Gold Skyrockets Past $4K, Bitcoin Looks South as Dollar Index Hits 2-Month High

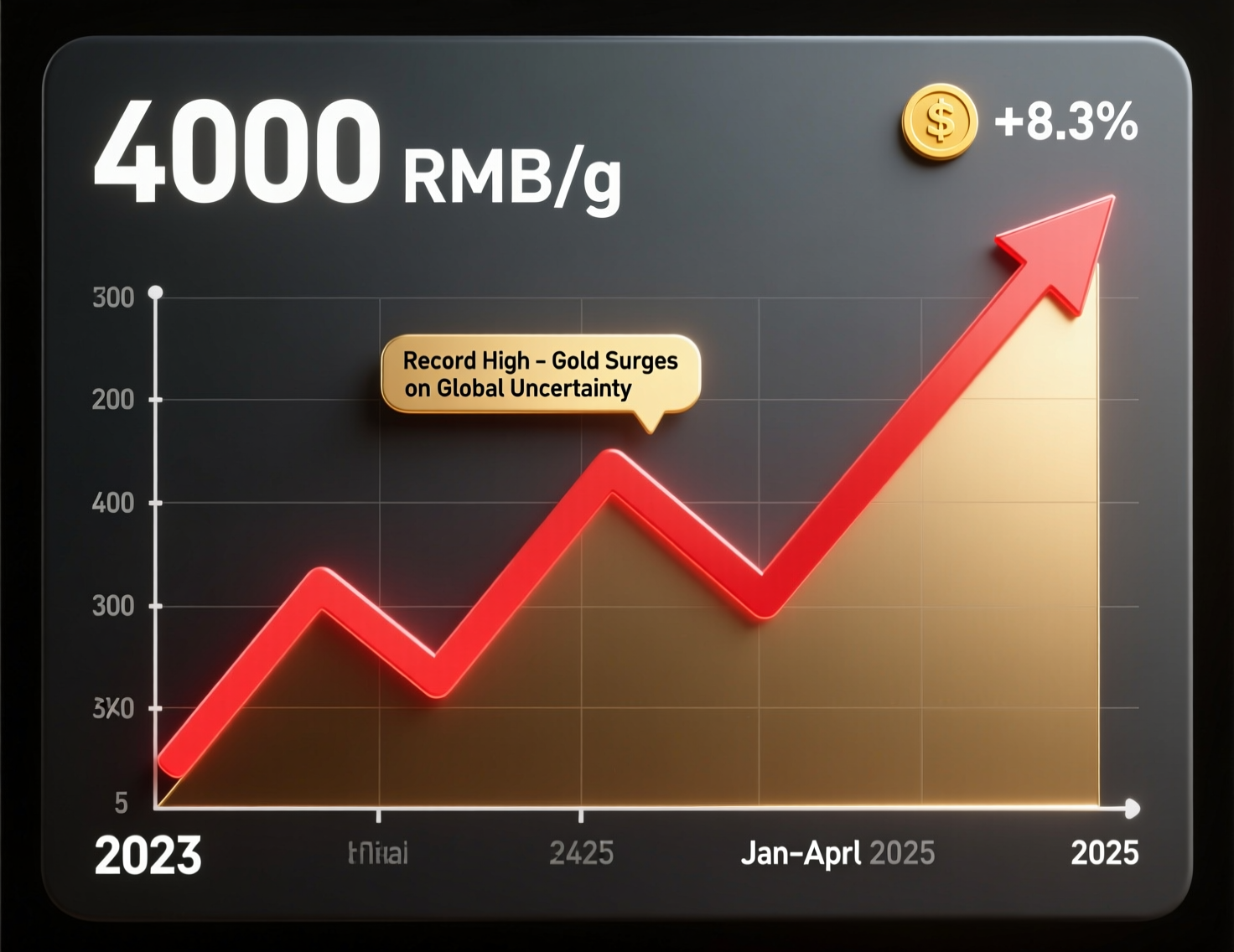

Gold soared to a record high, breaking above $4,000 per ounce, as investors continued to seek safety amid rising global uncertainty. The surge reflects an intensified flight-to-quality trend, with traders favoring tangible assets over volatile markets. Growing concerns around economic stability and inflation further boosted demand for the precious metal.

In contrast, Bitcoin slipped as a stronger U.S. dollar index pressured risk-sensitive assets. The firm dollar signaled reduced appetite for speculative trades, prompting some investors to rotate out of crypto. While gold benefited from its safe-haven appeal, digital assets struggled to maintain momentum. The contrasting moves highlight how shifting market sentiment continues to favor traditional stores of value during times of heightened uncertainty and cautious investor positioning.

Gold price above $4,000, Bitcoin softer, DXY at two-month high

Spot gold broke through the $4,000 threshold for the first time on Wednesday, extending 2025’s historic rally. The U.S. Dollar Index rose to about 98.9 its highest level in roughly two months—tightening financial conditions at the margin. Bitcoin, which tested resistance near $126,000 earlier this week, slipped back toward the low-$120,000s as broader crypto benchmarks retreated. Reuters+2MarketWatch+2

Bitcoin was recently around ~$122.6k intraday, with session extremes between ~$120.7k and ~$125.1k. Analysts flagged potential support near $118,000 if risk sentiment weakens further. The CoinDesk 20 Index fell over 4% to ~4,186.

What’s driving the move

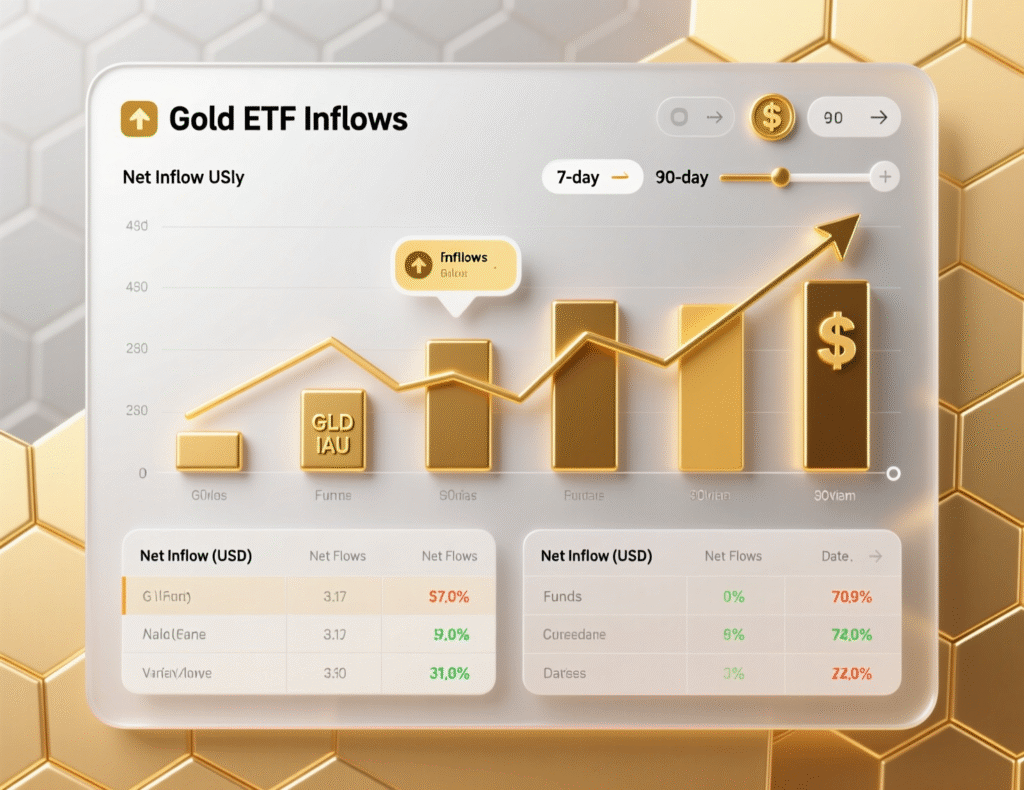

Multiple factors underpin gold’s breakout: safe-haven demand, expectations of U.S. rate cuts, and renewed inflows to gold-linked exchange-traded funds. ING notes ETF holdings have climbed to the highest since September 2022 and remain below the 2020 peak, “leaving room for further additions.” On the currency side, the dollar’s two-month high has pressured USD-denominated risk assets, including crypto.

Why the gold price above $4,000 matters for crypto

A stronger dollar and higher real yields typically lean against Bitcoin and other risk assets. While correlations shift over time, BTC has historically struggled during periods of dollar strength; a sustained DXY uptrend could cap crypto rallies even as gold benefits from haven demand.

Tokenized gold joins the rally

Gold-backed tokens PAX Gold (PAXG) and Tether Gold (XAUT) traded above $4,000 in tandem with spot prices. The combined market cap of gold-pegged tokens surpassed $3B as investors sought on-chain exposure to bullion.

Technical levels with gold price above $4,000

For gold, technicians are watching whether $4,000 can turn from resistance into support; failure could risk a retest of prior breakout zones. For Bitcoin, key resistance sits near ~$126k, with initial support cited around ~$118k.

<section id=”howto”> <h3>How to monitor gold, Bitcoin and the dollar index together</h3> <ol> <li id=”step1″><strong>Step 1:</strong> Check live spot gold (XAU/USD) and futures quotes on a major wire or data site.</li> <li id=”step2″><strong>Step 2:</strong> Track DXY levels and note trend changes around prior highs/lows.</li> <li id=”step3″><strong>Step 3:</strong> Compare BTC/USD to key technical markers (e.g., $118k support, $126k resistance).</li> <li id=”step4″><strong>Step 4:</strong> Review gold ETF flow updates (daily/weekly) for confirmation of demand.</li> <li id=”step5″><strong>Step 5:</strong> Set price/volatility alerts across all three to catch correlation shifts.</li> </ol> <p><em>Note: Process may vary by provider. Confirm sources, time zones and methodologies before acting.</em></p> </section>

Context & Analysis

The simultaneous rise in gold and the dollar is unusual but not unprecedented in periods of heightened geopolitical and policy uncertainty. Recent newsflow around U.S. fiscal negotiations and global political tensions has amplified haven bids in bullion, even as dollar strength tempers risk appetite elsewhere. (Analysis)

Conclusion

Spot gold has firmly held above the $4,000 mark, while the U.S. dollar hovers near a two-month high, creating a pivotal setup for risk assets. Market focus now turns to whether gold’s strength can sustain through continued ETF inflows, which have been a key driver behind its record-breaking rally.

For crypto, the near-term direction may depend on a potential cooldown in the dollar index (DXY). If the greenback eases, Bitcoin could regain momentum, but persistent dollar strength may cap upside moves. Traders are closely watching $4,000 on gold and the $118K–$126K zone on BTC for the next breakout signal.

FAQs

Q : What pushed gold to a record?

A : Haven demand, rate-cut expectations, and strong ETF inflows drove gold to new highs.

Q: Why did Bitcoin fall while gold rallied?

A : A stronger dollar weighed on risk assets, while BTC also faced resistance near ~$126k.

Q : What is the DXY and why does it matter?

A : It’s the U.S. Dollar Index; when DXY rises, it often pressures USD-denominated assets like BTC and commodities.

Q : Are tokenized gold assets benefiting too?

A : Yes. PAXG and XAUT both traded above $4k, with the combined gold-token market cap topping $3B.

Q : What levels should crypto traders watch now?

A : BTC shows resistance around ~$126k and support near ~$118k, according to market commentary.

Q : What is the CoinDesk 20 Index telling us?

A : It dropped over 4% to ~4,186, indicating broad weakness across major crypto assets.

Q : How does the exact phrase “gold price above $4,000” help searchers?

A : It targets users tracking fresh records and market implications, aligning with real-time search intent.