires reserve transparency and backing, but a confidence shock can still force rapid redemptions into Treasuries, creating liquidity frictions. That linkage is a key reason a 2026 failure would draw policy attention beyond crypto-native platforms.

Market backdrop heading into 2026

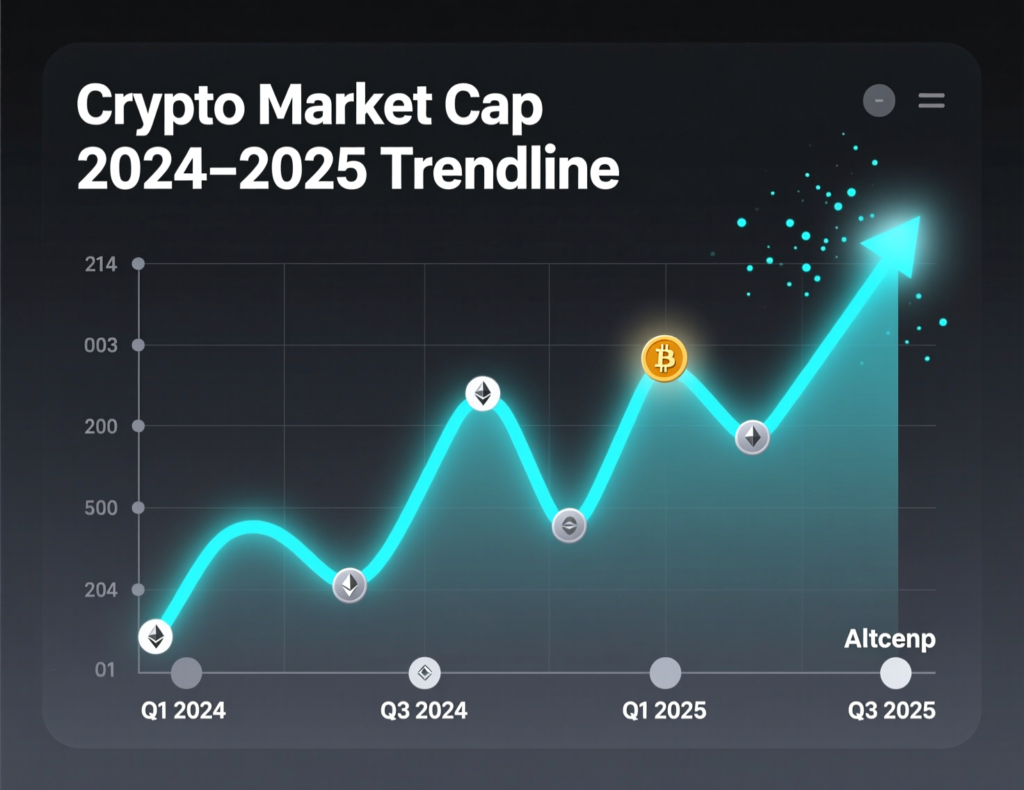

Crypto’s boom-bust cadence intensified across 2024–2025, with CoinGecko data showing sharp swings in total market capitalization. That growth and concentration in a few market rails heightens the potential for wider spillovers if a core token or venue stumbles next year.

Context & Analysis

Breakingviews’ thesis is conditional: a bailout becomes likely only if crypto stress threatens broader financial plumbing, notably through regulated stablecoins. The GENIUS Act improves transparency but also formalizes crypto’s ties to dollar markets. Combined with the administration’s political economy policy bets and personal brand exposure the threshold for intervention may be lower than in 2022.

Conclusion

The real question for 2026 isn’t whether crypto has become “too big to ignore,” but how regulators would contain the fallout if a major stablecoin or key platform collapses. Such a disruption could threaten broader financial stability, forcing authorities to step in quickly to limit the damage.

In the Breakingviews scenario, a potential Trump crypto bailout in 2026 would aim to restore confidence and support market liquidity. This would mark a significant shift, showing how deeply digital assets have become intertwined with traditional finance and how political leadership might intervene to protect the expanding crypto ecosystem.

FAQs

Q1 : Is a bailout guaranteed?

A : No. It’s a Breakingviews prediction contingent on significant market stress.

Q2 : What is the GENIUS Act?

A : A 2025 U.S. law establishing a federal framework for stablecoins, including reserve and disclosure rules.

Q3 : Why would stablecoins trigger intervention?

A : They link crypto to dollar markets and short-term Treasuries; a large depeg could cause liquidity strains.

Q4 : Did crypto gains accelerate after the 2024 election?

A : Yes market value expanded markedly into late 2024 and rebounded in parts of 2025.

Q5 : How big are Trump’s crypto ties?

A : Reuters estimates ~$802m in 1H 2025 income from crypto ventures.

Q6 : What could a Trump crypto bailout 2026 involve?

A : Confidence and liquidity measures around key rails; specifics depend on legal authority and stress.

Q7 : Does regulation eliminate bailout risk?

A : No. It may reduce opacity but can’t prevent runs if confidence breaks.

Facts

Event

Breakingviews predicts the U.S. administration would likely bail out crypto holders if severe stress hits in 2026.Date/Time

2025-12-22T12:00:00+05:00Entities

Donald J. Trump; Reuters Breakingviews; U.S. Treasury; stablecoin issuers (e.g., Circle, Tether generic categories); CoinGecko.Figures

~$802m Trump-organization crypto income in 1H 2025 (USD); large swings in total crypto market cap 2024–2025. Reuters+2CoinGecko+2Quotes

“Donald Trump will bail out crypto holders in 2026.” Reuters Breakingviews (prediction/analysis). ReutersSources

Reuters Breakingviews (article URL); Reuters investigation (article URL).