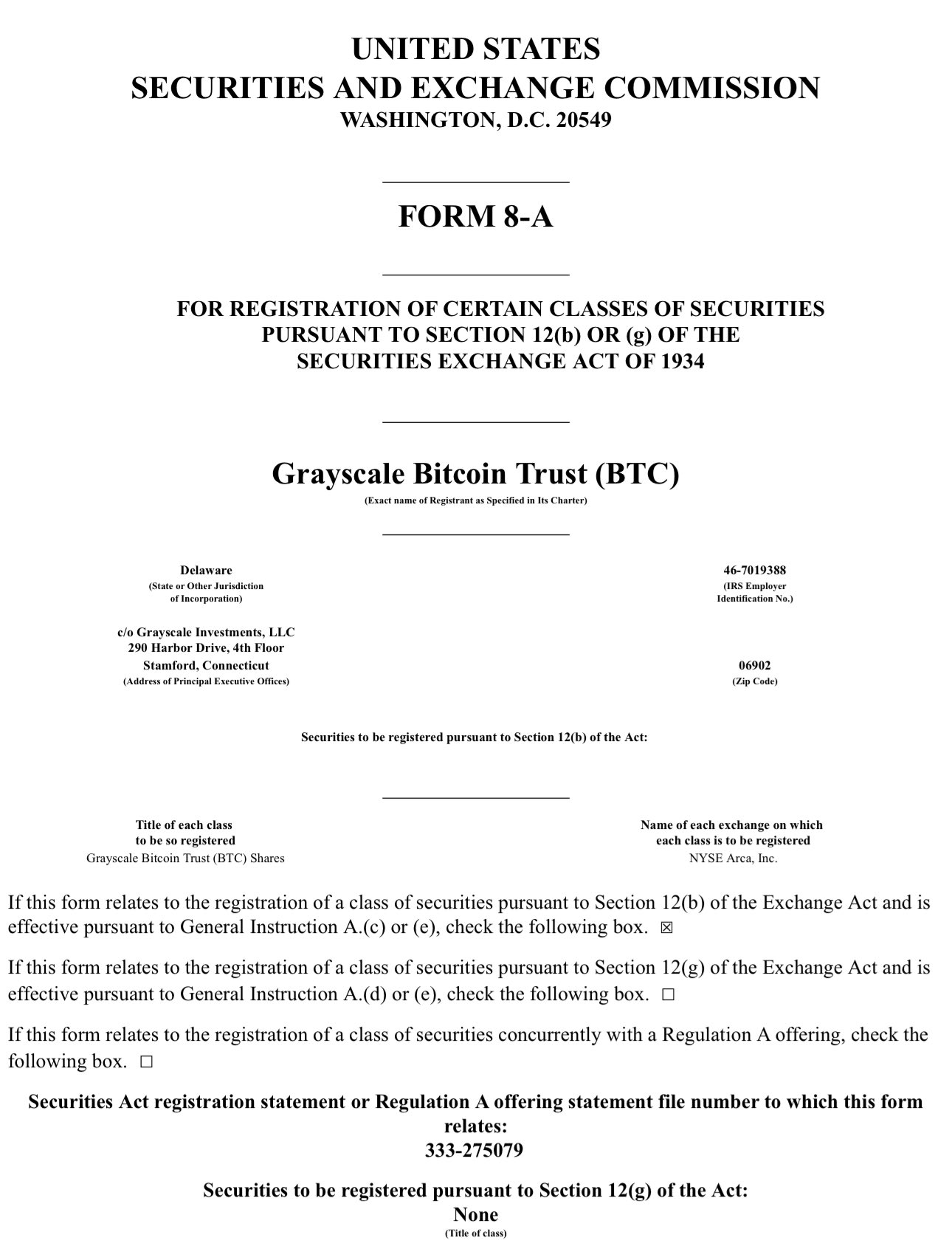

Grayscale, a major player in the digital asset management space, has taken a significant step forward in the process of launching its Spot Bitcoin ETF by filing a registration of securities with the US Securities and Exchange Commission (SEC). This move is a crucial part of the application process and signals that approval might be on the horizon.

Fidelity, another prominent firm, has also submitted a similar filing this week as part of their application process, with a decision expected before the upcoming deadline. These actions by Grayscale and Fidelity, among others, contribute to the growing optimism about the approval of a Spot Bitcoin ETF by the SEC.

The arrival of a Spot Bitcoin ETF has generated excitement in the digital asset industry over the past few months, with expectations of its positive impact on the market. Grayscale, known as one of the world’s largest digital asset managers, is set to convert its existing Grayscale Bitcoin Trust into a Spot Bitcoin ETF, making it one of the first in the United States.

Reports also highlight Goldman Sachs’ interest in playing a crucial role in the launch of this investment product. Analysts, including Bloomberg’s James Seyffart, suggest that recent SEC meetings indicate a favorable stance towards approvals, with a potential decision between January 8th and 10th.

In summary, the filing by Grayscale and similar actions by other firms enhance the likelihood of SEC approval for a Spot Bitcoin ETF, bringing the industry one step closer to witnessing this significant development.