Halal Crypto ETF: Your 2026 Guide for US & Europe

As of early 2026, there is still no widely available, exchange-listed crypto ETF or ETN in the US, UK, Germany or wider EU that is both spot-crypto-based and explicitly certified Shariah-compliant for retail investors.

In practice, Muslim investors who want halal bitcoin or ethereum exposure are mostly using a mix of carefully screened direct coin ownership, specialist Islamic crypto funds, and strict Shariah due diligence on any “crypto ETP” marketed as ethical or Islamic.

Introduction

Is there a halal crypto ETF you can just buy in your brokerage account today and if not, what are your real alternatives?

Short answer

There is no mainstream, Shariah-certified spot bitcoin ETF or ETN for everyday Muslim investors in the US, UK, Germany or wider Europe yet. But there are ways to get riba-free digital asset exposure if you’re willing to be selective, patient, and a bit nerdy about structure.

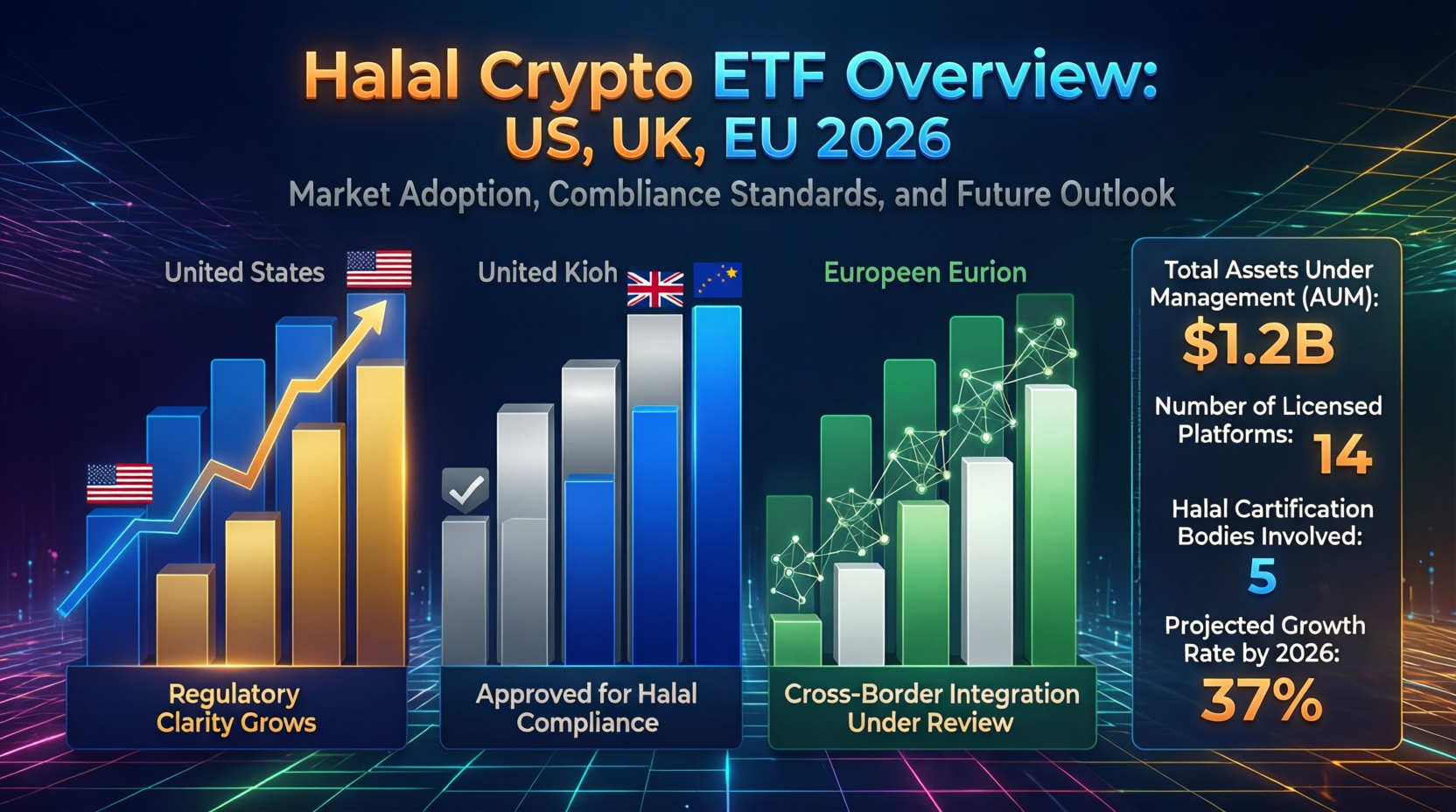

Crypto is now firmly part of the global financial system. As of early 2026, the total crypto market cap is around $3.3 trillion, with bitcoin alone just under $2 trillion in value .Since January 2024, the US SEC has approved multiple spot bitcoin ETFs, and their assets have grown to well over $1.2 trillion within two years of launch, making ETFs the default route for many conventional investors . Shariah governance, however, has lagged behind product innovation.

This guide is written for Muslims in New York, London, Frankfurt and across the EU who are asking

“Can I get halal bitcoin exposure, and should I wait for something with a ‘halal crypto ETF’ label?”

We’ll unpack product structures, Shariah issues, regional rules, and a practical checklist you can use with your own scholars and advisors.

What Is a Halal Crypto ETF?

A halal crypto ETF is an exchange-traded fund that gives you exposure to cryptocurrencies (usually bitcoin or ethereum) in a way that satisfies core Shariah principles: real underlying ownership or clear constructive possession, no riba-based leverage or derivatives, no excessive gharar, and oversight by a recognised Shariah board.

Most existing crypto ETFs and ETNs fail this test because they’re built on futures, swaps, structured notes or interest-bearing operations that scholars view as problematic.

Basic ETF vs Crypto ETF vs ETN (Quick Primer)

At a simple level.

An ETF (Exchange-Traded Fund) holds assets (like shares or commodities) and issues units you can buy on an exchange. You own units in the fund, not barrels of oil or individual stocks directly.

A crypto ETF works the same way, but the underlying asset is bitcoin, ethereum or a basket of coins. In the US, most of the volume is now in spot bitcoin ETFs that actually hold bitcoin in custody on behalf of the fund .

An ETN (Exchange-Traded Note) is different. It’s usually a debt obligation issued by a bank or financial institution. You don’t own the coins or even units in a segregated fund; you hold an unsecured or collateralised note whose return is linked to the price of bitcoin or another crypto index.

That distinction fund units vs. debt claim is a major Shariah concern.

In all three cases, remember: you are buying listed securities, not coins in your own wallet.

What Makes an ETF ‘Halal’ in General?

For an ETF to be considered halal by many contemporary scholars, several conditions usually need to be met, often echoing AAOIFI-style standards.

Permissible underlying assets

The fund mostly holds Shariah-compliant assets (e.g. screened equities, physical commodities, or if deemed permissible spot crypto).

Real ownership / constructive possession

The fund should actually own the assets, and unit-holders should have a clear beneficial interest, not just a cash-settled bet.

No riba-based leverage or margin

Minimal or no interest-bearing borrowing; no speculative short-selling.

No excessive gharar or maysir

Avoiding complex derivatives that are essentially side-bets on price with no real transfer of ownership.

Shariah governance

A named Shariah board, published fatwa, ongoing audits, and a purification policy for any incidental non-halal income.

These criteria have worked for Shariah equity and sukuk ETFs for years; the challenge is now adapting them to volatile, 24/7 crypto markets.

Halal Crypto ETF: Working Definition for This Guide

For this guide, we’ll use a practical working definition.

A halal crypto ETF or ETP is a listed product that

(1) gives investors beneficial ownership or constructive possession of spot crypto (not just futures or swaps),

(2) avoids riba-based leverage and interest on collateral, and

(3) is explicitly certified as Shariah-compliant by a recognised Shariah board with ongoing oversight.

Physically backed products (where coins are held 1:1 in custody) are generally easier to analyse than futures-based funds. ETNs remain riskier from a Shariah perspective because they are usually debt obligations, not true ownership – even if the issuer itself holds coins in custody.

Why Most Crypto ETFs & ETNs Are Not (Yet) Shariah-Compliant

Most existing bitcoin and crypto ETFs/ETNs are not considered halal by many scholars because they rely on derivatives, leverage, interest-bearing collateral, or debt-note structures rather than simple spot ownership. Even where the underlying is spot, operational practices like securities lending, staking and interest on cash can introduce non-halal elements.

Futures-Based Bitcoin ETFs and the Problem of Riba & Leverage

The earliest US bitcoin ETFs – and some still heavily marketed to retail today – are futures-based. They gain exposure via CME bitcoin futures rather than holding actual bitcoin.

Common Shariah objections include.

Derivatives and speculation

Futures are standardised contracts traded on margin, with profit and loss tied to price changes rather than real delivery. Many scholars classify this as excessive gharar and maysir.

Riba on collateral and margin

Futures ETFs typically park collateral and cash in interest-bearing instruments. That interest is usually part of fund income.

Roll costs and synthetic exposure

Funds constantly “roll” contracts as they expire, turning the structure into a rolling bet on price rather than straightforward ownership of bitcoin.

Even if your scholars permit bitcoin itself, combining it with interest-bearing derivatives is a red line for many Shariah boards.

Debt-Based Crypto ETNs in the UK & Europe

In London, Frankfurt and Zurich, much of the “crypto ETP” menu has historically been ETNs, not UCITS ETFs. These are typically collateralised debt securities: you lend money to the issuer, and they promise to pay you a return linked to bitcoin, ethereum or a crypto index.

From a Shariah lens, that raises issues.

You hold a debt claim, not units in a pool of assets.

Your recourse is to the issuer, not directly to the coins.

If the structure charges or earns interest (for example on collateral or cash), that has to be identified and purified or avoided entirely.

Some ETNs are marketed as “physically backed”, meaning the issuer holds coins 1:1. That may reduce market risk, but it doesn’t automatically fix the debt/interest problem. Without a clear Shariah fatwa and purification policy, many scholars remain cautious.

Custody, Lending, and Staking.

Even where the legal wrapper looks closer to acceptable, operational details can quietly turn a product non-compliant:

Securities lending / rehypothecation

Coins or collateral lent out for extra yield, often in interest-based deals.

Interest on idle cash

Uninvested cash swept into money market funds or overnight deposits that pay interest.

Staking or DeFi yield

Some products may stake ethereum or other proof-of-stake coins, or interact with yield protocols whose contracts and use-cases have not been Shariah-reviewed.

You’ll only see these details in the prospectus, KID/KIID and custody agreements, not the marketing PDF. A serious Shariah review means reading those documents line by line – not just trusting words like “ethical”, “sustainable” or even “Islamic” if no scholars are named.

Halal Bitcoin & Crypto Exposure Today in US, UK, Germany & Europe

Right now, the most realistic halal routes for Muslim investors in the US, UK, Germany and wider EU are:

Carefully screened direct coin ownership

Shariah-compliant crypto funds and unit trusts

Only in exceptional cases, listed products that pass a strict Shariah checklist with scholars

As of early 2026, there is still no widely marketed spot bitcoin ETF or ETN in these regions that carries a clear, public Shariah certification for retail investors.

Direct Coin Ownership vs “Halal Crypto ETF” Marketing

Buying bitcoin or ethereum directly via an exchange or custodian your scholars are comfortable with – is still the cleanest structure if they consider those assets to be permissible māl (store of value / digital commodity).

Pros of direct ownership.

Clear constructive possession: you (or your custodian) hold the coins.

No futures, swaps or debt notes.

You can opt out of interest-bearing features (lending desks, margin accounts, yield products).

Cons.

Technical complexity: wallets, private keys, security.

Volatility: you see every price swing.

Operational risks with exchanges and custodians.

By contrast, a “halal crypto ETF” promising easy access from your regular broker can sound ideal – but until a product is explicitly Shariah-certified, it’s safer to treat that phrase as marketing, not fiqh.

Spot ETFs, Futures ETFs, and Shariah Alternatives

In the US, the SEC approved 11 spot bitcoin ETPs in January 2024. Within two years, their combined assets have climbed to over $1.2 trillion, showing just how quickly conventional investors have embraced the ETF route

For a Muslim investor asking “Is there a halal bitcoin ETF in the US for retail?” the honest answer today is.

However

Spot bitcoin ETFs that simply hold bitcoin in cold storage are structurally cleaner than futures ETFs, because they avoid most derivative and leverage issues.

You still need to check:

– cash management,

– lending or repo,

– use of any derivatives,

– and whether any Shariah board has actually reviewed the structure.

Some private funds and SMAs (often for accredited investors in New York, Austin, San Francisco and other hubs) now offer Shariah-labelled bitcoin or multi-asset strategies, sometimes advised by Islamic finance firms .

If you’re looking for halal alternatives to futures-based products like BITO, a path many scholars prefer is:

Directly owning screened spot bitcoin via a reputable custodian; and/or

Using a Shariah-compliant bitcoin fund (often offshore) accessed through a US-friendly platform, if your scholar approves.

Crypto ETNs/ETPs vs True Halal Exposure

For UK and EU investors, the listed crypto landscape has been even more dominated by ETNs and ETPs.

In the UK, the FCA has now opened retail access to certain crypto ETPs/ETNs, with rules taking effect from 8 October 2025 and additional guidance around risk warnings and suitability.

In Germany and Switzerland, exchanges like Xetra and SIX list multiple physically backed bitcoin and ethereum ETPs, most of which are debt-style products rather than UCITS ETFs.

So, “Can Muslim investors in the UK or Germany get halal bitcoin exposure through listed products today?”

Technically, yes but only if a specific ETP passes a rigorous Shariah review.

At the moment, very few (if any) mainstream ETPs come with publicly available Shariah certification and purification policies.

Practically, many scholars still recommend direct spot exposure or Islamic crypto funds over ETNs, because of the debt structure and embedded interest.

As MiCA moves from staggered implementation towards full EU-wide enforcement by mid-2026 , we may see more transparent, Shariah-branded ETPs in Frankfurt, Dublin, Luxembourg or Zurich – but you should assume they are not halal by default.

Shariah-Compliant Crypto Funds & Unit Trusts

If you prefer a managed solution, Shariah-compliant crypto funds and unit trusts are where most of the real innovation is happening. These are not “ETFs” in the stock-exchange sense, but regulated (or semi-regulated) pooled funds designed specifically for Muslim investors.

Types of Islamic Crypto Funds.

Across Malaysia, the GCC, Europe and offshore centres, you can now find offerings such as.

Bitcoin-only Shariah funds

Unit trusts that hold spot bitcoin with Shariah oversight and clear purification rules.

Ethereum-only funds

For investors whose scholars permit ethereum, some funds track ether or combine it with Islamic-screened staking policies.

Islamic multi-coin portfolios

Diversified digital asset funds (“crypto titans” style) that hold several screened coins and rebalance actively using Shariah criteria.

These funds often rely on external Shariah advisory firms and AAOIFI-style standards, and they increasingly target investors not only in Kuala Lumpur, Dubai and Doha, but also in London and Frankfurt via cross-border registrations.

How Shariah Crypto Funds Are Structured

Common structures you’ll see.

Fund domicile

– Ireland, Luxembourg and Cayman for global investors

– Malaysia and GCC jurisdictions for local Islamic wealth

– sometimes specialist Spezialfonds in Germany for institutions

Regulatory regimes

– AIFs or private funds for qualified investors

– occasionally UCITS-like structures where diversification rules can be met.

Who can invest?

– US: often limited to accredited investors via private placements

– UK/EU/Germany: sometimes available to professional or qualified investors via local brokers or wealth managers

– Retail access: slowly improving, especially as halal wealth platforms and banks launch Islamic digital-asset sleeves

For tech-driven Islamic fintechs building front-ends on top of these funds, partners like Mak It Solutions can help with secure web, cloud and data architecture from London to Berlin (Mak it Solutions)

Shariah Screening Methodology for Crypto Funds

Shariah boards typically look at criteria such as.

Nature of the asset

Is the cryptocurrency recognised as māl (valuable property) with real use, or just a speculative token?

Use-cases and ecosystem

Is the chain primarily used for permissible activities, or dominated by gambling, riba-based DeFi or haram industries?

Leverage and derivatives

Does the fund use margin, futures, swaps or options?

Staking and yield

Are staking rewards structured in a Shariah-compliant way, or do they resemble interest?

Yield platforms

Are DeFi or CeFi products screened and approved?

Governance

Named Shariah scholars, documented fatwa, periodic audits and a clear purification process.

AEO micro-answer

In practice, a crypto fund is more likely to be Shariah-compliant if it (1) holds spot-only exposure, (2) avoids riba-based leverage and interest-bearing yield, (3) screens coins and use-cases carefully, and (4) is overseen by a credible Shariah board with published fatwa and ongoing audits.

How to Check If a Crypto ETF, ETN, or Fund Is Actually Halal

You don’t need to be a mufti to do a first-pass screen. Anytime you see phrases like “halal crypto ETF”, “Islamic bitcoin fund” or “Shariah crypto ETP”, you can run a DIY Shariah checklist, gather documents, and then present a concise pack to scholars you trust.

Step-by-Step Shariah Checklist for Any Product

Use this as a practical “how to check if a crypto ETF, ETN or fund is halal”:

Identify the underlying exposure

Is it spot crypto, futures, swaps, options or a mix? Favour pure spot exposure.

Clarify ownership vs. debt claim

Are you buying units in a pooled fund/ETP, or a debt note (ETN)? Debt-style notes are more problematic.

Check leverage and shorting

Does the product use margin, borrow assets, or short bitcoin/ether? If yes, that’s a major red flag.

Review treatment of cash, interest and staking

How is idle cash handled? Is there lending, repo or staking? Are any interest proceeds identified and purified, or just kept?

Look for a named Shariah board and fatwa

Are real scholars named? Is there an accessible Shariah opinion you can send to your local imam or mufti?

Confirm ongoing Shariah audits and purification policy

Is there a regular review and a clear process for purifying incidental non-halal income?

Check domicile and regulator

Understand whether you’re under SEC, FCA, BaFin or another regulator, and what investor protections apply.

Match with your personal fatwa

If your scholar considers bitcoin itself impermissible, no structure will make it halal.

Prospectus, KID/KIID, and Shariah Certificates

To answer that checklist, you’ll typically need to download.

The prospectus or offering memorandum

The KID/KIID (Key Information Document) for EU/UK products

Any Shariah certificate or fatwa, ideally from the Shariah advisory firm’s own website

Red flags include.

Vague marketing language (“ethical”, “values-based”, “Shariah-friendly”) with no named scholars

Complex derivative language (swaps, TRS, options overlays) in something branded “Islamic”

No mention of purification, even though the fund admits to holding cash in interest-bearing instruments

For Islamic fintech platforms building investor dashboards, these documents can be parsed and tagged automatically using BI and AI pipelines. Mak It Solutions’ Business Intelligence services and cloud cost-optimised architectures can support you if you’re building such a screening engine at scale (Mak it Solutions).

Digital Tools & Islamic Fintech Platforms That Can Help

You don’t have to do everything manually.

Islamic robo-advisors and halal investing platforms in the US, UK and GCC increasingly include digital asset sleeves, with in-house Shariah screening

Screening apps and websites (like those that rate stocks and ETFs) are beginning to add crypto screening, listing fatwas on bitcoin/ethereum and Shariah views on staking/yield

AAOIFI and other standard-setters publish guidance and conference papers on digital assets, which your scholars may already follow

If you’re building or integrating such tools, robust web and mobile front-ends plus solid SEO/AEO for terms like “Shariah screening for crypto ETFs and ETNs” are essential. Mak It offers web development, mobile app development and SEO services to support that (Mak it Solutions).

Building a Halal Crypto Investing Plan

A halal crypto plan is less about timing the market and more about limits, behaviour and documentation.

Risk, Volatility, and Position Size

Crypto is volatile. That doesn’t magically change because an ETF wrapper looks familiar. Sensible Shariah-minded investors often:

Keep crypto to a small slice of total net worth (for example, 1–5%, sometimes up to 10% for high-risk-tolerant investors) agreed with their advisors.

Use dollar-cost averaging (DCA) rather than speculative trading.

Avoid leverage, day-trading and meme-coin hype entirely.

Treat bitcoin/ethereum as long-term, high-risk satellite positions, not core retirement assets.

You can combine halal crypto exposure with Shariah equity ETFs, sukuk and real-world assets to build a diversified, riba-free portfolio.

Tax Wrappers & Accounts.

Tax and Shariah are separate questions, but they meet in practice.

US

Some custodians now allow spot bitcoin exposure or bitcoin ETFs inside IRAs/401(k)s. You’ll still need to check whether the specific product meets your Shariah checklist and whether your custodian allows direct coin holdings if that’s the path you choose.

UK

With the FCA lifting the ban on crypto ETNs and HM Treasury policy confirming retail access from October 2025 and eligibility in some IFISAs from 2026, future Shariah-compliant ETNs could sit inside a Stocks & Shares ISA or IFISA for UK Muslims (FCA, Gov.uk).

Germany/EU

Many local brokers offer access to Xetra/SIX-listed crypto ETPs and EU-domiciled funds. You still need to run the Shariah checklist, but tax-efficient wrappers and MiCA-aligned custody rules can help manage risk and capital gains.

Working With Scholars and Advisors You Trust

Because fiqh opinions on bitcoin and ethereum vary, your goal is to build a documented, repeatable process with scholars you trust:

Prepare a short pack.

product factsheet, prospectus link, KID and any Shariah certificate.

Summarise your understanding of the structure and key risks, including the checklist above.

Ask for a written or clearly documented fatwa, and revisit it annually or whenever product terms change.

A good wealth advisor can then translate that Shariah guidance into concrete allocation and rebalancing rules that fit your life in New York, London, Berlin or elsewhere in Europe.

Future of Halal Crypto ETFs in US, UK, Germany & Europe

The next few years will likely bring more crypto ETFs/ETPs, tighter regulation and growing demand for clearly labelled Islamic options. The question is whether Shariah governance keeps up.

Regulatory Trends: SEC, FCA, BaFin, ESMA and MiCA

SEC (US)

After approving spot bitcoin ETFs in January 2024, the SEC is now dealing with ethereum and broader crypto ETPs, including options on those funds (SEC).

FCA (UK)

The FCA has lifted the retail ban on crypto ETNs under strict risk warnings and distribution rules, opening the door to more mass-market products via UK exchanges

BaFin & ESMA (EU)

Under MiCA, crypto-asset service providers and issuers face harmonised rules on disclosure, custody and governance. Transitional regimes run until mid-2026 in some states, after which MiCA authorisation will be the baseline for operating in the EU

For Muslim investors, this is generally good news: clearer regulations make it easier for Shariah boards to trust custody, valuation and risk controls – but they do not automatically make a product halal.

What a “Gold-Standard” Halal Crypto ETF Would Look Like

If we imagine a “dream” halal crypto ETF listing in New York, London or Frankfurt, it would probably.

Hold 100% fully reserved spot crypto in segregated, audited cold storage.

Avoid futures, options, swaps and interest-bearing lending entirely.

Maintain zero or minimal cash, and where unavoidable, place it in Shariah-compliant liquidity instruments.

Be overseen by a credible Shariah board aligned with AAOIFI-style standards, publishing a fatwa and annual Shariah audit.

Offer a clear purification policy and annual report of any non-halal income.

Provide transparent, plain-language documentation for retail investors in the US, UK, Germany and EU.

Practical Next Steps for Muslim Investors Today

Until that ideal product exists, your action plan is simple:

Use direct spot exposure and vetted Shariah funds as your primary halal routes.

Treat any crypto ETF/ETN or ETP as “haram until proven halal”, not the other way around.

Build a repeatable process with checklists, documents and trusted scholars.

When a credible halal crypto ETF finally launches under SEC, FCA or EU rules, be ready to compare its structure to what you already hold – and switch only if it’s a genuine upgrade.

If you’re an Islamic fintech building tools around this space, firms like Mak It Solutions can help with cloud architectures, DevOps and outsourcing models that respect EU data-residency and MiCA constraints, and AI-driven analytics to power your Shariah screening engine (Mak it Solutions)

Concluding Remarks

A halal crypto ETF must give spot-based exposure with real or constructive ownership, avoid riba-based leverage and interest, and be governed by a credible Shariah board.

Most current bitcoin and crypto ETFs/ETNs worldwide fail that test because of futures, swaps, debt structures, interest on collateral or opaque operations.

Today, the real halal routes mainly include direct spot ownership, Shariah crypto funds/unit trusts, and a strict DIY checklist applied with trusted scholars.

Principles to Remember When New Products Launch

When the next “Halal Bitcoin ETF” hits headlines in New York, London, Frankfurt or Dublin:

Check structure, not slogans.

Spot vs futures, fund vs debt note, leverage vs no leverage.

Follow your scholars, not influencers.

Fiqh opinions on bitcoin differ; your responsibility is to act on a credible one.

Document and review.

Keep PDFs, fatwas and notes so you can re-check annually or when the rules change (e.g. MiCA updates, FCA guidance).

Protect capital before chasing returns.

The crypto market is huge over $3 trillion today but so are frauds, hacks and speculative bubbles

Done well, halal crypto investing is about aligning your digital asset exposure with your values, not just your risk appetite.

If you’re an Islamic wealth platform, Shariah advisory firm or fintech founder planning a halal crypto investing experience for users in the US, UK, Germany or wider EU, you don’t have to figure the tech stack alone.

Mak It Solutions can help you design

compliant web and mobile apps,

secure cloud back-ends, and

analytics pipelines that support your scholars’ screening methodology.

Share your target markets and feature wishlist, and the Mak It Solutions team can sketch a practical roadmap from MVP screening tools to AI-assisted Shariah dashboards tailored to your budget and regulatory constraints.

FAQs

Q : Can I treat a physically backed crypto ETN as a halal ETF if it doesn’t say “Shariah-compliant”?

A : Not automatically. A physically backed ETN usually means the issuer holds coins in custody, but you still hold a debt note, not units in a pooled fund or direct constructive ownership of bitcoin. From a Shariah perspective, that raises questions about riba, counterparty risk and your actual relationship to the asset. Unless a qualified Shariah board has reviewed the specific ETN and issued a clear fatwa, treat it as non-compliant by default and run it through the checklist with your scholars.

Q : Are staking rewards or yield products on my crypto automatically haram, or can they be purified?

A : It depends on how the yield is generated. If rewards are clearly interest on loans (for example lending coins to an interest-bearing desk), many scholars classify this as riba and therefore haram. If staking rewards reflect protocol-level compensation for securing the network, some scholars may permit them subject to conditions. In both cases you need to understand the contract, the counterparty and your scholar’s view. Purification (giving away the non-halal portion) is sometimes possible, but it is not a magic fix for inherently impermissible contracts.

Q : How often should I review the Shariah status of a crypto ETF or fund I already own?

A : At a minimum, review annually – and sooner if you receive notices about strategy changes, new derivatives, lending programmes or mergers. ETFs, ETNs and funds can quietly alter their investment policies, cash management or leverage limits over time. A quick yearly review of the latest prospectus, KID and any updated Shariah certificate, followed by a short check-in with your scholar, helps you stay aligned with your original fatwa and risk appetite.

Q : What’s the difference between a Shariah-compliant crypto fund in Malaysia/GCC and one domiciled in Europe?

A : Malaysia and many GCC markets have more mature Islamic finance frameworks and regulators used to supervising Shariah funds, so local products often benefit from familiar governance models and Shariah boards. European-domiciled funds (e.g. in Ireland, Luxembourg or under BaFin in Germany) tend to sit under AIFMD/UCITS and MiCA rules, which are strong on disclosure and investor protection but not inherently Islamic. In practice, you’ll want to examine which scholars sit on the Shariah board, how often they audit the fund, and how easily you as a US/UK/EU investor can access the structure.

Q : Is it better to wait for a certified halal crypto ETF or start with small, direct bitcoin exposure screened as halal?

A : There’s no one-size-fits-all answer. If your scholar considers bitcoin permissible and you are comfortable with the volatility, starting with very small, direct spot exposure using a simple, non-leveraged setup can be more transparent than waiting indefinitely for the perfect ETF label. If you’re not confident about custody and security, or you strongly prefer regulated wrappers, you may decide to wait for a properly certified product or invest through a reputable Shariah crypto fund instead. In all cases, a written fatwa and clear risk limits should guide your choice.